The latest construction news reports that while interest rates remain high, inflation is finally losing steam. This could go a long way toward helping U.S. construction projects. However, the Construction MMI (Monthly Metals Index) continues to experience pull in both directions. This is mainly due to ongoing labor shortages and the inflated cost of materials plaguing construction efforts.

While it appears the Fed’s hawkish stance on interest rates finally started to slow down inflation, the cost of construction materials has yet to drop. But while many breathe sighs of relief over the dropping economic pressures, the construction industry still faces several key challenges in Q3 and Q4 of 2023.

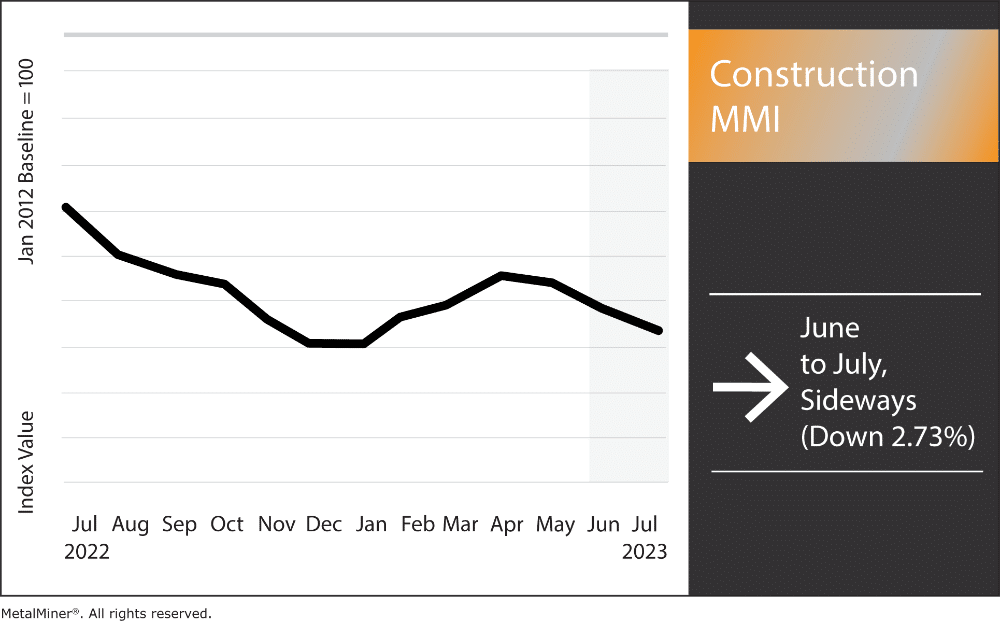

Month-over-month, the index traded sideways, inching down just 2.73%.

It’s nearly time to start thinking about annual contract negotiations! But what cost-saving tactics should you be armed with when negotiating with your suppliers for 2024? Join our special August workshop 2024 Annual Budgeting & Forecasting.

High Cost of Construction Materials Impacting Construction Projects

Construction projects continue to struggle under high material costs, causing delays and increased project expenses. According to research from Gordian, construction materials have seen significant price increases since 2020. This accounts for around 82.5% of materials affected. Meanwhile, construction news outlets report that metals like steel and aluminum have experienced substantial price hikes (long-term wise).

Supply and demand imbalance remains the primary factor in these elevated costs. The COVID-19 pandemic significantly disrupted global supply networks, resulting in raw material shortages and higher transportation prices. As the global economy continues to recover from the pandemic and construction activity grows, the heightened demand for construction supplies could lead to even more price increases.

This material price volatility introduces more uncertainty to building projects, making it challenging for contractors to forecast project costs effectively. And despite recent price decreases, overall building material costs remain significantly higher than pre-pandemic levels. According to the Associated Builders and Contractors (ABC), construction supplies are still 37% more expensive than before the pandemic. This indicates the long-term influence the pandemic continues to have on material costs, which will also impact the industry going forward.

The high cost of construction materials, particularly metals like steel and aluminum, significantly affects project profitability. As contractors grapple with increased expenses, businesses must accept higher project costs and potential compromises in profitability. To mitigate these challenges, contractors must carefully manage budgets and identify strategies to offset the impact of growing material costs.

Get monthly metal buying strategies and price alerts for 10 industrial metals. Request a MetalMiner Monthly Outlook free report.

Construction News: Infrastructure Woes Continue

According to a recent Construction Dive article, U.S. infrastructure projects are not seeing the boost they should be from the Biden-Harris Administration’s Infrastructure Investment and Jobs Act. While there has been some progress, there remains a significant backlog of U.S. infrastructure projects. Some construction news outlets argue that private projects are currently experiencing the same issue. However, infrastructure projects increased their backlog for three straight months.

The backlog is the result of several factors:

- There is an overwhelming demand for clean energy initiatives.

- Bureaucracy frequently necessitates numerous permits and approvals from numerous government departments. These can cause delays and add to the backlog.

- The construction industry continues to experience labor shortages, impeding the overall pace of infrastructure projects.

Economy Effects of the Infrastructure Backlog

The backlog of infrastructure projects has had several different effects on the economy. Indeed, infrastructure investments can have both short and long-term economic and employment consequences. For instance, infrastructure improvements can create jobs and boost economic activity in the short run. They can also boost productivity and the economy’s overall competitiveness in the long run. However, the infrastructural backlog continues to prevent the U.S. from realizing these benefits.

While it is true that infrastructure spending can stimulate the economy, this only applies to particular situations. If the sole goal of infrastructure creation is generating economic stimulus rather than bringing about desired improvements in regional economic development, serious long-term consequences could arise. This is especially important to remember since the state may hurry infrastructure in the interest of temporary stimulus, disregarding long-term repercussions.

See how MetalMiner’s should-cost models can help you generate more revenue even in the face of grim construction news. Read here

Construction MMI: Notable Price Shifts in Construction News

- Chinese H-beam steel moved sideways, rising a slight 2.19%. This brought prices to $500.02 per metric ton.

- Chinese steel rebar also traded sideways. Ultimately, rates inched up 0.84%, leaving prices at $518.98 per metric ton.

- Weekly Midwest bar fuel surcharges dropped by $0.02 per mile (a 3.7% decrease), leaving prices at $0.52 per mile.