Table salt is pictured in this illustration following the Food and Drug Administration’s new guidelines for sodium intake in the Manhattan borough of New York City, New York, U.S., October 13, 2021. REUTERS/Carlo Allegri/Illustration

HONG KONG, Feb 7 (Reuters Breakingviews) – It is a truth only recently acknowledged by Tesla (TSLA.O) CEO Elon Musk and his rivals that Chinese carmakers are eating their lunch. But a pinch of salt might unsettle the auto industry’s new world order all over again. Brands from BYD (1211.HK), (002594.SZ) to French-Italian Stellantis (STLAM.MI) are betting on sodium for electric batteries. The tech could accelerate electrification – and might loosen China’s grip on the industry, too.

Sodium can be used as the key ingredient in electric-vehicle batteries, replacing lithium, used in most of today’s EVs. The process is roughly the same. Ions, which are electrically charged atoms, move through a liquid electrolyte, allowing the unit to store or release energy. However, using sodium makes the process faster than most lithium – or nickel-based models. Sodium battery packs can reach 80% of capacity in just 15 minutes, the time a Tesla Supercharger takes to charge a car for a 275 km trip. Sodium batteries hold up better in colder temperatures, too.

Most enticingly, sodium is a cheaper alternative to lithium. That’s because it is easily found in salt and soda ash, making it the sixth most abundant element on earth. While there are just over 100 million metric tons of known lithium resources in the world, there are tens of billions of tons of soda ash, according to the U.S. Geological Survey. In 2022, the cost of a sodium-ion battery pack was as low as $90 per kilowatt of energy stored, while cells using lithium were 30% to 40% more expensive, Wood Mackenzie noted.

On the downside, sodium-based batteries hold only about half as much energy per kilogram as their lithium counterparts. That means that larger power packs are needed to carry the weight of a Tesla Model Y or a BYD Seal over long distances. However, beyond a certain point, it is not possible to fit an oversized battery into a conventional chassis without disturbing the delicate balance of mass, proportion and aerodynamics. Consequently, unless there is a major tech breakthrough, cars using this material will have a shorter range than many models available on the market today.

Reuters Graphics

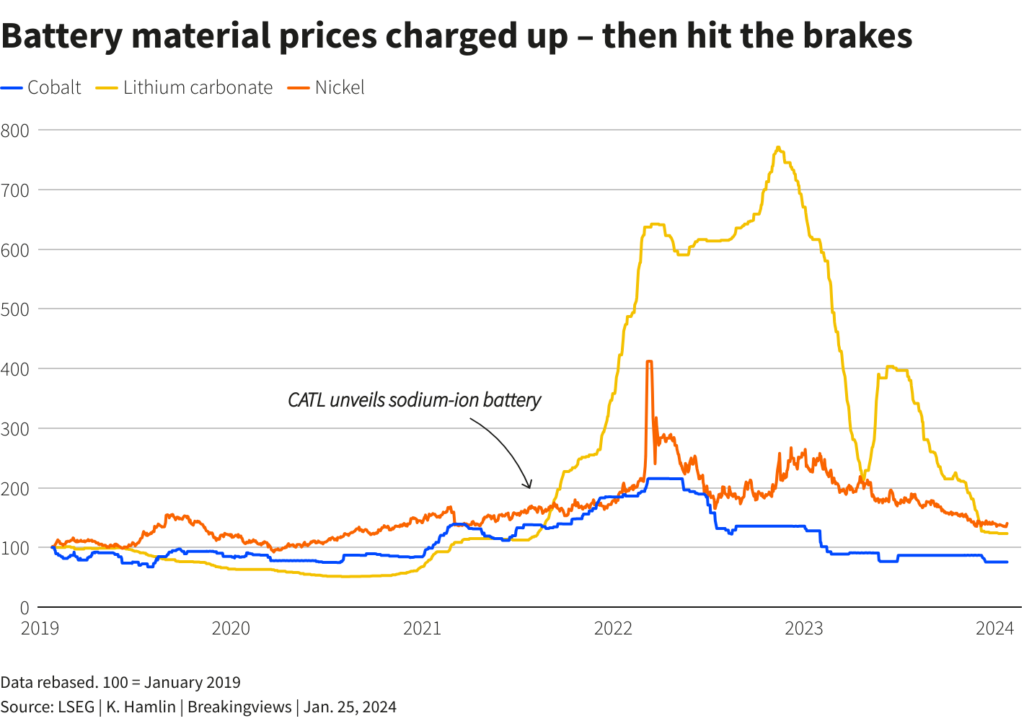

Those qualities meant sodium was largely neglected in the early days of electric vehicles, despite decades of research into its potential. But companies became less concerned about its shortcomings when the price of lithium and other key battery metals soared in 2021. The rally acted as a catalyst for the first wave of commercialisation. Industry leader CATL (300750.SZ) announced plans for cheaper sodium-ion packs that same year, and started to deliver the new products to Chinese auto giant Chery in April 2023.

POWER STRUGGLE

Western players will see advantages beyond affordability. China’s grip over crucial battery metals allows it to dominate the entire electric-car supply chain. The country could secure access to around a third of the world’s lithium mine production by 2025, while Chinese companies already accounted for 72% of the metal’s global refining capacity in 2022.

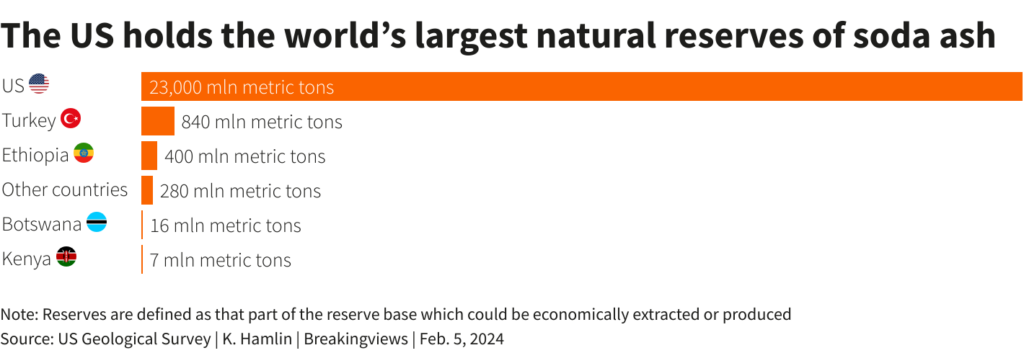

Reuters Graphics

Replacing lithium with sodium offers a chance to rebalance. The United States holds over 90% of the world’s known reserves of soda ash, the most cost-efficient source, says the U.S. Geological Survey. China has started using the synthetic alternatives, but extracting sodium from natural sources can halve the cost, emit 70% less carbon dioxide, and consume nearly 80% less water, according to Turkish producer WE Soda.

Supply chains are not the only factor that could see this tech tilt the centre of gravity away from China. Sodium-based batteries are suited to smaller, cheaper four-wheelers, scooters and energy storage solutions. Demand for such products is growing in India and Southeast Asia. That may favour local champions like Mumbai’s Reliance Industries (RELI.NS), which bought a British startup focused on sodium in 2021.

Salt is still in its salad days. Battery manufacturers had announced a grand total of 158 gigawatt hours of annual production capacity as of August, according to Wood Mackenzie: that’s only a little more than Musk’s Nevada gigafactories can make each year. Even so, sodium ion’s geopolitical advantages are too tempting to ignore.

Follow @KatrinaHamlin

(The author is a Reuters Breakingviews columnist. The opinions expressed are her own)

CONTEXT NEWS

French-Italian carmaker Stellantis announced on Jan. 12 that it is investing in European startup Tiamat, which produces batteries based on sodium, commonly found in salt and soda ash. The exact amount of the investment, which is part of an initial 150 million euro fundraising, was not disclosed.

China’s electric auto manufacturer BYD has started construction on a plant in Jiangsu to build batteries based on sodium ions, electrically charged atoms. The factory, with total investment of 10 billion yuan ($1.4 billion), has a planned annual capacity of 30 gigawatt hours, Reuters reported on Jan. 5.

Indian conglomerate Reliance Industries agreed to buy British startup Faradion, which specialises in sodium-ion batteries, for 100 million pounds in December 2021.

The world’s largest battery maker, China’s CATL, first unveiled its sodium batteries in 2021, and has since started to deliver sodium-ion products to customers.

Share This: