LAUNCESTON, Australia, July 26 (Reuters) – China boosted its stockpiling of crude oil to the highest level in three years in June, taking advantage of cheap Russian crude to bolster inventories and add flexibility to future import requirements.

The world’s biggest oil importer added 2.1 million barrels per day (bpd) to commercial or strategic stockpiles in June, according to calculations based on official data.

This was up from the 1.77 million bpd added in May and the most since June 2020, when imports surged as Chinese refiners lifted imports as crude prices slumped to the lowest in three decades as global demand collapsed during the initial stages of the COVID-19 pandemic.

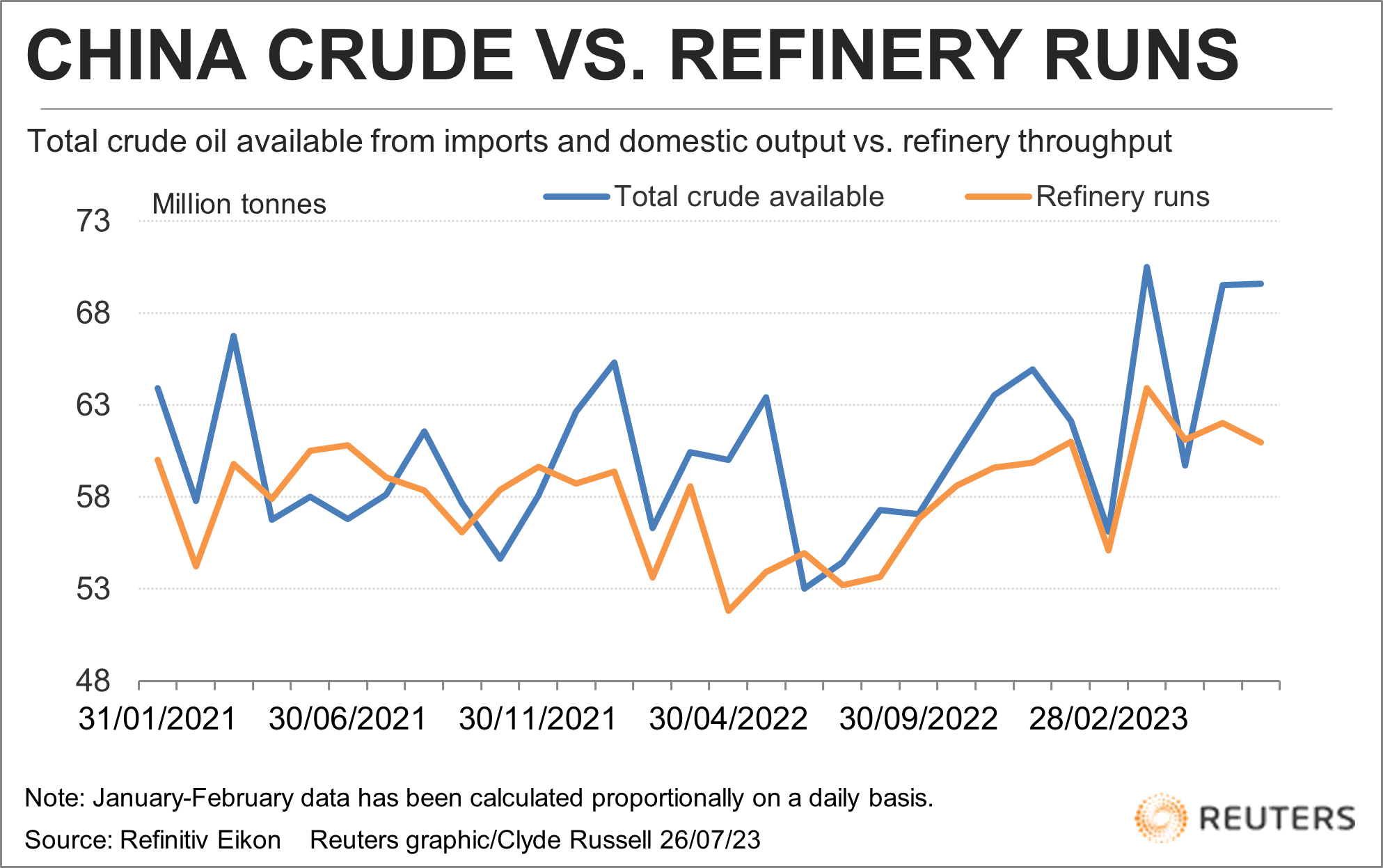

China doesn’t disclose the volumes of crude flowing into or out of strategic and commercial stockpiles, but an estimate can be made by deducting the amount of crude processed from the total of crude available from imports and domestic output.

China’s refiners processed 60.95 million metric tons in June, equivalent to 14.83 million bpd, according to data released on July 17 by the National Bureau of Statistics.

This was up 10.2% from the same month in 2022, and was the second-highest monthly total, eclipsed only by the 14.91 million bpd in March.

The volume of crude available to refiners was 16.93 million bpd, consisting of imports of 12.67 million bpd and domestic output of 4.26 million bpd.

Subtracting the refinery throughput from the total crude available leaves a surplus of 2.1 million bpd that was available for storage.

Over the first five months of the year China has added about 950,000 bpd to inventories, an increase of 28% from the 740,000 bpd added over 2022 as a whole.

What the storage numbers show is that China has been building up ample stockpiles in the first half of the year, even as refinery processing has increased.

The question for the market is what will Chinese refiners do with all the extra oil in their storage tanks, and the answer is likely to be largely dependent on what happens to global prices.

The prevailing market narrative for 2023 so far has been widespread expectations of a strong rise in global crude demand, led by China, and especially in the second half of the year.

The International Energy Agency trimmed its forecast for global demand growth to 2.2 million bpd in 2023 on July 13, down 220,000 bpd from its prior estimate, citing economic headwinds.

However, growth of 2.2 million bpd is still robust and implies a substantial tightening of the oil market in the second half.

The OPEC+ group of producers, led by Saudi Arabia and Russia, has been cutting output in efforts it describes as moves to stabilise the market, although it’s widely believed the exporting alliance aims to keep oil prices at least $75 a barrel, if not higher.

PRICE DEPENDENT

If the market narrative of strong second-half demand coupled with output restrictions is correct, it implies oil prices will rise from the current $83.29 a barrel for global benchmark Brent futures .

If this is the case, Chinese refiners have now the ability to trim imports and use their ample stockpiles.

This would have the impact of lowering their import bills, but also of cutting global oil demand and putting some downward pressure on oil prices.

However, if oil prices remain in a broad $70 to $80 a barrel range, China’s refiners may decide to continue importing at the current robust pace.

What is becoming clearer is that the amount of heavily discounted crude China can buy is reaching a maximum.

China imported a record volume of Russian crude in June, with official data recording arrivals of 2.56 million bpd, up 44% from the same month last year.

For the first half of this year, imports from Russia are up 22% from the same period in 2022.

In addition to discounted Russian oil, China also buys crude from Iran, although this is largely disguised as imports from other nations in official data.

Both Russian and Iranian crude sells at a discount to other grades as those countries are under various Western sanctions, Russia for its invasion of Ukraine and Iran for its ongoing nuclear programme.

If China cannot secure any more discounted oil, it may also trim import levels in coming months as refiners may prefer to use up inventories rather than pay prices they deem too high.

Share This:

Next Article