Aug 23 (Reuters) – A busy oil sands maintenance season and early summer wildfires put a dent in Canadian crude production in the second quarter, but oil companies are ramping up growth over the next two years and will add nearly 8% to Canada’s total output, analysts estimate.

The roughly 375,000 barrel per day (bpd) increase in two years would be more than Canada, the world’s fourth-largest oil producer, has managed to add over the last five years combined, even after promising European allies it would boost crude output in the wake of Russia’s invasion of Ukraine in early 2022.

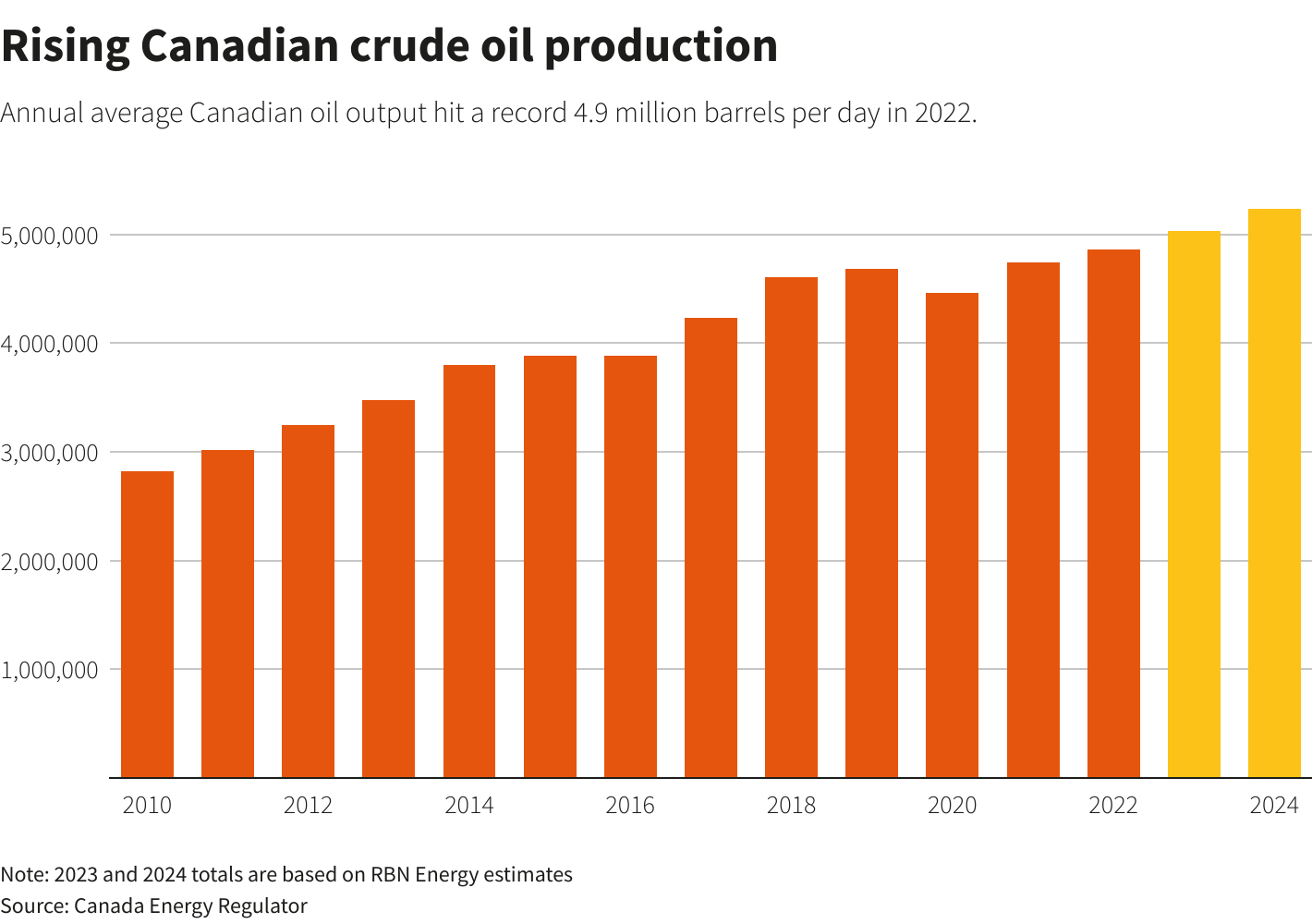

According to Canada Energy Regulator data, Canadian oil production averaged 4.86 million bpd in 2022, up from 4.61 million bpd in 2018.

Much of the growth will come from oil sands producers like Cenovus Energy and Canadian Natural Resources Ltd (CNRL) tweaking operations to boost efficiency.

Companies are also moving forward on so-called “step-out” or “tie-back” oil sands thermal projects, where instead of building an entirely new facility to steam bitumen deposits, they are linking new areas with existing plants to speed up development and lower costs.

The move to boost output – while continuing to funnel free cash to shareholders – shows producers are confident prices will stay firm, analysts said.

“Companies can finally say things have recovered enough in the industry that we can maintain returns to shareholders and put some money into production growth,” said RBN Energy analyst Martin King.

Benchmark North American crude has averaged $75.64 a barrel year-to-date, declining from 2022 highs, but above the five-year average of $65.89 a barrel.

Increasing production would be at odds with the Canadian government’s effort to meet its goal of cutting carbon emissions by 40-45% by 2030, given oil and gas is the country’s highest-emitting sector.

RBN expects total Canadian crude output to increase 175,000 bpd this year and another 200,000 bpd in 2024, while S&P Global Commodity Insights analyst Kevin Birn said annual oil sands production alone will rise around 350,000 bpd by 2025.

Two-thirds of Canada’s crude comes from northern Alberta’s oil sands.

STEP-OUTS AND TIE-BACKS

Following a lacklustre second quarter, Cenovus downgraded its full-year production forecast due to wildfires, while Suncor Energy, CNRL and MEG Energy warned that output would come in at the lower end of their 2022 guidance after big maintenance turnarounds.

Output is expected to pick up in the second half of the year, and companies are making progress on tie-in projects.

Cenovus is building a 17-km (11-mile) pipeline connecting its Narrows Lake site to its Christina Lake processing facility that will add up to 30,000 bpd in 2025 , while CNRL is planning to develop the Pike project, purchased from BP in 2022, by stepping out from its Jackfish and Kirby facilities.

“It’s a great opportunity and quite innovative. Rather than building a central processing facility all way up at the site, we’ve been able to tie it back to our existing plant,” Norrie Ramsay, Cenovus’s executive vice-president upstream, told an earnings call this month.

The new volumes will coincide with the planned start-up of the 600,000 bpd Trans Mountain expansion (TMX) pipeline project in the first quarter of 2024. However, delays to TMX could result in pipeline congestion and force producers to ship crude by rail, adding costs.

“It’ll have to be done by the middle of next year or we’ll have to have more rail,” said Eight Capital analyst Phil Skolnick.

Reporting by Nia Williams; Editing by Denny Thomas and Sephen Coates

Share This: