Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

With our storied history as automobile leaders of the 1900s, it is easy to assume the US will continue being automotive leaders globally and especially domestically. However, we are rapidly being outmaneuvered, out-innovated, and left in the dust by our Chinese competitors.

We’ve written about a number of individual stories along these lines lately, but I wanted to pull several of the stories into one piece here to give a better picture of what is happening.

Let’s start with BYD, the world leader in plugin vehicle sales. The company:

- Reached more than 500,000 sales last month, approximately equal to one great quarter of Tesla sales. No other automaker is anywhere close to 500,000 plugin vehicle sales.

- Just reached 10 million cumulative plugin vehicle sales, the first company to do so. Tesla is the closest to this total and will reach 7 million cumulative sales this quarter.

- Has 900,000 employees and 110,000+ R&D engineers.

- Is more vertically integrated than Tesla.

- Is launching about 10 new models a year.

- Is entering new markets almost every week, from Ethiopia to Paraguay.

- Just grew its production capacity by about the same amount as Tesla’s total production capacity in just one quarter! (While Tesla production and sales has been basically flat.)

- Has seen a 36.5% sales increase this year so far.

- Just launched this stunning new model for $49,000. (Includes two refrigerators; seats with built-in heating, cooling, massaging features in the front and back; rear reclining seats with extending footrest; HUD; camera mirrors; and much more.)

Aside from BYD, you’ve got NIO & XPENG expanding across the world and seeing strong sales growth. You’ve also got Zeekr sales soaring and expanding into more and more markets. There’s not any comparable growth or expansion from other US automakers — legacy or startup.

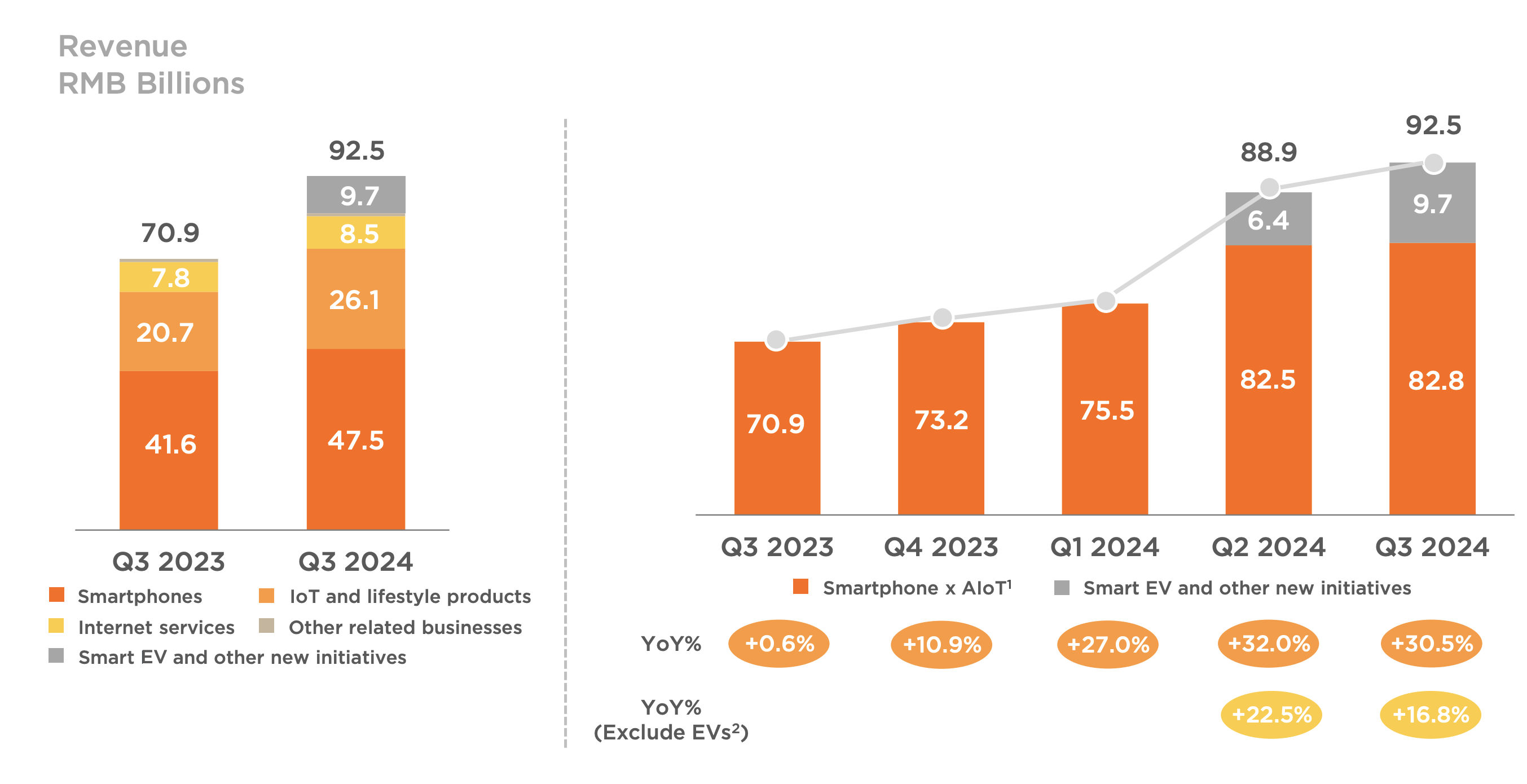

And then you’ve got the wild new case of Xiaomi. Whereas Apple seemingly gave up on producing cars after spending years looking into it and spending a billion dollars or more, the #2 smartphone producer in the world, Xiaomi, jumped into the electric car market this year and is already crushing it.

The tech giant’s brand new electric car business is already approximately 20% of the company’s revenue, and the electric car business is making a gross profit margin of about 17%. Furthermore, its first electric model, the SU7, has shot to the top of category sales charts.

Already above 20,000 sales a month, or at an annualized rate of approximately 250,000 sales a year, how long will it take to reach Tesla’s current annual target of 2 million cars a year?

Then you’ve got Chery becoming the first automaker to develop a solid-state battery factory.

We’re comparing most of these companies to Tesla, the USA’s automotive/EV leader, but where are Ford and GM? Almost nowhere to be seen, and certainly not in the conversation. Overall, Chinese electric cars are leaving the US auto industry in the dust, and it’s hard to imagine that story won’t get even more imbalanced in the coming four years with Donald Trump slowing US progress on EVs.

Tesla’s Hail Mary pass is AI and robotaxis, but the ball has been in the air on that for about 7 years. You can hope or be optimistic that Tesla’s going to come out on top there, but there’s no solid evidence of that after years of watching its development. We shall see. In the meantime, we can guess what will be happening when it comes to Chinese EV producers.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy