Support CleanTechnica’s work through a Substack subscription or on Stripe.

Japan has been a tough market for import brands. The top 10 automobile brands in the country last year were all Japanese. Products from foreign brands are often not a good fit for the market and customers tend to support the home team. Many automakers have tried to break through, but few have been successful. EVs that once looked promising have also failed to gain significant share. However, perhaps due to the domestic brand strength, Japan also has not put up the kind of trade barriers against EVs that we tend to see in the West. That creates an opportunity. BYD seems to be taking that opportunity seriously, with an expanding lineup of commercial and passenger vehicles, new partnerships and distribution channels, and aggressive pricing.

New Commercial Vehicles

At the Japan Mobility Show 2025, BYD’s commercial vehicle division is releasing the new T35 truck and a J6 “Living Car” concept. Commercial vehicles tend to have smaller overall sales volume, but each electric vehicle can have a significant impact due to heavy use. BYD’s naming convention isn’t always clear, so we can’t be sure what the T35 will be. However, a bare chassis that looks like a smaller version of the e-Bus Platform 3.0 is in the background of the show teaser image. So, there is a chance that it might be some sort of low-floor cargo van. In the teaser image, you can see what looks like a larger bus, reportedly the K8, two smaller vehicles that could be minibuses or delivery vans, and what looks like a box truck. We’ll have to wait to see what the T35 actually ends up being.

The J6 “Living Car” concept is likely one of the two smaller vehicles. The J6 is not new, having launched in Kyoto in 2021 to build the first all-electric loop line in Japan. This small bus has also operated autonomously in Hong Kong and is anticipated to be the model used for the new autonomous bus route in Singapore to launch next year. However, according to reports, the concept is intended to be a mobile office space, potentially to support emergency evacuations or as a reception area for events.

Tiny Kei Car Adds to Growing Passenger Car Lineup

Also at the Japan Mobility Show, BYD’s passenger car division is scheduled to reveal its smallest EV. Kei cars are small in size but reflect the largest vehicle segment in the Japan. Overall, regulations limit vehicles to be no more than 3.4 m long, 1.48 m wide, and 2.0 m high, with no more than 63 hp. Due to the constraints, the most common form factor for passenger vehicles is roughly a box with the wheels pushed to the corners. The teaser image and spy shots of BYD’s Kei car follows this vehicle form. There is a lot of speculation on battery size, which tends to be small for these tiny, lightweight vehicles that are mostly used in the city. We will have to wait for specifics. However, the flat torque of electric vehicles tends to make the most out of the power limits, and users tend to appreciate the onboard electronic devices and ADAS. That is part of the reason why the Nissan Sakura is a popular Kei car and the most popular EV overall in Japan.

Pooling Emissions with Nissan

Speaking about that Japanese automaker, BYD will now be pooling emissions in Europe with Nissan. This is further evidence of Nissan’s shift away from partner Renault. Automakers pooling CO2 emissions is often a somewhat limited cooperation to meet regulatory requirements. However, this could lead to deeper collaboration moving forward. Some of us still have positive memories of when Nissan led the world in BEVs, up until the Model 3 took off in 2018 and Nissan shifted direction. BYD already partners with Toyota in China, but the relationship has never been exclusive. While the new LEAF looks promising, Nissan could likely benefit from a technology partner like BYD, and BYD could benefit from Nissan’s established distribution channels.

Expanding Distribution with AEON

Speaking of distribution, recent reporting indicates that BYD entered a partnership with AEON in Japan, which operates 164 shopping malls and over 620 supermarkets. Initially, AEON will establish BYD electric vehicle sales outlets in roughly 30 commercial facilities and department stores across Japan. This represents a significant change compared to the traditional dealership model in Japan, which could help to open the market to new brands. As part of the partnership, AEON will be allowed to provide special pricing and discounts on the vehicles. AEON currently also deploys over 2,500 charging stations at its stores and installs home charging stations. While BYD sales are up this year, the increased distribution is poised to expose more people to BYD’s value proposition.

Shrinking Prices with Growing Equipment

BYD also recently announced that it would be reducing the price of the Seal by 330,000 JPY to 4.95 million JPY ($32,400). At the same time, equipment levels are rising on the imported EV sedan. This follows price reductions on other models last month. Compared to China, prices are still somewhat high, and sales are undoubtedly contributing to BYD’s gross margins. Of note, these prices are before government subsidies, which are surprisingly high, given the low EV sales in Japan. However, as prices come down and equipment levels go up, sales are likely to increase.

A Small EV and Import Market with Big Potential

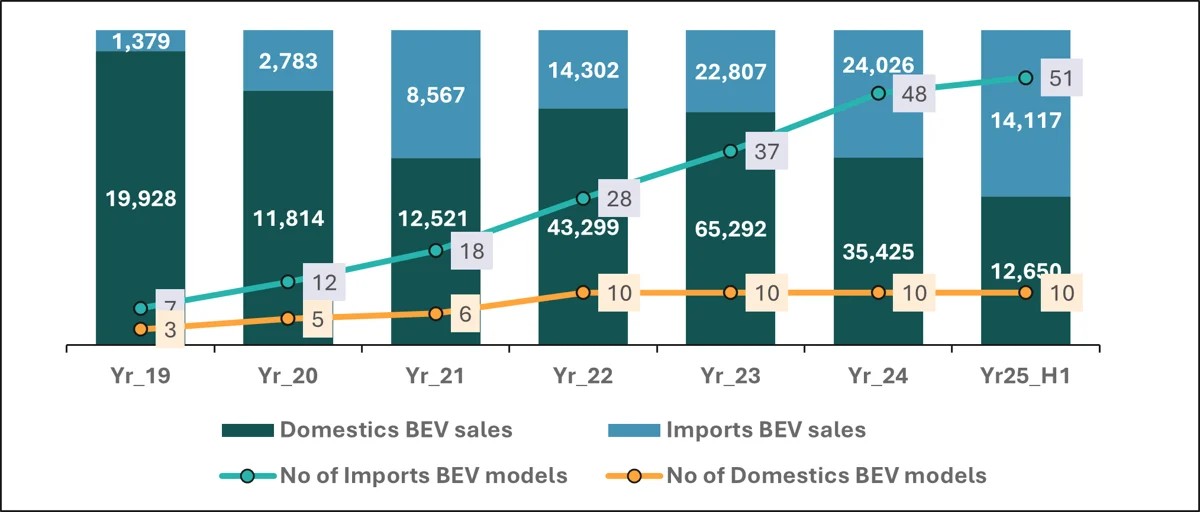

According to JATO, only 26,767 BEVs were sold in Japan in the first half of 2025, 14,117 of which were imported. While Japan once seemed to be leading, BEV market share has stagnated at barely over 1% in the country. In addition, import brands only make up 6% of sales. In that context, BYD’s record sales of 802 EVs in September already makes it a big fish in the imported EV pond. However, its recent moves indicate it is not satisfied with that. If BYD is successful in breaking through in the Japanese market, that could open the door for other import brands and EVs. That increased competition at home could stimulate Japanese domestic brands to finally step up their EV game, with major implications for global adoption.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy