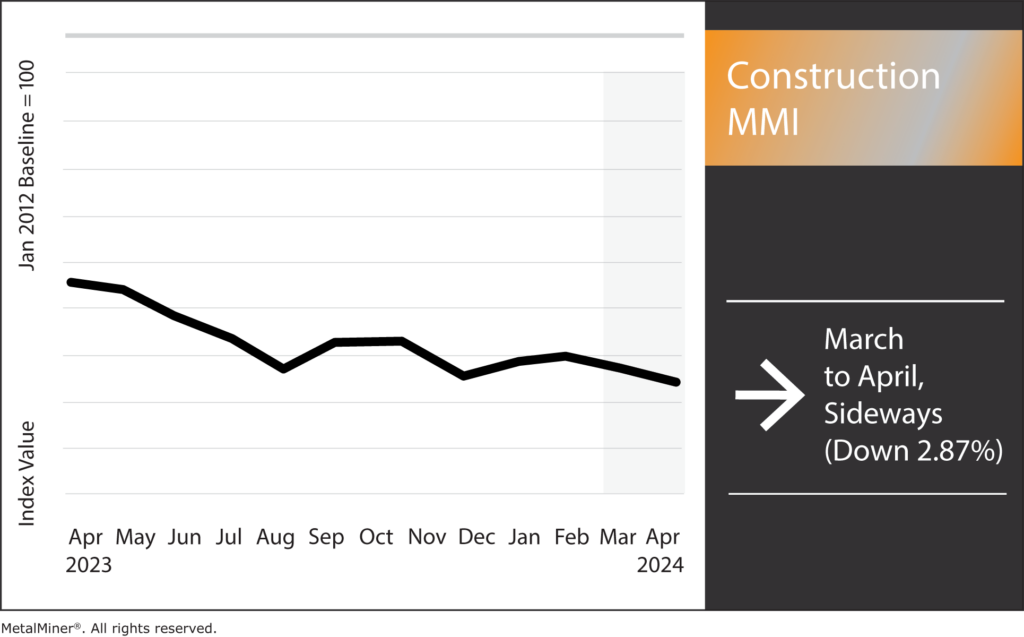

Month-over-month, the Construction MMI (Monthly Metals Index) moved sideways for the fourth month in a row, only sliding down a slight 2.87%. Of all industrial metals, iron ore suffered the worst drop in price by far, hitting a 10-month low before a slight rebound. The main component holding the index up was aluminum 1050 sheet from Europe.

The manufacturing boom in the U.S. construction industry continues to aid in the demand for industrial metals like steel and aluminum. However, high interest rates remain the talk of the town. With the Fed holding off on lowering interest rates until the second half of 2024, the U.S. construction industry will continue to face obstacles, including project delays.

Knowing which strategy to execute in different market conditions makes all the difference between saving and losing money. See how MetalMiner looks at different market scenarios.

U.S. Manufacturing Boom Fueling Demand for Industrial Metal

The United States continues to experience a manufacturing boom, with a surge in industrial activity driving up demand for a wide range of metals. According to Bloomberg, there has been a twofold increase in real manufacturing building investment since the end of 2021, mostly due to the computer, electronic, and electrical manufacturing sectors.

Furthermore, the World Economic Forum reports that during the past several decades, there has been a notable increase in the use of industrial metals in steel-making and construction, including iron ore, aluminum, copper, and zinc. Lastly, the Manufacturing PMI of the Institute for Supply Management (despite still being in contraction zones) recently improved, going from 47.1 in December 2022 to 49.1 in January 2024.

As the manufacturing sector in the United States grows, so will the need for industrial metals. Meanwhile, manufacturing outside of the United States continues to rise as well. According to the World Economic Forum research, this recovery in global manufacturing will likely be beneficial for the copper market in particular.

U.S. Construction Projects Facing Delays and Cancellations, Impacting Demand for Industrial Metal

Numerous national projects continue to be postponed or canceled due to the difficulties facing the American construction sector. This, in turn, has had negative effects on the industrial metal market.

One of the key reasons why construction projects continue to witness interruptions is the ongoing problems with the supply chain. Even after four years, the COVID-19 pandemic’s severe disruption of global supply chains remains a problem, having hit the construction sector particularly hard.

Causes for Ongoing Delays

The lack of common building supplies like steel, cement, and wood has also driven up prices. Meanwhile, the limited supply of several types of construction equipment continues to hamper the construction sector. Another ongoing culprit in the delays and cancellations of construction projects is high interest rates. With the Fed now unlikely to lower interest rates until late 2024, fewer loan options are available for commercial and residential building projects.

All of these factors continue to negatively impact the demand for industrial metals. Materials like steel, aluminum, and copper are commonly used in the construction industry, as well as in a variety of other applications. This includes plumbing and electrical systems within building structures. However, the demand for certain metals continues to decrease due to postponed or canceled building projects, resulting in lower pricing and less money for suppliers and manufacturers.

Construction MMI: Noteworthy Price Shifts

Get a competitive edge in challenging metal market conditions. Learn game-changing metal industry insights by opting into MetalMiner’s weekly newsletter.

- European commercial 1050 aluminum sheet prices increased by 3.72%, reaching $3265.70 per metric ton.

- Chinese h-beam steel fell by 6.24%, leaving prices at $465.40 per metric ton.

- Chinese steel rebar also dipped in price. After falling a total of 4.47%, prices sat at $535.29 per metric ton.

- Lastly, iron ore PB fines dropped the most out of all other components of the index. In all, prices dropped by 16% to $103.67 per metric ton.