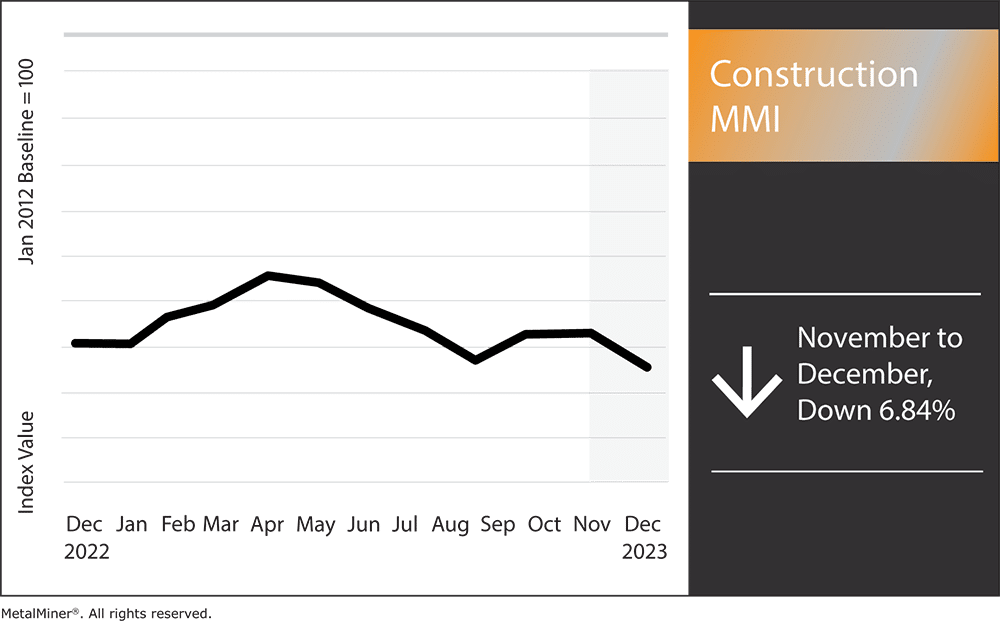

The Construction MMI (Monthly Metals Index) strayed from its sideways trend to drop 6.84% month-over-month. A drop in European commercial aluminum 1050 sheet prices was the main culprit in the index’s decline. Construction news sources indicate with steel prices finally flattening out in recent weeks, the index could face further bearish pressure. Despite this, construction spending witnessed a boost throughout Q4 of 2023. This brings some much-welcome optimization to an industry currently battling high interest rates.

MetalMiner Insights covers price points, correlation charts and price forecasting for a full suite of industrial metals. See our full metals catalog.

Construction Spending Rises

The most recent information available shows that U.S. construction expenditures grew in late Q3 and throughout Q4 of 2023. Construction spending increased by 0.4% in September, and there was a notable year-over-year surge of 8.7%. Increased investment in private construction initiatives played a significant role in driving this expansion, especially within the residential domain. Meanwhile, spending on new single-family construction projects surged by 1.3%, partly due to a pronounced scarcity of preowned homes.

Additionally, September residential construction investment increased by 0.6%. This followed a 1.3% increase in the preceding month. However, September also saw spending on multi-family housing projects decrease by 0.1%. Meanwhile, public construction spending increased by 0.4% that same month, following a 0.9% gain in August.

The report also highlighted the influence of federal infrastructure funding, emphasizing how urgent it is for governments to utilize these funds. Should they do so, it could potentially lead to an additional boost in infrastructure investment.

Stay up to date on steel prices, industry trends and other commodity news via weekly updates – without the sales pitch. Sign up for MetalMiner’s weekly newsletter.

Construction News: Manufacturing Sector Also Witnesses Slight Boost

From a broader perspective, the construction industry has grown consistently, with total construction expenditures reaching $1.98 trillion in August 2023. This represents a substantial 7.4% increase compared to last year. Indeed, nonresidential construction spending proved the principal driving force behind this expansion, with a notable year-over-year growth of 17.6% in August 2023.

Meanwhile, the manufacturing construction sector witnessed the most significant annual spending rise, boasting a remarkable growth rate of 65.5% as of August 2023. The latest construction news and statistics underscore a robust expansion within the sector, particularly in the realms of nonresidential and manufacturing construction.

Does the U.S. Possess Enough Infrastructure to Meet Green Energy Goals?

The clean energy sector requires a variety of specialized equipment to operate properly. Examples include solar panels, wind turbines, and batteries for storing energy generated by wind and solar power. The Inflation Reduction Act includes over $15 billion in tax credits to boost domestic production capabilities for solar panels, wind turbines, and lithium batteries. Despite this, many analysts continue to wonder if the U.S. has enough of the necessary infrastructure and ongoing infrastructure projects to meet its clean energy goals?

In its effort to combat climate change and reduce greenhouse gas emissions, the U.S. government has established ambitious clean energy goals. In fact, President Biden previously announced a target of achieving 80% renewable energy generation by 2030 and 100% carbon-free electricity by 2035. However, that goal may not be as obtainable as it appears.

One of the largest obstacles with the U.S. hitting green energy goals is the need to establish fresh transmission infrastructure. Indeed, to power crucial equipment and achieve electrification goals, the U.S. must triple the capacity of its existing 700,000-circuit-mile network of utility poles and cables. However, construction news outlets report that fossil fuel preservationists, environmental advocacy groups, and local communities continue to resist this expansion, often expressing concerns about its potential repercussions on wildlife and the environment.

Sign up for MetalMiner’s free Monthly Metals index report to stay updated on price trends, metal market intelligence, and outlooks for 10 distinct metal industries.

Construction MMI: Notable Prices Shifts

- Chinese h-beam steel increased by 5.64%, leaving prices at $525.94 per metric ton.

- Chinese aluminum bar also rose by 4.77%, bringing prices to $3,012.07 per metric ton

- Chinese steel rebar moved sideways, only increasing by a modest 1.54%. This left prices at $562.48 per metric ton

- Finally, European aluminum commercial 1050 sheets moved the most, dropping by 18.5%. Prices at month’s start sat at $3,022.55 per metric ton