Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Before November 2023, Colombia had been a consistent member of the podium in Latin America as far as EV adoption goes. That month the position got snatched by Brazil thanks to the lowering of the BYD Dolphin’s price and, later, the arrival of a more affordable BYD Dolphin Mini (BYD Seagull).

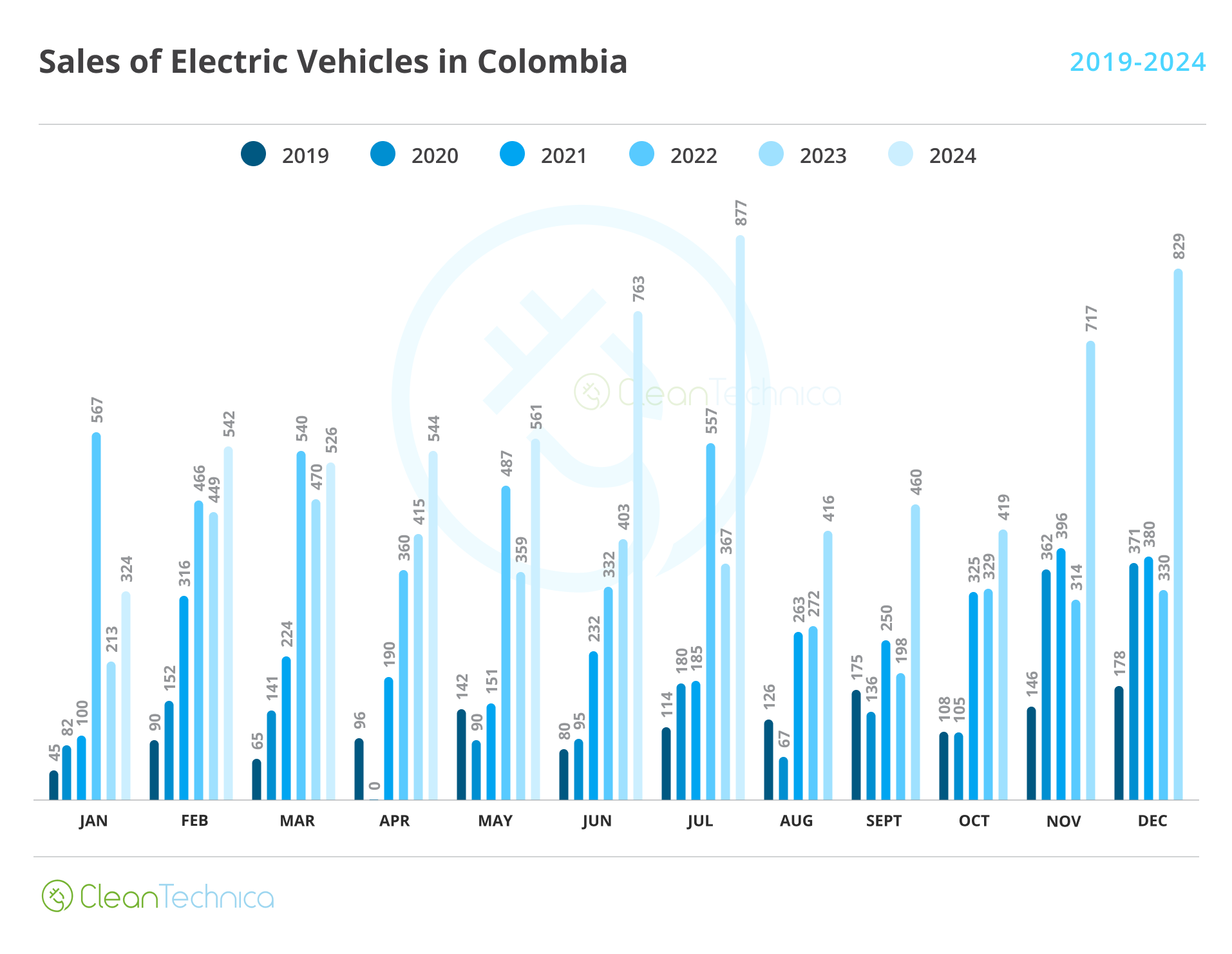

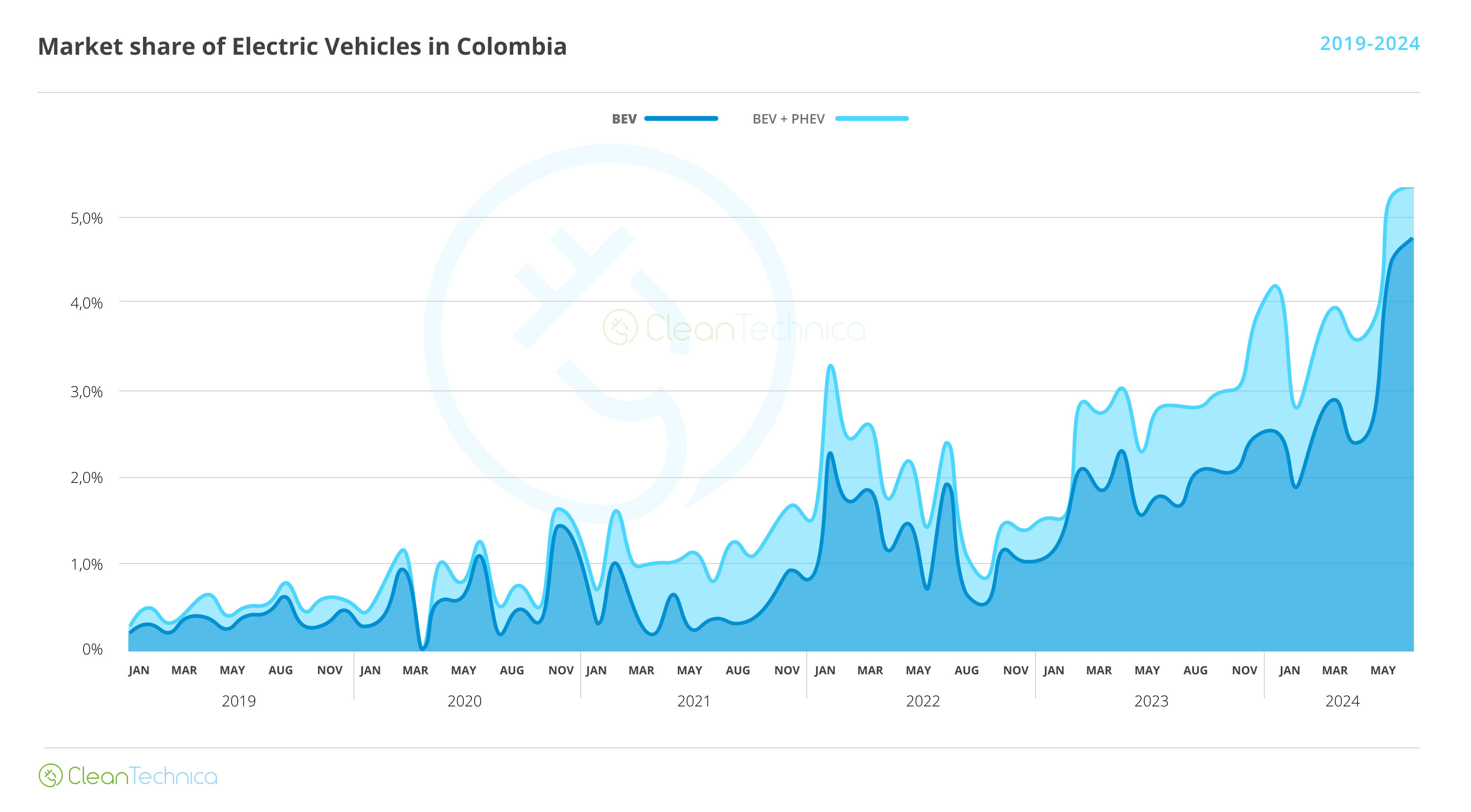

It took a few months for Colombia to get its own affordable EVs, but now they have arrived, and the country is once again rising in sales, surpassing Brazil in July 2024 and reaching and all-time high share of 5.3% (4.7% BEV). Let’s look at the numbers!

General overview of the market

Colombia’s EV landscape in 2024 was completely transformed thanks to the arrival of three affordable champions: the Volvo EX30 (COP$180’000.000, or $44,900), the BYD Seagull (COP$78’000.000, or $19,500), and the BYD Yuan Up (COP $105’000.000, or $26,200). These three EVs for the first time in history arrived at price points similar to or even lower than comparable ICEVs, allowing them to rapidly gain market share from the old combustion-mobiles. Moreover, the arrival of these three champions triggered price wars in their respective segments, creating a more diverse ecosystem of affordable EVs even if — for now — most of the sales remain within the most-known brands. The results, sales-wise, speak for themselves: the arrival of the Volvo EX30 in February, the BYD Seagull in June, and the BYD Yuan Up in July are clearly visible, as each one represented a significant jump in sales over the previous month.

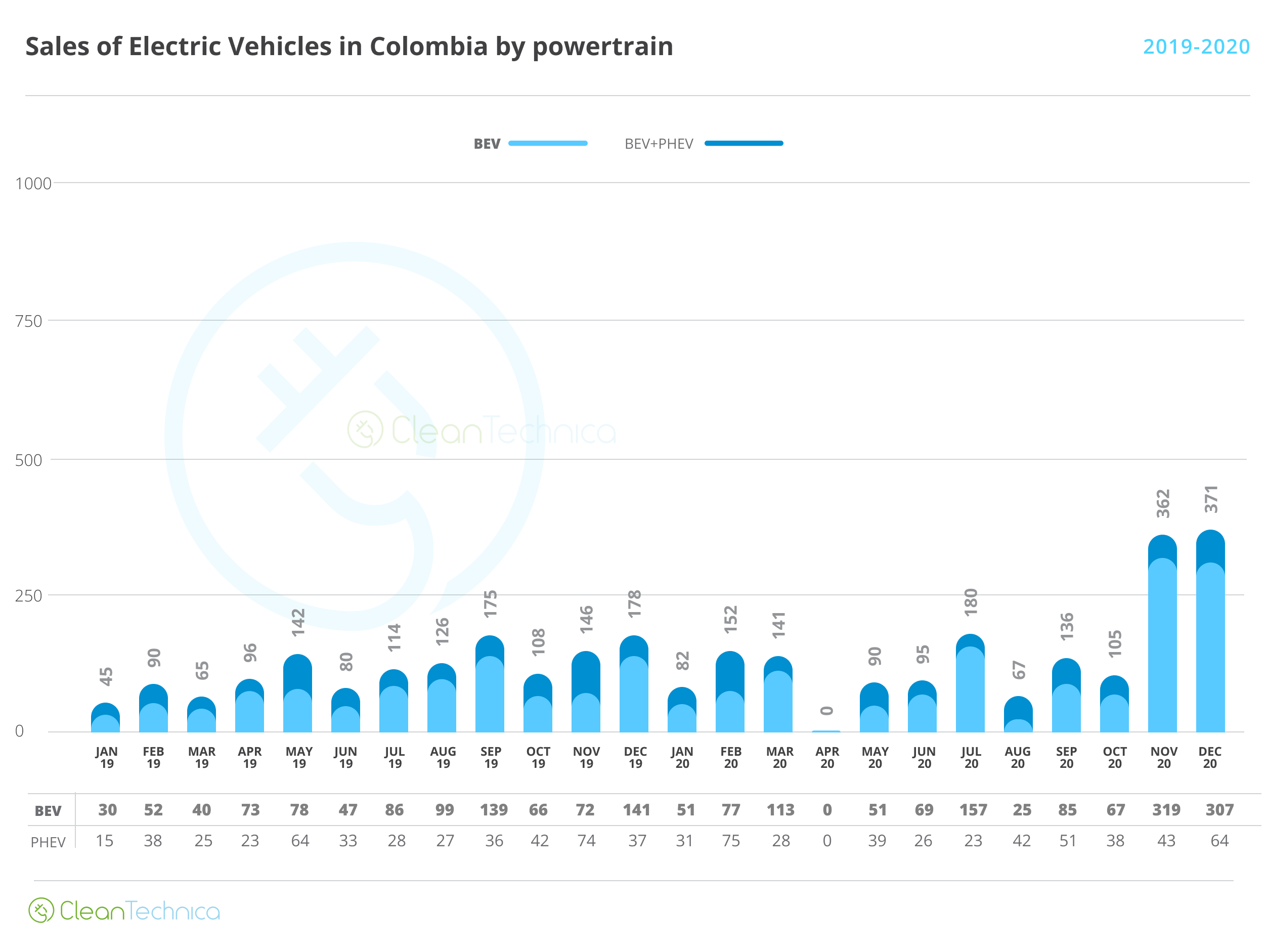

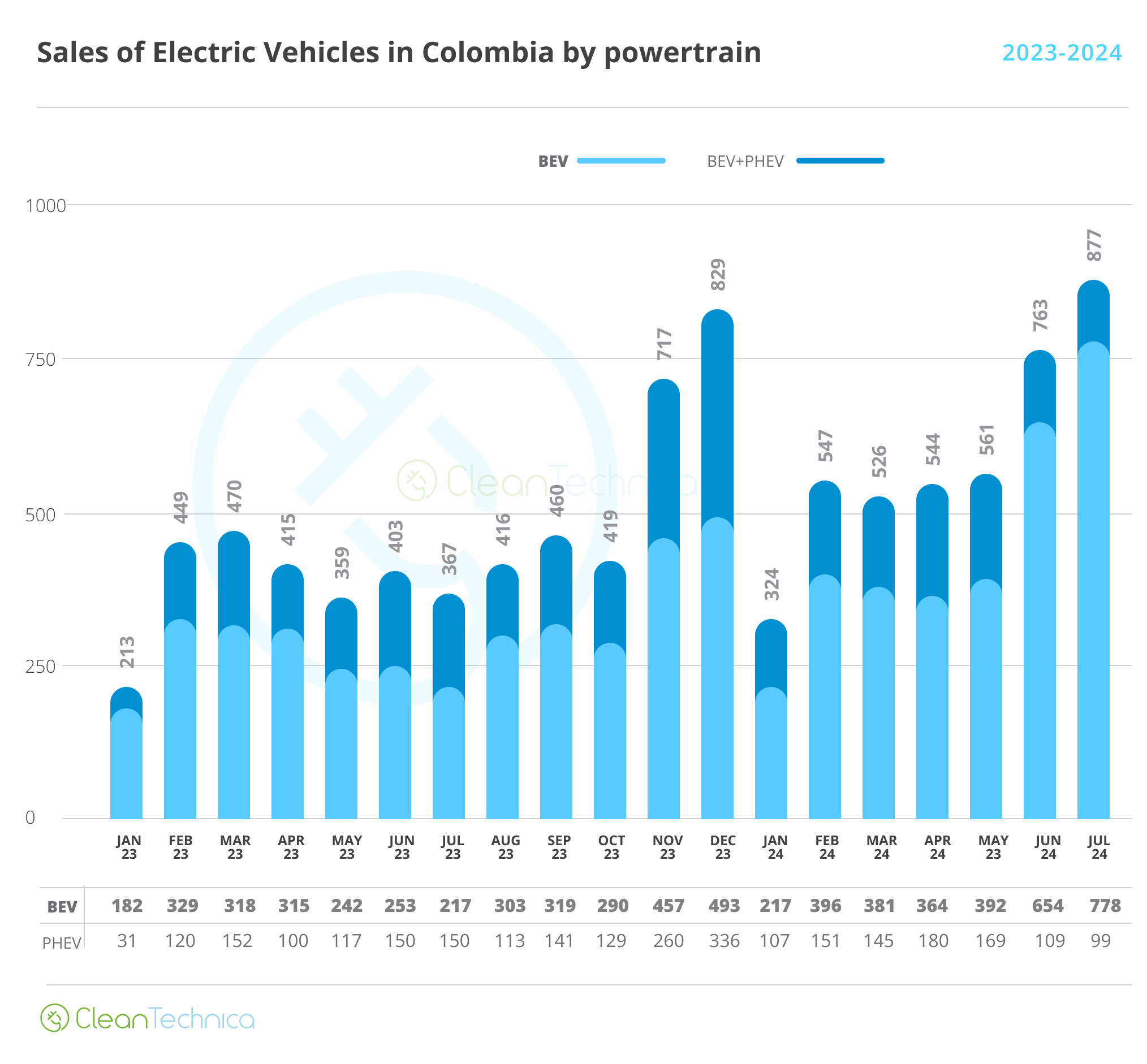

EV sales reached a new high in July, and more interestingly, they did so as PHEV sales fell. This is very interesting because in previous years PHEVs held a significant part of the market: for example, in 2021 and 2022, there were months when they became more numerous than BEVs:

By 2023, BEVs were consistently more popular, but PHEVs still held to a third of the market or so. The trend was only (and abruptly) broken in June 2024, when BEVs became much more popular and started commanding an absolute majority: over 85% of the market.

From my perspective, however, there’s no mystery as of why this is happening. PHEV prices remain high, with only two models below the psychological barrier of 200 million COP ($49,900) and none below 100 million COP ($24,950). Meanwhile, there are at least six BEV models currently under 100 million COP (more if you include quadricycles) and we’re probably getting close to 20 models available for under 200 million COP. In developing markets, affordability is key, and the times when hybrids were cheaper than BEVs is now in the rear-view mirror.

Market-share wise, Colombia has finally reached the 5% barrier (surpassing Brazil), meaning we’re into what José calls the Disruption Zone! And the increase in the last two months has been considerable, which means there’s momentum and market share may yet rise more before stabilizing.

The sad news is that ICEV sales (including HEVs and MHEVs) have slightly increased, as the overall vehicle market has been recovering from the depths it reached in previous months. So far, the recovery is slow and there remains a chance that EVs will snatch all of it and then some more — but, for that to happen, even faster growth is needed.

Sales ranking

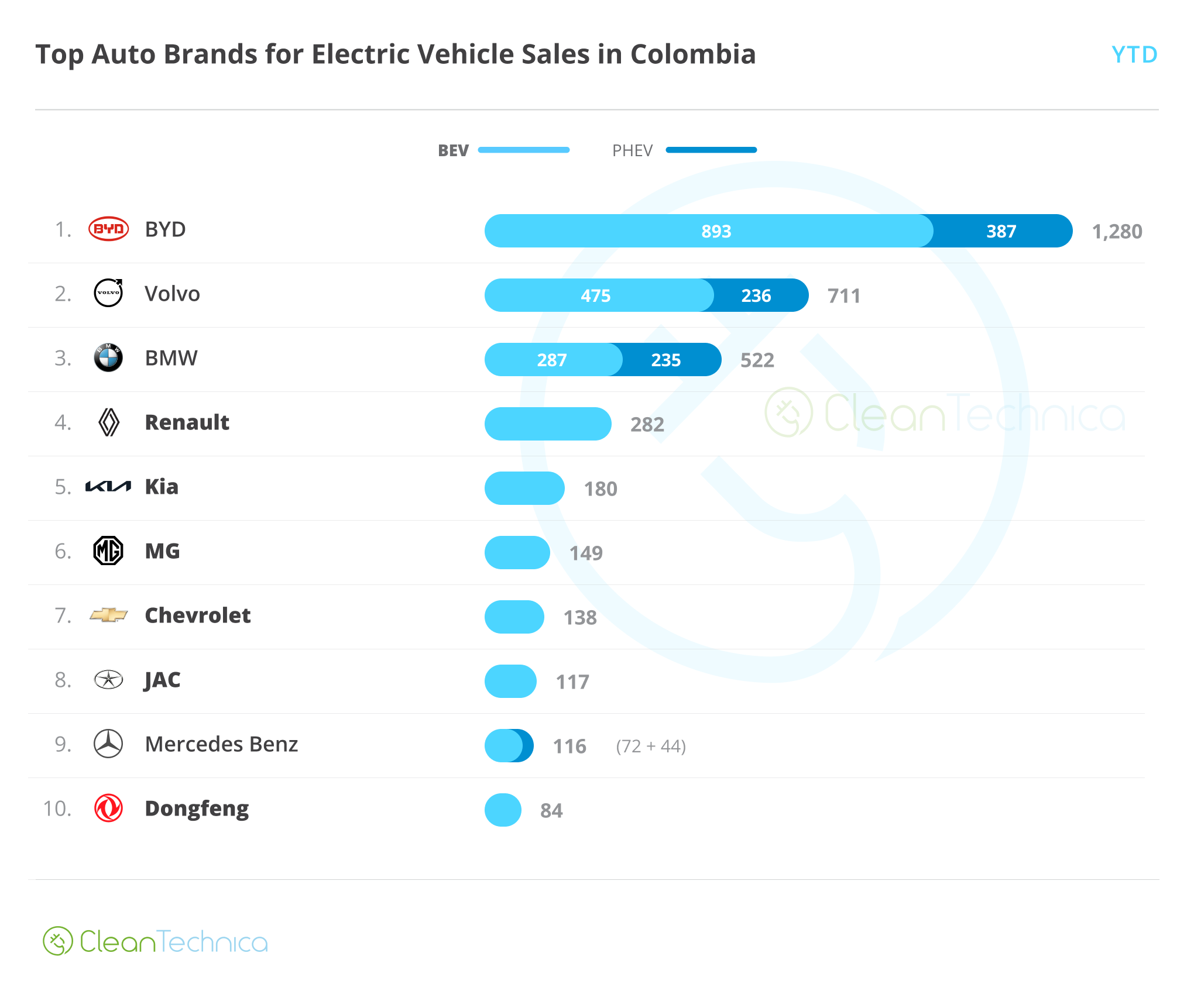

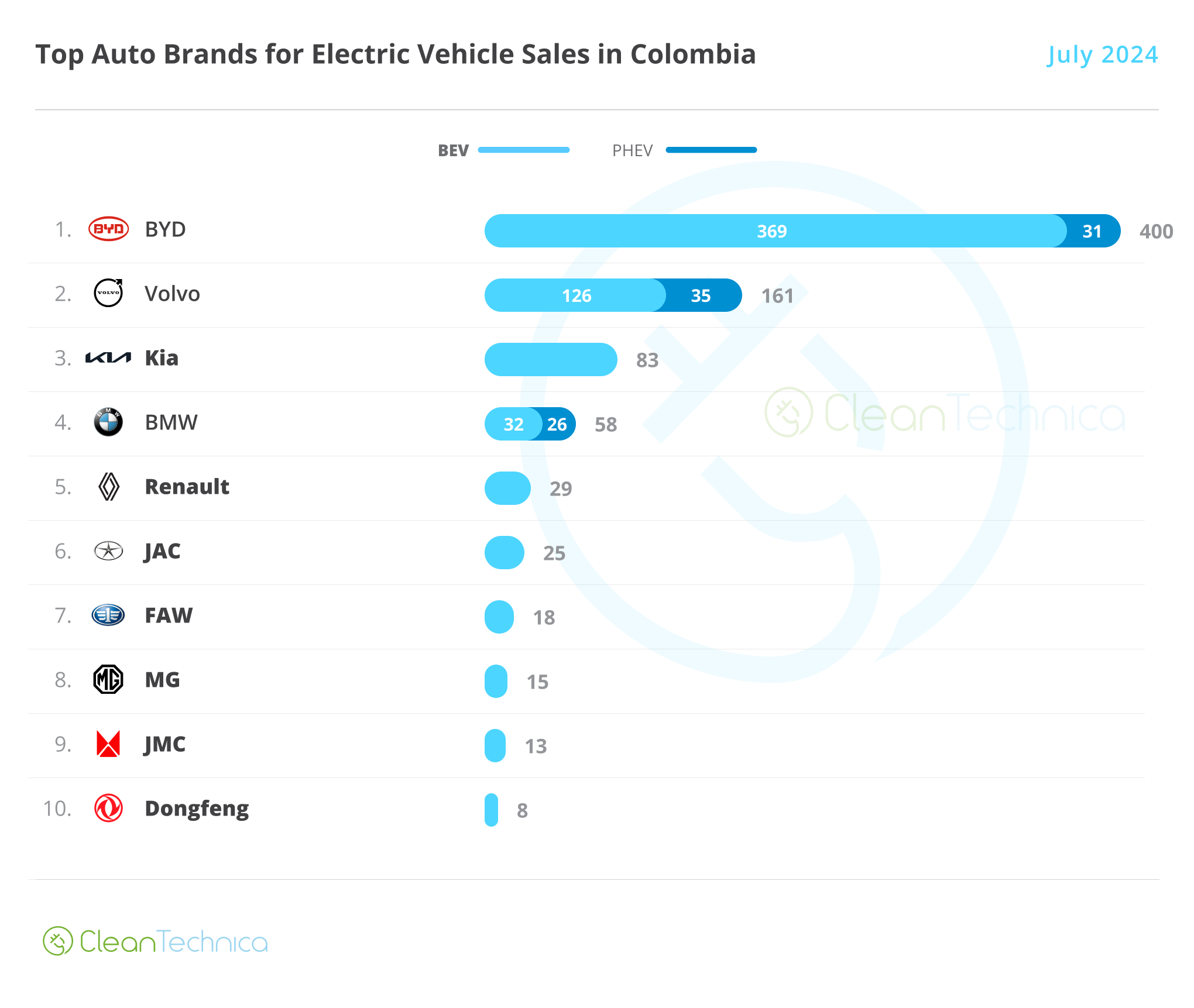

It shouldn’t come as a surprise for most of our readers that BYD is the absolute leader in EV sales, followed by Volvo. More interesting things are happening below, where three established automakers are fighting for the bronze (BMW, Renault, and Kia), and then in the second half of the chart, where three Chinese and two legacy automakers make an appearance.

Year to date, BYD holds some 30% of the total market, followed by Volvo (17%) and BMW (13%). Renault, in fourth place, is bound to progressively lose positions, as its success early in the year was mostly due to the Renault Kwid E-Tech (Dacia Spring), a car that has fallen out of grace as the more affordable, better equipped BYD Seagull has entered the market. Meanwhile, Kia is bolting ahead, and even though it may not be able to snatch the bronze from BMW by the end of the year, it managed to beat it in July and get onto the podium!

Kia’s “secret sauce” is the Kia EV5, a large SUV by Colombian standards that offers a compelling price, being more affordable than the PHEV BYD Song Plus, its most direct competitor. It’s important to note that Kia proudly boasts its Kia EV5 is equipped with a BYD Blade Battery: by now, the connoisseurs in the country seem to find BYD the most reliable brand as far as batteries go, and its Blade Battery the non-plus-ultra, the standard other batteries must be upheld to if they wish to be considered worthy. Truly, BYD has done a great job making itself a name in this small market … and in July, thanks the arrival of the BYD Yuan Up and the strength of the Seagull, it got nearly half of Colombia’s EV market for itself!

Some new names appear in the latter parts of the list, particularly FAW — a Chinese brand that sold 18 taxis in July, but that otherwise has not been present in the market. Renault, highly dependent in the Kwid E-Tech, is now in 5th position and falling, while BMW maintains a decent position thanks to its competitive EVs in its own segment.

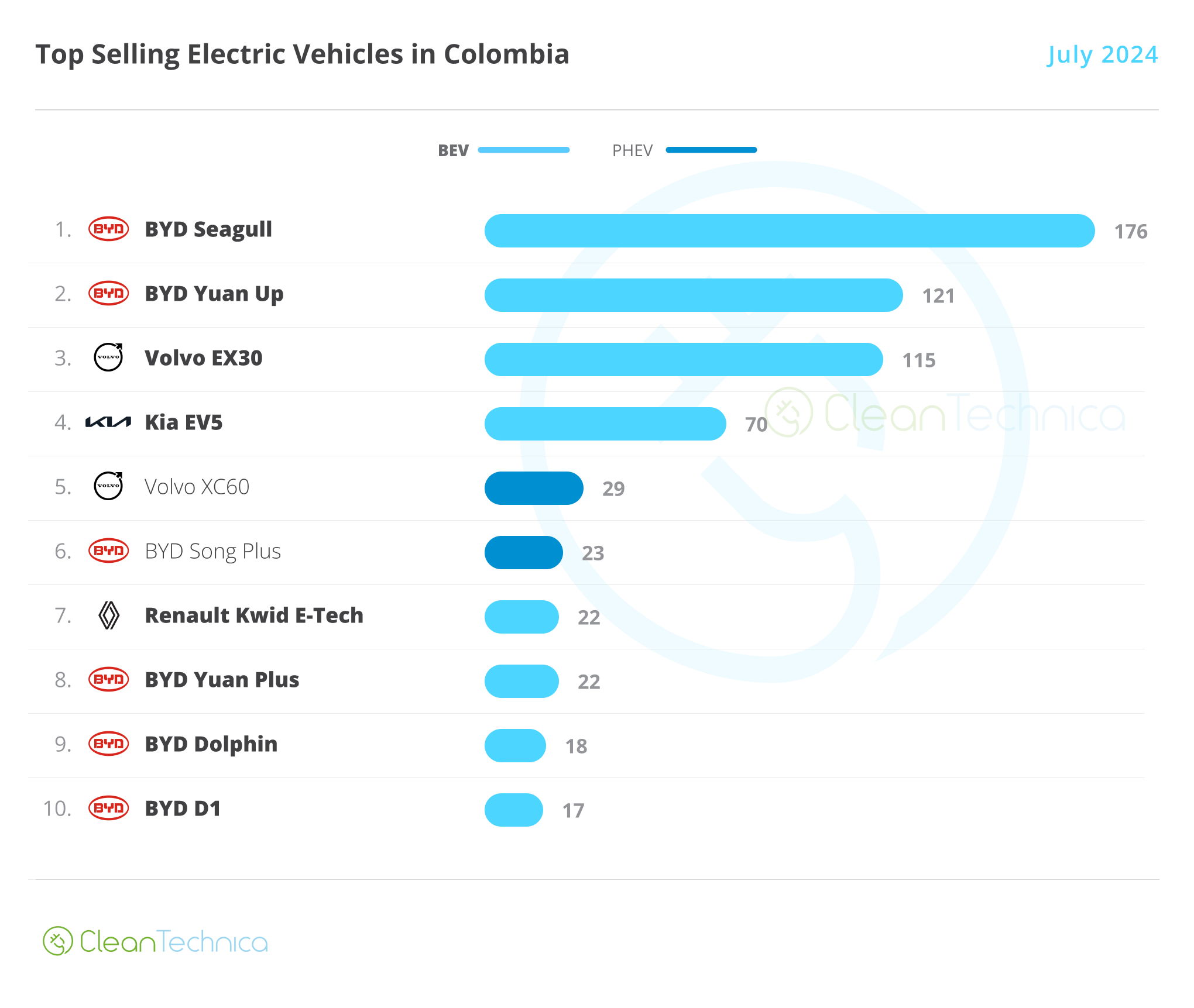

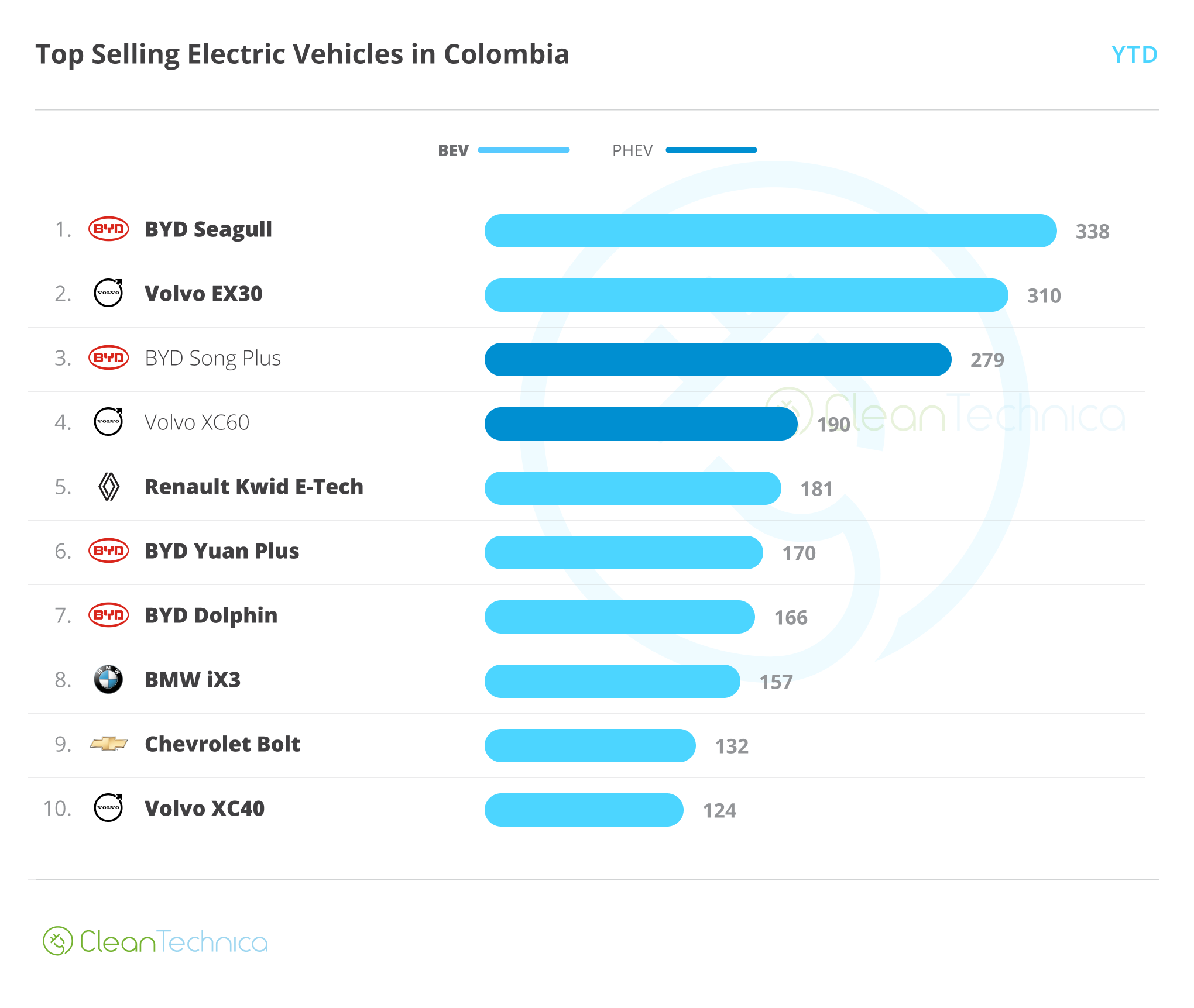

Model-wise, July was dominated by the three “affordable champions” mentioned above, from least to more expensive, followed by the Kia EV5. BYD dominates, with 6 models in the top 10; Volvo has an additional two; and Renault and Kia make up the remaining. Year to date, however, the list is different and BYD only manages to get 4 out of the top 10 spots:

The fact that the Seagull is leading this ranking after only being available for two months is telling. Likewise, the BYD Yuan Up sold 121 units in July (its first month in the market), meaning it was only missing 3 units to make it into the yearly top 10! These two vehicles are poised to dominate the Colombian EV market in the foreseeable future.

The silver goes to the Volvo EX30 (no surprises here), which increased sales in July, meaning it could well maintain its position through the rest of the year. The bronze goes to the BYD Song Plus, the most popular PHEV in the country, but it’s almost a certainty this position will go to the BYD Yuan Up in a couple months at most.

Further down we find the BMW iX3 and the Chevrolet Bolt making an appearance in the 8th and 9th positions, respectively. The Bolt is on its way out, but, being sold at $40,000, it makes a good omen for the upcoming Equinox EV (a better car in all aspects) so long as they can sell it at a similar price. As for the Renault Kwid E-Tech, it has been a success, but the Seagull has taken that segment for itself and now the Kwid lingers on the sidelines.

Final thoughts

The EV transition is accelerating. Price parity is finally here, and years of preparation by these electric brands are paying dividends as the country surpasses the 5% share mark. Growth is fast and there’s momentum, so it will remain so for at least a few months.

And yet, I can only think on what comes next. The Seagull has arrived with a bang, yet equally affordable EVs for other automakers (JAC, Changan, JMC) are failing to gain traction. The Yuan Up is a game-changer for sure, but it can’t make a transition by itself. Where are the affordable SUV-ish cars from other automakers? Where are the small BEV sedans?

In this sense, my hope remains that the current momentum lasts us until new arrivals bring a new wave of growth. These new arrivals, in the short term, are mostly focused on the SUV segment and include Chevrolet’s EV Armada (Equinox EV, Blazer EV, perhaps Baojun Yep Plus), some of the Zeekr champions, and Kia’s new EV lineup. And Tesla, of course, which was supposed to arrive a few months ago but never did. I sometimes wonder if Elon fired the people in charge of that.

It’s Kia that I have the highest hopes for. This brand made itself a name in this country with the successful Kia Picanto and maintains a good reputation as far as sedans and SUVs go. The Kia EV3 — if sold at a price near the promised $30,000 for the 61kWh version — could be a game changer with a far larger impact than the Yuan Up, for its range would be enough for the most common inter-city trips in this country. It would also be competitive even with Kia’s own ICEV lineup and strengthen the EV presence in Colombia’s most sold segment. And unlike BYD, Kia already has brand recognition and the confidence of the costumer.

At last, infrastructure is lagging, but so far, this does not seem to affect sales. However, it’s only a matter of time until we start seeing lines at the fast-charging stations (most of which have only one stand) or complaints about the one stand being out-of-order, effectively leaving travelers stranded. This should be fixed beforehand, but I doubt it will be, and that could take momentum off the transition at some point in the near future.

For now, though, the sun shines and the sky’s bright blue as Colombia’s EV transition gathers steam and sales bolt ahead. With the US at some 8% BEV sales, and Canada at around 12%, I wonder if Colombia could surpass either by the end of the year, fulfilling an omen I’ve been prophesizing for a while: that developing countries will transition faster than developed ones.

It’s a long shot, but the game is just starting.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy