Support CleanTechnica’s work through a Substack subscription or on Stripe.

Mark Carney’s first federal budget arrived with the promise of discipline and credibility, but also a signal that Canada would stay in the clean economy race. The climate provisions were not new programs so much as extensions of what already existed. They provided more time for industry to commit to projects and more certainty for investors. The biggest changes came in carbon capture and hydrogen, where the government chose continuity and timeline over reinvention. The real question is not whether the credits exist, but who will actually use them and for what purpose.

The policy mechanics are clear. The Carbon Capture, Utilization and Storage Investment Tax Credit was extended at full value through 2035, with half-rates from 2036 to 2040. That means capture equipment still receives a 50% credit, while transport, storage, and utilization equipment receive 37.5%. The Clean Hydrogen Investment Tax Credit remains at 15–40% depending on carbon intensity, with methane pyrolysis now eligible for the same tiers as electrolysis and blue hydrogen. Clean Electricity credits were adjusted so that the Canada Growth Fund can co-invest without reducing the creditable base. The extension is worth billions in deferred revenue. Using the announced and expected projects as a baseline, the total potential value of the credits is about $1 billion per year, with the largest single project—the Pathways oil sands hub—accounting for about 80% of that.

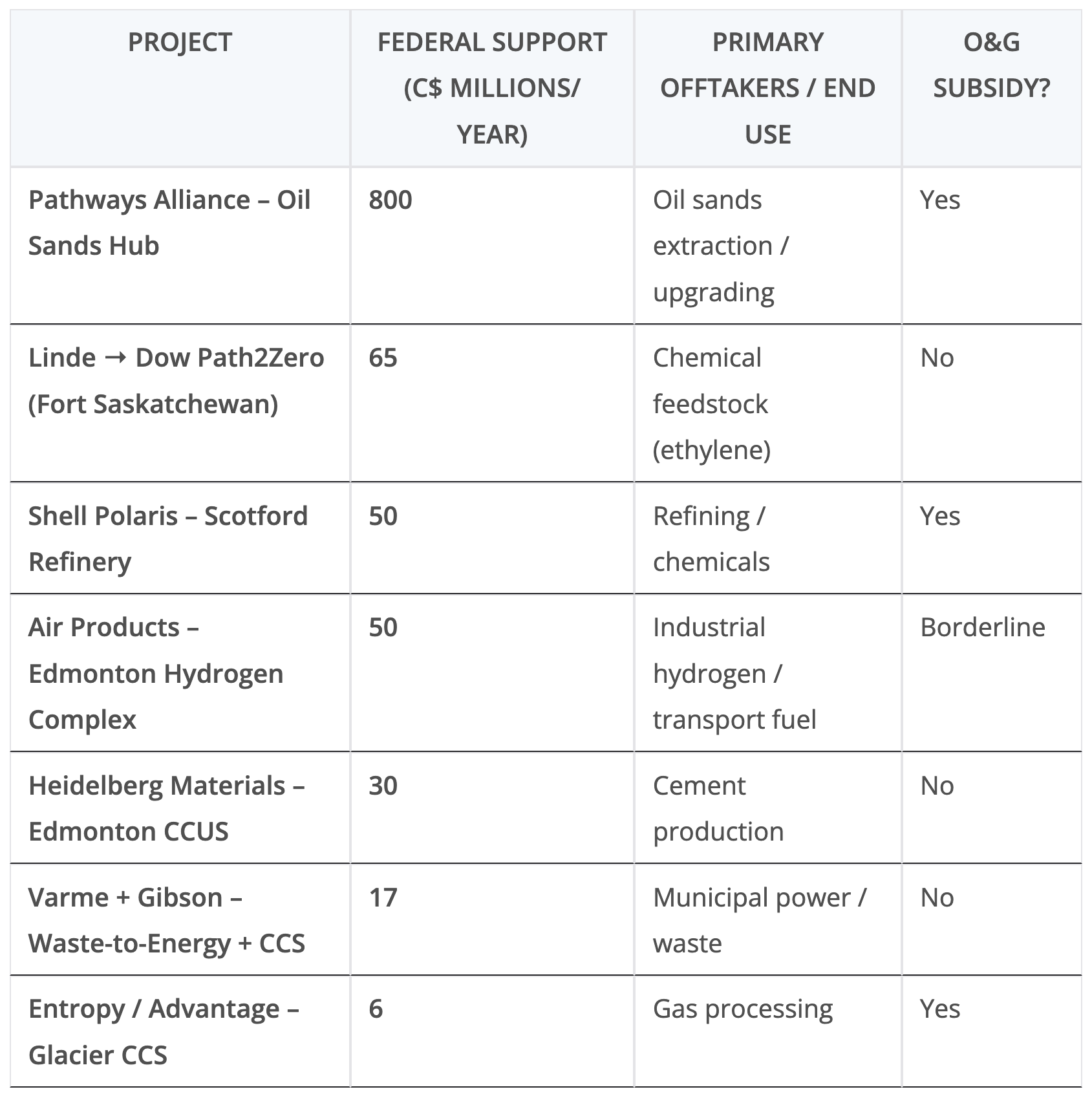

Following the money shows that the majority of near-term benefits go to fossil-linked projects. The Pathways Alliance hub in Alberta represents roughly $800 million in annualized support potential if the project reaches a final investment decision and completes construction before 2036. Shell’s Polaris project at the Scotford refinery would receive around $50 million per year in equivalent value, and Entropy’s Glacier capture unit about $6 million. Together they account for nearly 90% of the modeled total. Non-fossil industrial users such as Heidelberg’s cement plant, Air Products’ Edmonton hydrogen complex, Linde’s supply to Dow, and the Varme waste-to-energy project split the remaining 10%.

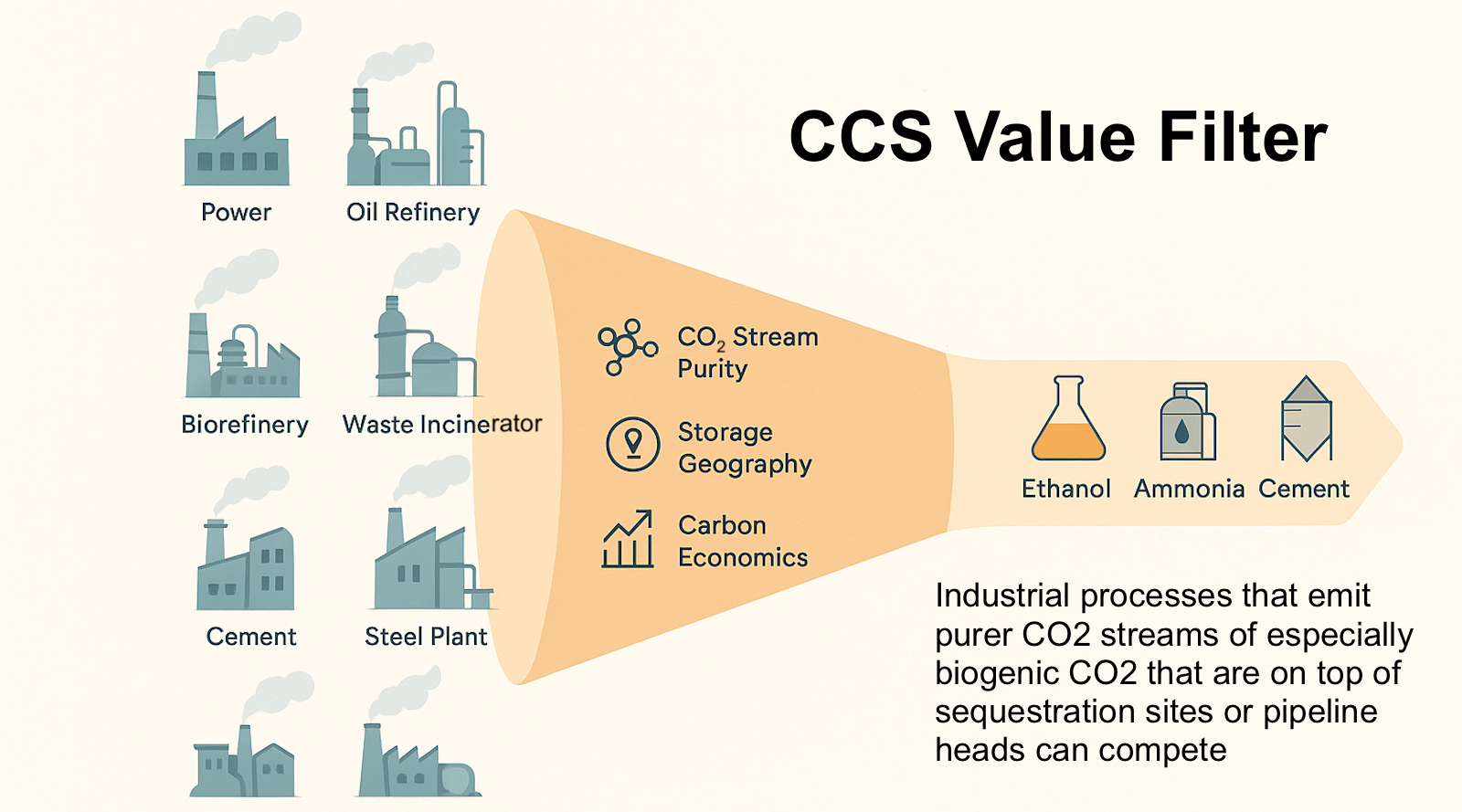

Canada’s carbon capture policy still treats a ton of CO₂ from an upgrader stack the same as a ton from a cement kiln, even though the economics and physics are very different. That distinction is where CCS either makes sense or becomes a holding pattern. The projects that work are those with pure or nearly pure streams, especially those with biogenic CO2 emissions, low-cost storage nearby, and an industrial use case that cannot easily electrify. Those that fail the test are usually trying to clean up combustion rather than process chemistry.

The Heidelberg Materials project in Edmonton is the cleanest example of CCS used properly. Cement production releases CO₂ from calcination as part of the process itself, not from fuel combustion. The stream is concentrated, the storage geology is proven, and the company has committed to permanent storage rather than enhanced recovery. The government’s investment through the Strategic Innovation Fund adds a grant layer to a credible decarbonization project that cannot simply switch to renewable electricity.

Shell’s Polaris project at Scotford is another large-scale capture facility, built around hydrogen and chemicals production. It captures a high-purity stream and sends it to the same storage formations as Pathways, but it sits squarely within the oil and gas value chain. The incentive is framed as industrial decarbonization, yet the captured CO₂ comes from refining feedstocks. In practice, it preserves the life of a fossil-based operation rather than accelerating its transition.

The Varme and Gibson waste-to-energy project represents a different approach. The carbon offtake contract guarantees an $85 per ton floor for captured CO₂, worth around $17 million a year for 15 years. It proves the model for risk-sharing, though the underlying combustion of municipal waste raises questions about the purity and cost of the stream. The energy and most of the carbon in that waste come from plastics, which are hydrocarbons in solid form. Burning them for electricity releases fossil CO₂ and a complex mix of pollutants that otherwise could have been avoided by better waste management. Simply burying municipal waste sequesters its biogenic and plastic-derived carbon by definition, locking it away in landfills instead of re-releasing it to the atmosphere. Adding a capture unit to an incinerator introduces a new layer of complexity and cost to a process that did not need to occur in the first place. If the objective is carbon management, landfilling residual plastics is already carbon capture. Building a combustion plant to burn them and then trying to recapture the emissions is an expensive detour.

Applying carbon capture to the Glacier gas plant in Alberta illustrates why retrofitting natural gas facilities is a poor investment. The project, led by Entropy and Advantage Energy, captures CO₂ from gas combustion used for onsite power, not from an industrial process that produces concentrated emissions. The resulting flue gas is diluted, so the capture system must move and treat enormous volumes of exhaust to isolate a relatively small amount of CO₂. That energy penalty cuts into the plant’s efficiency and adds operating costs that renewable power does not face. The facility remains tied to gas production and combustion, creating emissions upstream while claiming to remove them downstream. There is no way that bolting CCS onto fossil fuel plants is remotely competitive with wind, solar, storage and transmission in a well-balanced economy, and extending CCS credits while playing field leveling carbon pricing is removed isn’t a well-balanced economy.

The Pathways Alliance hub, still pre-FID, is on another scale altogether. If built on schedule, the oil sands consortium could receive $7–8.5 billion in credits over its first decade, dwarfing every industrial CCS project in Canada. The government’s decision to extend the full-rate window to 2035 was likely driven by this schedule, not by the smaller process-emission projects.

Hydrogen funding tells a different story. Air Products’ Edmonton complex combines blue hydrogen production with capture and liquefaction, serving industrial and transport uses. Linde’s investment to supply Dow’s net-zero ethylene plant in Fort Saskatchewan is a clear example of hydrogen as a chemical feedstock rather than a fuel. Both projects will claim hydrogen credits between 25% and 40% depending on their verified carbon intensity, equivalent to about $50–65 million in annualized support. This is the hydrogen that makes sense: feedstock for fertilizer, steel, or chemicals where no direct electrification option exists.

The budget still flirts with hydrogen for heavy transport, but that is a dead end. Trucks and trains will electrify directly because of efficiency and infrastructure economics. The policy language does not distinguish between industrial and mobility hydrogen, yet the funding reality does. The only credible pathways are those that make materials cleaner, not those that move people or goods.

The balance of spending reveals the structural bias of Canada’s energy transition. Legacy producers have the scale and engineering depth to move first and claim the largest credits, while process industries that actually need carbon capture remain smaller and slower to act. The tax system rewards capital expenditure, not abatement cost per ton. Without reform, the biggest share of federal support will continue to flow to projects that preserve existing fossil infrastructure.

There is still room for optimism. The CCS credit design explicitly excludes enhanced oil recovery, Canada’s storage geology is extensive, and the integration with the Canada Growth Fund can stabilize risk for industrial clusters. But the core principle remains the same: carbon capture belongs where CO₂ is a product of chemistry, not combustion. If the country applies that filter consistently, the billions now set aside through 2035 could drive real decarbonization instead of delay.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy