By Devin Lacy

Carbon capture and storage (CCS) is widely held to be a critical part of the mix of actions, technology, policy and strategy the world needs to reduce carbon emissions and mitigate climate change. Despite this need to rapidly adopt CCS as part of a carbon-reduction initiative, there are still significant challenges facing its widespread adoption. One of the most significant challenges for the adoption of CCS is the cost of the carbon capture technology. There has traditionally not been a supportive environment for viable CCS business models, however, given its recognition as a mature emissions reduction technology, these models have now been evaluated by industries and governments around the world. In a GLJ blog post from early 2022, it was noted that almost 10 years ago, Berend Smit et. Al.’s 2014 article declared that “if we were in a global war against climate change, we would carry out large-scale CCUS.”

The concept of taking carbon and sequestering it deep into subsurface geologic formations sounds simple in theory; if there is too much carbon in the atmosphere, capture it, process it, and send it to be stored. The challenge with CCS is that the technology, economics, and policy environments needed to make it happen layer on new levels of complexity.

One of the largest CCS projects in operation is the Sleipner CO2 storage project in Norway, which has been operating since 1996. The project captures CO2 emissions from a natural gas processing plant and injects them into a deep saline aquifer beneath the North Sea. The project has a storage capacity of around one million tons of CO2 per year and has stored more than 20 million tons of CO2 to date.

Another notable CCS project includes the Petra Nova project in Texas, which captures CO2 emissions from a coal-fired power plant and injects them into an oil reservoir for enhanced oil recovery (EOR).

Canada has several ongoing and planned CCS projects, including the Quest CCS project in Alberta, which has been in operation since 2015 and is one of the largest CCS facilities in the world. There are also several other CCS projects in development or under construction in Canada, including the Alberta Carbon Trunk Line and the Boundary Dam CCS project in Saskatchewan which captures CO2 emissions from a coal-fired power plant and utilizes them in an EOR project.

In addition to CCS, Canada is also involved in CCUS (carbon capture utilization & storage) technologies that seek to capture CO2 and use those emissions for other uses, such as building materials, and EOR.

Overall, Canada’s leadership in CCS and CCUS technologies has been led by industry and its significant investments in research and development. As of more recently, it has also been given significant impetus by federal government political and regulatory imperatives to reduce greenhouse gas emissions.

In addition to these large-scale projects, there are a growing number of smaller-scale projects that are exploring the potential for CCS in various applications and across industries beyond energy. In September of 2023, the Government of Alberta rolled out small-scale and remote (SSR) carbon sequestration tenure applications. These applications target emissions sources that are either too far from large hubs, or don’t have significant emissions volumes to tie into a hub.

While there is significant global interest in CCS, the small number of operational projects, compared to those in development or at concept phase, is proof that no country or jurisdiction is truly way out in front of any other. Many countries do not have a clear regulatory framework for CCS, which can make it difficult to secure financing and approval for projects. Additionally, there are concerns about liability and risk associated with CO2 storage, which can make it difficult to attract investors and promote social acceptance.

Several early-moving countries around the world including Norway, Australia, and China have implemented CCS-supportive policies, regulations as well as government investment as ways to encourage more projects and technological developments.

In the United States, the federal government committed $12 billion for CCS including research, development and demonstration CO2 transport and storage infrastructure, carbon utilization market development and four regional Direct Air Capture (DAC) with carbon storage hubs. (Global CCS Institute)

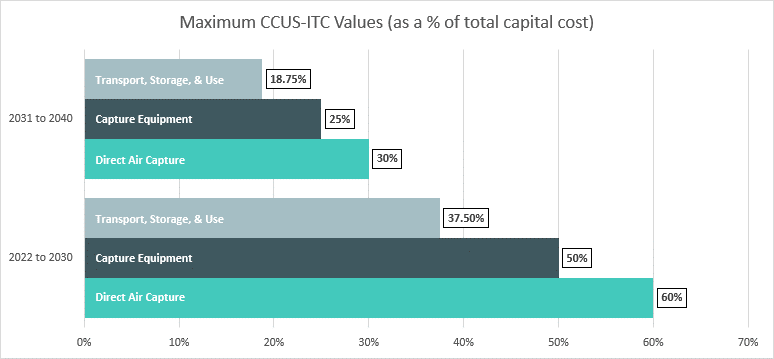

The Canadian federal government, meanwhile, has adopted a tax credit for CCS projects that aims to help alleviate the high up-front capital investment required for CCS projects. The amount of capital funding available to applicants is dependent upon equipment type as well as a myriad of other eligibility requirements. See below table for brief summary of capital funding eligibility by equipment component. Although this funding is laudable, it still only allows for a maximum of $2.6 billion per year of possible funding disbursement across all projects. Provincially, Alberta, B.C. and Saskatchewan have announced various CCS incentives and regulatory initiatives for tangible project development. As of September 2023, Ontario enacted legislative changes to enable CCS within the province.

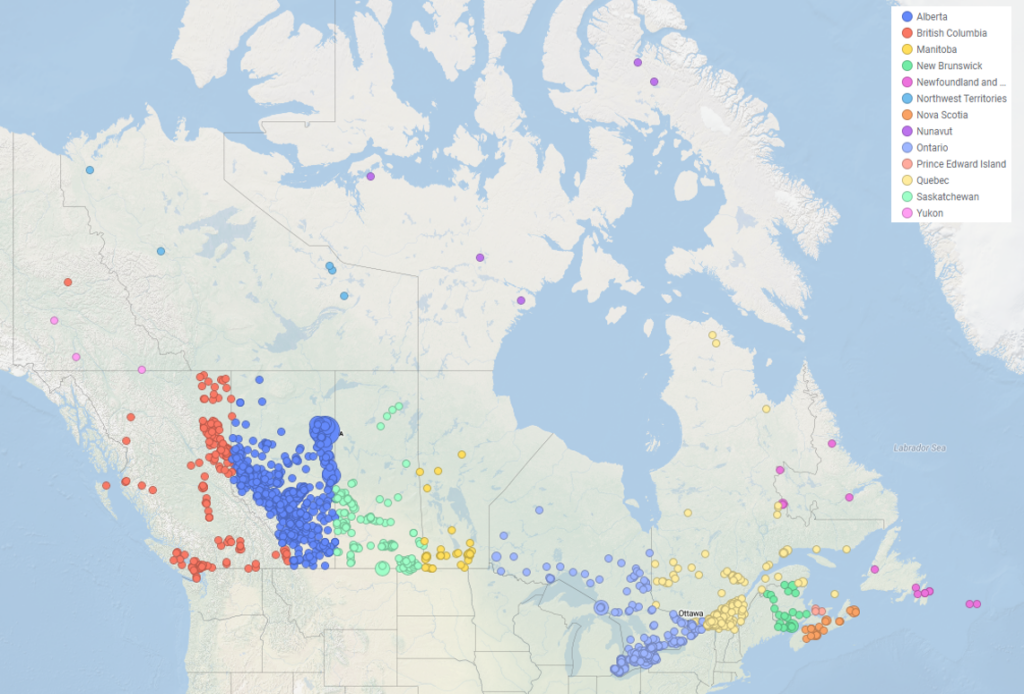

Canada’s Western Canadian Sedimentary Basin is the largest CCS-appropriate geological formation in the world and is proximal to high concentration industrial emissions sources. These factors combined with an established regulatory process are key enablers for the Canadian industry to move to store carbon underground rapidly (compared to other jurisdictions) and meet Canada’s commitments to reduce CO2 levels. The proximity of geological storage potential with concentrated emissions sources are two enabling requirements for the economic viability of CCS projects.

Looking ahead, there is significant potential for CCS to play a key role in reducing CO2 emissions and helping to mitigate the impacts of climate change. According to the International Energy Agency (IEA), CCS could contribute up to 15% of the total CO2 emissions reductions needed to meet the goals of the Paris Agreement.

To achieve this potential, it will be essential to overcome the barriers to CCS adoption and scale up deployment of the technology. This will require a coordinated effort by governments, businesses, and researchers to develop and implement policies and technologies that make CCS more cost-effective and efficient.

With over 50 years of energy consulting experience and over 30 years of CCS experience, GLJ is the leader in assessing site selection, economics, and utilization of carbon as a commodity. We have advised on CO2 EOR and sequestration projects for governments, producers, midstream and industrial partner clients in Canada and around the world. At conferences from London to Vienna and Houston to Australia, GLJ and our Canadian expertise is the go-to source for reliable, accurate and robust advice on CCUS initiatives.

We can identify strategic CCS opportunities to help you make the decisions on your projects. Our advanced static and dynamic modeling abilities led by our dedicated CCS team can help you get more out of your reservoirs through:

- site characterization

- reservoir injection modeling and CO2 sequestration modeling

- project planning and economic modeling

- regulatory and funding applications

- resourcing plans and partner identification

- complete evaluation and reporting

- decarbonization pathways and sustainability planning/reporting

Get in touch with us to see how we can help your company unlock its CCS potential.

Share This: