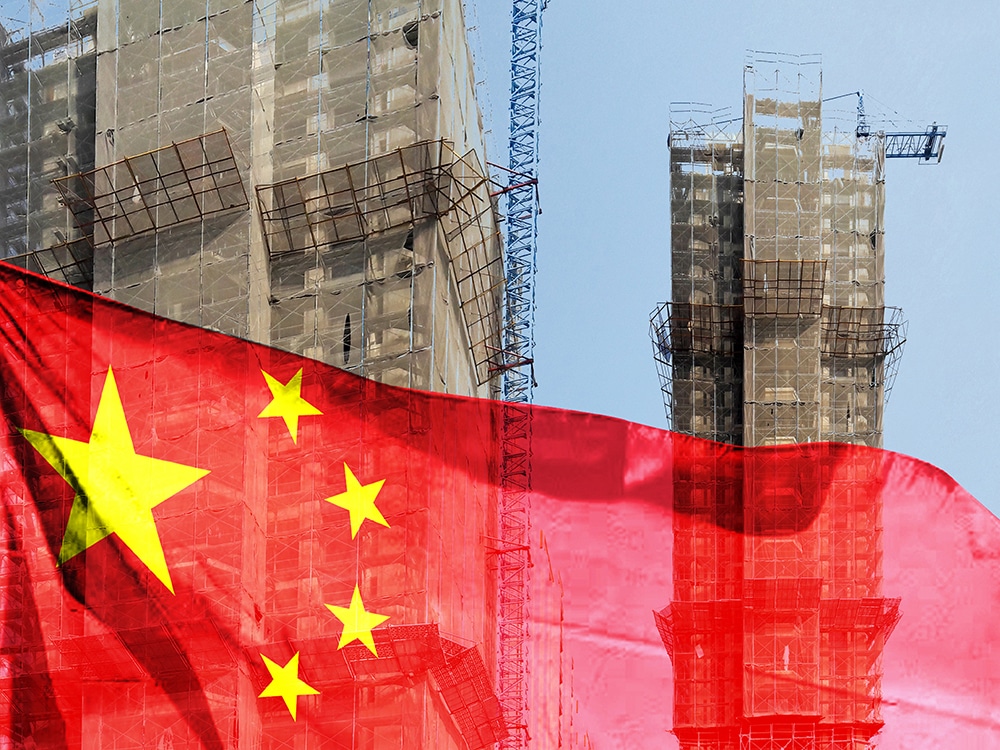

The recent liquidation order by a Hong Kong court of debt-ridden Chinese property giant Evergrande has once again raised that dreaded question: is China’s economy a ticking time bomb? It is a question experts continue to ask amid worsening Chinese construction news.

Not long ago, two rival property construction firms, Evergrande and Country Garden, were the poster children of China’s burgeoning property market. Then things began to unravel. A peek at the record books shows that, since 2021, over 50 such Chinese debt-ridden property firms have declared default. This figure now includes both Evergrande and Country Garden.

As sales collapsed and people stopped buying homes, those who had already purchased properties watched as the projects they counted on suffered delays and closures. Finally, after years of failed promises regarding debt restructuring and the occasional injection of government funds, the Hong Kong court judge ordered Evergrande shuttered. According to this BBC article, the judge stated, “enough is enough,” before appointing liquidators to initiate the process.

Step up your metal sourcing game with MetalMiner Insights’ data-driven insights and actionable pricing recommendations. Learn more.

Final Nail in the Coffin for Evergrande?

As per one estimate, Evergrande’s debt is a whopping $300 billion. The construction company’s woes began in 2020 when the government introduced a new set of rules to limit the amount owed by real estate developers. This forced firms like Evergrande to sell off their stock at heavy discounts to thwart a funds crunch. And therein lay the problem. Borrowing against future offerings, Evergrande struggled to meet the interest payment schedules on its debts.

The situation eventually became so precarious that the company’s shares lost 99% of their value over the past three years. Last year, the company filed for bankruptcy in New York before announcing plans for a multi-million dollar restructuring deal with its creditors.

To the Western world, the crisis inevitably brings back dreadful memories of the U.S. subprime crisis of 2008. For others, the collapse of Evergrande could potentially have a cascading effect on supplies and suppliers, as real estate used to be one of China’s primary growth engines (follow more on Chinese macroeconomic trends which impact global metal markets in MetalMiner’s weekly newsletter). Construction news sources were quick to note that any disruption represents a blow to the uptake of commodities needed for property building, including steel, aluminum, and iron ore. Indeed, mining operations and supply chains as far off as Brazil and Australia could feel the aftershocks of a collapsing Chinese real estate market. To some, that’s precisely why Beijing may want to prop up this business and ensure that building projects make it to completion.

Company Background & Potential Repercussions

Evergrande was founded in 1996 by businessman Hui Ka Yan, who originally called it the Hengda Group. Records indicate the firm currently owns over 1,300 projects in 280 cities across China. However, Evergrande’s interests go beyond real estate. Properties are just part of the larger Evergrande Group, with subsidiary companies ranging from wealth management and food and and beverage to electric car manufacturing. Meanwhile, Hui Ka Yan used to be Asia’s richest person, with an estimated fortune of $42.5 billion (£34.8 billion). However, this is reportedly no longer the case.

Experts say that much of the anticipated consequences stemming from a potential Chinese economic crash stems from two factors. For one, if the Chinese government chooses not to intervene and allows the real estate sector to slow down, it would lead to a lending crunch, significantly affecting the financial markets. On the other hand, thousands of suppliers, many of them international, would suffer the effect of the slowdown in metal imports. Even companies like Apple and Volkswagen may start losing revenue from the Chinese market due to household spending taking a hit. If the real estate market does collapse, this would only worsen.

China currently spearheads over a third of the world’s growth. Even U.S. credit rating agency Fitch recently said that China’s slowdown was “casting a shadow over global growth prospects,” while downgrading its forecast for 2024 for the entire world.

Are you on the hook for communicating the company’s steel performance to the executive team? Read what should be in that report.

Construction News Sources Wait to See Results

Countering such apprehensions are views from some economists who feel China’s status as a powerhouse of global growth is exaggerated. Nevertheless, any adverse fallout of Monday’s court ruling is bound to affect exporters from Australia, Brazil, and even some African countries.

It’s not for anything that economists call China “The World’s Factory.” After all, as much as 30% of global manufacturing output comes from this country alone. In 2022, China made 40 million tons of primary aluminum, more than half of the total global production of 68 million tons. At the same time, construction news sources report that the country consumes about 55% of global aluminum.

Why Experts Believe Local Real Estate Crisis Won’t Shake Global Markets

Some economists believe that despite the real estate crisis, the Chinese economy is robust enough to withstand such blows. While the terrible construction news could force a slowdown in consumption, in their view, China is an export-oriented economy. Therefore, any problem in the local market would not affect the global economy.

Between 1997 and 2022, global steel consumption climbed from 700 million tons to 1.8 billion tons a year, with Chinese demand accounting for much of that 1.1 billion ton per annum incremental consumption. The country’s growth was so intense that none other than the World Bank once described China as “the fastest sustained expansion by a major economy in history.”

Whatever the future holds, everyone’s eyes are now on the government of China. Will it intervene once again to halt the unraveling of the real estate sector, as so many expect? Will it bail out property developers, including Evergrande, much like the U.S. government did in the aftermath of the subprime crisis? Only time will tell.

Cut metal expenses without compromising quality using the Monthly Metals Outlook report. Start with a free sample report.