“Cap and trade” is a regulation designed to reduce greenhouse gases by setting a firm limit – or cap – on emissions.

Here’s how the California Air Resources Board describes it:

In 2014, OPIS began accounting for these compliance costs by showing California Cap at the Rack (CAR) in its gas and diesel reports. In 2023, Washington Cap at the Rack was added to OPIS gas and diesel rack reports to reflect the implementation of Washington State’s Cap and Invest program.

However, suppliers have not standardized how they reflect compliance costs in their prices.

Some suppliers include it as a line item on invoices. Others wrap the cost into their posted rack price. Thanks for keeping us on our toes!

In response to the lack of standardization, OPIS “normalizes,” prices so our rack data compares “apples to apples.”

This normalization has resulted in three OPIS report options. Check them out below.

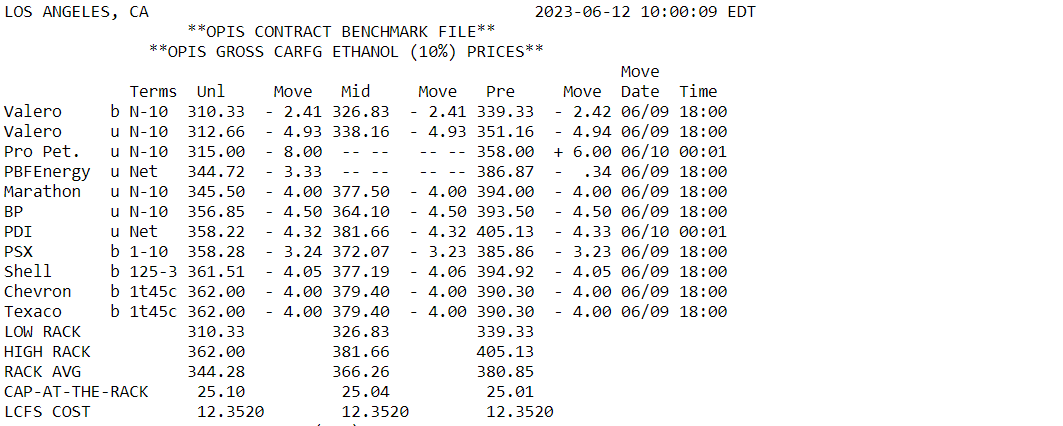

Option 1: Non-Adjusted — Prices are shown just as a supplier delivers them

Here’s what those prices look like in a gasoline rack report.

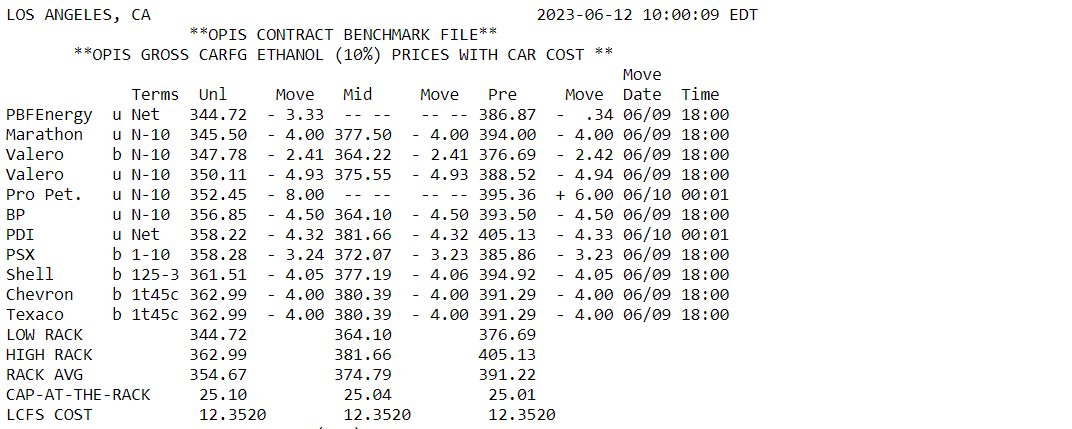

Option 2: Normalized — Includes compliance costs

We adjust the prices of suppliers who do not wrap in compliance values by adding OPIS’ CAR assessment or the suppliers’ own costs. Like this:

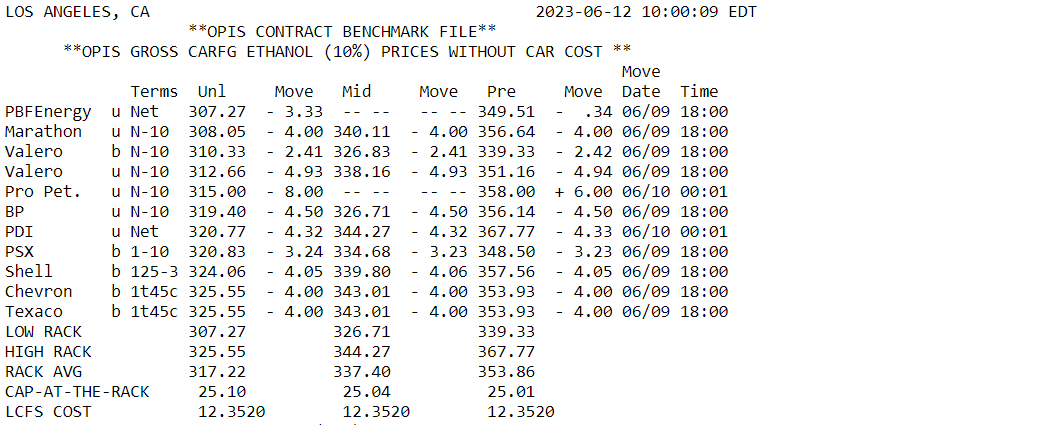

Option 3: Normalized — Excludes compliance costs

OPIS adjusts prices for suppliers who do wrap in compliance values by removing OPIS’ CAR or the suppliers’ own costs. Here’s a peek:

Note: The OPIS “CAR” value accounts for costs associated with BOTH Cap and Trade (Cap at the Rack) regulations AND the Low Carbon Fuel Standard (LCFS).

If you are a California or Washington rack fuel buyer and are not getting your report in the format you need, get in touch with us and we can get you sorted out. And, in the meantime, find out more about OPIS coverage of compliance costs: