How many ways are there to say that mechanical direct air capture (DAC) of carbon dioxide is a deeply stupid idea? Whatever the number is, I’ve probably used the majority of turns of phrase. So have many others. That, of course, doesn’t stop the fossil fuel industry, people that they influence, people who just don’t know any better and hopeful people with no STEM capabilities from loving the field.

And Occidental Petroleum just showed its love in a big way, committing US$1.1 billion to buy Carbon Engineering, the Canadian-ish DAC firm that set up shop in Squamish, BC a few years ago. At the time, I was annoyed that the Canadian government was throwing taxpayer’s money at it, but unsurprised at how many fossil fuel companies had chipped in.

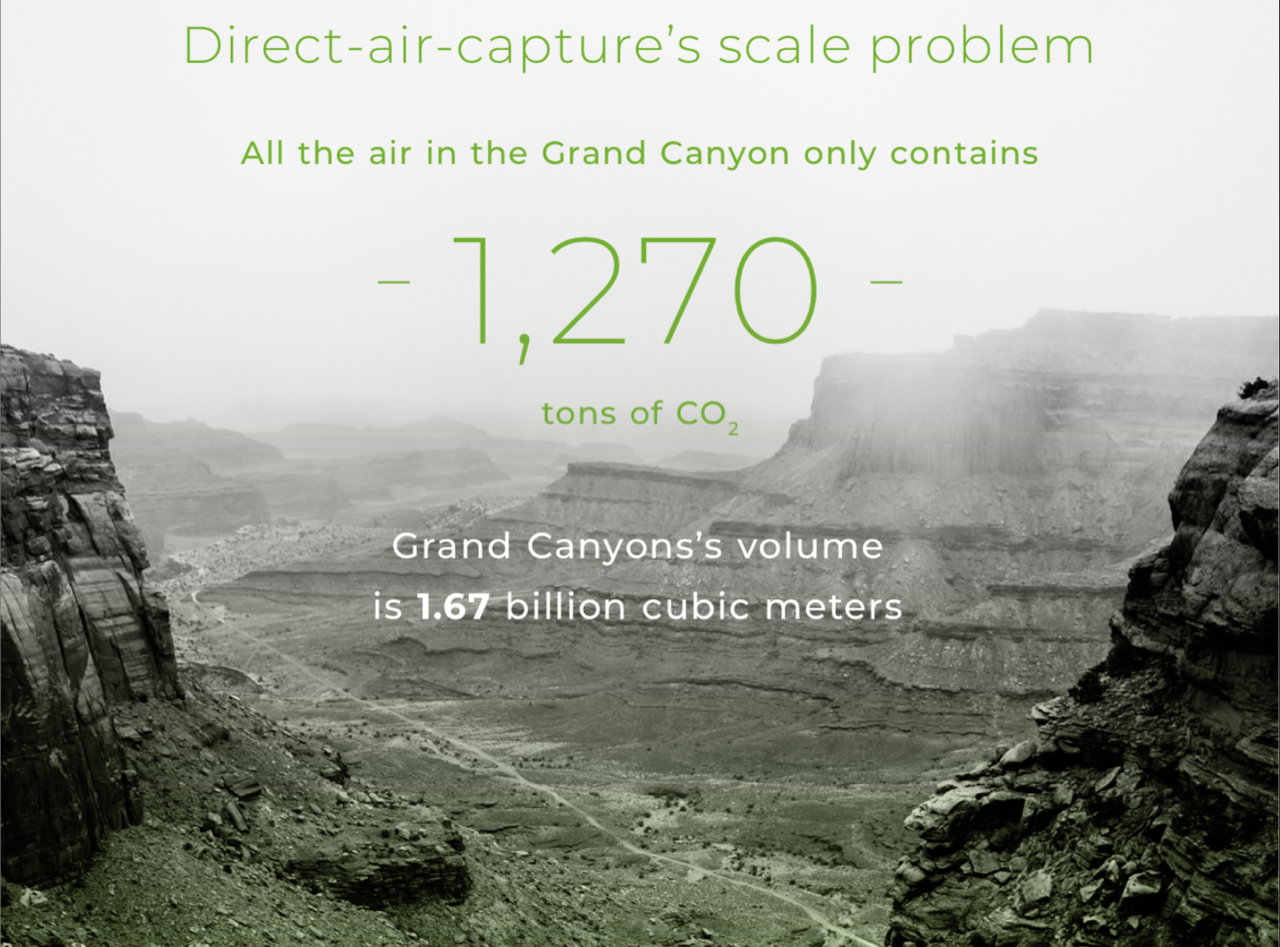

The entire, massive, deep length of the Grand Canyon only has 1,270 tons of CO2 in it.

That motivated me to publish nine lengthy pieces assessing different aspects of the technology and its actual markets, and then wrap them up in a 54-page case study with a foreword by Professor Mark Z. Jacobson of Stanford, well known for his team’s ongoing work on a scenario of 100% renewables by 2050, now covering 143 countries. I went deeply nerdy on this, rebuilding my brain to be a poor excuse for a chemical engineer, working in moles and reviewing scads of literature on synthetic fuel manufacturing. I have a bunch of chemical engineering nerd fans because I both worked up the chemistry and pointed out that Carbon Engineering was completely lacking in anything resembling clothes, never mind ones befitting royalty.

In the original series, I looked at all of the possible use cases for the technology and asserted that Carbon Engineering’s Only Market Is Pumping More Oil. That was, indeed, the headline of that article, and only a couple of months later, Carbon Engineering signed a deal with Occidental to do exactly that in the Permian Basis oil region of the southern USA. As the engineer behind it, David Keith of Harvard University, made clear in his peer-reviewed publications over a decade ago, the plan was to use natural gas to power a couple of kilometers of 20-meter high, 3-meter wide fans blowing air through dripping carbon-capturing solution, and then to heat the carbon-rich solution to 900° Celsius to unlock the CO2 so it could be captured. Oh, and to power the two different carbon capture systems required to capture the half-ton of CO2 from natural gas per ton of CO2 from the air as well.

Keith is also known for his couple of remarkably weak studies that found that wind energy — you know, one of the two biggest energy success stories and about the most benign form of electrical generation we have today — wasn’t all that, and his tireless efforts to put a bandaid on global warming by pumping sulfur particles into the stratosphere, ignoring all of the other problems with burning massive amounts of fossil fuels including ocean acidification. That he has the ear of so many affluent and influential people such as Bill Gates continues to perplex me.

Yeah, let’s take a bunch of sequestered carbon in natural gas, pump it up from underground, burn it to create 500 thousand tons of CO2, and use the power to capture a million tons of CO2 from the air. Then we’ll pump all the CO2 underground to sequester it. Sounds like a win, doesn’t it? Negative CO2?

Except, you have to ask the next question. Where is there a lot of cheap natural gas and a place to put CO2? Well, in tapped out oil fields. They often have natural gas that’s just sitting there leaking out of the fracking and shale oil sites in amounts too small to be worth piping to markets, but sufficient for illuminating a fig leaf.

Especially with the next bit. Tapped out oil wells aren’t empty of oil, they are empty of easily extractable oil. There’s a bunch of tarry sludge left underground, and CO2 has this handy property of liquifying tarry sludge. Pump it underground into tapped out oil wells, liquify the sludge, increase the pressure and pump the oil out the other end. That’s one of the techniques of enhanced oil recovery (EOR). And it typically recovers so much oil that the CO2 reduction claims are completely bogus, especially with burning natural gas to power the kit.

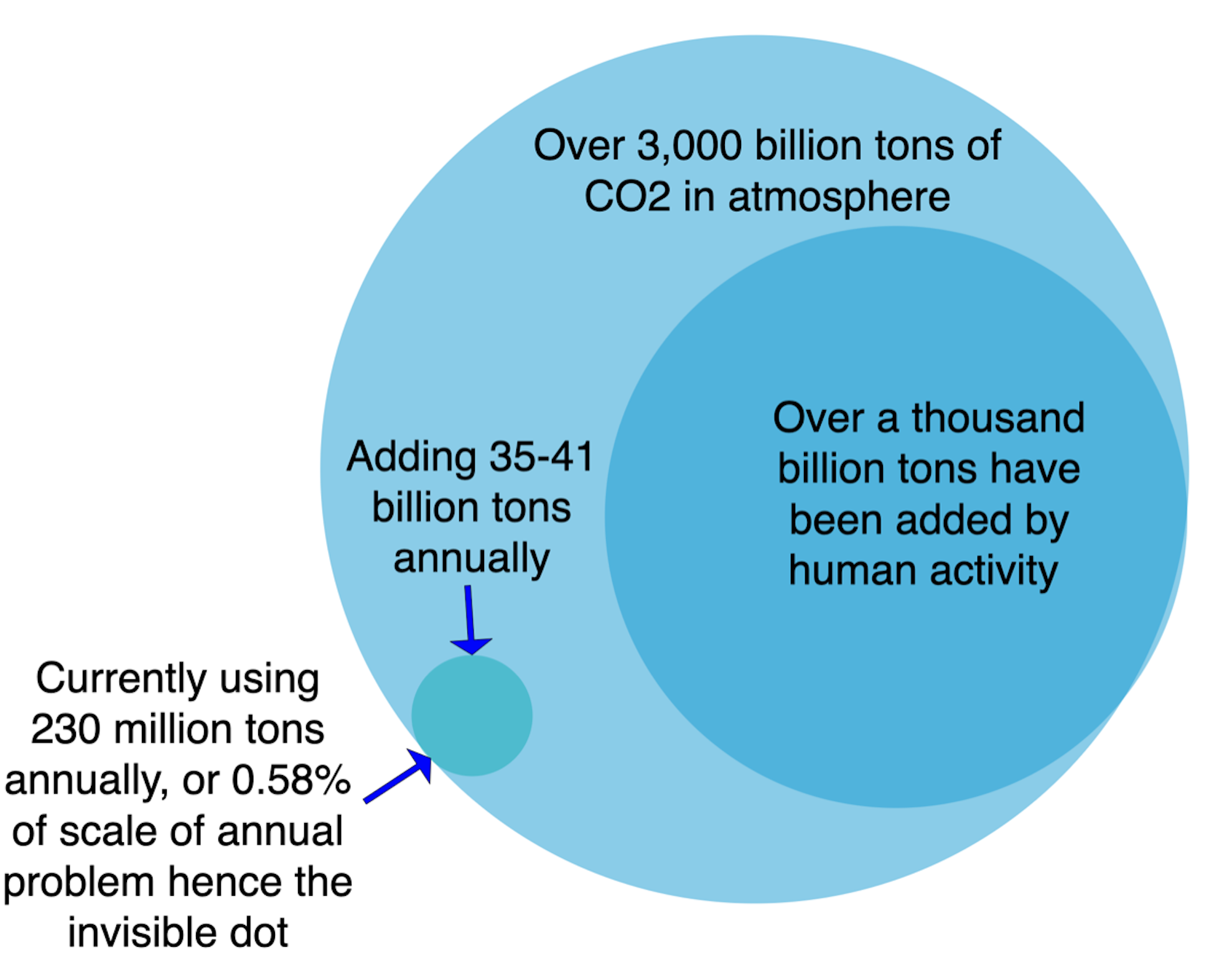

Scale of CO2 problems compared to global demand for CO2, chart by author

What’s with the Venn diagram? Well, that’s the scale of the CO2 in the atmosphere right now, with the scale of our historical additions and the scale of our annual additions. The invisible dot is our current annual consumption of CO2 as a commodity. Why do I bring this up? Because the single biggest market for CO2 today is enhanced oil recovery, about a third of that 230 million tons that somebody pays for every year.

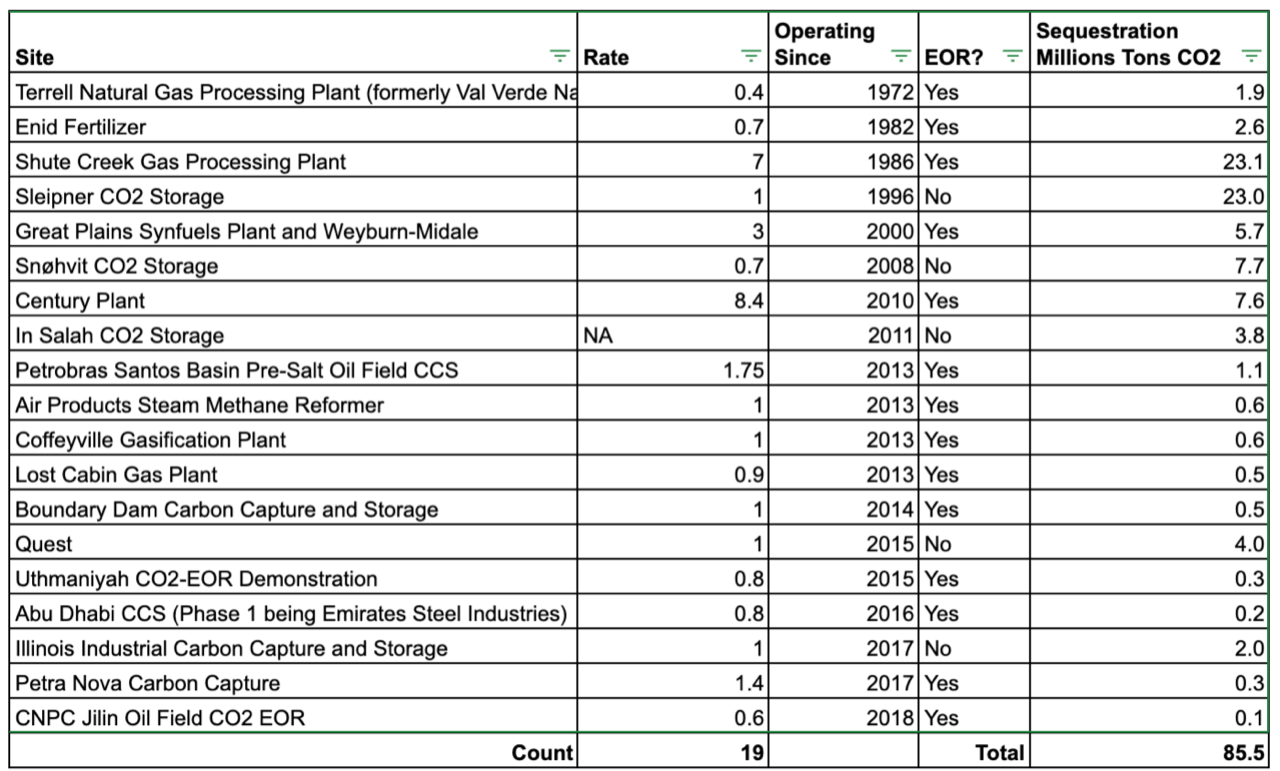

Table of all carbon capture and sequestration facilities over a million tons of CO2 per year by author

How do I know that? Well, it’s because the same year I looked at all of the significant carbon capture facilities for the past 50 years based on Global Carbon Capture and Sequestration Institute — yes, they are transparently a fossil-fuel industry lobbying and advocacy group — data and went through public information to figure out what exactly was what. As I determined out without much effort, Carbon Capture’s Global Investment Would Have Been Better Spent On Wind & Solar. Giving CCS every possible benefit out of the doubt, and burdening wind and solar energy with high costs and low capacity factors, it would have been vastly better to build wind and solar instead.

Claiming that we can vacuum CO2 out of the atmosphere to deal with the historical and annual problem is specious nonsense, and then using CO2 to pump more oil to add to the problem is adding insult to injury.

So yeah, after looking at pretty much every use for CO2 and the Carbon Engineering technical solution, it was clear that their claims of making cheap plug-compatible synthetic fuels were nonsense and that their only natural market was enhanced oil recovery.

Oh, wait. They were claiming something other than the only thing the kit was good for? Yeah, and they still are. But here’s the thing. They were sucking CO2 out of the air at great energetic expensive, somewhat like closing the barn door after the horses had fled, if the horses were numbered in the billions, invisible, tiny, and could fly, and then were going to use electricity from somewhere to get hydrogen at much greater energetic expense. And then they claimed that they were going to create carbon neutral diesel or jet fuel at yet more energetic expense, and that this was going to be virtuous and inexpensive.

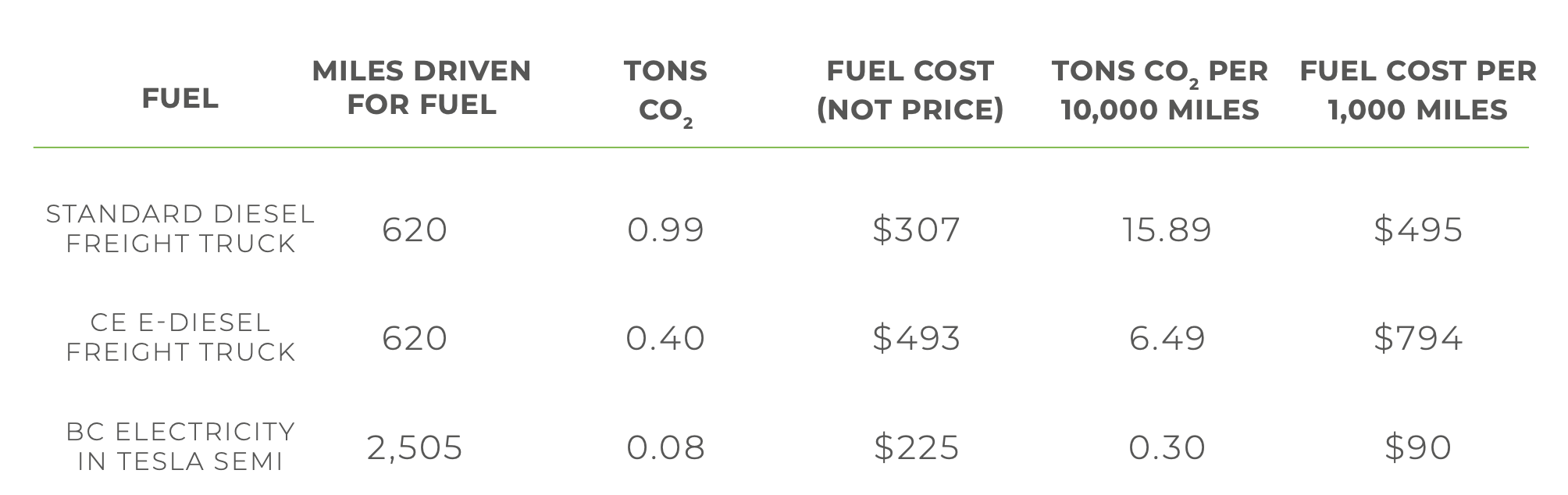

Comparison of Carbon Engineering plug-compatible synthetic diesel to alternatives, chart by author

Did any of this stand up to the slightest scrutiny? No, of course not. The table above was the freight truck comparison, where it’s much more expensive and high carbon to use their solution in the best possible case scenario where I gave them every benefit of the doubt than just putting the electricity into electric trucks. I did the same with jet fuel vs sustainable aviation biofuel, and the comparison was much worse.

Note the “BC Electricity.” British Columbia, the jurisdiction Carbon Engineering has its idyllic Squamish base in, has really low-carbon electricity at 12.9 grams CO2e per kWh. That was used both for manufacturing the hydrogen for Carbon Engineering’s synthetic fuel and the electricity for the Tesla Semi in my workup. You can’t make synthetic fuels from green hydrogen without them having carbon debts that are multiples of just using the electricity directly. Virtually every jurisdiction in the world has electricity that would multiply that carbon debt above the level of diesel, usually by a long way. As an example, the USA’s average is 389 grams of CO23 per kWh, 30 times worse. Carbon Engineering’s diesel would have had a CO2 load 16 times that of diesel on the average USA grid electricity.

No one is going to buy synthetic fuels made from direct air capture and hydrogen because there are lower carbon, much cheaper alternatives. And yet, this is the claim Occidental is making, per the press release.

“The U.S. oil producer aims to build about 100 plants using direct air capture (DAC) technology that strips carbon dioxide (CO2) from the atmosphere to bury underground or for use in making products such as concrete and aviation fuel.”

“About” is a fun word, isn’t it? But let’s pretend that they are going to build 100 of Carbon Engineering’s plants in addition to the one that they are building the Permian Basin for enhanced oil recovery. That should be “about” 100 million tons of CO2 captured from the air every year, with another 50 million tons created from burning natural gas. Sure.

Per the press release, 30 of those facilities will be built in Kleberg County, Texas. Remarkably, that county has a lot of tapped out oil wells. I wonder what Occidental is going to do with 30 enhanced oil recovery machines burning natural gas in that county?

Well, they are going to be harvesting the USA’s Inflation Reduction Act turbocharged 45Q tax credits for carbon capture and sequestration of course, and sharing in the largesse of US$4.5 billion to set up a CCS hub in the region. When I was at a conference a few years ago where one of Carbon Engineering’s engineers was on a panel, they let slip under mild questioning that the company was going to be receiving US$250 per ton of CO2 from a couple of governmental tax credits for their enhanced oil recovery. Seems like that economic and climate insanity is continuing.

The US$1.1 billion purchase price doesn’t seem so big now. Occidental will probably be able to harvest that and the costs of building the walls of fans powered by natural gas directly from taxpayers without passing go. Most of the oil that they pump up to continue to make the climate crisis worse will be pure profit. Who couldn’t wish taxpayer funded profits upon a major oil firm?

And who couldn’t wish an oil-soaked but very lucrative exit from a startup for Bill Gates and Breakthrough Energy Ventures, early investors in Carbon Engineering? After all, their entire purpose is to put money into climate solutions. Isn’t it? Anyone? Bueller? Anyone?

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …