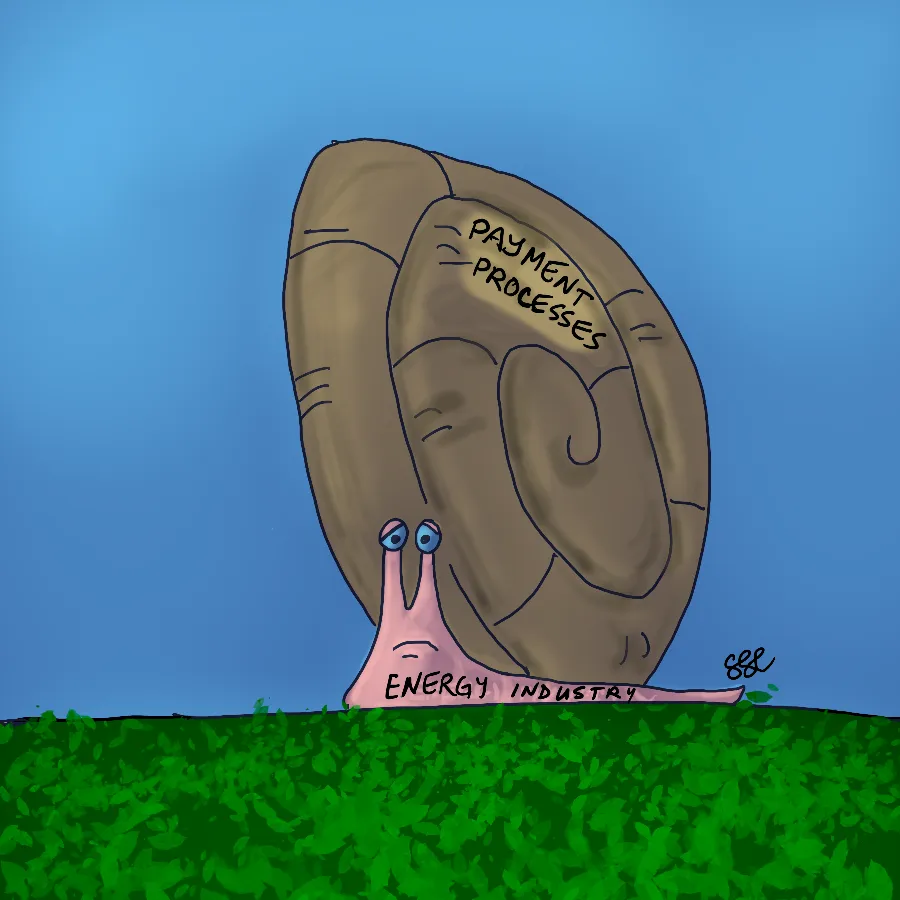

With payments technology innovating at a rapid clip, are energy companies ready to overhaul their snail-like order to cash processes?

By Geoffrey Cann

TL;DR

- Payments technology has rapidly advanced, but energy has been slow to adopt

- The costs of a built-in 60-to-90 day settlement delay are increasingly dear

- Rethink settlement end to end and not just the payment step

Payments Are So Last Millennium

In the digital world, payments technology is evolving very rapidly.

- micro payments,

- automated payments,

- direct deposits,

- touchless payments,

- 100% cashless businesses,

- crypto exchange,

- Apple Pay,

- loyalty points as settlement,

- payment through apps…

The list goes on. New payment solutions have taken over my ways of working with some speed. All of my domestic banking has evolved to e-transfers and contactless payment.

When I opened my new business banking accounts five years ago, the bank handed me a book of cheques. In all that time, I have yet to write one.

Today, many payments I receive internationally do not even pass through the banking system’s grasping claws, saving me considerable fees and currency conversion costs. My wallet has two forlorn pockets for holding the banknotes that I no longer handle.

But I’m frequently reminded that not everyone has moved with the times. My recent house renovation project highlighted that the construction industry is so far behind the curve they think they’re on a straight road.

As the project progressed, the contractor disbursed funds for their labour and materials, the costs for which they bundled up into digital invoices and submitted electronically every month to me, along with their fee. They required that I in turn settle the invoices using paper cheques mailed to them by post.

Cheques? In 2024, in an era of nearly instant everything, the construction industry still depends on a banking instrument whose origins date back to the 1600s.

But what about the energy industry? Of course, the energy sector has some unique features that make it harder to adopt these new payment mechanisms, but several innovations could transform one of the sector’s bigger headaches.

In oil and gas, and much of energy besides, the financial value chain runs parallel to the product value chain, and these two chains only occasionally connect up to synchronize, validate and reconcile. It’s been this way for my entire professional life time. Energy is one of the few products where the product is actually consumed (as fuel for heat, transportation, or movement, and as electricity) long before anyone gets paid.

Consider a simplified example.

- Oil is produced from a well, and collected into a battery.

- Eventually the battery reaches its capacity, and a truck is dispatched to the battery to collect the oil, which it then delivers to a collection point, such as a pipeline head, or a tank farm for rail loading.

- Title changes from the owners of the well to the product trader who will sell the oil to a refinery.

- The shipper takes over (the pipeline or rail company), who delivers the oil to the refinery or perhaps to another trader.

- The refinery then transforms the crude oil into valuable products (gasoline, diesel, jet fuel, marine fuel, waxes, lubricants, and hundreds of others).

- Wholesalers purchase the product, and in their turn arrange for pick up from the refinery and delivery to the wholesaler’s facilities.

- The wholesalers in turn sell products such as gasoline to fuel retailers, marine fuel to port operators, jet fuel to airports, and diesel fuel just about everywhere.

For each service delivered, and at every point of title change, the seller creates an end of month invoice for the buyer for the product or service, and the buyer schedules payment, usually 60 days later. The buyer then embarks on a lengthy task to confirm that the service or product was indeed delivered (the verification and reconciliation work).

This 60 day float is baked into the industry at every step of the way, and I mean every step. This depressing policy is even imposed on small scale suppliers to the industry (including me) who have little to do with the actual product.

In essence, the energy sector consists of a swift Ferrari-like product value chain where one commodity (energy) flows rapidly in one direction, and a snail-like money value chain where another commodity (cash) flows quite leisurely in the opposite direction.

Electric power is the extreme example—electricity is consumed the instant (or very nearly) it is produced, but is only paid for 60 days later.

The costs of this Ferrari-and-snail model are two-fold: the burden in managing archaic mechanisms like trade settlement, purchase orders, invoices, wire transfers, shipping notices, packing slips, and an expensive administrative labour force; and, the cost of the capital required to finance the business waiting for the slow snail.

On one of my podcast episodes, my guest, Austin Mitchell, who has spent a career working in the energy trade and settlement world, estimated that the average power company carries 10% more cost than necessary because of this timing disconnect between the product chain and the money chain.

Unsurprisingly, things never quite line up and disputes are rife. An energy company and a royalty partner set out a few years ago to straighten out their payments process and discovered that the two parties rarely had the same understanding of their own original agreements, which led to monthly Excel spreadsheets, growing 90-day old accounts payables and receivables, and hefty bank financing.

The big change is the recent rise in interest rates. Almost all banking agreements stipulate that the borrower keep a balance of cash on hand, enough cash flow coverage for interest payments, and overall debt levels under specific ceilings, so that the risk of default is lower. Higher rates put pressure on these lending convenants.

Accelerating Payments

It is certainly true that some energy businesses sometimes use some of these new mechanisms for some of their transactions with some of their customers. But to be blunt, occasionally using e-transfer to quickly settle an account after 60 days has expired is like putting make-up on a hog.

The hog looks a little better, but it’s still a hog.

The real problem is that snail’s pace 60 day delay built into the settlement process. To make a material difference, the industry has to tackle the energy transaction process end to end, and not just the settlement tail. It will need to embrace some new ideas and some new technologies. Energy transition provides just the opportunity to do so, and rising interest rates create a compelling economic incentive.

Out with SCADA

First, we need to move beyond the SCADA control model. In today’s approach, the data about energy production is captured at source using SCADA sensors, stored on a local SCADA historian, aggregated on some periodic basis, and fed into a remote head-office accounting process. SCADA systems are intentionally one-way only and site specific. Classic SCADA sensors are relatively simple devices—cheap, not upgradable, and very limited in their performance.

The reasons for this design go back to the 1970s and 1980s, when the compute landscape was rudimentary. Even back then, sensors generated a lot of data, but computers were costly and data storage was based on risky spinning disks. Telecommunications lines were very expensive and wireless did not exist. Sensors had to be hardwired and directly powered.

We’re now in a world of cheap, ubiquitous and high capacity wireless telecoms that can easily handle all this data. Sensor technology has advanced to where the sensor has much more on-board processing, low energy consumption, and is software upgradable. Orders of magnitude more data can be quickly and efficiently captured by newer sensors and moved directly and wirelessly to unlimited low cost cloud storage and processing environments where it can be crunched nearly instantly using algorithms that didn’t exist just a few years earlier.

Out with 1980’s contracting models

Second, we need to move beyond the prevailing contracting and commercial sales model. Today’s product contracts often stipulate monthly invoicing and two month settlement, commercially locking in a time delay. That made complete sense in the 1980s when the data that fed the billing engine was aggregated to a point where it lacked any context, relayed monthly to head office, and errors from uncertainties were hidden, forcing on-going human intervention to solve. With two months delay, parties could sift their way through the data, pick up on any errors, and delay payments until it was correct, or more convenient, or both.

We’re now in a world of talent shortages where lots of slow hand manipulation of data for billing and invoicing makes absolutely no sense. That two month delay is now very costly.

Out with large risky payments

Third, we need to move beyond the concept of aggregated settlements consisting of a handful of large risky payments to a steady/daily stream of micro invoices and tiny payments for energy.

We’re now in a world where sensors are highly capable. They are, or could be, reimagined as cash registers, sending their data directly into billing individually. Micro payments have proven their worth and simplicity in the consumer world. Assuring the trustworthiness of sensors and their data isn’t a stretch. Leveraging machine tools to sift through all the invoices and payments to detect fraud and anomalies is well within contemporary system capabilities.

Conclusions

There is a huge prize to be captured here, amounting to fully 10% of the cost of large energy enterprises, once carrying costs for all purchase activity is factored in. And with interest rates on the rise, financing that float is a lot more expensive for everyone. Fortunately we have all the digital tools at hand to turn that snail into a proper performance vehicle.

A variation of this post first appeared in March of 2023.

Artwork is by Geoffrey Cann, and cranked out on an iPad using Procreate.

Share This: