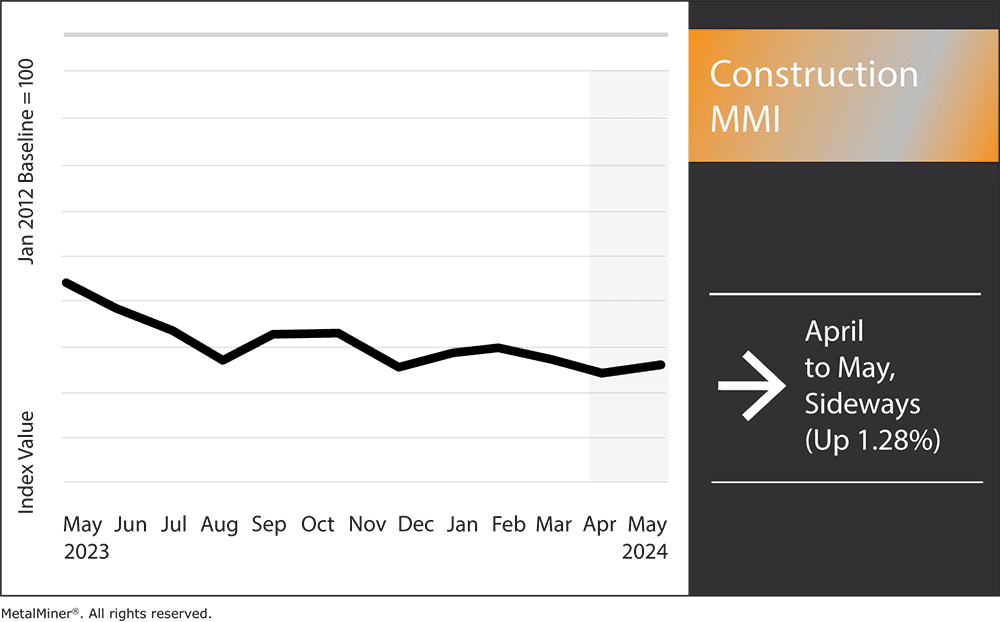

The Construction MMI (Monthly Metals Index) remained firmly in a sideways trend, only budging upward by 1.28%. The rising price of iron ore PB fines in China had the heaviest impact on the index, holding it more up than down. After that, the next biggest factor was European commercial 1050 aluminum sheets. Meanwhile, all other components of the index’s metal prices trended sideways or down. Despite this, the recent ban on Russian aluminum and copper could impact aluminum and copper prices and snowball into the U.S. construction industry.

How Rising Copper Prices Impact the U.S. Construction Industry

Recent increases copper prices could pose a significant challenge for the U.S. construction industry and the copper market. The primary drivers behind the escalating prices is projected supply-demand imbalances and the recent LME and CME ban on Russian copper. With copper being a crucial material used in various construction applications, including electrical wiring, plumbing, and roofing, recent price increases could have ramification for construction projects all across the nation.

There are several ways that increasing copper prices could impact the construction sector. First of all, copper-based products could become expensive, forcing building costs to increase depending on how much copper is needed. This could result in budget overruns, project delays or even project termination. Furthermore, contractors and developers often find it difficult to precisely predict costs when significant fluctuations happen with copper prices. This adds a degree of uncertainty to bidding and planning procedures.

Furthermore, the consequences of the current copper price forecast go beyond the immediate expenses associated with the commodity. For instance, the economic burden on building projects may increase if manufacturers of copper-containing HVAC systems, electrical equipment and other items feel compelled to boost their pricing.

Want to find out how MetalMiner’s copper price forecasting methods save copper sourcing companies millions of dollars and learn cost-saving sourcing tactics? Join our May introduction chat session MetalMiner Introduction: From Price Data to Forecasting to Cost Modeling.

Mitigating Challenges in Copper Price Volatility

Some industry participants continue to look at other materials to lessen the impact of increased copper prices. For example, HVAC manufacturers continue to produce more air conditioners and heat exchangers out of aluminum since it is currently a more affordable option. Nonetheless, wholesalers and contractors may need to work together to persuade homeowners and contractors to choose these options.

Although the construction sector typically withstands changes in commodity prices, the recent spike in copper prices still poses a threat. Sophisticated risk management techniques, such as protecting against price fluctuations and investigating substitute materials, will be essential for construction companies to maneuver through these challenges.

From sourcing strategies to long-term aluminum and copper price projections, MetalMiner’s Monthly Metals Outlook report covers it all. Grab your free sample report.

Other U.S. Construction Market Trends: April and May 2024

The government’s increased funding for infrastructure development projects had a notable influence on the construction industry over the past couple of months. The government’s emphasis on enhancing the nation’s infrastructure resulted in a rise in building activity in a number of industries. Not only did this investment promote economic growth, it produced a wide range of job possibilities.

But despite this rise, the U.S. construction sector continues to face a skilled labor shortage. In fact, the need for trained labor grew right along with the demand for construction projects. Still, the lack of personnel with the necessary experience made it difficult for construction businesses to obtain professional labor.

Construction MMI: Notable Price Shifts

Navigate volatile prices with confidence. MetalMiner equips you with the critical insights you need to develop a winning category portfolio strategy. View our full metal catalog.

- Chinese iron ore PB fines (Dalian 62% settlement) saw the biggest price increase out of all components of the index. Altogether, prices rose by 14.87% to $120.58 per metric ton

- European commercial 1050 aluminum sheet also rose in price. In total, prices went up 9.76% to $3,456 per metric ton

- Chinese h-beam steel prices moved sideways, only budging up by 0.63%. This left prices at $481.30 per metric ton

- Chinese steel rebar also trended sideways, dropping a slight 0.29%. This brought prices to $544.60 per metric ton

- Finally, Weekly Midwest bar fuel surcharges also moved sideways, but exhibited slightly more downward price action than the steel components of the index. Prices ultimately dropped 2.87% to $0.53 per mile