Canterra Minerals, a Canadian resources company, has finalised its purchase of critical and precious metals projects in Newfoundland from Buchans Resources.

The critical and precious metals properties add 316km² of area including the Buchans Mine property, which hosts the Lundberg, Bobby’s Pond, Tulks Hill and Daniel’s Pond deposits, bringing its total property position to 684km².

As consideration for the transaction, Canterra issued 24.9 million of its shares, representing a 19.9% stake, and 128.5 million of its share purchase warrants. These warrants must be exchanged for shares within two years of closing.

Pursuant to the transaction, Canterra also issued 23.6 million of its critical mineral exploration tax credit (CMETC) flow-through (FT) common shares, each priced at C$0.065, and secured C$1.5m.

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Canterra CEO and president Chris Pennimpede said: “Canterra aims to uncover mineral deposits in central Newfoundland. These assets strengthen land position within the central Newfoundland mining corridor, opening avenues for substantial discoveries within the belt.

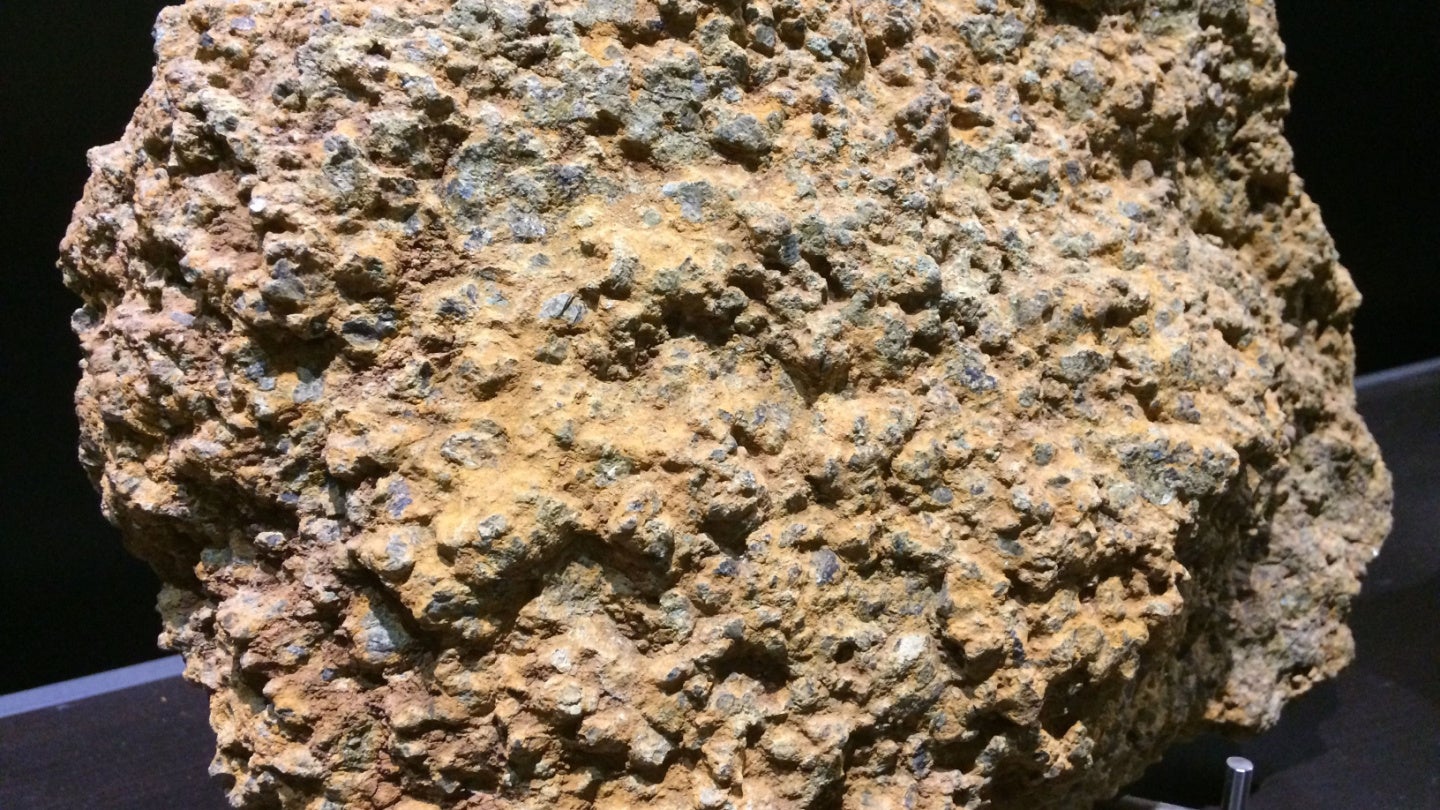

“Our existing properties near the Teck’s past producing Duck Pond Mine already has compelling VMS [volcanogenic massive sulphide] deposits and exploration prospects, complementing our established orogenic gold deposit opportunities. Echoing the industry adage that the best place to look for a mine is in the shadow of a headframe, Canterra will now be exploring at the brownfields site of the prolific Buchans Mine.

“The Buchans project is ripe for a modern approach with significant exploration potential for high-grade VMS mineralisation. With a 684km² land position encompassing mineral rights across existing deposits, we anticipate being strongly positioned to unveil the next mineral discovery in central Newfoundland.”

For Canterra, this acquisition will create a district-scale portfolio comprising seven resource-stage critical mineral projects.

Its consolidated indicated mineral resources are estimated to be 1.4 billion pounds of zinc with inferred mineral resources of around 317 million pounds of contained zinc.

The consolidated indicated mineral resources for other precious metals including contained copper and significant gold and silver are estimated to be 251 million pounds.

A large bulk tonnage of mineral resources at the Lundberg deposit brings significant opportunity for new high-grade zinc-copper (Zn-Cu) VMS discoveries.

Sign up for our daily news round-up!

Give your business an edge with our leading industry insights.