Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

On paper, Chile has everything to be the Latin American leader in electrifying mobility. It’s relatively small and wealthier than most other countries in the region, it has abundant renewable electricity, and it lacks meaningful oil reserves, so there’s a huge financial incentive to curb those expensive oil imports with EVs. Yet, despite being the regional leader as far as electric buses go, EV sales have lagged badly in the country during the last couple of years, falling further and further behind the likes of Uruguay, Brazil, and Colombia.

At least, this was the case a few months ago.

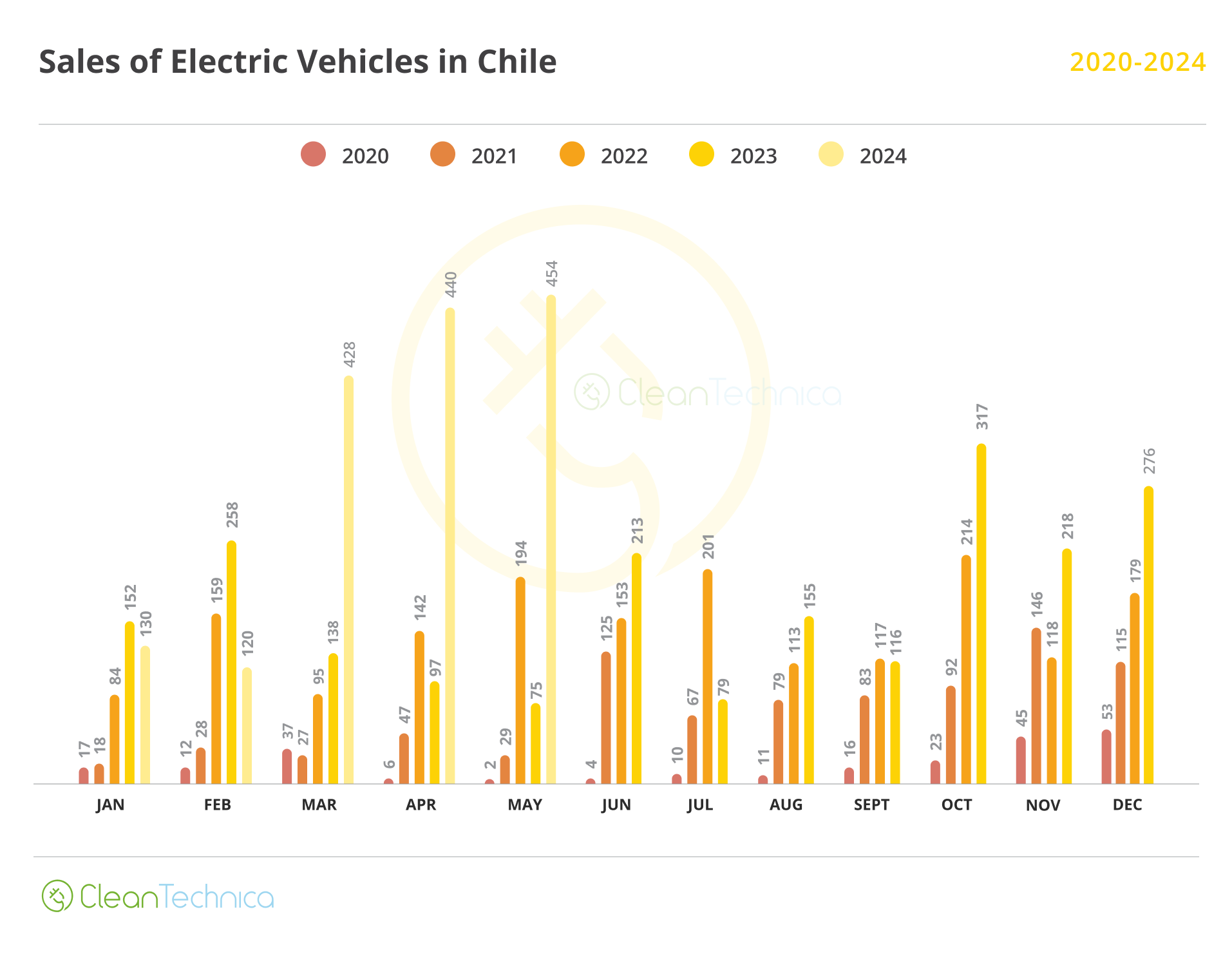

But things change fast. EV sales are few and far between up until they aren’t, and in the last three months, BYD and Tesla have joined forces to turn one of Latin America’s more disappointing markets into one of its rising stars. For in the months of March, April and May, EV sales have consistently stayed over 400, getting close to the 2% market share mark and rising 300% cumulatively and 500% in May YoY!

General Overview

Chile’s previous record month had been October 2023, with 317 EVs sold. During the following months, EV sales fell below 300 and in January and February 2023 they fell below 200 (and fell YoY) making it look like the country was headed to another disappointing year. But after March, sales have consistently stayed above 400 light vehicles, making a new record each passing month: as we will see, this is a trend we expect will maintain through the year.

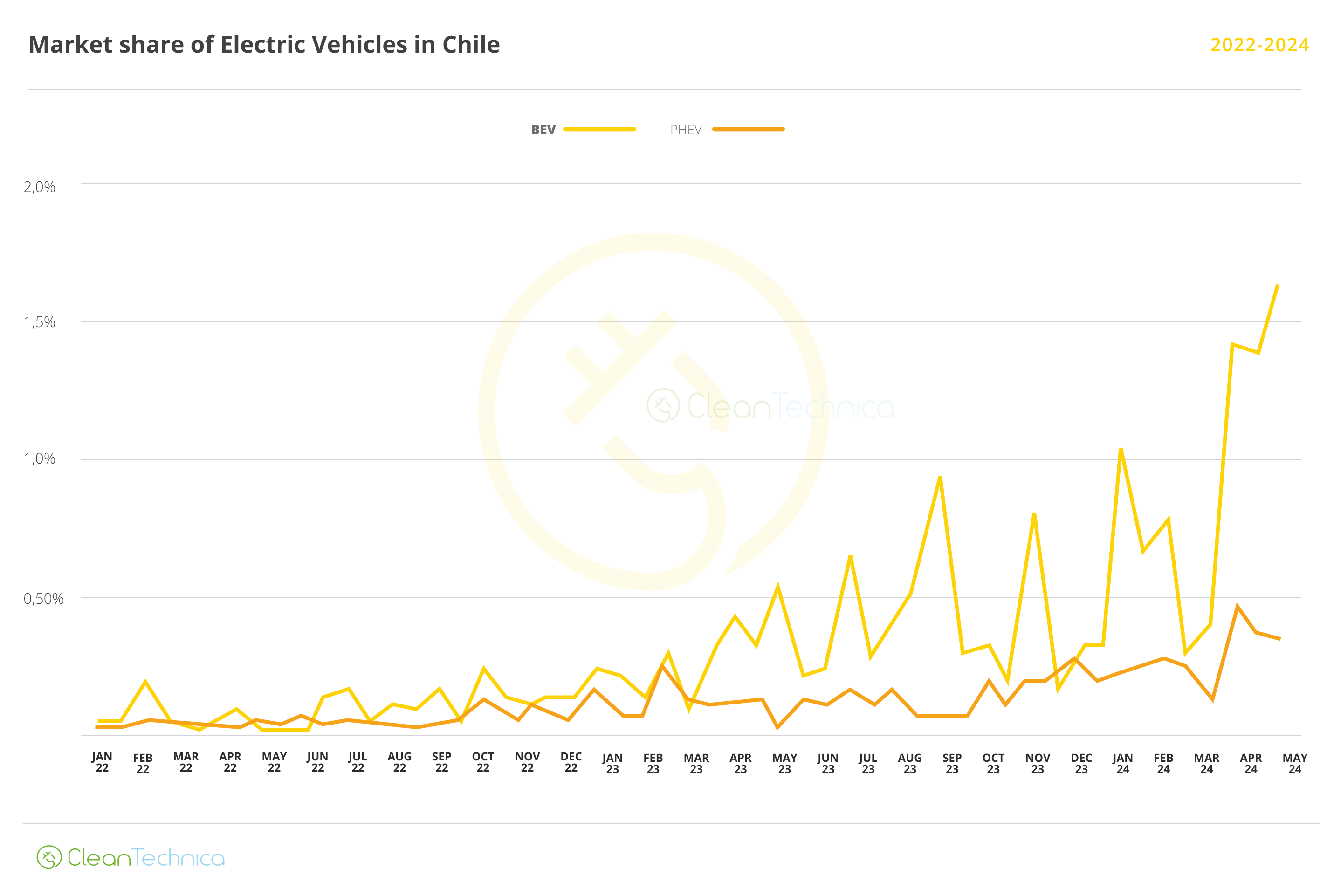

The Chilean market is significant, averaging over 20,000 light vehicle sales a month, which means that market share wise, the country is still behind many of its peers. With the surge of sales from March onwards, BEVs have finally crossed the 1% mark, while plug-ins are now close to 2%: these are magnificent results, but with Mexico already over 2%, Colombia and Brazil already over 4%, and Uruguay already over 5%, Chile remains a relative latecomer.

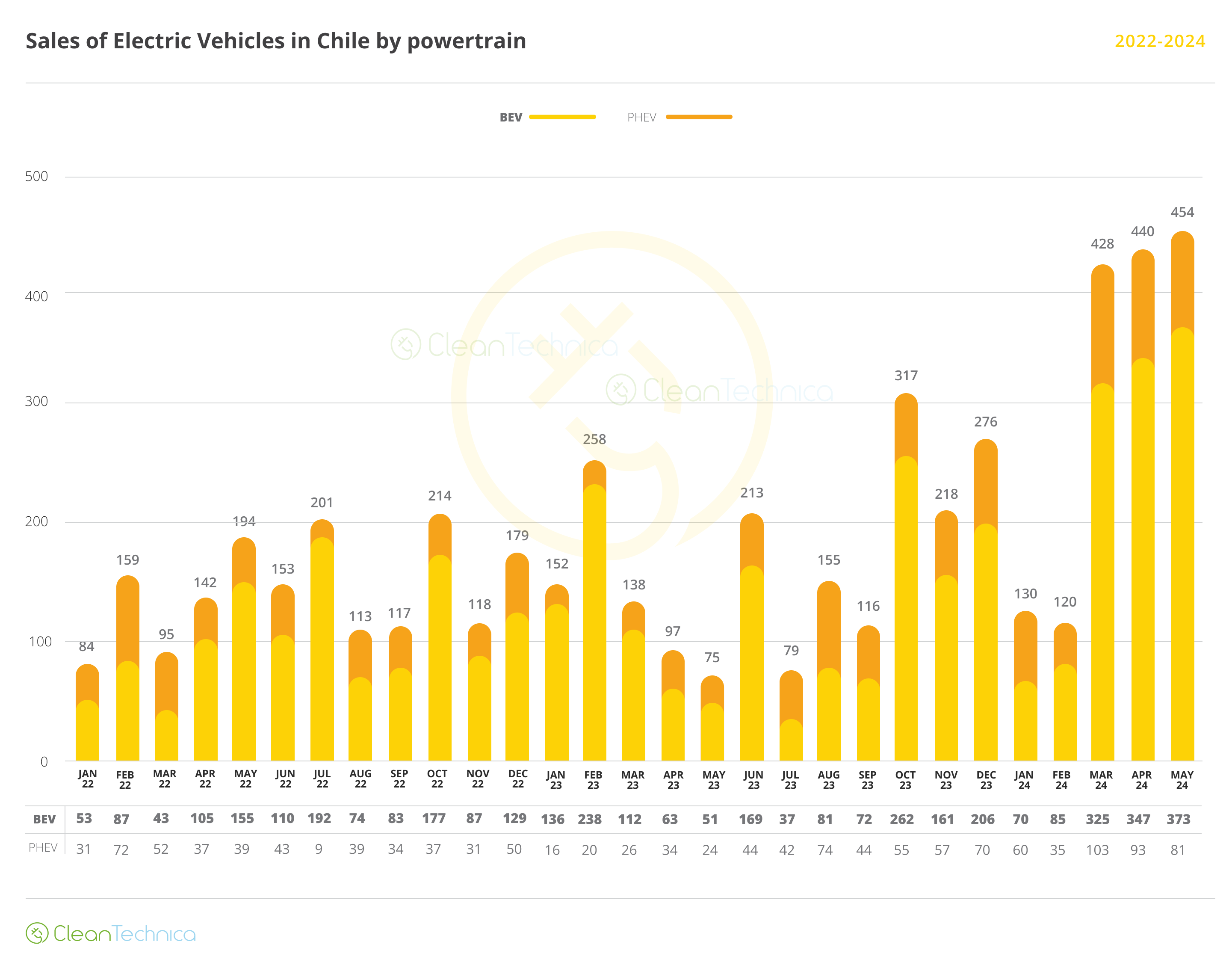

The two previous charts make it clear that this is a very BEV-centric market: sales-wise, BEVs have grown sevenfold since January 2022, while PHEVs (already departing from a lower base) have barely tripled:

BYD & Tesla Account for Most of the Increase

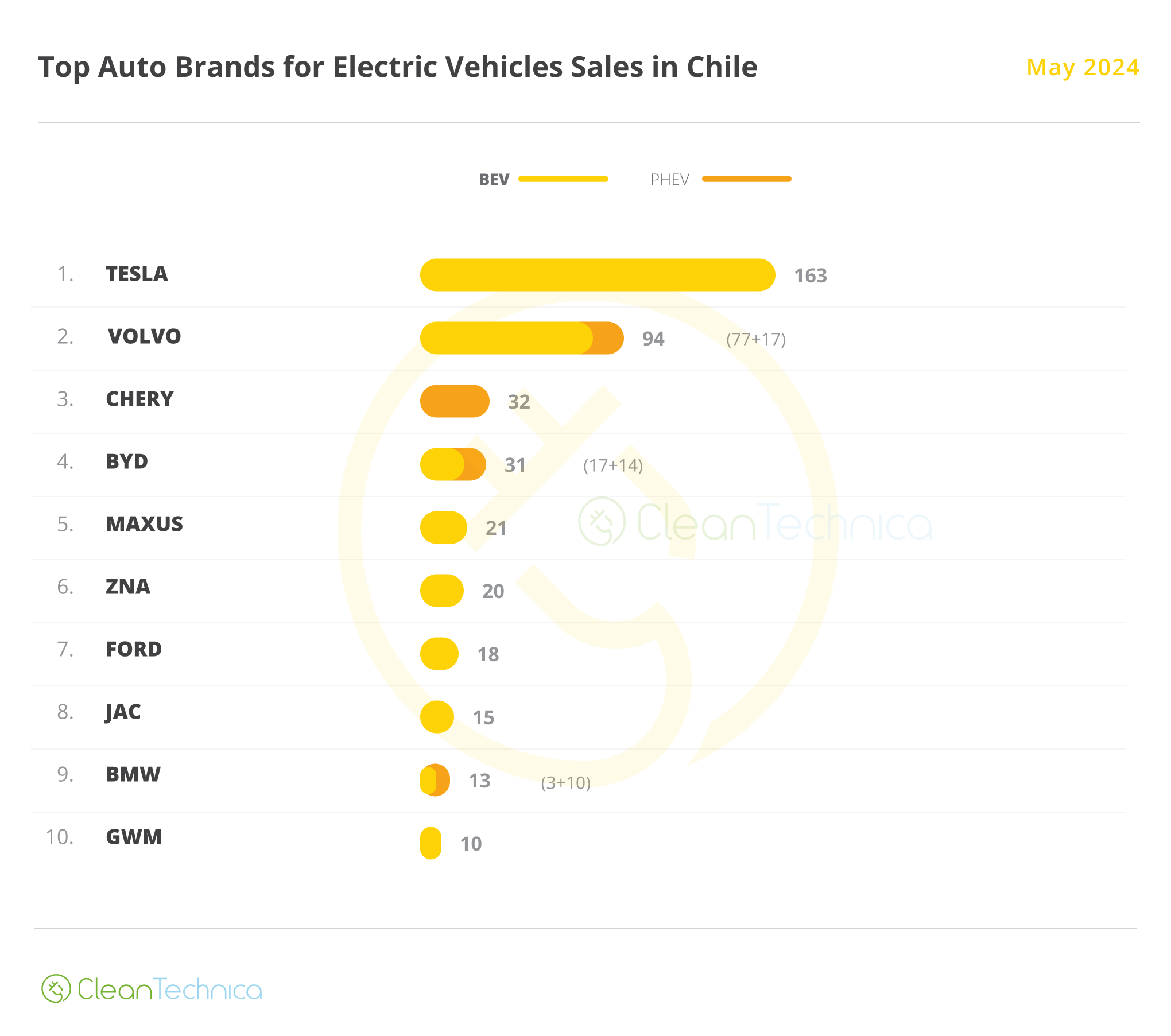

EVs are becoming cheaper, better, and more widespread all over the place, but a significant part of the sales increase can be traced to either the Dolphin Mini or one of Tesla’s siblings. What’s more interesting: we have not seen them both at the same time. BYD sold the Dolphin Mini back in March and April, but Tesla only started delivering its models in May, at the same time the Dolphin Mini sales went to zero. In fact, May was a pretty bad month for BYD.

Since I don’t believe the brand has suddenly lost all its appeal, this is more likely to mean it ran out of stock.

It comes without saying that May was an atypical month: not only is BYD off of the podium, but Kia is also absent from the top 10, and Ford makes it to a respectable seventh place thanks to (drumroll) 18 cars being sold!

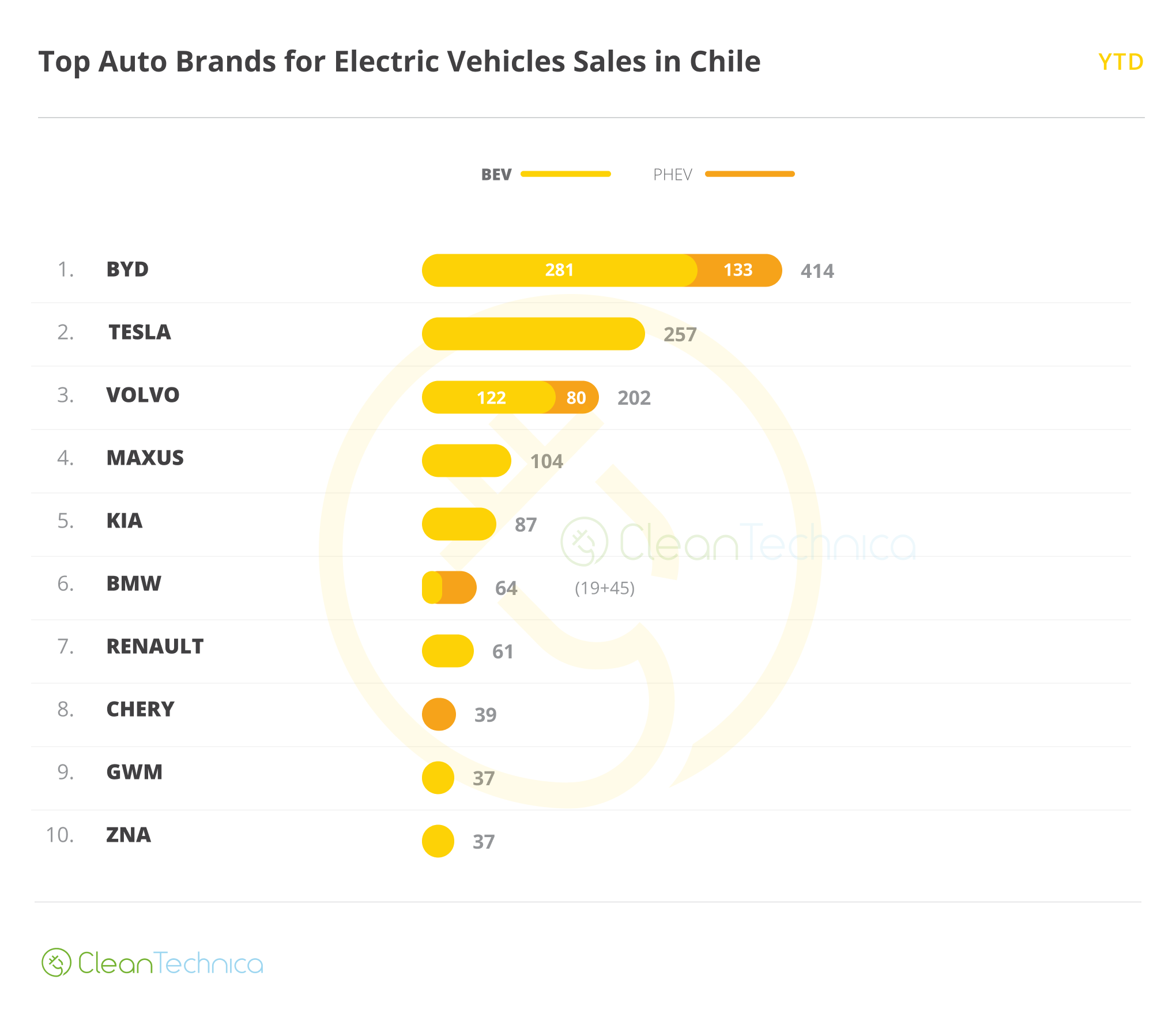

Because of this, it’s worth it to have a more long-term view, which in this case means YTD sales by brand:

This is a far more realistic view of the market, with BYD in a comfortable lead, Tesla following closely and probably expecting to gain the lead soon, and Volvo in third place. A lesser-known brand, Maxus (owned by SAIC) gets fourth place, and Kia closes the top 5.

This top 10 has a decent non-Chinese presence, including Tesla, Renault, BMW, and arguably Volvo (ZNA is the Chilean brand distributing Dongfeng, so it is Chinese). However, once we look at sales per model, things start to look different:

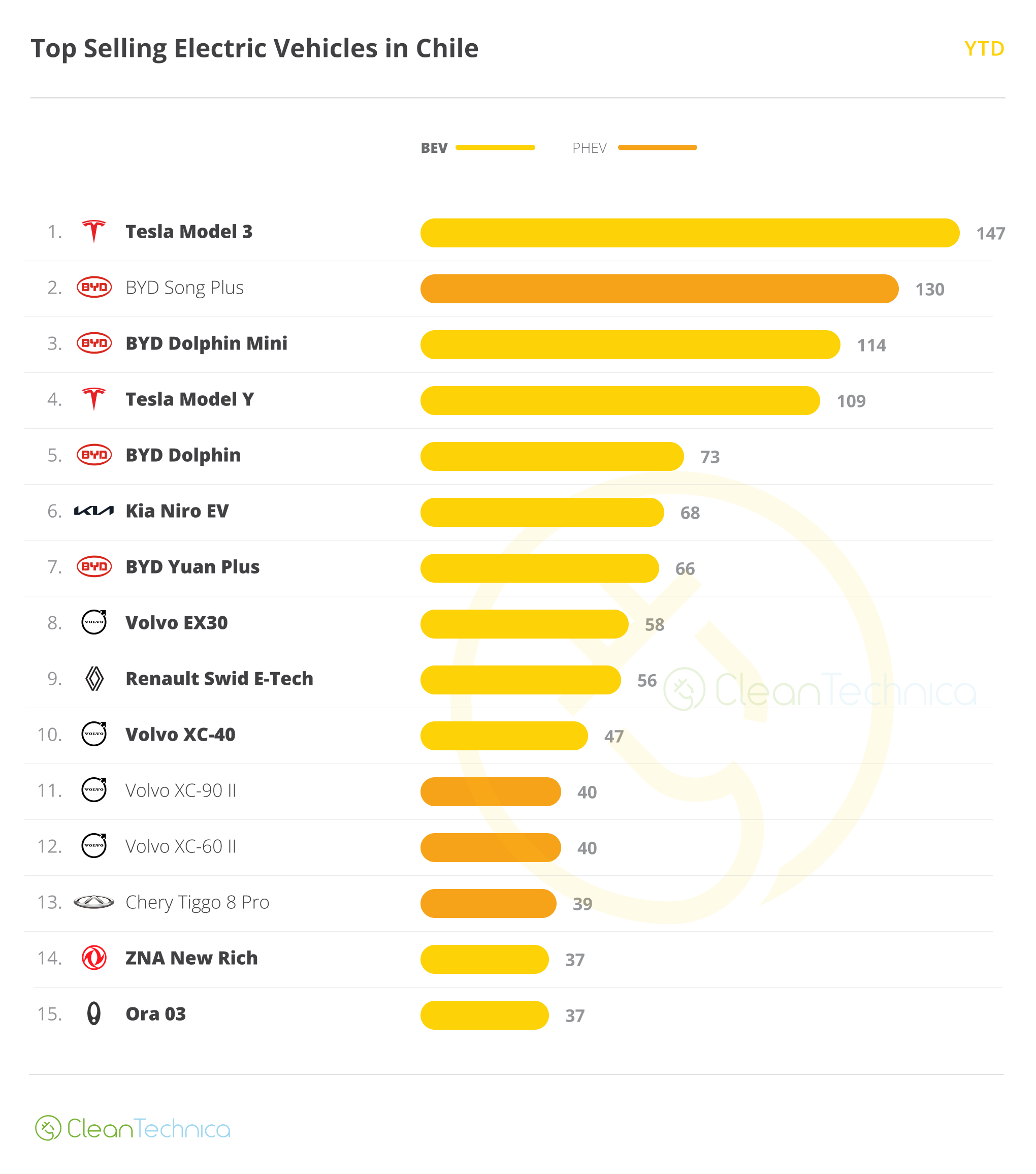

Leading the market during the first five months of the year we find the Tesla Model 3 — the Model Y had to stand off the podium this time, only reaching fourth place — and in #3 we have the BYD Dolphin Mini. These are the three stars that have finally pulled the Chilean EV market out of the depths, something more impressive if we consider that the Dolphin Mini has only been sold for two months out of the five, and the Teslas have only been sold for one!

Joining the lead with these three stars, we find the BYD Song in second place. This PHEV is equipped with an 8.3 kWh battery, capable of over 50 km in pure electric mode, and boasts 1,150 km (714 miles) with one tank of gas. It is also the only model in the top that has been in this market for more than a few months, but like most of BYD’s lineup, it received significant price cuts in early 2024 that have made it far more competitive.

Even though there are foreign brands in the top 10, once we look at models, we have a nearly 100% Made in China list, with the only exception being the #6 Kia Niro, and perhaps the Volvo XC60 and XC90* (remember, the Renault Kwid E-Tech is also Made in China). The Kia Niro being present here solidifies something many have been talking about: the Koreans are doing a decent job, they’re not far behind the Chinese, and they have by now bolted ahead most of Legacy Auto.

*I’m on the fence regarding Tesla. I assume these are Made in Shanghai, but does anyone know for sure?

Final Thoughts

It was August last year when the Geometry E landed in Costa Rica and triggered the first EV price war in the region. The result was rapid growth in a market already ahead, bringing Costa Rica in line with several European markets and making it the undisputed leader in the region.

The story is now repeating in many other countries, only this time it’s the BYD Seagull/Dolphin Mini that’s triggering the change. Chile is only one of the markets that will see rapid growth through the rest of the year, and it’s likely that by December we’ll see at least a couple countries getting close to or even surpassing 10% EV market share.

Will Chile be one of those markets? Time will tell.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy