Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

After years of EVs being priced well above their thermal competition, the arrival of a veritable armada of competitively priced EVs in Colombia (most, but not all, being Chinese) has resulted in the obvious consequence: people are buying them in droves. Record after record has been placed since October, with sales nearly doubling between that month and December alone!

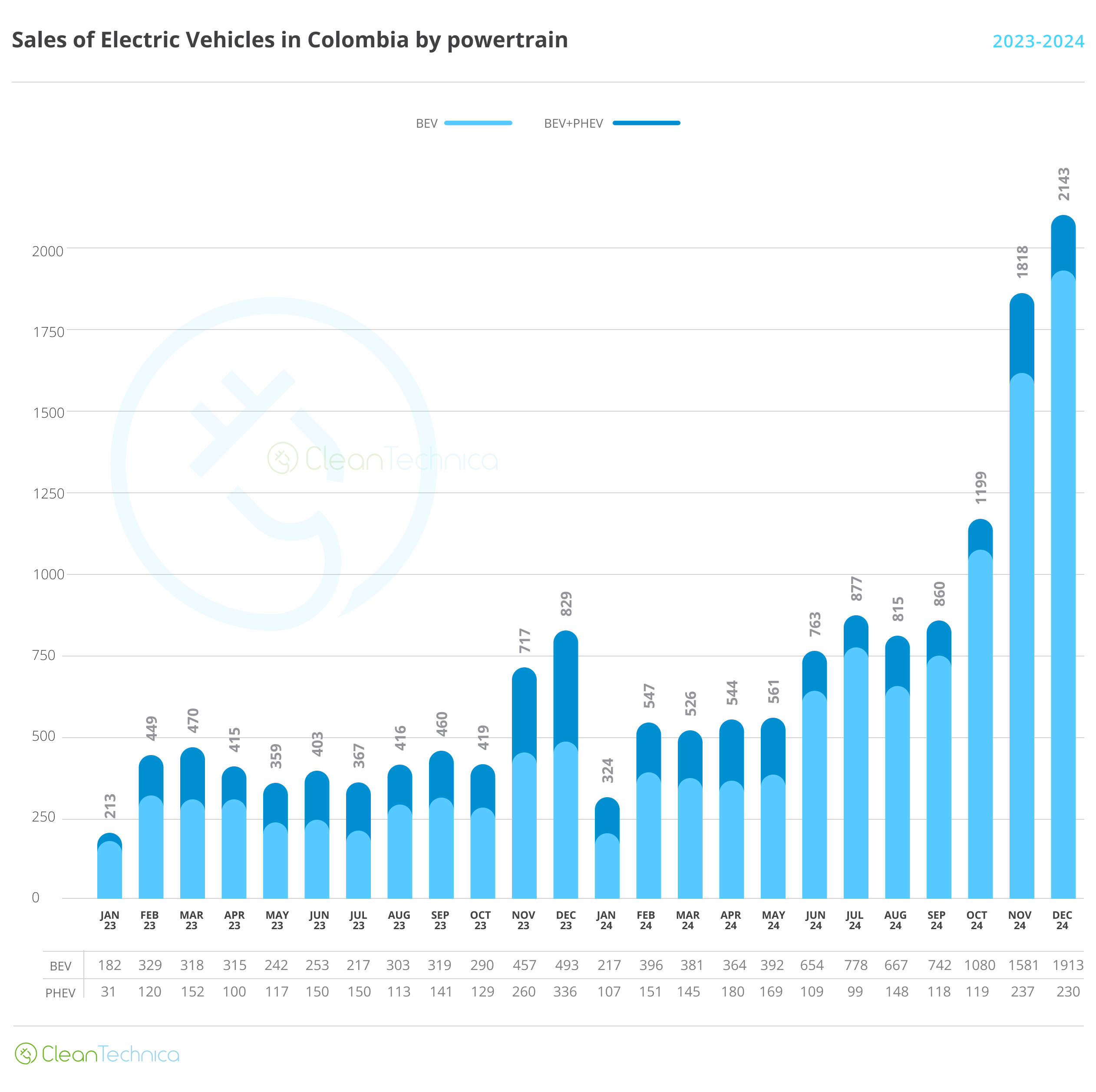

Crucially, all this growth has fallen on BEVs, as PHEVs are facing headwinds and stagnated in 2024. As I mentioned in previous articles, this has a lot to do with the fact that BEVs are much more affordable, but new circumstances are further pushing this switch: the Colombian government — both at the national and municipal levels — has been moving away from hybrids (with HEVs currently accounting for around 25% of the market); the national government recently ended the tariff and tax exemption for HEVs; and several cities have been considering ending benefits related to traffic restrictions (BEVs are exempt by law from these restrictions, so there’s no threat here).

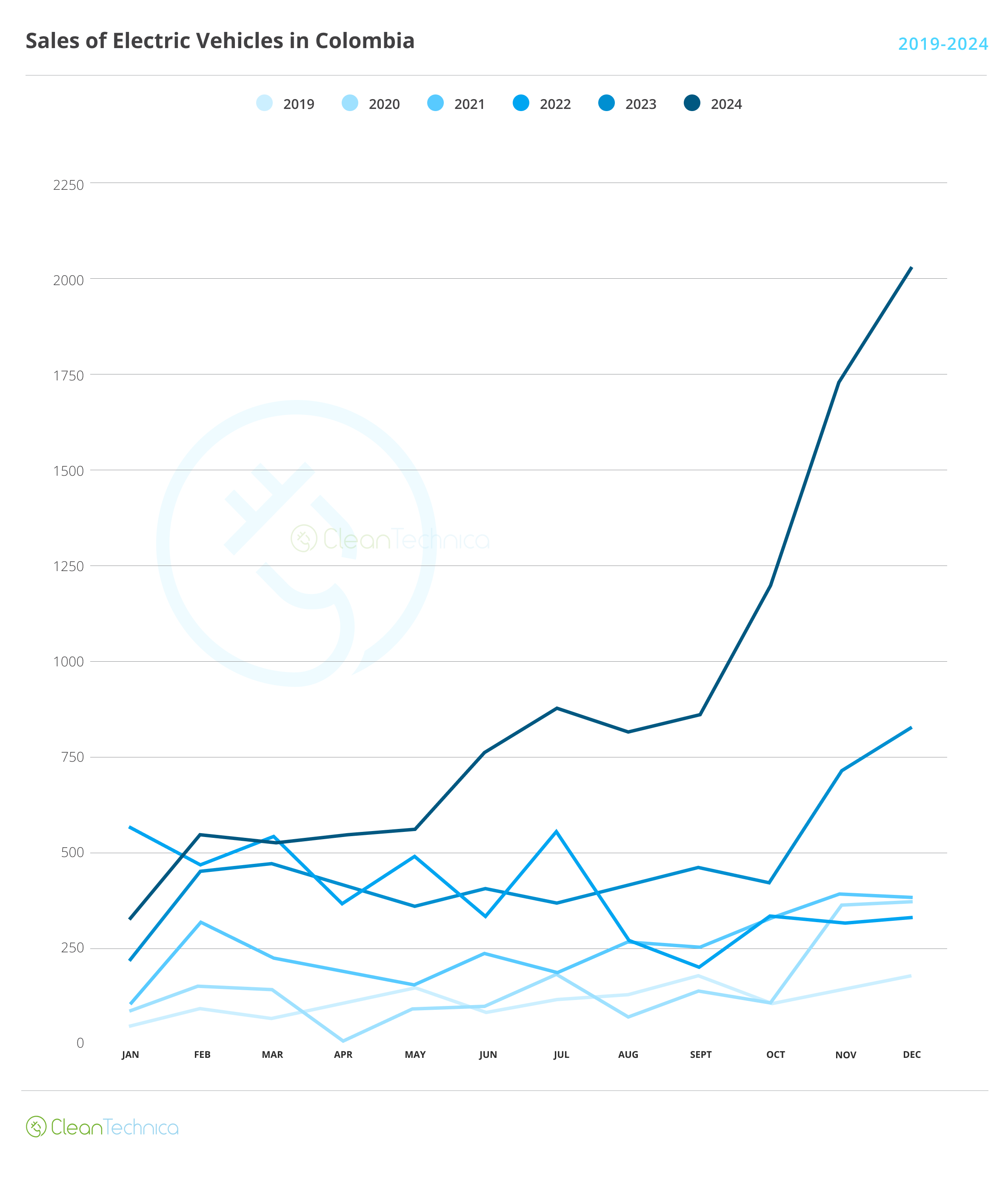

Ordinarily, vehicle sales are very high in December, so it’s likely that we’ll see a month-on-month decline in January. Hopefully, the market share will not fall and Colombia will surpass 10% BEV market share at some point in mid-2025.

Colombia EV Market Overview

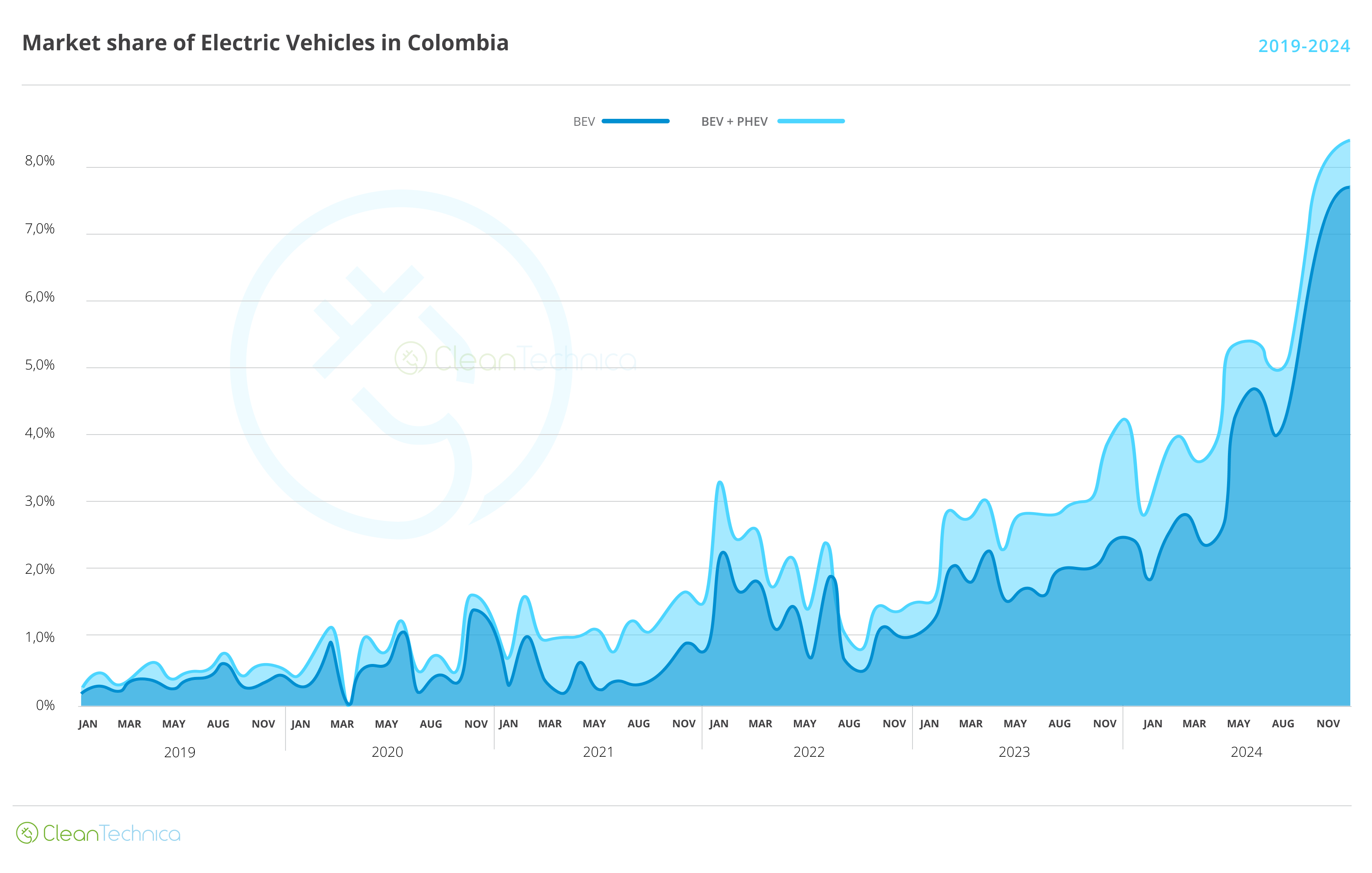

From 2022 onwards, the trend in Colombia has been slow growth in the EV segment whilst the general vehicle market has been in free-fall, so market share has been slowly rising. This trend was finally broken in the second half of 2024. From then on, we’ve seen a booming vehicle market and massive growth in EV sales. Colombia sold over 2,000 EVs in December, nearly doubling the record from October when sales surpassed 1,000 for the first time ever. When looking at this in graph form, the growth is truly impressive and showcases that Colombia is now over the “early adopter” phase:

BEVs account for all of the growth, as PHEVs grew by a mere 0.7% through 2024 and fell by 32% in December. Meanwhile, BEV sales nearly quadrupled between December 2023 and December 2024!

However, as the total market reached over 25,000 units, market share did not rise as steeply (had this happened in any month prior to November, we would’ve seen over 10% BEV market share). BEVs got 7.5% market share in December, with PHEVs reaching 0.9%. Through 2024, market share was 4.5% for BEVs and 0.9% for PHEVs.

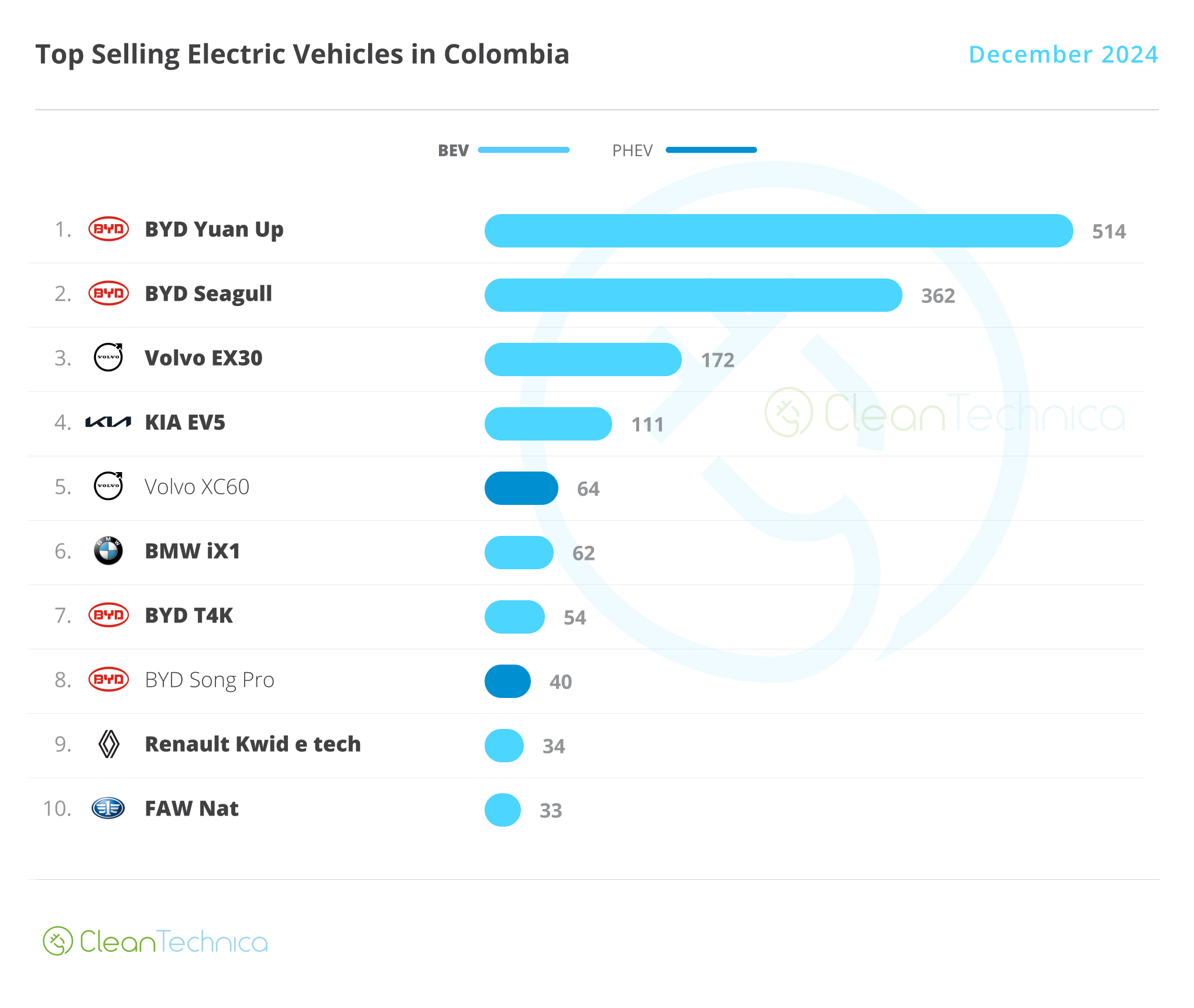

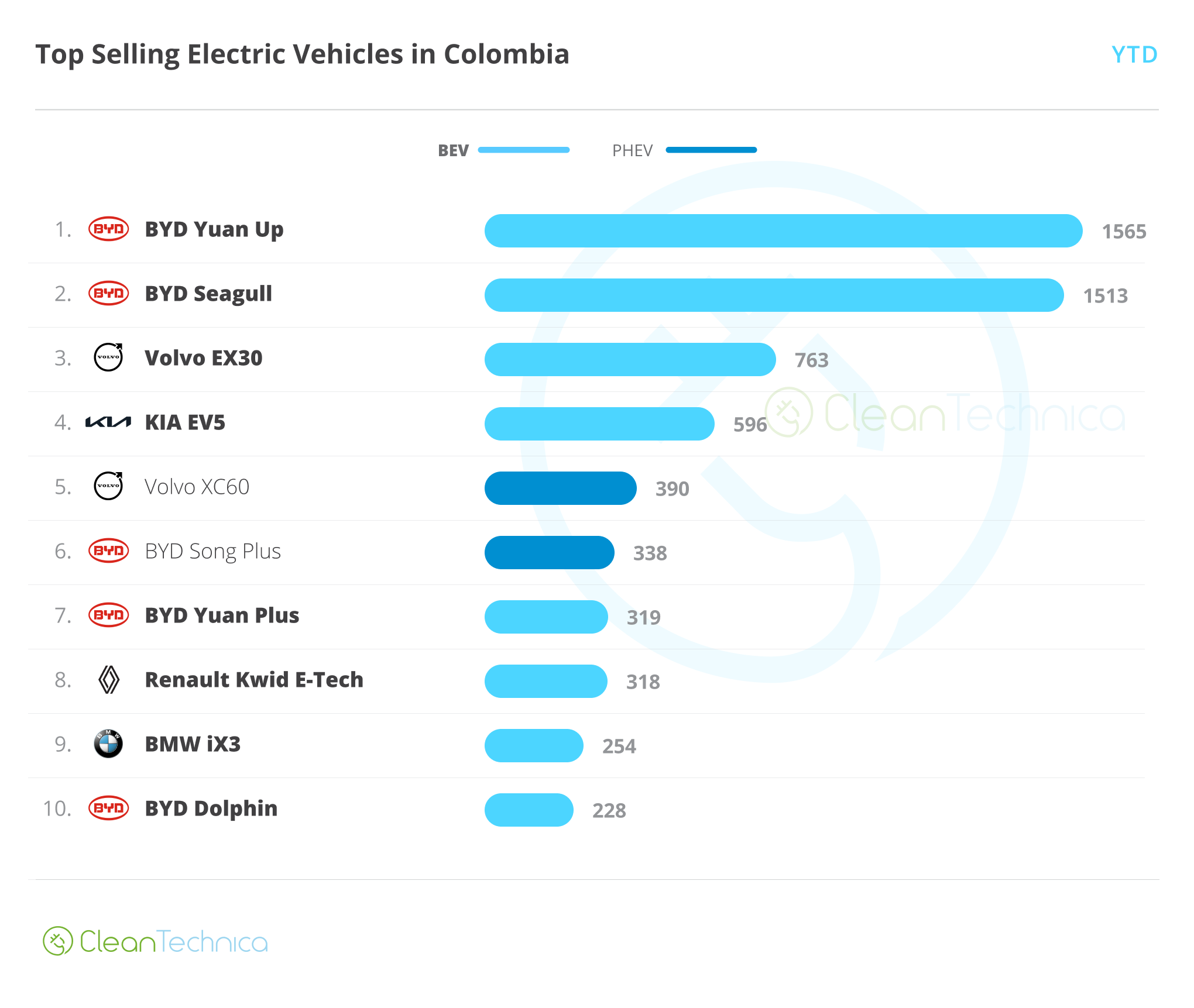

Momentum has largely been maintained by BYD’s two champions (the Yuan Up, which was the 8th most sold car in December, and the Seagull) as well as the great value-for-money offers of Volvo (EX30) and Kia (EV5), which led the market in December in that order.

Below them, at least a dozen new brands are fighting for recognition and slowly gaining the confidence of the Colombian consumer, including MG, Chery, FAW, GAC, and GWM. A notable mention is due for the FAW Nat Bestune, which managed to get in the top 10 thanks to 33 sales last month.

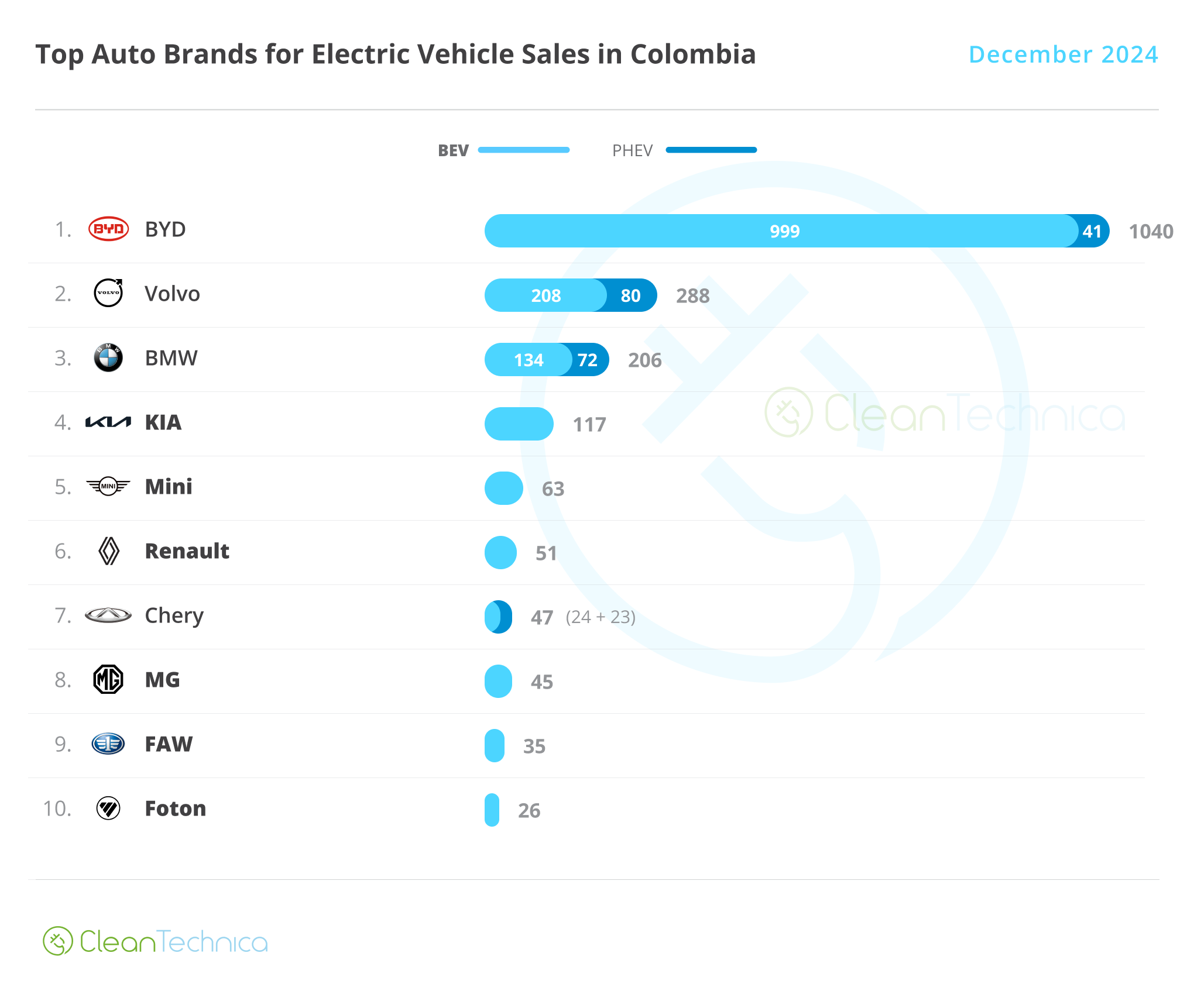

Brand-wise, BYD still maintains around half of the market for itself, with Volvo in silver and BMW back in bronze! Kia was relegated to fourth place despite the success of the EV5. Notable mentions for Chery, FAW, and Foton — which for the first time are getting into the top 10!

Model sales for the entire year showcase the impact of the new arrivals in this market. Out of the top 5, only one vehicle was available the whole year (Volvo XC60). The leading model, the BYD Yuan Up, only started deliveries in July. The BYD Seagull started deliveries in May. The Volvo EX30 arrived in April, and the Kia EV5 in June. This illustrates how rapidly markets can pivot as long as the newcomers offer confidence and good value-for-money.

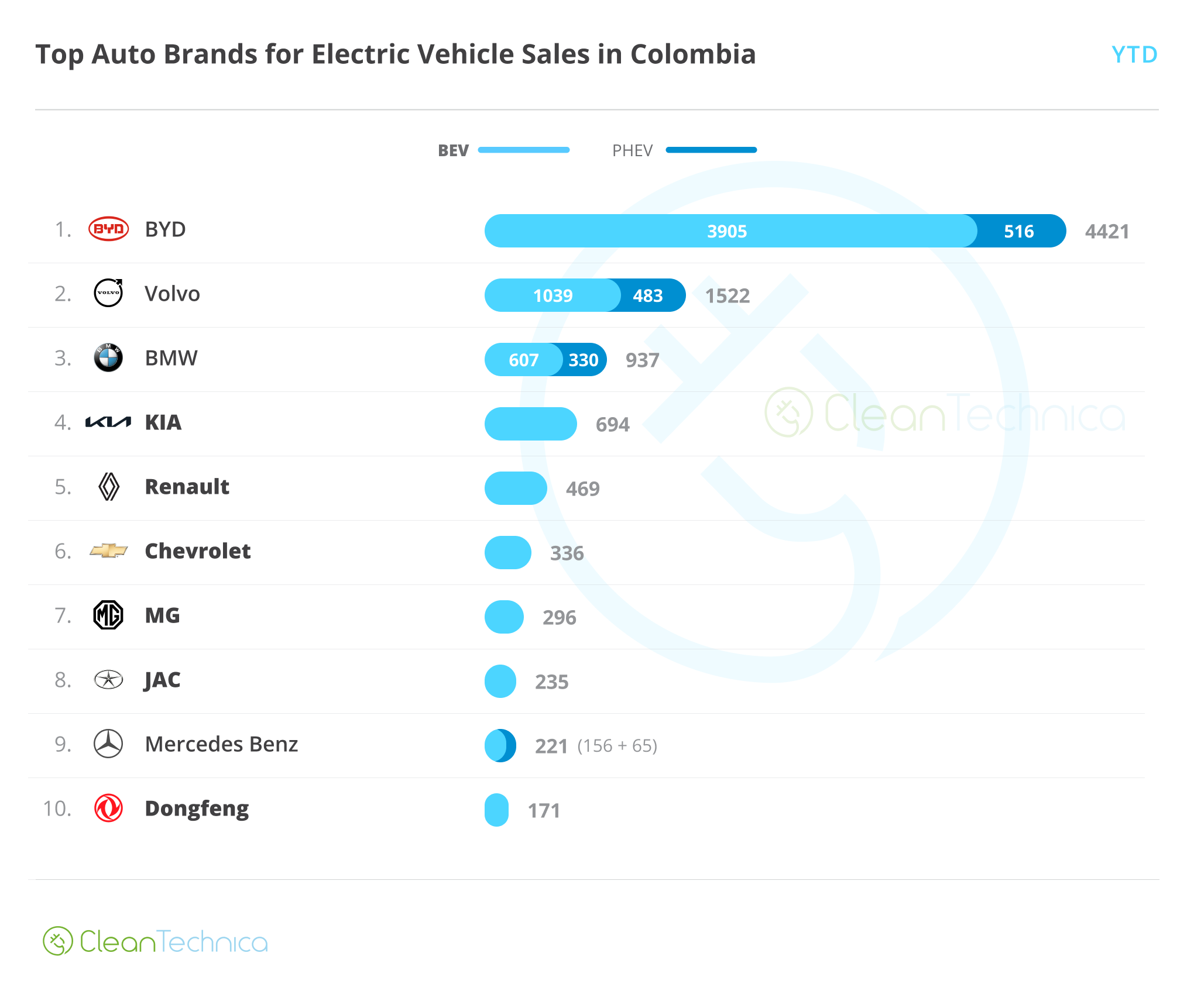

Brand sales for the year start with BYD (still with around half of the market for itself), followed by Volvo and, surprisingly, BMW! The German automaker managed to snatch the position from Kia, which I thought was certain to win the bronze.

Honorary mention to Chevrolet, the only automaker on this list whose entire portfolio is built outside China. However, this is unlikely to be the case in 2025, as GM is now officially testing the Baojun Yep Plus in the country as a rebranded Chevrolet Spark.

Final Thoughts

Two factors seem to be propelling EVs in Colombia: first, their relative affordability thanks to the price wars launched in 2024; second, the strict traffic restrictions in Colombia’s larger cities, which have moved people towards hybrid and electric vehicles, and — should they phase out benefits for HEVs — could soon motivate hybrid buyers to move into BEVs.

However, there seem to be other factors at play. BYD arrived very early (2013) and at unaffordable prices, yet it seems all that time and those few sales served to gain the confidence of customers and develop brand awareness. It remains to be seen how long until other brands get to that point.

The trend from June to December has been positive, and extremely so in the last three months. I do not expect such explosive growth to last for long (otherwise, we would be seeing a fully electric market by mid 2025), but I do expect sales will at least maintain current levels through the first half of the year. As hybrids lose their tax exemption and they become inevitably pricier, it could be that BEVs replace them … or it could be that people revert to ICEVs.

E-motorcycle sales are actually falling: amidst a booming market of over 800,000 bikes sold in 2024, only 2,095 were electric. However, most importers have focused on small, underpowered e-mopeds which do not require registration or a license to drive, meaning we have no idea how large sales are. Though, it would seem there’s an e-moped seller every couple of blocks here in Bogota.

At last, during my December trips to visit family, for the first time I saw EVs venturing outside the city. Furthermore, I passed the one charging station between Bogota and my home city four times, and two of those there was an EV charging there. I remain worried about the number of plugs at these charging stations (1 of each type nowadays) and the inevitable moment when lines start appearing. Hopefully, more infrastructure will be deployed in time and things won’t be as bad as I fear.

But, for now, the EV transition is in full swing on the streets of Colombia!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy