Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Cement is the gray glue that holds our modern cities and infrastructure together. We use about 4.1 billion tons of it a year, and every ton has a carbon debt of about a ton of carbon dioxide. That’s about 10% of our global emissions, so it’s a big problem. From India to the UK to the USA, calcined clays are one of the big levers governments and industry are straining to pull.

The big cement emissions come from the limestone kilns. We quarry the soft rock, crush it, and feed it into kilns operating at 900° Celsius to bake lime out of it. Unfortunately, that means we make carbon dioxide out of it as well. Then we take the lime, mix it with some additives in a clinker kiln and make little ceramic nodules, which we crush into cement powder, bag, and ship.

Limestone is broadly spread, shallowly buried, and soft, so it also requires quarrying and moving the billions of tons of the rock to local cement plants. About 1.2 tons of limestone are required per ton of cement, with 44% of the limestone disappearing into carbon dioxide. It doesn’t have to travel far, 50 to 80 kilometers in the USA and 50 to 100 kilometers in China and 100 to 200 kilometers in India, because limestone is just old seabeds which are everywhere.

So what are calcined clays, and why are they supposed to help?

Let’s start with how they are used in cement plants that adopt them. The plant has a new kiln, one that runs at 700° to 800° Celsius, which is lower than the limestone kiln and much lower than the clinker kiln, that big rotating drum on cement plants. A specific type of clay, kaolin, which is rich in particular minerals, is put into the kiln to dry it out and push its chemical composition into one that’s more reactive. That’s crushed in a new crusher and mixed with powdered cement..

It’s possible to add about 30% of this baked, powdered clay to the powdered cement. What results is not Portland cement, but Limestone Calcined Clay Cement (LC3). This cement has a bunch of good properties that makes it more durable, stronger, and more impervious to water and corrosive chemicals, so there’s a strong upside.

It’s a fairly recent cement variant, having emerged in the early 2010s from research done in Europe and India, for the most part. Pilot projects have sprung up, and India is leading in the space, with a pilot plant, several demonstration buildings, and lots of work done across the country to create the conditions for change to shift from Portland cement.

Because LC3 is 30% clay for the same gluey results and strength, that’s a 30% reduction in emissions. Because the clay kiln runs at temperatures hundreds of degrees lower than the clinker kiln, that’s a big energy savings and hence carbon emissions savings. Cement types are pretending that this lower heat makes it amenable to electrification while the higher heat isn’t, but that’s just resistance to change combined with real concerns about capital and operational expenditures, a pretty hard combination to overcome.

Overall, that would allow for 40% reductions in emissions related to cement, about 1.6 billion tons a year if it was adopted globally. That’s a pretty big wedge and the product is better, so what’s the hold up? Well, a few things.

Did you notice the new inventory on cement plants, new kilns, new crushers, and new mixing equipment? Those are capital costs that have to be born by the plant. For small- to medium-scale plants, the costs can range from $7 million to $15 million, while large-scale plants may require investments ranging from $23 million to $45 million, per the numbers I’ve been able to find. A cement plant is a $500 million capital asset, and most plants in Europe and North America are fully amortized. Less so in the growth economies of India and China.

Adding another 10% of capital costs has to be paid for with higher prices for cement, but that’s not a big kicker, perhaps $2.25 per ton of cement. That’s 1.5% to 4% of the cost of cement in Europe, India, and China per my quick calculations. Not insurmountable.

No, the problem is the clay. Clay deposits aren’t nearly as evenly spread as limestone. Like the wollastonite that Brimstone wants to use for low-carbon cement, the origins of the kaolin clay are in igneous rocks, ones that have a lot of feldspar. Igneous means molten rock, lava, so they formed in places where there was a lot of tectonic activity in the past, which is mostly around the edges of continental plates. Those rocks formed 500 million to a couple of billion years ago. The weathering mostly took place 66 million to 250 million years ago. For context, the continents formed from the breakup of the supercontinent Pangaea between roughly 200 to 240 million years ago.

The kaolin clays are old lava, effectively, which means that their distribution is a lot more uneven. Clay is inherently less stable than limestone, so while miners can just cut blocks of limestone out of a quarry face and not worry about it collapsing, mining clay is more complex and expensive. That adds up.

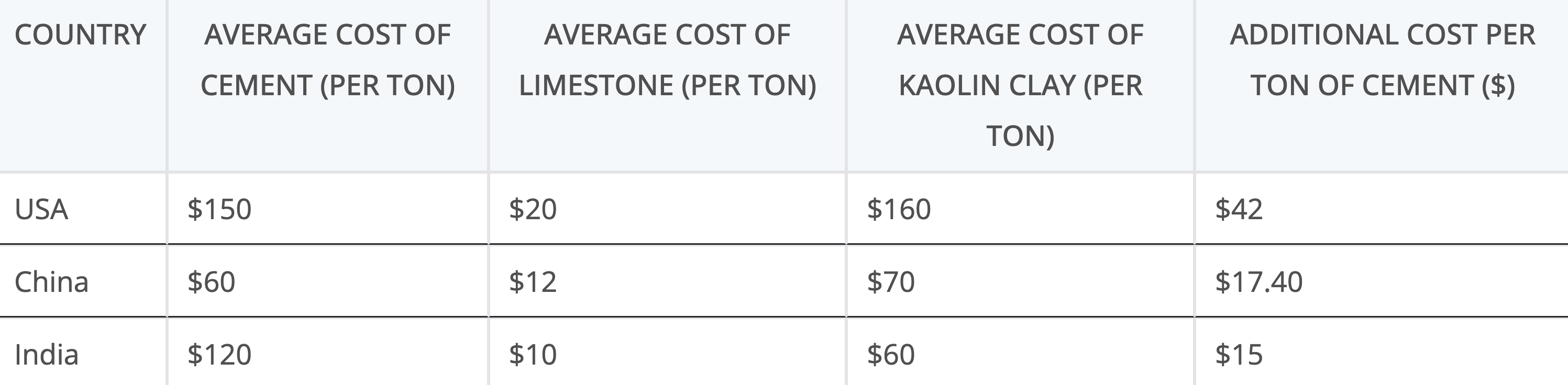

I pulled this data together for a rough comparison just now. It’s relatively coarse, but indicative that while LC3 is a superior product, it’s also going to be a significantly more expensive product.

There’s another factor to consider. The kaolin deposits aren’t just more expensive to mine, they aren’t right beside cement plants, which are evenly distributed. I did some assessment on the concentrations of kaolin deposits in India vs population and economic activity. The states of Gujarat, Kerala, and Rajasthan have big clay deposits, and Gujarat is a center of heavy industry already.

But cement is used across the country. Assuming that the average ton of clay had to travel about 500 kilometers instead of India’s 100 to 200 kilometers, that’s an additional 26 billion ton-kilometers of rail freight against an annual base of 7.1 trillion. That’s less than half a percentage point of additional freight, which you wouldn’t think would be a problem. But India’s freight rail network is currently experiencing high levels of capacity utilization, particularly on key routes. Many of the shared trunk routes, such as the Howrah-Delhi and Mumbai-Delhi corridors, operate at utilization rates between 115% and 150%, indicating they are over capacity. At India’s ton-kilometer rates, that’s another $500 million in additional freight rail transportation costs that gets spread across each ton of cement, assuming that cars can be booked.

So cement is going to get more expensive to get lower carbon going down the calcined clay route. Is that the last of the headwinds for this?

How about one more before the really big one?

Today, the global extraction of the clay that’s required is about 46 million tons per year. The requirement if all cement used today were to become LC3 is 1.6 billion tons. A couple of orders of magnitude into billions of tons is a big deal. The people and firms that own the mineral rights in places like Georgia, Alabama, eastern Germany, the Czech Republic, Gujarat, and Guangdong are undoubtedly salivating. Remember, $100 per ton is the global average. That’s $160 billion per year from a current $4.6 billion.

And so, the really big one. There’s a reason so much effort is focused on decarbonizing Portland cement that is separate from all of the rest of the above — red tape.

Cement is such an incredibly important industrial commodity, necessary for keeping pretty much every that sticks up above ground staying upright and everything below ground from collapsing in cave-ins, that it’s a very heavily regulated substance for quality. That regulation isn’t just national and international standards, although that’s a bunch of the work that’s being done around it. No, below the national level and down to the municipal level in most places, Portland cement and often its very specific characteristics have been written into often lengthy and complex building codes.

Changing the chemical composition of cement to make it 40% less carbon dioxide-emitting is one thing, changing all of those sets of regulations is another. Returning to the USA, there are roughly 22,000 municipalities and counties, and of those, 10,000 to 15,000 are estimated to have their own building codes or significant modifications to model codes. To be clear, municipal building codes have often been the subject of backroom deals favoring local business-people.

Imagine if you were a major regional cement manufacturer. Imagine if you were looking at having to spend a bunch of money upgrading your cement plants, sourcing kaolin clay, and convincing buyers to pay a big premium. Imagine you cover a hundred municipalities and know that no matter what else, it’s going to take years before all of them write LC3 into their codes, meaning your investment is across a lot fewer customers initially. Imagine you’re a big deal in your region, supporting local baseball or cricket or soccer teams. Imagine you play poker with city councillors.

Imagine how much influence you might have over changes to local building codes that aren’t ones you want to see put into place, influence that will be invisible to the naked eye.

As I wrote years ago, the patchwork of regulations that exists today is a serious hindrance of rapid climate action for municipalities. Even innocuous things like heat pumps have to be in the code, which means months or years of municipal processes. Imagine something that holds up 20-story buildings and keeps 5-level underground parking garages from pancaking. This is going to take serious, often top-down, often jamming of model building codes into thousands of municipalities and counties over their desire to be doing pretty much anything else.

Even after that, then everyone who works with cement in the building industry has to be familiarized with LC3 and its specific characteristics. Every engineer who does finite element analysis has to be read in. All of the inspectors who sign off on plans and construction have to be educated. All of the construction companies have to be educated. All of the customers have to be educated on why their buildings cost more. All of the software solutions that use the drying and thermal characteristics of Portland cement have to be updated. All of the estimation tools that start with Portland cement have to be updated. All of the workers who mix concrete at concrete batch sites have to be brought up to speed. All of the workers who pour cement have to be trained up a bit.

As of 2023, approximately 7.4 million people are employed in the construction industry in the United States, 55 million in India, and 51.42 million in China. That’s how many people will be touched in one way or another by LC3.

The degree of organizational transformation that this requires is incredible. That’s why so many startups are focused on making lime without carbon or at least with lower carbon, because it turns into Portland cement that’s identical to what is already being used and can actually be sold everywhere.

Others are focused on the aggregate, with one, Blue Planet, using industrial, high carbon dioxide smokestack emissions to create artificial limestone for use as aggregate instead of gravel or sand. This allows them abide by all of the regulations and codes that specify Portland cement or its specific qualities immediately, not in years or maybe even decades. I’m aware of this regulatory and code issue because the CEO and founder of the company, Brent Constantz, told me about it and how it shaped his firm’s strategy three or four years ago when we were talking concrete in a seminar.

This is a well understood problem. While India is leading on implementation of LC3, quite a bit further down the path than other countries, a lot of nations are pursuing this. It’s great that India is doing it because it’s going to be building a lot of infrastructure and buildings in the next forty years as it increases its affluence and brings its most impoverished both into the lower middle class and also out of the streets and slums.

But still. If all of this massive work were done globally, it would only reduce cement emissions by 40%. 60% of them would still be produced. The scale of the problem means that there are multiple levers that have to be pulled, and often they will be in direct economic competition with one another. Calcined clays have to compete with carbon capture, concrete recycling of cement, electric arc furnace slag, mass timber, and building reuse. The economics of the gray glue that holds our modern economy are being upended, and the winners will be winning big.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.