Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Colombia’s EV market is booming.

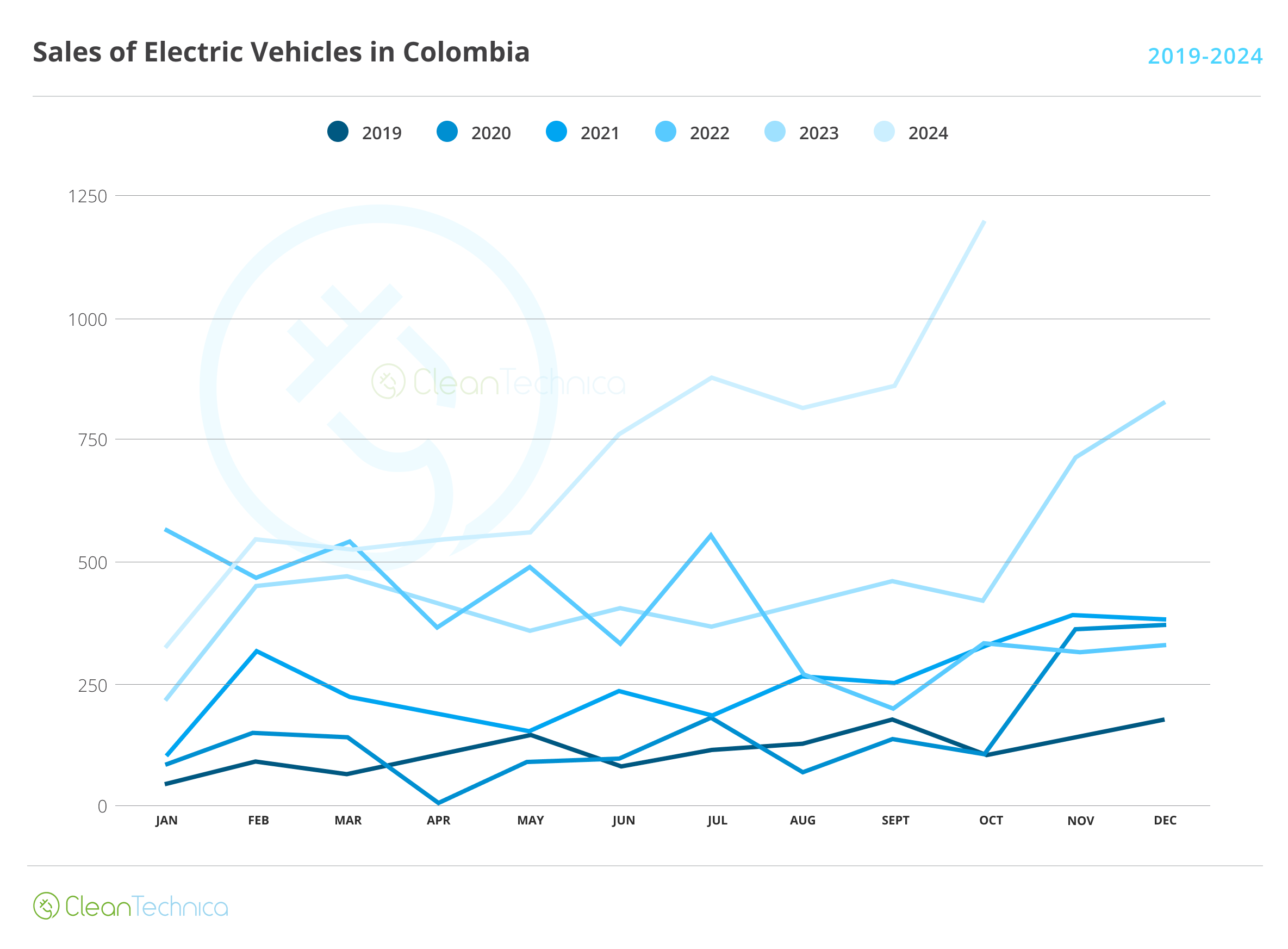

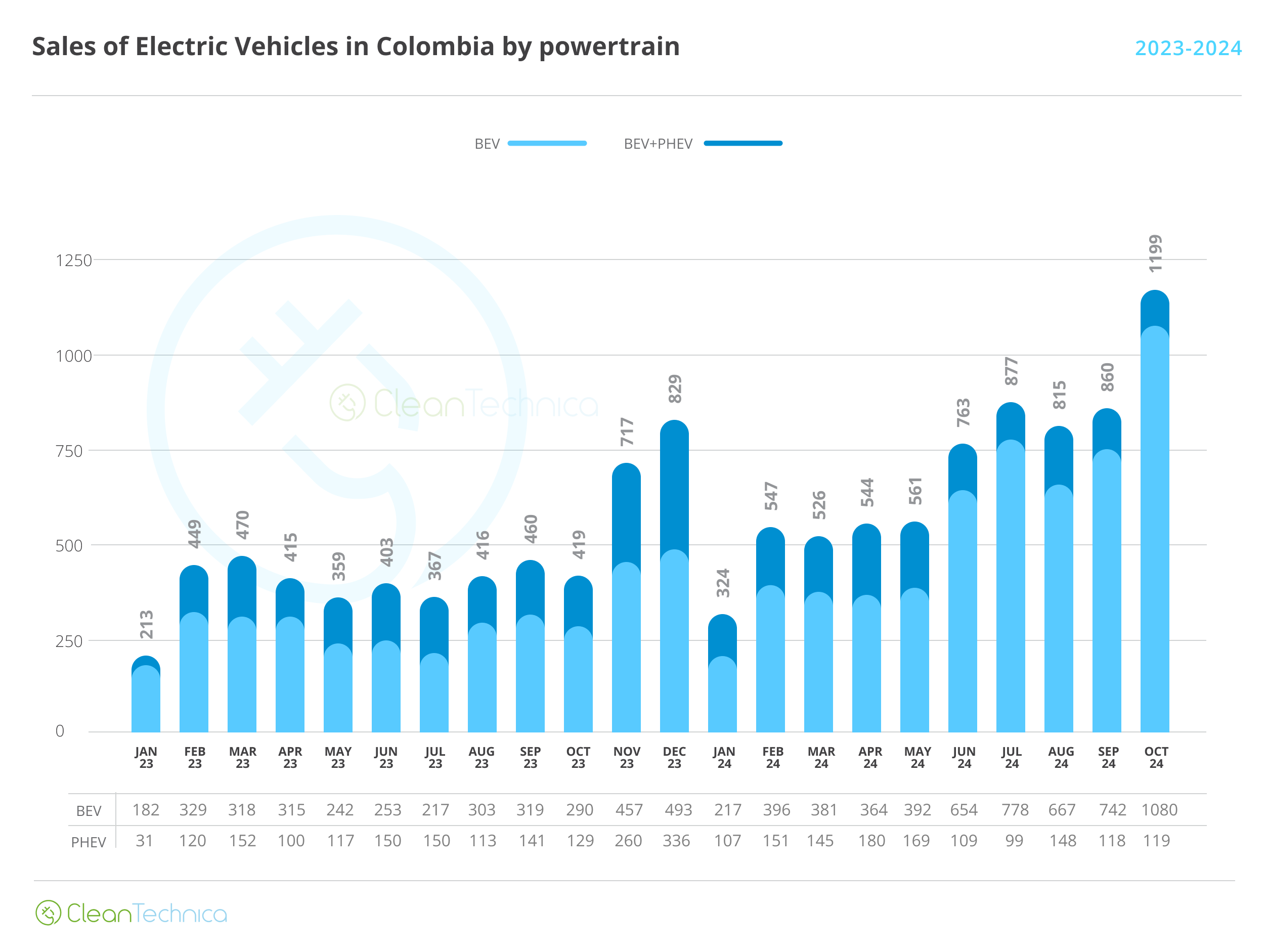

As I said a couple months ago, we’re not only seeing significant YoY (year over year) growth (as we are in several other markets, including Costa Rica, Uruguay, Mexico, and Brazil), but we’re also looking at “bursts” of demand that lead to significant MoM (month over month) increases. The most recent of these we just witnessed in October, when nearly 1,200 EVs were sold, over a thousand of them being BEVs.

Having surpassed the psychological barrier of 1,000 BEVs (something noted in several car magazines around the country), and with a total market well below 20,000 units a month (18,521 in October), EVs have basically gotten into the Great Leagues.

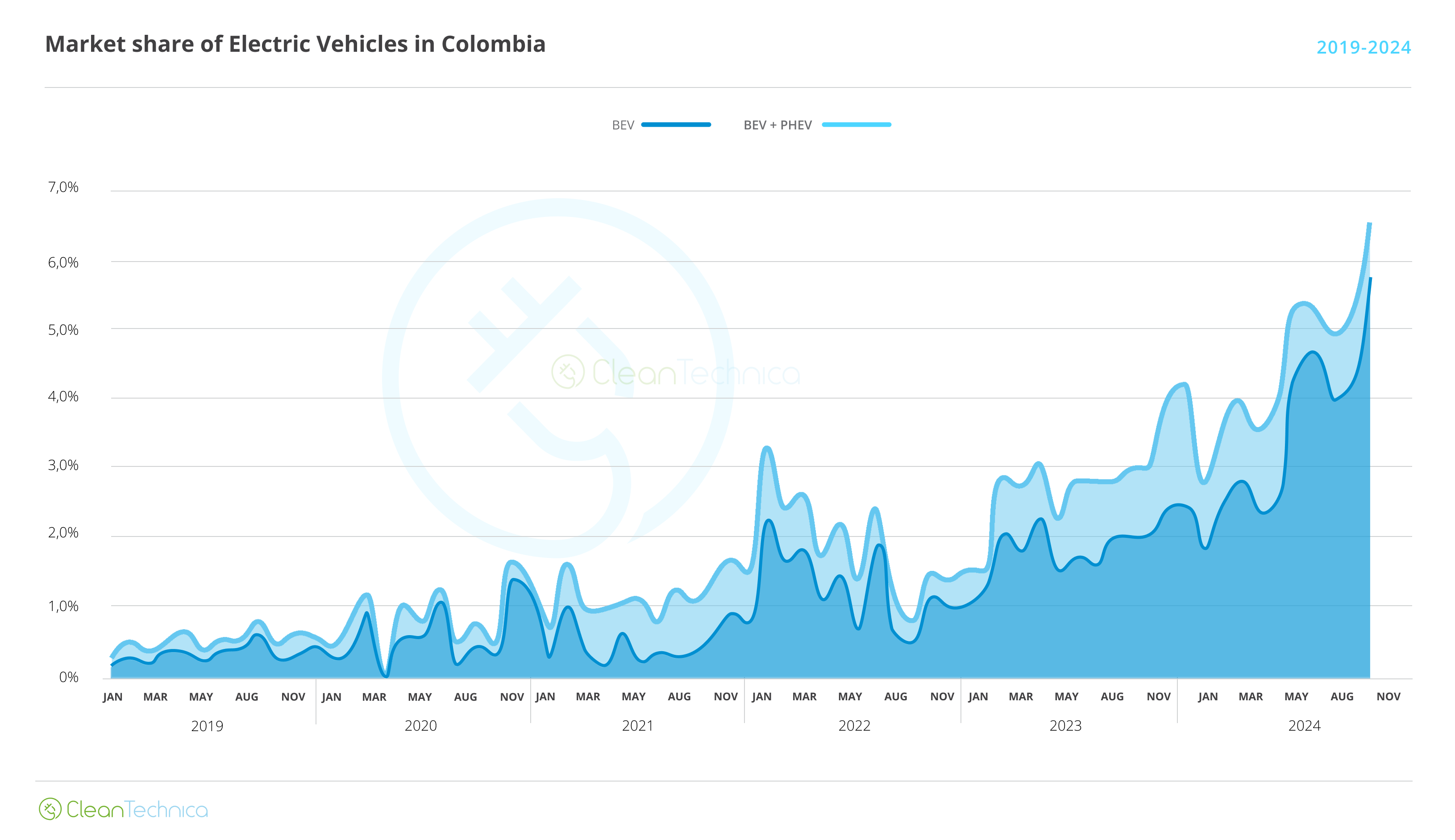

Now, as far as market composition goes, Colombia is bucking the global trend. The arrival of affordable BEVs and the comparative steep price of PHEVs has led to the latter falling in relative as well as absolute terms: whereas in October BEV sales grew an impressive 270% YoY, PHEVs fell by 8%; as a result, BEVs made up 90% of the plug-in market last month.

This growth means that only 4 months after surpassing 5% market share, we find ourselves over 6%! Specifically, 6.4% (5.8% BEV, 0.6% PHEV).

Now, as you can see from previous years, November and December tend to be positive months for new energy vehicles, and more so as a veritable tsunami of them is arriving in Bogota’s 2024 Hall of the Automobile. This means that closing the year at 8% or even 10% market share is now a possibility!

Market Composition

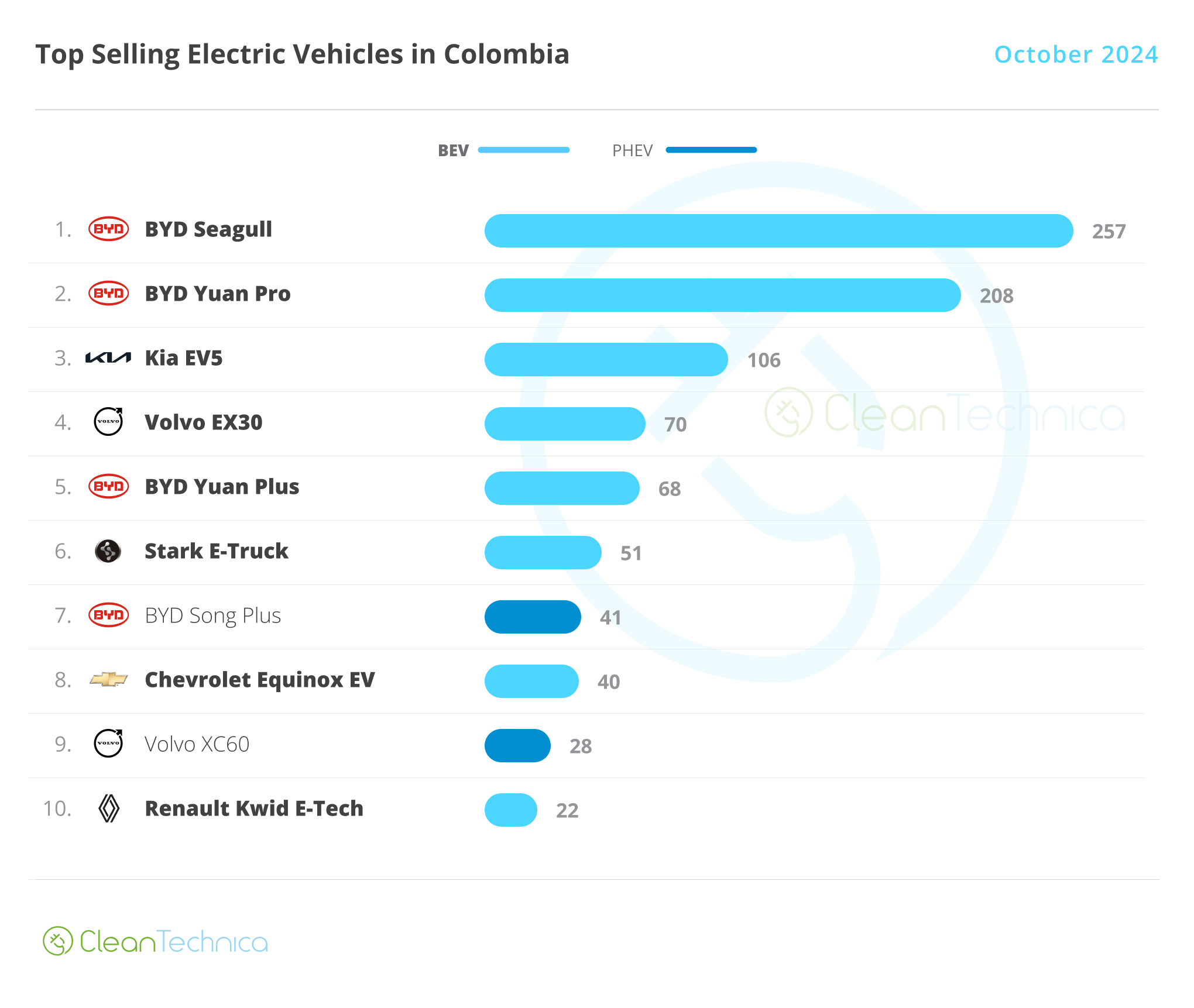

New and competitive BEVs and PHEVs are arriving in droves, but the Hall of the Automobile opened in November, so the impact of these will only be known in a month. For now, the new wave of growth seems to have been unlocked by the arrival of a couple of ships full of BYD Seagull and BYD Yuan Up, the two models that by far lead this market:

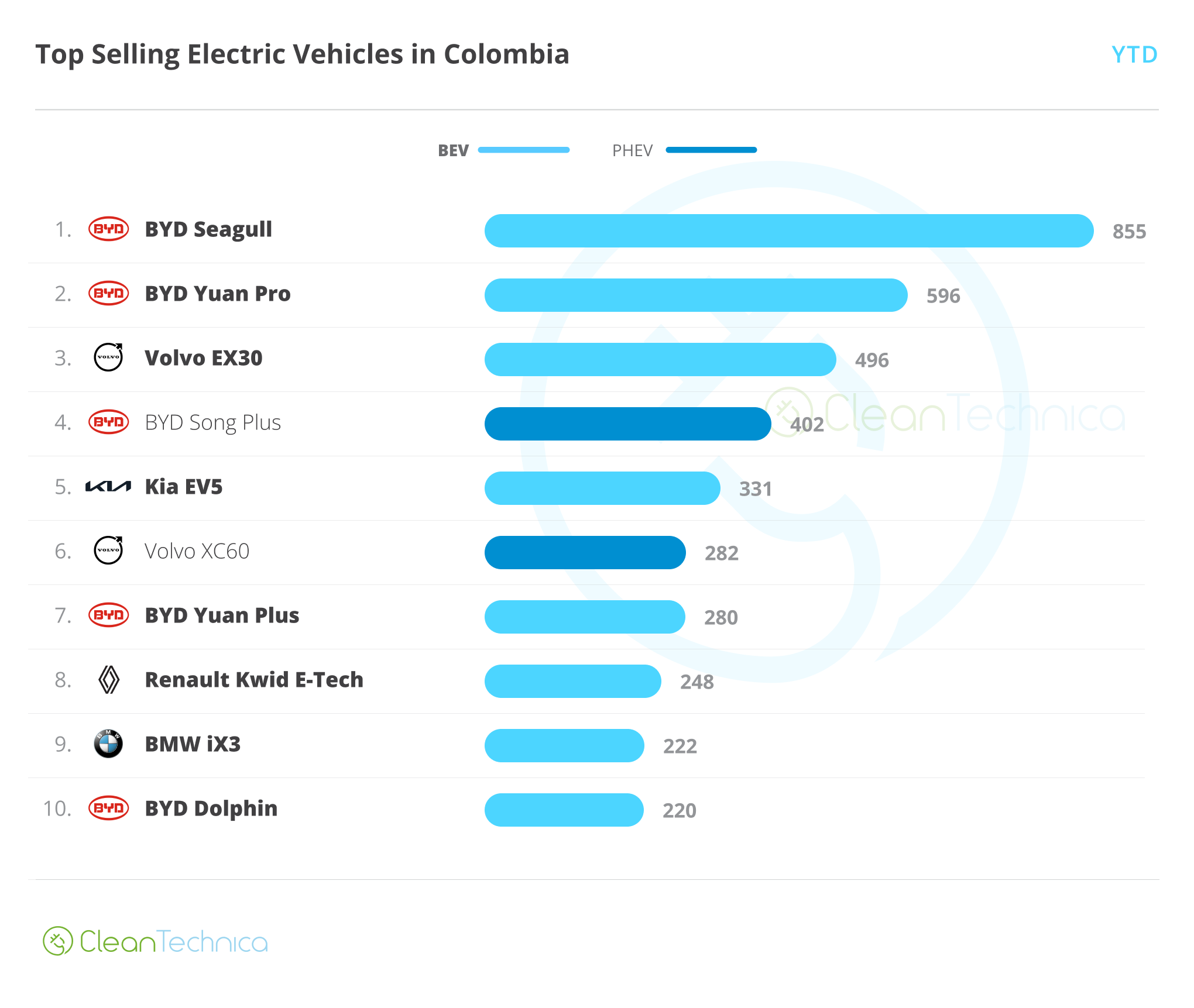

The more affordable Seagull leads the chart, followed closely by the Yuan Up, and in a not-so-distant third place we have the Kia EV5, a Chinese-made SUV with a 64 kWh or 88 kWh battery depending on the version. The EV5 has dethroned the Volvo EX30 thanks to its much higher value for money: for a mere $1,000 more ($43,500 vs $44,600), you get a long-range SUV with a huge battery and much more space. Or you can go for the short-range EV5 ($40,000), save over $3,000, and still get a much larger battery (the EX30 has a 51 kWh battery, vs a 64 kWh one for the EV5).

Further down the list, I want to focus on two models. First: the veteran rebranded Stark E-Truck, a 4-ton, last-mile delivery truck that’s become quite popular in the country and has been at the heart of Auteco’s strategy since its arrival in 2018. If not for the absurd diesel subsidy still present in the country, no doubt this truck would be doing much better.

Second: the recently arrived Equinox EV, which can be purchased roughly at the same price as the Kia EV5 long-range, with a very similar battery but with AWD. I’ve long said that the Equinox could be a success in Latin America, and even as competition grows tougher, I still believe that. But for Chevrolet to get sales as high as Kia’s, it must bring a more affordable RWD version of this vehicle (if close to Kia’s 64 kWh EV5 price, it should demolish it thanks to its much longer range). Also, this is (probably) the only EV not made in China in the entire top 10, so props to GM!

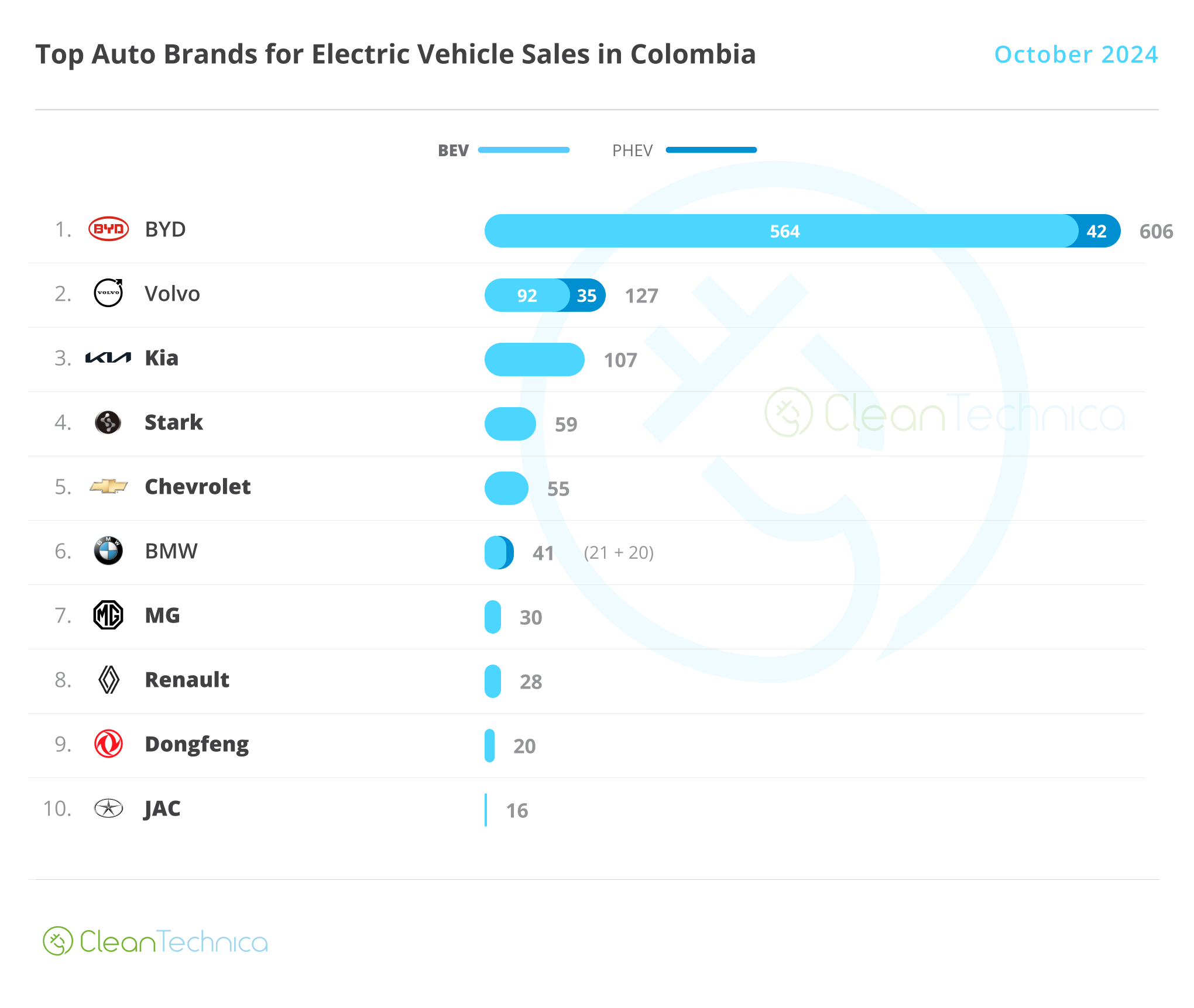

Brand-wise, BYD absolutely dominated the market in October, and it actually made it to the top 10 of most-sold brands in the country! Below it we have Volvo and Kia completing the podium.

Year to date, we have a more balanced market due to the fact that the Seagull only arrived in June, and the Yuan Up in August. Kia is yet to surpass the Volvo EX30 (and it probably won’t be able to in the two months left), so Volvo’s cheapest model completes the podium, with the Song Plus in fourth place and the EV5 in fifth.

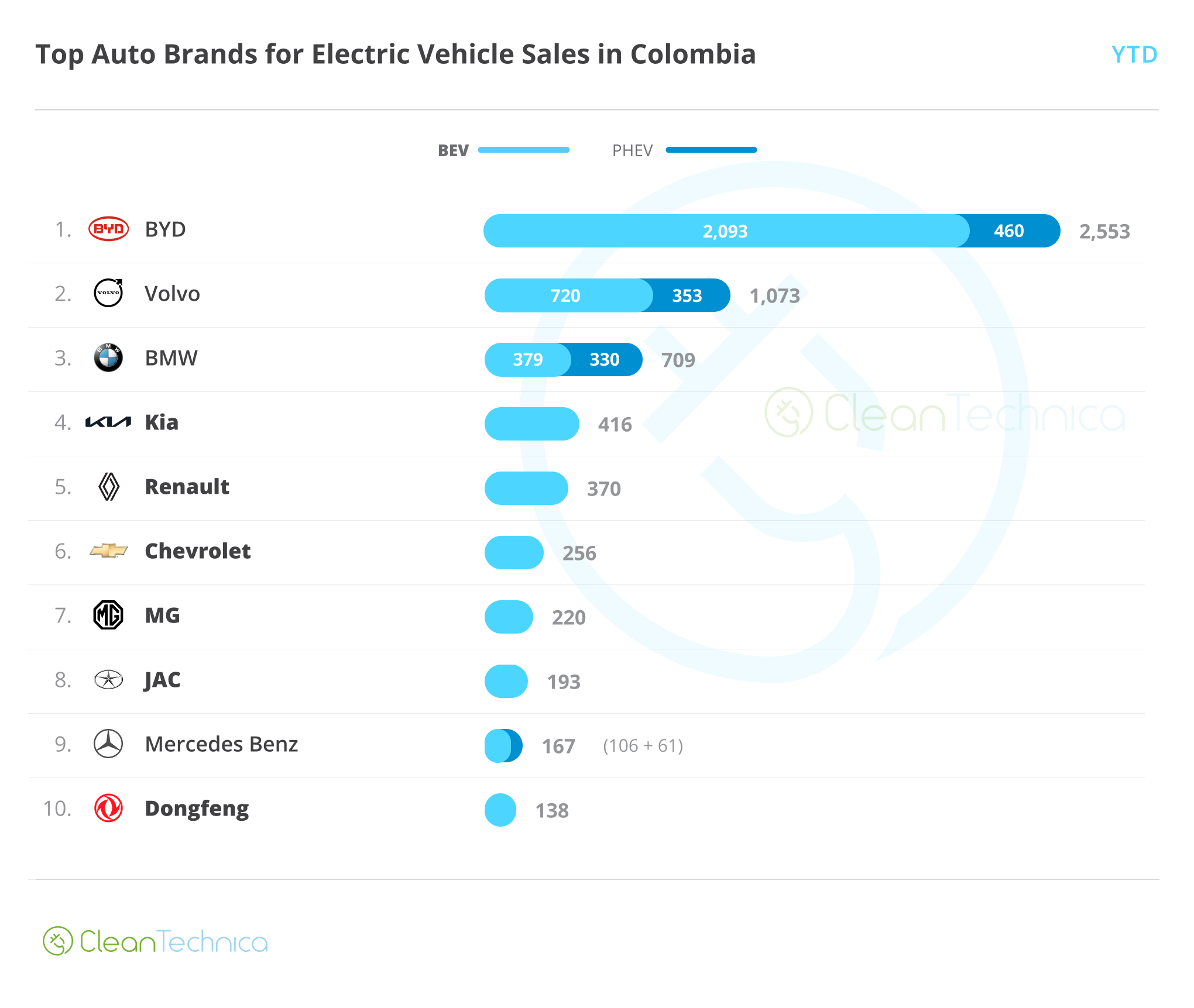

Brand-wise, YTD, we have BYD still dominating (though not as absurdly as it did in October), followed by Volvo and BMW! This podium is likely to hold, as no model is selling enough to dethrone BMW in the two months left in the year. Kia’s EV5 and Renault’s Kwid E-Tech have put these two brands into fourth and fifth place, while the new Equinox EV and the now discounted Chevy Bolt allowed Chevrolet to climb to sixth. Below, three Chinese brands compete with Mercedes for a place in the top 10.

Most EVs from these brands are made in China … except for Chevrolet’s*. GM’s brand, a lone warrior, is now the sole legacy manufacturer standing up to the Chinese onslaught in this market. Even the Koreans have seemingly bowed to China’s proficiency (choosing to build the EV5 there), so GM clearly has something good going on for it, and I really hope its advances are not wrecked by the coming US administration.

*I’m yet to determine whether all Mercedes and Volvo EVs are built in China, or if some come from Europe. My intuition tells me most if not all are Chinese.

The Coming Tsunami

We’re amidst Bogota’s Hall of the Automobile, and, frankly, I’m a bit overwhelmed by the number of arrivals. For years, I’ve known and followed every single BEV arriving in this country, but the last couple of weeks I’m feeling that may no longer be achievable.

Arrivals start from $10,300 — the 13.5 kWh ultra-cute “Pony” FAW Bestune Xiaoma — and include the Zeekr X and 001, the Deepal S05 and S07, the Chery EQ7, the Kia EV3 and EV4, the BYD Sea Lion, the BMW iX M60, the Audi Q6, the Blazer EV, the Porsche Macan EV, the ORA 04, and the GAC Aion ES and Aion Y. I may be missing some, and this is only BEVs (I no longer hope to keep up with PHEVs).

A notable mention goes out to the 55kWh GAC Aion ES, a Model 3 sized sedan arriving at a mere $21,800! This is what we’re talking about when we ask for affordability! No fossil-fueled sedan of a similar size can be purchased in this country for such a low cost: the age of EVs being cheaper than ICEVs has begun.

Finally, the popular segment of midsized SUVs seems to be saturated, and many of the new arrivals will be fighting against similarly priced ICEV offers. We’ll see how they fare.

Final Thoughts

With the new arrivals, many segments are now covered with BEVs at similar prices to their ICEV competition. However, two critical segments for this market remain uncovered: entry-level SUVs, and small sedans (~4.2m). You can get a decent, no-frills-added SUV for $20,500 and a small sedan from $13,800: EVs aren’t remotely close to these numbers for now. It’s also worth mentioning the city car segment, which, although well served by several EV models, is still far too expensive and — save for the Seagull — far too range limited to compete successfully with its ICEV competition.

But in the more premium segments, EVs are already effectively at price parity. The path now goes through brand recognition and creating confidence in the consumer: this may take a while, but with the advantages EVs have in large cities, it should be achievable in the medium term.

Rapid-charging stations are popping up here and there, and recently the fourth of them opened between Bogota and Santa Marta, finally allowing EVs to “go to the coast,” which is the stereotypical trip for a Colombian middle-class vacation. The number of stalls is still limited, but I haven’t yet heard of lines or long waiting times: as the total number of BEVs in the country remains under 20,000, perhaps not many of them are needed yet.

As EV prices fall, expect EV adoption to increase. At this point, I’m starting to see the occasional EV even in less wealthy parts of Bogota, and several brands are working to expand through mid-sized and small cities. I have no idea how fast this will be, but if the pricing trend continues, we could well have cheaper EVs in every segment in a couple of years … and that will surely be a tough time for ICEV Legacy Auto.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy