Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Cement is the gray glue that holds our economy together. It’s ubiquitous, if often hidden behind paint or plaster. It holds together the rock, sand, and steel that keep our buildings upright, our bridges spanning chasms, and our dams holding water for irrigation, generation, and recreation. And it’s a carbon bomb, responsible for 8% to 10% of global carbon dioxide emissions.

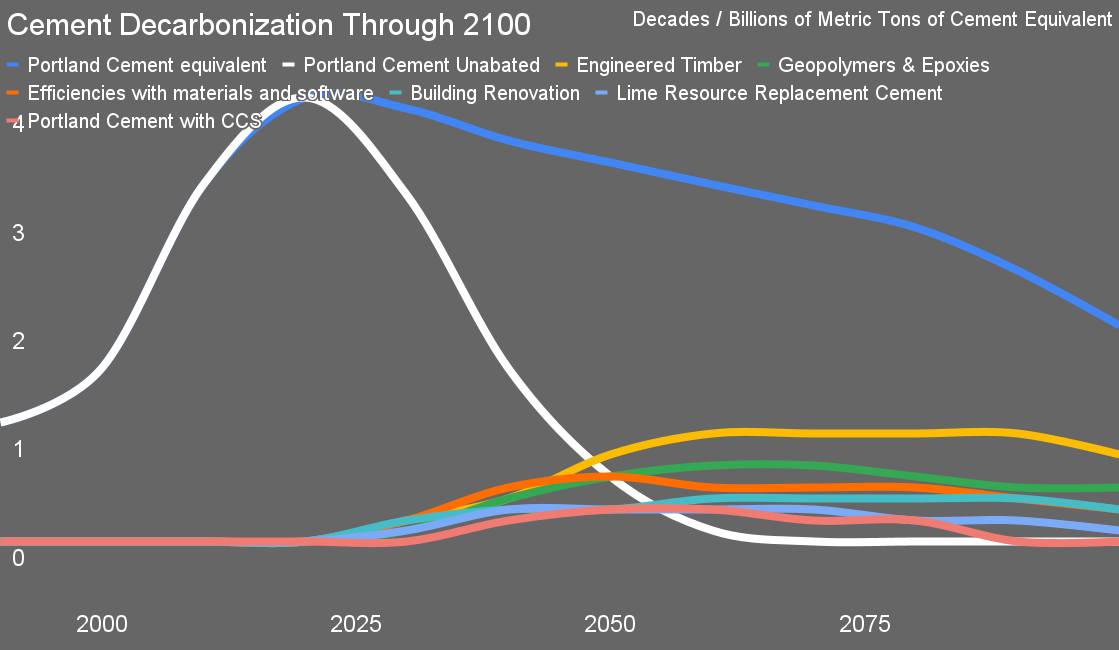

But we have solutions in hand that will address this problem over the coming decades. I’ve now completed the first version of my cement displacement and decarbonization projection through 2100, with the emphasis on displacement. Earlier today, I shared it for the first time with Indian utilities as part of my seminar series with them under the auspices of the Indian Smart Grid Forum.

As with my more recent projections, I started in 1990 with the historical perspective and then considered how to represent that set of levers that would be applied decade by decade through 2100. The blue and white lines of demand for something like cement and supply of cement overlap 100% for the past 30 years, but will be diverging radically as we move forward.

Let’s start with the blue line. You’ll note that it’s starting to decline in this projection, slightly by 2030 and more steeply in coming years. That’s due to several reasons. First is that cement demand fell in the west from 1990 to 2020 as those affluent regions had already built most of their infrastructure and urban areas by that time. The vast majority of the growth was in China, as with everything else.

But China did in 40 years what took the west 80 to 150 years, and is now reaching the end game of building cities and infrastructure. Its ghost cities are now more populated, but not full. Its urbanization is not complete, but close to complete. It has 45,000 kilometers of the 52,000 or so kilometers of high-speed electrified rail it requires, all built since 2007. It has all of the highways it requires, 177,000 kilometers of them, all built since 1987. It’s still building wind farms, solar farms, hydroelectric dams, pumped hydro, transmission, and grid storage, but these are relatively small consumers of cement compared to entire cities. And its population is not growing, but in fact is in slight decline, its affluence and health care having reached the point where its citizens are not pressured to have many children in the hope that enough will survive to work the land and provide for them in old age.

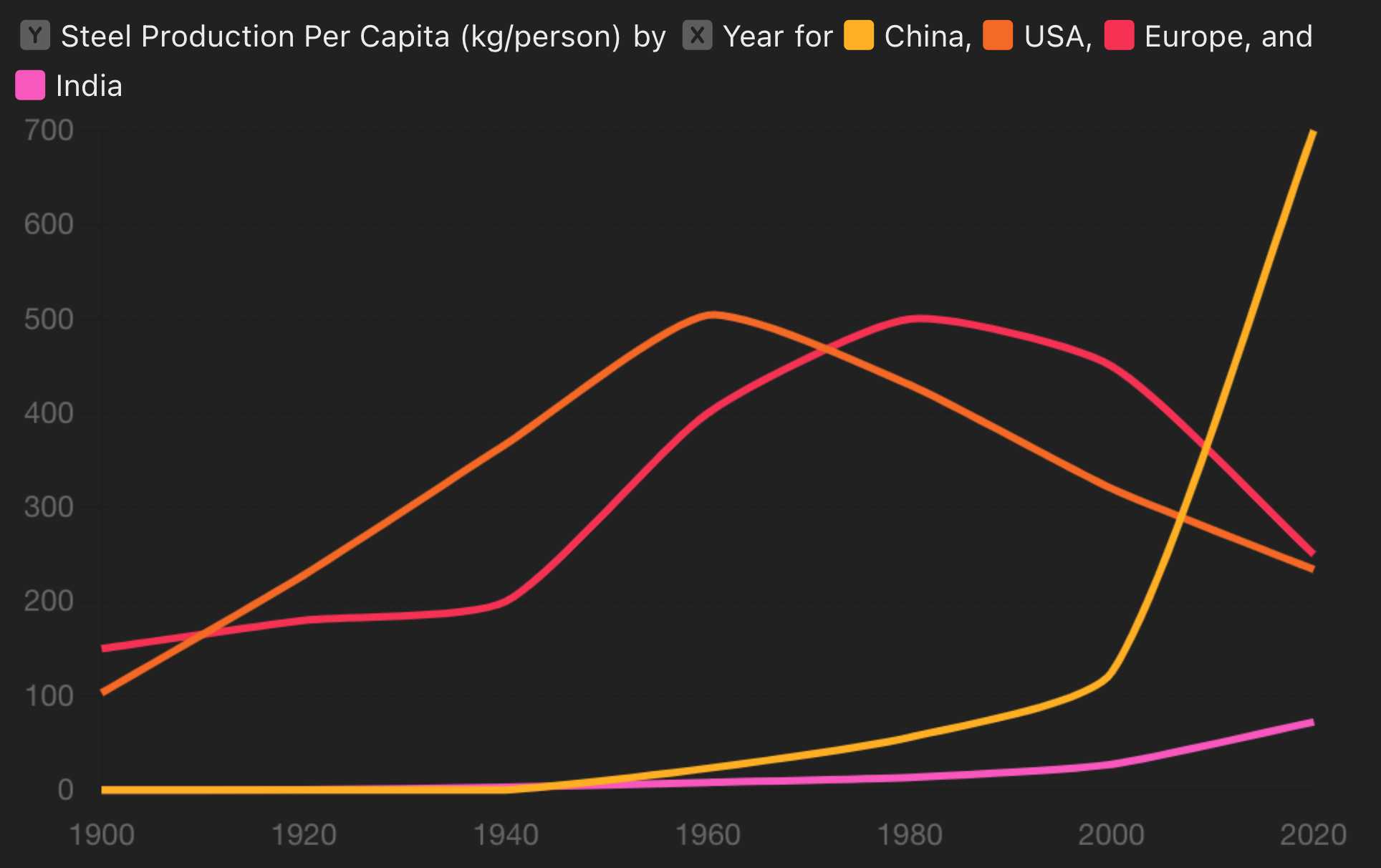

This steel demand history since 1900 I put together recently tells the story. Europe and the USA saw a much slower but still massive growth of steel per capita from 1960 to 1980, and then a decline due to the end of significant infrastructure projects combined with deindustrialization as heavy and light manufacturing shifted to Asia, and especially China. That country’s demand started rising in the 1960s and then shot upward for the past 35 years, especially the last 25. India is the most developed of the remainder of the developing world, yet it’s only producing 90 kg of steel per capita, still far under Europe or the USA, never mind China. As with steel, cement.

Soon China will turn to maintenance and occasional replacement, not massive new building. China’s demand for cement will start declining, along with its concrete and steel demand. 1.4 billion people will still need a lot, but much less than the last 40 years of extraordinary growth.

The rest of the developing world, on the other hand, will see increasing demand as they build infrastructure and improve their urban areas. However, India, Brazil, Indonesia, and Africa don’t have the conditions that will lead to the mad dash of building that China experienced. Their demand growth will be slower and spread over the next 150 years. Their economies are not going to build nearly as much heavy industry and consumer goods manufacturing for the world as China did. China has a lock on multiple industries which will be hard to overcome without an economic collapse that is not in the cards for decades, if ever, despite the dreams of many in the west. The rest of the developing world won’t be building massive numbers of factories and shipyards to match China’s, although they will be building some, often with Chinese partnership.

Just as China is already experiencing peak population, so is the world. In the west this is masked by significant immigration from countries that aren’t as affluent or stable, but we have not been replacing ourselves through organic growth for decades. Current demographic projections have peak global population between 2050 and 2070. Without growth of human population, it is only growth of affluence which will drive increases in demand. India’s and Africa’s populations are growing, so in coming decades that youth and vigor will pay dividends, but those dividends won’t equate to cement growth to nearly the same extent as in China.

The white line in the cement displacement and decarbonization graph is unabated Portland cement, 4.1 billion tons of demand in 2020 and in 2023, roughly flat and a useful indicator, although the COVID-19 epidemic muddies the waters. 2.1 billion tons of that was used in China, more than half. But the white line is declining much more rapidly than the blue line of demand, and yet the solutions aren’t rising to equal Portland cement. Why is that?

We use Portland cement not because it’s extraordinarily good, efficient, effective, and lightweight, but because it’s cheap and limestone is everywhere. If it were three times as expensive or limestone weren’t ubiquitous, we would be using existing alternatives which are usually lighter and leaner for the same structural virtues. And cement will be more expensive. A combination of carbon pricing and regulations will drive the effective cost of cement to roughly the social cost of carbon over the coming decades. Europe is already pricing carbon to half of the social cost of carbon with clear signals that they are aiming to close that gap. Canada is a third of the way there. California is at about a sixth of the social cost today. All are rising, although there is potential for Canada to backslide as Australia did a decade ago.

And countries and US states that aren’t pricing carbon but export anything to Europe will still be hit. All carbon pricing systems and the EU carbon border adjustment mechanism will start pricing Scope 3 emissions, which includes the cement used in the buildings and plants that products require. Firms and countries that don’t decarbonize cement will be uncompetitive with the ones that do. Europe is the largest trading block in the world, with combined imports and exports that exceed China’s or America’s. Its affluence isn’t going away, and any firm what wishes to grow significantly needs to be competitive in Europe. Supply chain carbon emissions are going to matter.

With the rise of the cost of cement and the reduction in demand, the alternatives spring into action. In my assessment, the largest of these is likely to be engineered timber. Thin sheets of wood are peeled off of logs by huge lathes, then cross-laminated into beams, walls and floors. Their structural strength is equal to reinforced concrete with a fifth the mass. Every ton of engineered timber displaces 4.8 tons of reinforced concrete, and hence the roughly 0.5 tons of cement required for the concrete.

But that’s not the end of the value proposition for engineered timber. Manufacturing currently produces 0.2 to 0.3 tons of carbon dioxide per ton of product, but that’s mostly due to the use of fossil fuels for harvesting, transporting, and processing. All of that can and will electrify or otherwise decarbonize with sustainable forestry practices. There’s more to the carbon story. As trees draw down carbon dioxide from the atmosphere to harvest the carbon for their skeletons, skin, and leaves, breathing out the oxygen, each ton of mass timber has sequestered about a ton of atmospheric carbon dioxide. At end of life, decades from now, there are at least five approaches to permanently sequestering the carbon in the wood, from deep sea burial to biofuel/biochar manufacturing to reuse in further buildings and more.

And yet, there is one more virtue from engineered timber. Buildings made from it are lighter than buildings made from reinforced concrete, so the foundations don’t have to be as massive. A full engineered timber building cuts the foundation mass by 30%, reducing concrete demand further. A hybrid building, where reinforced concrete — or replacements discussed shortly — provides the load-bearing structure and engineered hardwood provides all of the floors and walls, still reduces total concrete mass required by 50%. An engineered hardwood building can be carbon negative.

We harvest roughly 3.5 billion cubic meters of wood annually. A tremendous amount of that goes to single use products, from chopsticks to tissues to paper tower. We harvest so much, in fact, that we can displace an enormous amount of cement and contract simply by diverting just a subset of single use wood and paper products to engineered timber. My projection does not increase wood harvesting, just diverts it to higher merit, lower carbon offerings, and in fact prevents sources of anthropogenic biomethane from entering waste streams. Not all of them, but a reasonable amount of them.

The developed world has massive forestry industries. The developing world has massive forests. Reforestation and afforestation in China has created a sustainable forestry industry that is a significant portion of the country’s GDP where a forestry industry barely existed in 1980. A decarbonized forestry industry that expands forest cover and harvests a subset of mature trees annually for sequestration of carbon dioxide, first in buildings and then in long-term sequestration pathways, is going to be a key part of our future.

But it is not enough by itself. Despite diminishing real demand and a strong global industry, more is required. Enter the second biggest wedge, in my current opinion, geopolymers and to a lesser extent their petrochemical siblings epoxies. Polymer is in the name of geopolymers, but both combine precursors and activators to form polymers, long chains of identical monomers, which have incredible mechanical and chemical strength.

Raw resources for geopolymers include the massive piles and lagoons of fly ash, blast furnace slag, aluminum-process waste red mud and copper refining waste, as well as burned biomass ash that’s high in silicates, such as rice husk and wood ash. When I first dug through geopolymers, the potential was less obvious to me as I was focused on industrial and energy waste streams, not potential biological waste streams. We will still be refining bauxite to make aluminum, likely more of it, in fact, as we increasingly use it as a substitute for steel and copper, and the prevalence of waste streams suggests that industrial processes will continue to produce suitable geopolymer precursors for a long time. The combination makes them number two.

Geopolymer and epoxy concrete replacements would still require reinforcement with steel or alternatives for structural purposes which will be discussed shortly, but steel decarbonization is something I’d already worked through in earlier efforts and a projection through 2100. Decarbonized steel is still steel, however, with its high mass per ton of concrete or alternative, and geopolymers and epoxies only produce somewhat stronger concrete, not substantially lighter as with engineered timber. There’s another set of levers to pull there.

They are software and advanced materials, both of which I looked at during concrete month. Finite element analysis software is now embedded in the engineering and architecture tools available globally. What used to be restricted to the most demanding structures is now available for people building small multi-unit residential buildings and shopping plazas. The software already knows the strength characteristics of geopolymers, epoxies, engineered timber and more, so the most efficient set of materials can be used in the most efficient way, often cutting 30% of concrete out of even a building designed entirely with concrete.

But modern software isn’t restricted to analyzing what an architect or engineer designs. Now it can design buildings itself to fit the brief and parameters provided. It can run through a thousand or ten thousand designs to find the most efficient design that uses the least materials while remaining 100% safe. More materials savings result.

These tools were not available for most of the infrastructure and buildings that the west built during their long decades of construction. Finite element analysis tools were available for China’s boom, but were slow and expensive, so used sparingly. But for the rest of the century, they will be applied to the vast majority of construction simply because they will save time and money. There are no barriers to their use in the developing world, and so as India, Indonesia, Brazil, and Africa build their futures, they will build them with far less material than the west or China did per capita for the same comfort, utility, aesthetic, safety, and economic value propositions.

On to advanced materials, where fiberglass and carbon fiber appear. Fiberglass can be decarbonized, just as steel can, but isn’t as recyclable. In terms of steel, it can displace wire mesh used for floors or pads where mass timber isn’t an option. It’s mixed and poured with the concrete, reducing the time and effort required and enable bigger pads or floors to be poured with fewer forms. Its biggest climate advantage is that fiberglass-reinforced concrete is significantly lighter than steel-mesh reinforced concrete, so on multi-story buildings, the lower weight per floor means less structural concrete and smaller foundations, for an overall saving of concrete or alternative. The savings aren’t as high as with engineered timber, but exist, and where there’s a lot of sand — 60% to 65% of fiberglass comes from sand — and there isn’t a big sustainable forestry industry or any chance to develop one, low-carbon fiberglass has merit.

Carbon fiber has more merit. It can replace or seriously reduce both the steel and concrete required in structural components, and remember, every reduction in weight shaves mass of concrete off of the foundation. Lignin from the pulp and paper industry can displace polyacrylonitrile from the petrochemical industry, but the petrochemical industry will decarbonize as well. It’s burning fossil fuels that’s the problem, not using them as a good source of stored biochemical precursors for the chemical industry.

The combination of fiberglass and carbon fiber, and finite element analysis and generative architecture software that knows how to use them effectively and safely is another big lever that is already being pulled to reduce cement demand, but we’ve barely budged it so far. The developing world has no barriers to the use of these technologies and strong motivations to use them where they save money.

The next lever is repurposing existing buildings instead of demolishing them and building new ones in their places. As the industry is fond of saying, the greenest building is the one that’s already standing. In the developed world and China, there is an enormous resource of existing buildings that will be renovated and reused for a succession of purposes rather than replaced. The flattening of population growth and subsequent decline means that peak buildings is possible, although difficult to predict a decade for, or even whether it will occur this century.

In the developed world, office buildings and light manufacturing buildings anywhere near to city centers are constantly being redeveloped as condos and apartments, sometimes with demolition and new construction, but even now often by reusing the space with new partitions and amenities. As an example, Calgary, home of Canada’s oil and gas industry headquarters, is suffering from a vacancy blight. With mergers and consolidation of the industry and the major shift to operational efficiency in extraction instead of exploration and new facility development, their office vacancy rate peaked at 32.4% in 2022, so they are converting old fossil fuel industry buildings to residential buildings. Around the world, taking advantage of existing buildings for new purposes will become mainstream.

Replacement resources for the lime that we currently get from limestone will have a part to play too, although we are getting down to the thinner wedges. This is a big source of US funding for innovation, with a firm targeting common igneous rocks such basalt, diabase, and dacite getting the lion’s share. However, as I noted when assessing the geography of resources for concrete, that’s going to result in very expensive cement and very expensive supplementary cementitious materials, so is rarely going to pencil out. Where there’s a huge basalt quarry and no other options except limestone within a few hundred kilometers, maybe.

A bigger wedge is getting cement out of recycled concrete. The USA leads in recycling demolished concrete, getting the steel back out to be sent through electric arc furnaces to make new steel, and crushing the remaining concrete for use as new aggregate or where fill is required. However, it’s technically possible to get the cement out and put it through processes to reactivate it as cement. A US startup called Sublime Systems is doing that with electrochemistry, and the basalt-focused firm claims to be able to do that as well. In the USA, this has the potential, in the best case, to provide 25 to 30 million of 85 to 100 million tons of annual cement demand, so it’s not a complete solution, but a significant one where a lot of demolition is occurring. However, it’s also a resource that will diminish over time as the rest of the levers are pulled.

Last, and least, is carbon capture and sequestration. I’ve held out the potential for cement to be one of the few industries where carbon capture might be economically viable compared to alternatives, and now I’ve assessed it. Electrification of limestone kilns or electrochemical solutions like Sublime’s would produce fairly pure streams of carbon dioxide, reducing capture costs. If they were right beside major sequestration facilities, costs and risks of distribution would be minimized. Under those conditions, it’s possible that cement will continue to be used and be economically competitive with the alternatives listed above.

Still, I think it won’t be used a great deal compared to the alternatives above and will diminish over time as the need for it disappears. Creating big, useless waste streams with repositories that have to be monitored for centuries isn’t really something that makes long-term economic sense, so I think it will have a five-decade run from 2040 through 2080, peaking around 2060 before diminishing. Among other things, all of the technical skills and firms as well as a lot of the potential sequestration sites, are in oil and gas country, and cement is used everywhere. The geographic mismatch is heavily limiting.

My next effort will be to at least coarsely estimate what this means for carbon emissions from the sector, decade by decade through 2100. At present, I’m optimistic. It took longer to get to the point where I had a handle on the entire space than it did for hydrogen, steel, maritime shipping, or aviation because the solution set is much broader and the problem is more intractable. But once again, I find strong reason to believe that this is a solvable climate issue. As always, it’s deployment, not whether we can solve it, money and policy, not technology. If someone tells you that we will innovate our way out of climate, tell them yes, but that it will be incremental innovation of technical solutions we already have emerging from deploying them at scale.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.