Support CleanTechnica’s work through a Substack subscription or on Stripe.

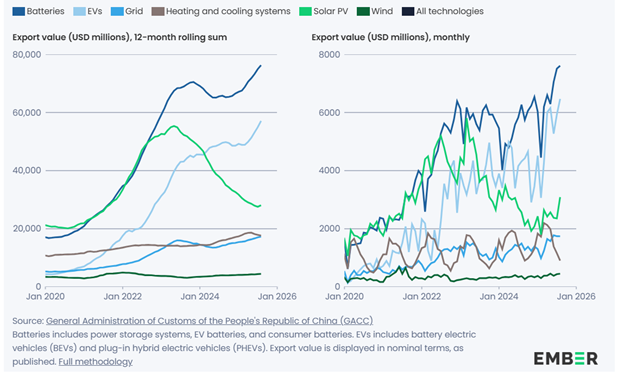

Recent reports out of think tank Ember on China’s record-breaking $20 billion in August clean technology exports and the underlying data have stimulated discussion online. Electrek focused on the EV exports that are driving much of the growth. Meanwhile, Bloomberg put the numbers together with DOE and EIA data to show how China’s cleantech exports are outpacing US fossil fuels (reposted in Energy Connects). We also published a piece on it a few hours ago: “Renewables Drive A Stake Through The Cold, Dark Heart Of King Coal.” The different perspectives are all worth a read.

However, beyond national bragging rights, there are significant implications in terms of global trade, global energy consumption, and the overall energy dynamic between countries.

A Shift in Exports and Energy Paradigms

Of course, comparing fossil fuel exports to cleantech exports is like comparing apples to oranges. The two categories are significantly different. However, the differences indicate a substantial shift in how the world approaches energy and the global dynamics that drive trade.

- Fossil fuels are extractive. Once they are taken out of the ground, it takes millions of years to replenish fossil fuels. When burned and energy is extracted, they cannot be recycled without putting in significantly more cost and energy than they started with. In comparison, while there is mining for materials, the extractive aspects are a fraction of the overall product value for cleantech. In addition, many of the materials can be recycled. Unlike an extractive commodity, most of the value comes from the application of technology, rather than the raw materials used in production.

- Fossil fuels are consumable, while clean technology is durable. If you conservatively estimate that a solar panel lasts 25 years and gets an average of 8 hours of sun a day, each watt of solar panel would provide 73 kWh of electricity over its lifetime. In other words, if panels cost $0.10/W and electricity costs $0.10/kWh, you are looking at a product that enables 73 times the energy value of its initial cost. Of course, the panel itself is just part of a much more expensive system, and it tends to provide more economic benefits and employment in installation and deployment than in manufacturing. Meanwhile, once you consume the fossil fuel, it is gone, and you need to come back for more. In the short term, this dependency can provide economic benefit to petrostates. However, each dollar of solar panel sales leads to a larger long-term energy shift.

- Technology prices have fallen. This was pointed out in the Bloomberg article, particularly related to solar. As a result, overall energy generating exports have grown more in capacity than the dollar amounts would indicate. By nature, technology products tend to use manufacturing technology to reduce prices and/or increase performance. Television prices are a good example. Some technologies can also apply to fossil fuel extraction and processing, such as fracking, but the ability to reduce prices is more limited.

- EV exports are different. While fuel costs can add up to more than the purchase price over the entire life of an ICE vehicle, they tend not to add up to multiple times the price for the typical use case. The multiplier is not as high as it is for solar. New buyers also tend to own the vehicle for a fraction of its total life. As such, the fuel savings can be a motivator, but it often comes secondary to the overall vehicle value proposition. But the experience of owning an EV helps to establish repeat purchases. The repeated purchases of new buyers can multiply the number of EVs on the road, far beyond the vehicles they currently own. The transition to EVs has long-term energy consumption implications that go far beyond the first purchase.

- Batteries and EVs increase electrification and utilization. The primary drivers of China’s clean technology export growth are batteries, followed by EVs. These technologies drive overall electrification. They also ensure that renewable energy generation can be put to use, even if output is intermittent or peak generation does not align with peak usage. Curtailment can be eliminated. The grid can become more stable, enabling further electrification. EVs shifting energy consumption away from petroleum not only allows emissions to be cut now but also sets up future reductions. By increasing the demand for electricity and creating a means to coordinate supply with demand, the next stage in renewable energy adoption is positioned to take off.

- Trade policies support fossil fuels and hold cleantech back, but that could be changing. While some countries are penalizing or blocking China’s clean technology exports (particularly the US), relatively few trade barriers exist for heavily subsidized US fossil fuel exports. However, global perspectives are shifting, with the International Court of Justice issuing a unanimous decision that fossil fuel subsidies have been “unlawful.” Not only do fossil fuel subsidies distort markets, but they also fail to consider the negative externalities of climate change that extend beyond the exporter’s borders, impacts that are most felt in the developing countries of the Global South. While they saw little of the benefits from fossil fuel driven economic growth over the past century, they are paying the highest environmental price for those emissions now. It may take some time, but we could see a global shift toward supporting cleantech trade and penalizing fossil fuels. That could lead to a massive shift in energy consumption and emissions. Emerging economies are growing regardless of the legacy economies targeting cleantech trade. Developing countries like Ethiopia and Nepal, which have taken measures against fossil fuels while removing trade barriers for cleantech, are leading the way.

- Cleantech trade is leading to leapfrogging. Most of China’s cleantech exports are no longer going to wealthy OECD countries. Central Europe now outpaces the EU in solar growth, with panels largely coming from China. So far this year, EV exports are up 75% to ASEAN and up a staggering 287% in Africa. These numbers may be starting from a low baseline, but these countries represent growth markets. As countries develop out of poverty, energy consumption and overall consumption will rise. Having that growth tied to cleantech will ensure the economic development is not accompanied by environmental devastation.

- Exports build upon domestic adoption. While China produces 80% of solar PV modules and battery cells and 70% of electric vehicles globally, it is also by far the largest consumer of clean technology. Some will point to China also being the largest fossil fuel consumer, even though its per capita and cumulative emissions are roughly half of the US. However, the lasting effect of clean technology adoption is poised to rapidly change the country’s energy consumption. Electrification of its economy overall will enable that adoption to accelerate. That change will have economic impacts that extend for decades and provide global scale for other countries to follow.

A Shift Away from Dependence and Dominance

While some may be thinking that we are trading the dominance from one country to another, clean technology disrupts that dynamic. Most of the economic benefits come from the use of the technology, rather than its production. Rather than being consumed and needing more, cleantech projects can continue to provide benefits for generations. Countries can continue to generate electricity using their existing solar panels regardless of the trade situation. EV drivers can continue to drive without tailpipe emissions. By shifting from an extractive, consumable commodity to a durable technology, dependency on imports to keep the lights on can be reduced. While China may dominate cleantech manufacturing, the use of that technology reduces the ability of any country to dominate on energy overall. To put it another way, the US is providing fish, while China is providing fishing equipment and instruction.

The change is happening, even if it is not evenly distributed. Solar and wind met all electricity demand growth in H1, leading to a slight decline in fossil fuel consumption globally and a 2% drop in China. Cleantech growth is poised to stimulate economic growth in developing countries, like Thailand. Due to the cumulative nature, the energy shift will happen faster than many expect. Countries that do not shift from a legacy energy mindset will be left behind.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy