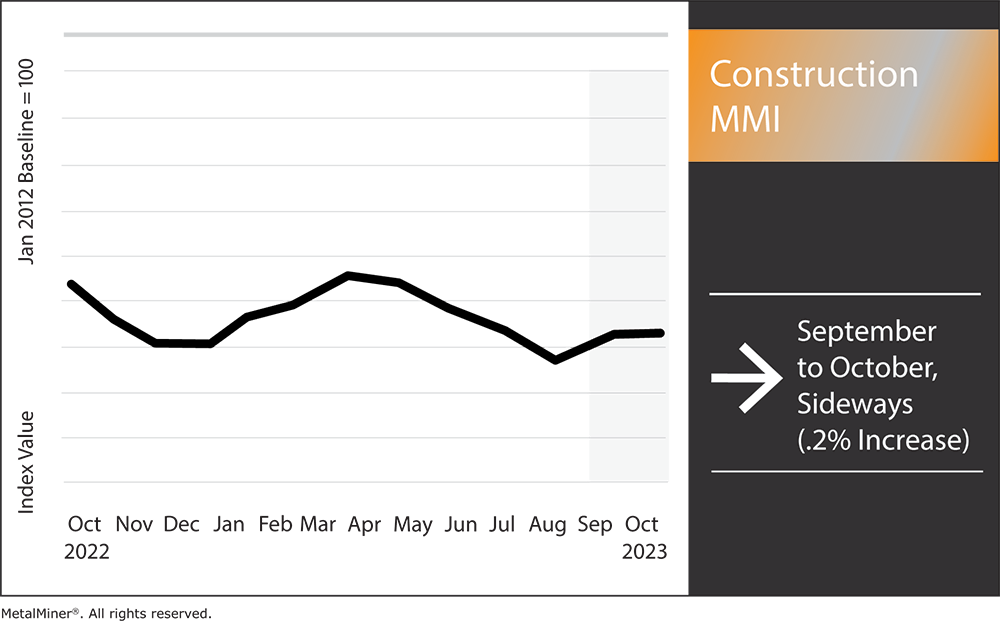

Month-over-month, the Construction MMI (Monthly Metals Index) narrowly missed trading completely flat, ultimately moving sideways with just a 0.2% increase. Meanwhile, steel prices, specifically h-beam steel and steel rebar costs, either dropped or traded sideways, as did bar fuel surcharges.

Energy have risen at an astounding rate since 2021 due to high inflation and geopolitical events like the war in Ukraine. Even with cooler inflation in the US, energy prices still remain elevated. This could further impact aluminum and steel prices as these two metals, particularly steel, tend to suffer immensely when construction demand drops.

Considering near-shoring as a sourcing alternative but don’t know where to start? Join MetalMiner’s free October fireside chat: “Don’t Ship Your Pants: Options for Near-shoring” where near-shoring expert, German Dominguez, will discuss all of the key points, pros and cons of near-shoring.

How Construction Impacts Steel Prices

Steel prices significantly influence construction project costs, so price shifts can greatly impact construction firm competitiveness. And since steel plays a significant role in many construction projects, an increase in steel costs may dramatically raise the project’s overall budget. As a result, construction firms may feel the strain of having to raise their prices to pay the increased expenses.

However, lower steel costs often prove beneficial to the construction sector, as businesses can offer more competitive bids on projects. Additionally, lower steel prices may make construction projects more accessible to individuals and businesses, which may result in an uptick in overall construction activity.

Moreover, supply and demand, production costs, and governmental regulations all impact steel pricing. For instance, government infrastructure expenditure can enhance steel demand and sustain its pricing, while tariffs on steel imports might raise steel costs dramatically. Indeed, over the past few decades, infrastructure projects have offered significant assistance amid declining steel prices.

MetalMiner customers have saved millions of dollars by following our industrial buying strategies. Take a look at MetalMiner’s track record.

Construction’s Impact on Steel Demand

The construction industry is one of the largest sectors for steel use, accounting for more than 50% of global steel consumption. Therefore, fewer construction projects will often impact overall steel demand. For instance, steel demand initially decreased due to the COVID-19 outbreak, but it soon returned with a vengeance. However, the pandemic also resulted in supply chain breakdowns, which raised costs and contributed to steel scarcity. At almost $1,900 per ton, steel costs were more than 300% higher than before the pandemic.

Since 1970, global steel demand has increased more than threefold and continues to rise as economies grow, urbanize, consume more goods, and build up their, you guessed it, infrastructure. However, it’s important to note that more efficient use of materials helps to lower overall levels of demand relative to baseline projections.

According to predictions, steel demand will decline globally over the next ten years, but in different ways across different areas and industries. Indeed, growth in Southeast Asia and India may somewhat offset the slowdown in construction. Meanwhile, growth in energy and transportation could compensate for the “normalization” of demand in China, which would effectively end decades of rapid expansion.

All of this could result in regional overcapacity and imbalances. Still, pockets of growth may yet emerge, primarily driven by the energy and transportation sectors. This is despite experts who anticipate that demand growth will slow down or stagnate in some regions due to the decline in important industries and sectors like construction.

Construction MMI: Steel Prices and Other Price Trends

- Steel rebar prices shifted up a slight 0.71% to $526.81 per metric ton.

- H-beam steel dropped by 0.85%, bringing prices to $508 per metric ton.

- Weekly Midwest bar-fuel surcharges traded flat, remaining at $0.64 per mile.

- Finally, European aluminum commercial 1050 sheet dropped by 2.11%, leaving prices at $3,711.78 per metric ton.

Enjoying this article? MetalMiner’s monthly MMI report gives you price updates, market trends and industry insight for steel and 9 other metal industries. Sign up for free.