Courtesy of The Atlantic

Courtesy of ENERGYminute

See more articles and infographics from ENERGYminute HERE

If China was the community that we all collectively watched grow up over the last couple of decades, then this chapter is titled The Kids Aren’t Alright. A story truly not getting enough airtime is what’s happening right now with the Chinese economy.

Let’s back up: In December of last year, following unrest and protests over the country’s draconian zero-Covid policies, Chinese President Xi Jinping announced a complete reversal of pandemic rules and re-opened the country. Economists predicted this would be a boon for the global economy.

- Not only would the globe’s second largest economy start humming along again, but China’s citizens would have replenished savings ready to spend, spend, spend.

But like trying to mask months of not working out by popping a Red Bull right before the game, the buzz wore off quick, leaving just the signs of unhealthyhabits.

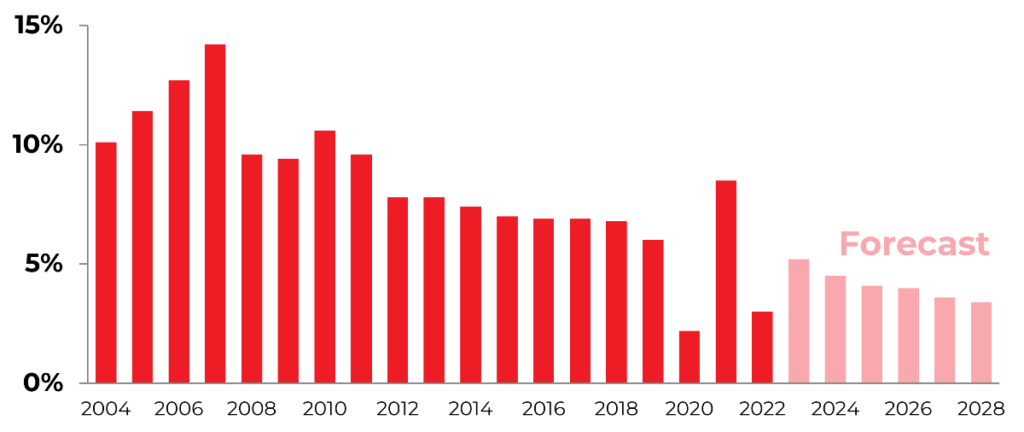

Growth slowing down: To start, China is not the growth engine it used to be. No longer an economy that grows at double digit rates, the Chinese economy is expected to grow at only 5 percent this year and drop down to just 3 percent by the end of the decade.

- China grew just 3 percent last year, a low level seen just twice over the last 40 years.

Growth in China’s real domestic product

percent annual change

Data courtesy of the International Monetary Fund

Weighed down by debt: The country is also feeling the effects of taking out too many loans. Zero-Covid saddled municipal governments with huge unforeseen costs from lockdowns and testing centres, something funded by debt which now amounts to $5.1 trillion.

- Because of all that debt, according to the Wall Street Journal, one third of cities in China are struggling just to pay off the interest payments. And two thirds of cities are in danger of breaching unofficial debt thresholds.

Bad debt usually bodes poorly for real estate.

The housing crisis: Unfortunately for China, the debt overload crept into its real estate market. In 2021, Chinese property giant Evergrande defaulted on its loans and just yesterday revealed its losses totaled more than $81 billion. This led to developers abandoning construction sites, left citizens unwilling to pay mortgage payments on unfinished buildings, and caused housing prices to fall 20 percent last year.

- Real estate is an unusually large size of the country’s GDP, accounting for about one third of China’s economy. This contrasts with Canada and the US that are both closer to about 20 percent.

China is now broadly experiencing deflation, the uglier little brother of already ugly inflation.

And then there’s the population issue

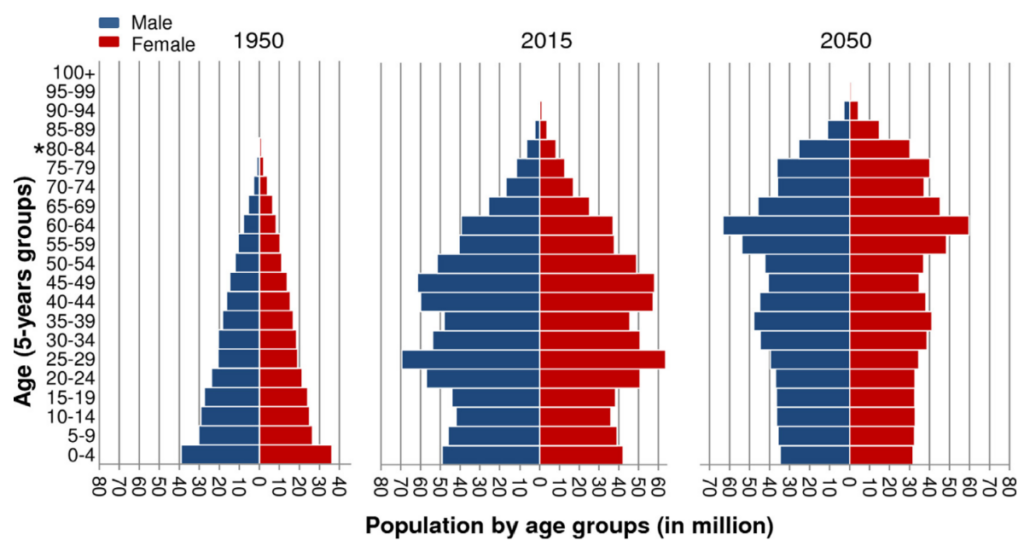

In 2022, China’s population fell for the first time since the 1960s. A product of the famous one-child policy of the 1980s and changing attitudes towards marriage and family, the country must now shift to thinking how it will start to care for its aging population.

The changing population demographics for China over time

Courtesy of Ageing Research Reviews

As more and more of the country enters retirement, the country’s healthcare and retirements costs will balloon with young workers to pay for it.

Speaking about the youths: The current generation of young Chinese workers could prime the economic pump, but – trying to put this delicately here – they don’t really want to. Or at least there’s a mismatch between job postings and dream jobs.

- According to Goldman Sachs, manufacturing is still the sector with the highest demand for workers in China. But the current pool of young workers is the first in the country that had broad access to higher education, so many are looking for advanced technical jobs instead of factory work but not having any luck. This is leading to huge youth unemployment across the country.

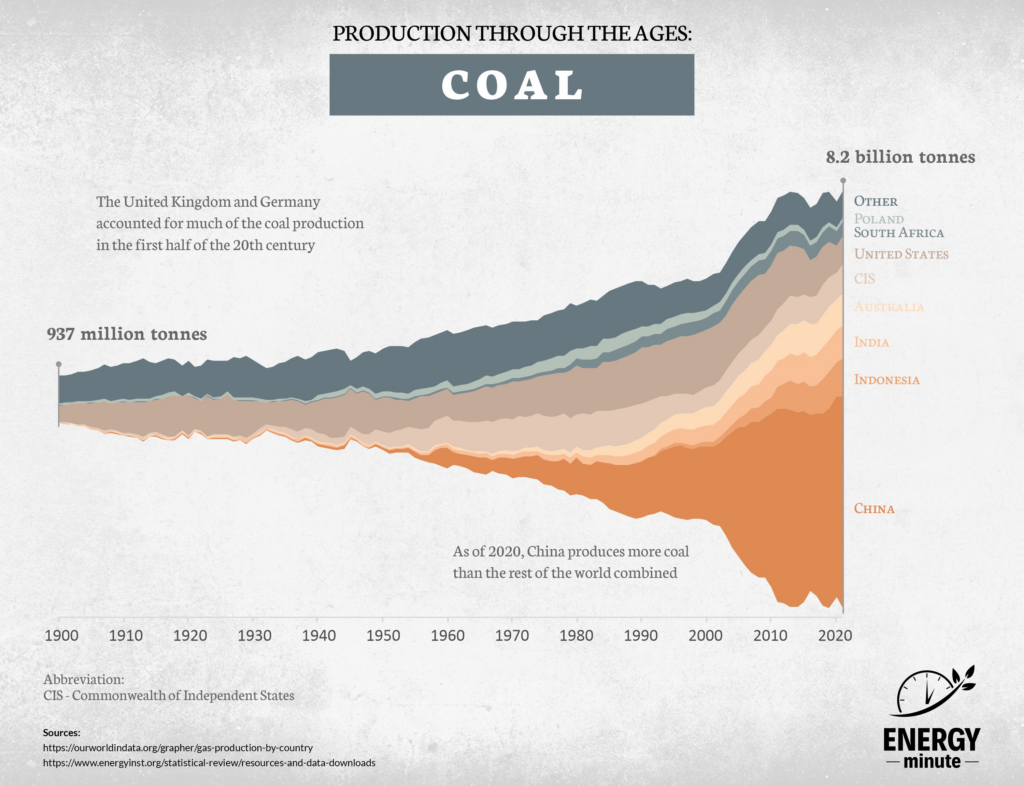

What it means for energy: Being that China gobbles up energy like Joey Chestnut gobbles up hot dogs, a softening up of the economy would reduce global energy demands.

This could end up being good news for the climate. As the world’s largest producer and consumer of coal and the main driver of global emissions growth over the past 15 years, China may be able to take advantage of a slowdown to switch out some coal for gas and invest more in renewables.

Global coal production, 1900-2021

Courtesy of ENERGYminute

The world has the chance to take a breath. As the main driver of recent global economic growth, China’s torrid pace of development has reshaped the world economy.

A shifting focus to more internal affairs from the ruling Chinese Communist Party may also help alleviate some geopolitical tension that has been building up in the system for the past decade.

Bottom line: China’s unbelievable growth story has been a remarkable one to watch and defined much of the first two decades of this century. How it settles into its new phase could shape the next two.

Share This: