Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

T&E analyses the strategies that manufacturers are expected to use to comply.

Summary

The EU’s 2025 Car CO2 target is reachable and feasible

After years of stagnant EV sales due to the lack of new car CO₂ targets, carmakers will face stricter standards in 2025, following the last targets set in 2021. While some carmakers have been calling to weaken the regulation, T&E shows that all carmakers can meet their 2025 targets. T&E breaks down the strategies carmakers are expected to use to comply based on modelling of compliance scenarios relying on: sales data, carmakers’ public plans, and analysis of data from market research company GlobalData. The compliance options include increasing sales of full electric cars (BEVs), mild and full hybrids (HEVs) and plug-in hybrids (PHEVs), as well as various compliance flexibilities. This analysis provides an insight into carmakers’ paths to comply with the target in 2025.

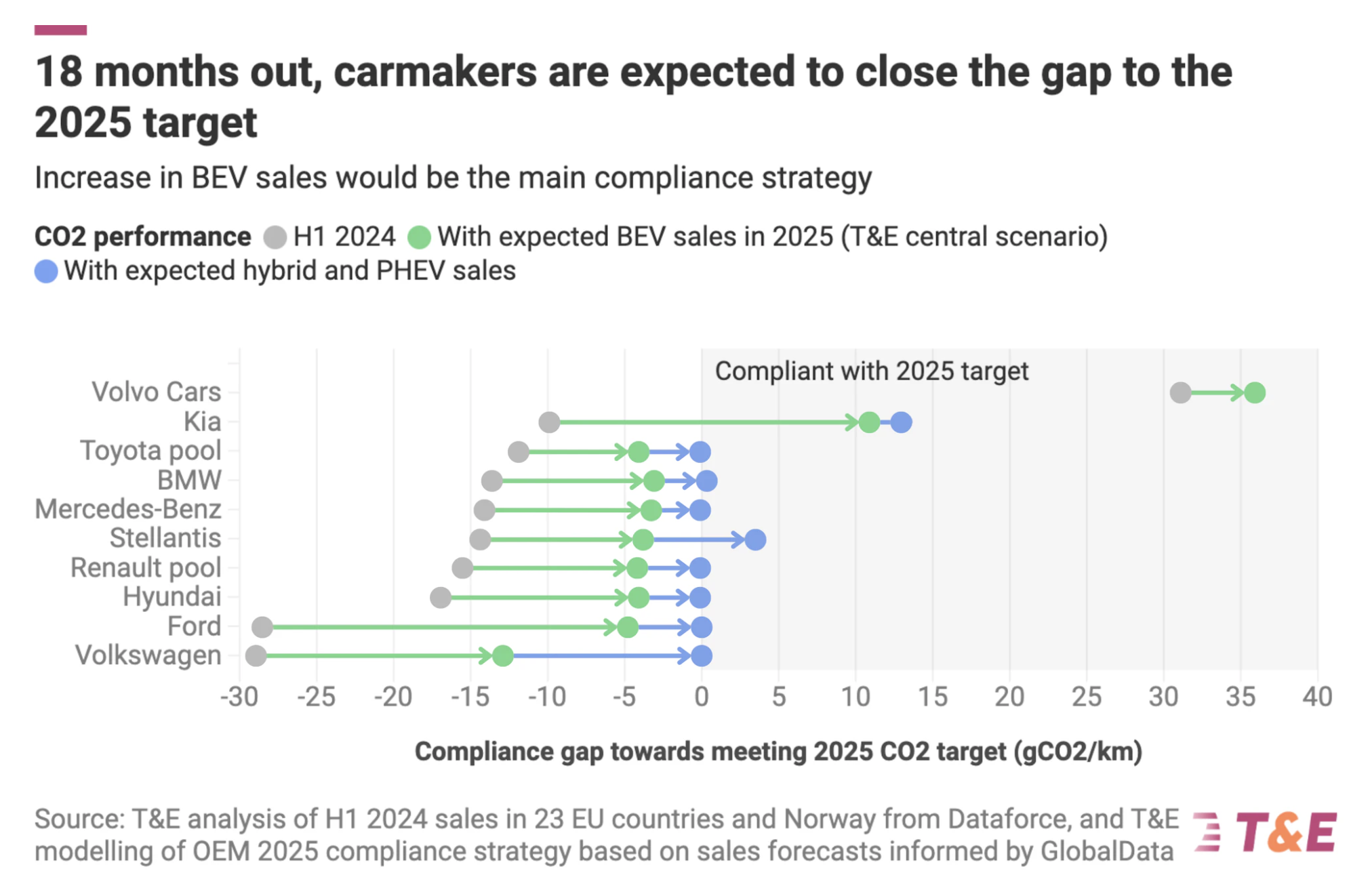

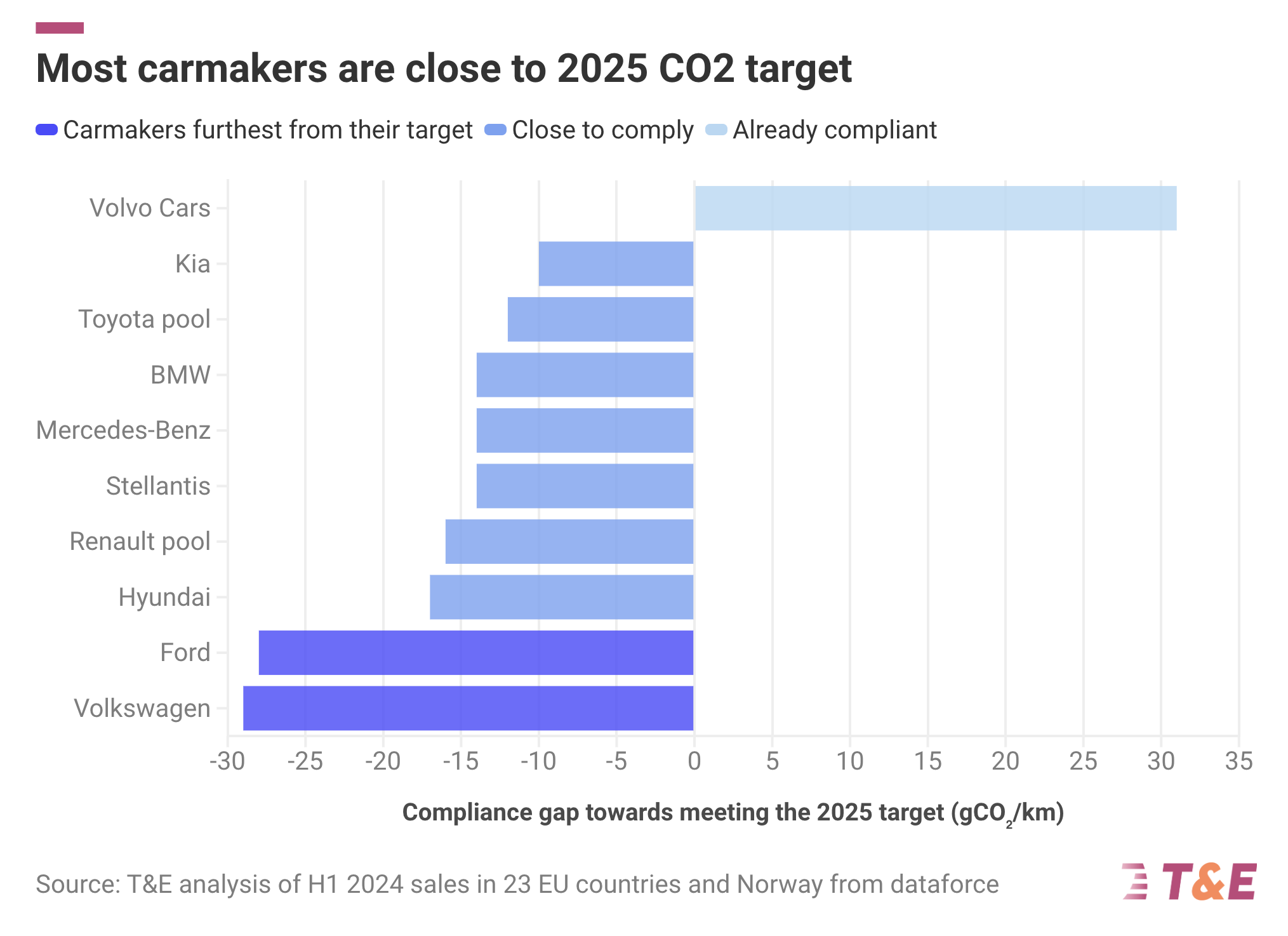

As with past car CO₂ targets, carmakers are expected to close their compliance gap in the target year, rather than ahead of time. Between 2019 and 2020, carmakers furthest away from their targets improved their CO₂ performance by 20 gCO₂/km. In the first half of 2024, most carmakers are close to meeting their target with gaps ranging from 10-17 gCO₂/km. Leaders in EV sales such as Volvo Cars have already reached their 2025 target. Volkswagen (VW) and Ford are the furthest behind with gaps of 28-29 gCO₂/km and may consider forming compliance pools with leaders to reduce the gap. For instance, if VW pools with Tesla, it would only need to achieve a 17% BEV share in 2025 (down from 22%). Similarly, if Ford pools with Volvo again, BEVs would need to account for just 9% of its sales, instead of 21%.

It is crucial to stress that the 2025 target is not an electric car mandate, and — technically — no mandatory EV sales share is necessary. The target, proposed back in 2017 and unchanged since then, is a CO₂ average: selling more efficient petrol cars (or fewer SUVs) helps as much as selling electrics. In addition, numerous flexibilities are allowed: an additional bonus for >25% ZLEV sales, eco innovations, as well as pooling emissions with other manufacturers, e.g. pure EV players.

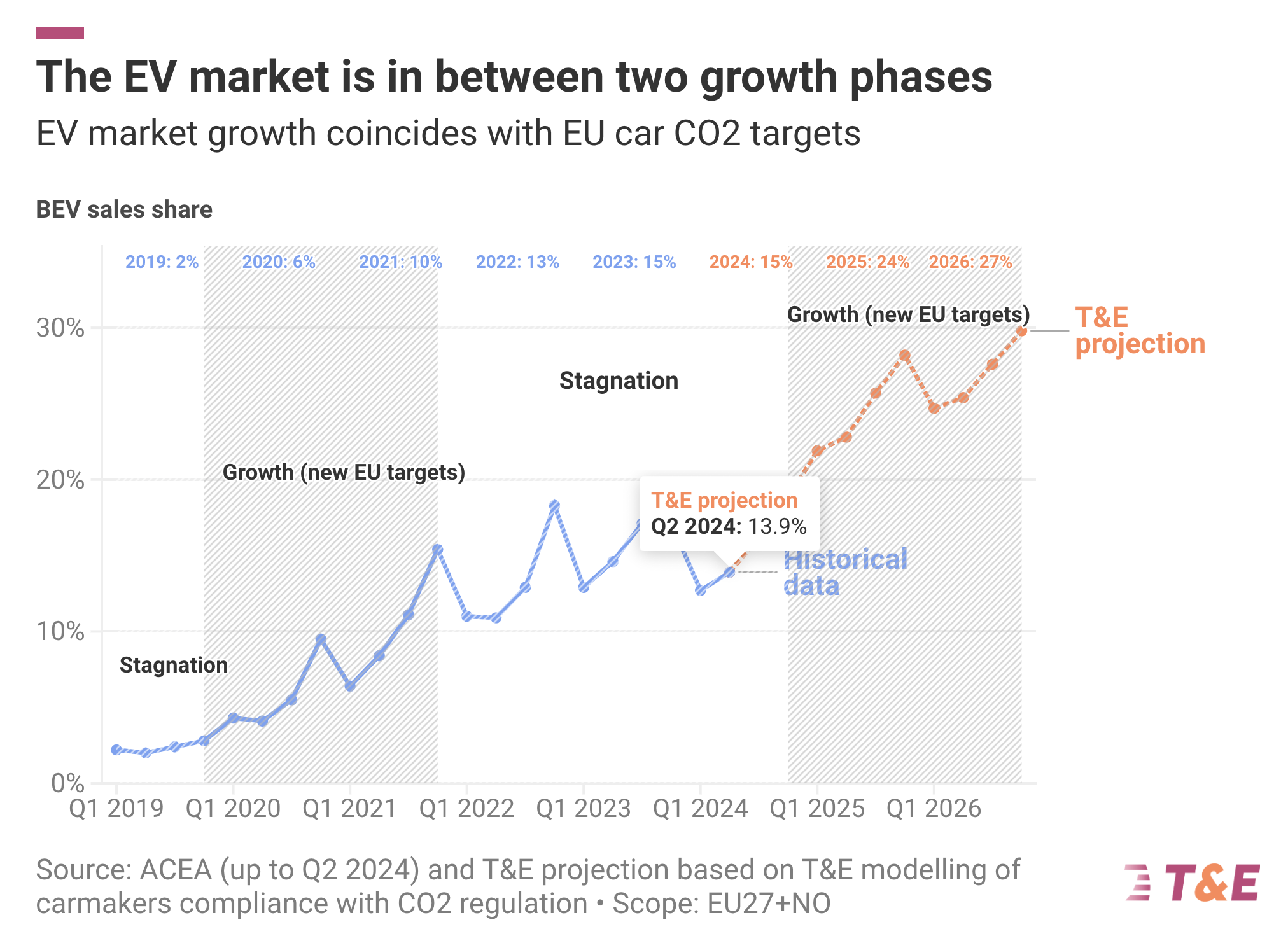

In 2025, carmakers are expected to boost EV sales in 2025. In T&E’s central compliance scenario, EV sales are expected to rise to 24% market share in 2025 (from 14% in the first half of 2024), supported by an expansion of mass market EV offerings, including seven affordable (<€25,000) EVs available. If carmakers rely more on hybrids, they would need less BEVs to comply (20%). The growth in EV sales would account for more than half (60%) of the CO₂ reduction needed to reach 2025. This comes after three years of stagnation, due to carmakers focus on profits from ICE and higher-priced EVs.

While BEVs play the biggest role, carmakers also rely on other compliance options. In T&E’s compliance scenario, on average, 20% of the CO₂ reduction would be achieved by selling more hybrids, while regulatory flexibilities would contribute to a 12% CO₂ reduction, and PHEVs could provide 8% of the improvements. Stellantis (33%) and VW (30%) would rely the most on HEV sales to meet their targets. As a result, despite not being a future proof option, the share of mild hybrids is expected to double (from 19% to 37%). BMW is expected to rely most on PHEVs (18%).

The car CO₂ regulation has proven effective and will continue to push carmakers towards electrification but needs to be accompanied by national EV policies: charging masterplans and stable, targeted subsidy schemes. To ensure Europe’s automotive industry remains competitive and leads in the mass-market EV sector, policymakers must resist calls to weaken the 2025-2035 targets or delay compliance. The current lead enjoyed by Chinese EV makers only shows that the longer the EU protects its laggard automakers, the less competitive they will be.

Part 1

Stagnation and growth: how the European EV market works

The BEV share of the European car market decreased slightly to 13.3% in the first half of 2024, compared to 13.8% in the first half of 2023 and 15.4% for the whole of 2023.

Stagnation phase: The slow growth of BEVs in the 2022-2024 period is due to the CO₂ standards design and carmakers profit driven strategy. This stagnation has been expected by T&E and market analysts since 2020.

-

The EU car CO₂ regulation is designed with 5-year steps with new targets in 2025 and 2030. Past evidence shows that carmakers don’t comply with car CO₂ targets in advance, but only when the targets require it. Previous T&E analysis showed carmakers were only half-way to the 2020 target 4 months before the start of 2020.

-

Carmakers focus on ICE profits ahead of the next growth phase driven by 2025 targets. In the stagnation phase, carmakers prioritise short-term profits through the sale of high-margin vehicles (e.g. Volkswagen’s “value over volume” strategy). Previous T&E analysis has shown that carmakers’ disproportionate focus on larger, more premium models has resulted in high prices for EVs in Europe which has slowed down EV sales as a result.

Growth phase: Carmakers are expected to ramp up mass-market affordable EVs to meet 2025 targets

In the next growth phase from 2025 onwards, electric car sales would pick up as carmakers need to prioritise EV sales to meet the next car CO₂ target. As presented in section 4, T&E expects EV sales to grow to 20%-24% in 2025, partly thanks to affordable models coming to the market (see section 3). This stop-and-go strategy creates a succession of stagnation and growth phases.

However, as carmakers prioritise their profits and shareholder payouts, many OEMs are calling on the European Commission to weaken the car CO₂ regulation despite the fact that the targets have first been proposed back in 2017. For instance, ACEA’s president Luca De Meo is calling for “a little more flexibility” in the regulation implementation while Volkswagen wants the EU to soften CO₂ emissions targets. This briefing looks ahead to 2025, analysing carmakers’ compliance gap based on sales in the first half of 2024 and describing how all carmakers can adapt their sales to meet the targets (methodology described in annex 6.1 of downloadable pdf briefing).

Part 2

Carmakers’ progress towards 2025 CO₂ targets is uneven

While Volvo Cars is already on track to meet its 2025 target based on sales in the first half of 2024, Volkswagen and Ford are furthest away. Other carmakers are in the middle and expected to meet their targets. This overall compliance picture with one leader, two laggards and other carmakers with a moderate gap around 10 gCO₂/km has not changed much since 2023. However, given there’s been a BEV slowdown since 2023, the compliance gap has slightly increased for most carmakers over the first half of 2024 (compared to the full year 2023). This situation is not new as most carmakers had similar gaps with their 2020 target in 2019.

The BEV slow-down in the first half of 2024 led average CO₂ emissions to increase to 109 gCO₂/km from 107 gCO₂/km in 2023. Volvo Cars is the only legacy carmaker that is already compliant (over-compliance of 31 gCO₂/km). Among the non-compliant carmakers, Kia is the closest to the 2025 target with a gap of 10 gCO₂/km. Most of the carmakers’ targets are well within reach with gaps ranging from 10 and 17 gCO₂/km.

To close the gap by 2025, Ford and Volkswagen will need to redouble their efforts.

Ford and Volkswagen are the furthest away from their targets with gaps of 28 and 29 gCO₂/km respectively. While these two carmakers will need to double down on their efforts in 2025 to close the gap, they have many possible compliance strategies as highlighted in section 4.

Back in 2019, carmakers also had large gaps with their 2020 targets.

Looking at the market average, the compliance gap is 15 gCO₂/km in H1 2024, a similar value as the 13 gCO₂/km gap in 2019 compared to the 2020 target. BEV sales are expected to normalise in the second part of 2024 as the market recovers from the abrupt removal of the subsidy in Germany (e.g. by lowering EV prices as VW has already done). The full year 2024 gap would be lower than the current 15 gCO₂/km and could even become lower than 2019. Hyundai was the major carmaker that was the furthest away from its 2020 target in 2019 with a gap of 17 gCO₂/km. Despite this gap, it still over-complied in 2020, improving its CO₂ performance by 20 gCO₂/km. Ford and Volkswagen currently have significantly higher gaps than in 2019 (Ford eventually formed a pool with Volvo Cars and VW with MG) while Kia and Mercedes-Benz are currently doing better than 5 years ago.

Read Part 3 of the report, “Carmakers strategies to comply with their CO₂ targets in 2025,” Part 4, “EV sales to grow as carmakers focus on compliance,” and more in the full report here.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy