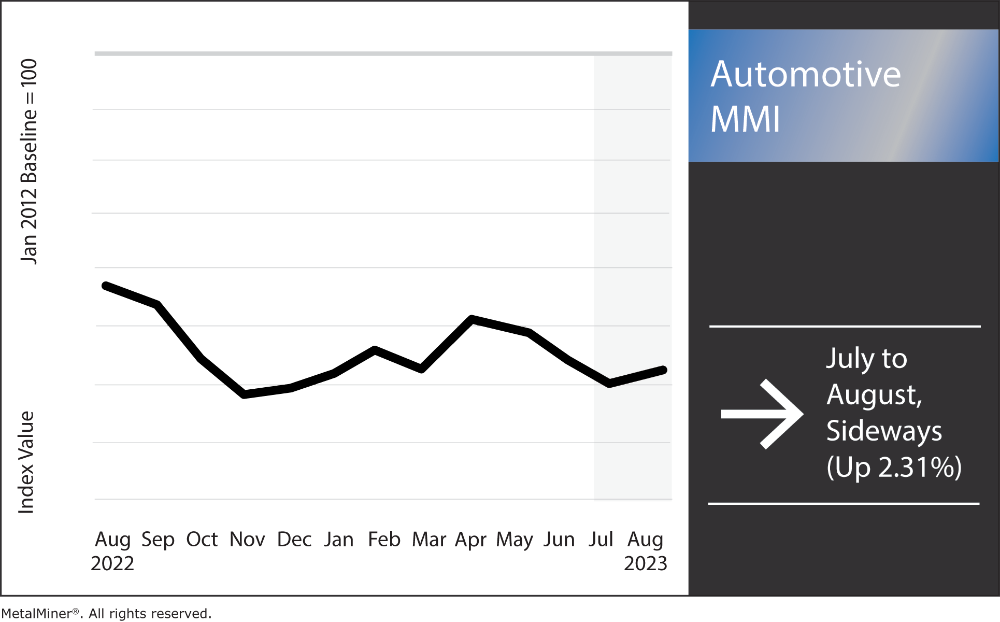

Compared to other metal industries, components of the automotive industry still remain somewhat strong, despite the Automotive MMI (Monthly Metal Index’s) sideways movement over the past seven months. Pent-up consumer demand still runs strong in the industry. However, it still continues to battle high interest rates and falling steel prices due to slumping demand. There could potentially be a swing to the upside in the long-term should the Fed begin lowering interest rates. However, most experts don’t anticipate that will happen until at least 2024. Until the Fed goes dovish, the index could remain in a somewhat sideways trend. All-in-all, the Automotive MMI moved sideways, rising up by 2.31%.

MetalMiner’s 2024 Annual Budget & Forecasting Workshop is happening tomorrow at 10 AM CST. Opt in to receive the recording through email if you’re unable to attend. Click here.

Semiconductor Shortage Still a Problem With no End in Sight

The ongoing microchip shortage is significantly impacting the automobile sector in the U.S., particularly in the production of electric cars (EVs). Automakers have faced shortened production schedules and suffered huge financial losses since the chip shortage began. The scarcity is projected to result in cutting 2.8 million global vehicles for the year 2023, a stunning figure that highlights the seriousness of the crisis. Chip scarcity has been a significant impediment for organizations in numerous industries, with automakers being among the most affected.

While consumer electronics manufacturers account for approximately 50% of microchip supply, automakers account for approximately 15% of supply. As passenger vehicles become more technologically advanced, they continue to rely more and more on microchips.

Despite the global chip scarcity, more manufacturers are prepared to cut prices in order to qualify for the EV tax credit. This may end up making EVs more affordable. However, buyers may have to wait for some time before they can purchase brand-new EVs at a more affordable rate. Due to the continued chip shortage, automakers will eliminate about 18 million vehicles from production plans by the end of 2023. According to Ford’s Chief Financial Officer, John Lawler, “there is still going to be volatility around chips” in 2023. “It’s easing,” said Sam Fiorani, Auto Forecast Solutions’ vice president of global vehicle forecasting. “There are more chips out there, and if you have proper access to them, your production will be fine.”

By calling a bullish market or calling a bearish market, buying organizations can always generate cost savings or cost avoidance. Read MetalMiner’s track record.

Sideways Steel Prices Could Aid Automotive Industry

Steel prices still currently find themselves in a sideways market, with prices only recently beginning to witness more movement. Sideways movement in steel prices can benefit the automotive sector in the following ways:

- Limited steel price volatility helps automakers to have more predictable and steady costs for steel inputs. This pricing stability aids them in planning and budgeting for their manufacturing processes and overall operations.

- Steel price stability allows automakers to offer competitive pricing for their vehicles. When steel prices are variable or rising, automakers may be forced to pass on the greater costs to customers, resulting in higher vehicle pricing. However, if steel prices remain stable, automakers may keep their vehicle prices low, luring more buyers.

- Stable steel prices support a steady supply of steel for the car sector. Automakers can ensure a consistent supply of steel with predictable prices, assuring continued manufacturing.

Get a competitive edge in challenging metal market conditions. Learn game-changing metal industry insights by opting into MetalMiner’s free weekly newsletter.

Negative Implications of Sideways Steel Prices on The Automotive Industry

Any major changes or sideways movement in steel pricing, on the other hand, can have a detrimental influence on the automotive sector. If steel prices break out of their sideways trend, the automotive market could experience the following:

- When steel prices fall or rise, automakers must endure higher costs for procuring steel, which can eat into profit margins.

- Sudden changes in steel prices can result in automakers facing higher production costs, leading to lower profit margins. If steel prices remain high or rise while other expenses remain unchanged, automakers may struggle to sustain profitability.

- When steel prices rise, automakers may pass the increased costs on to customers in the form of higher vehicle pricing. This action may make vehicles less affordable to prospective customers, resulting in a drop in demand for new vehicles.

- Rising steel prices may lead automakers to pass on extra expenses to customers in the form of increased vehicle prices. This could make vehicles less affordable to prospective customers, resulting in a drop in demand for new vehicles.

It should be noted that these negative consequences may not be instantaneous or universal across the whole automotive industry. The magnitude of the impact varies based on factors such as the magnitude of steel price swings, market conditions, and individual automakers’ tactics for mitigating the consequences of steel price movements.

MetalMiner customizes price points, price forecasts and procurement solutions based on the specific metal type your company purchases. See MetalMiner’s full metal catalog.

Automotive MMI: Notable Price Shifts

- Chinese lead went up in price by 5.02%, bringing prices to $2,199.68 per metric ton.

- Hot-dipped galvanized steel stayed within a tight sideways range, only dropping in price by 1.01%. This ultimately left prices at $1,080 per short ton.

- Korean aluminum 5052 coil premium over 1050 moved sideways, only edging up in price 1.2%. Prices at month’s start sat at $4.23 per kilogram.