Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

When people found out I was going to be in Brussels, invitations for lunch and dinner came out of the woodwork, and people started booking train rides, including two from London. Lengthy conversations on different decarbonization challenges ensued, around the main event itself, the book launch of the second edition of Supergrid Super Solution: A Handbook for Energy Independence and a Europe Free from Fossil Fuels. This quick article won’t do them justice, but the depth and breadth of people looking at specific subsets of the climate problem with intelligence, insight, and focus was inspiring.

First up was a long-time transportation and energy decarbonization solution creator and their regular collaborator. They currently work for the company which owns three ports in the country. The core of the discussion centered on port decarbonization and the implications for ports of maritime decarbonization, an area that has received insufficient focus.

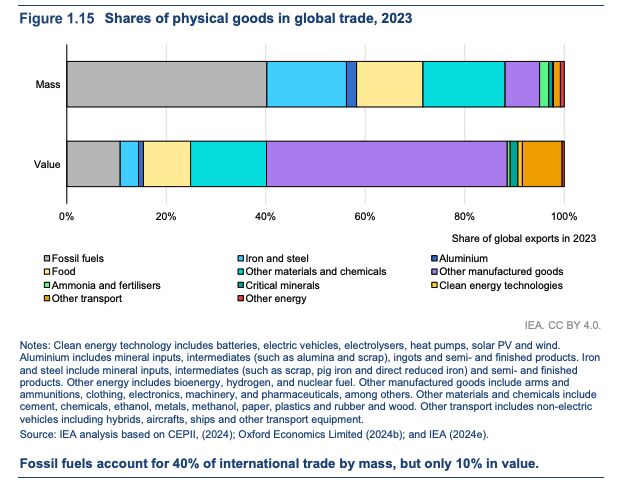

As I noted recently, the roughly 900 major ports around the world are going to be undergoing a radical shift in volumes. As the IEA noted recently, 40% of all goods by mass that cross borders are fossil fuels. A great deal of that is carried by ships, with my data indicating that roughly 40% of bulks are fossil fuels. Pipelines and trains carry vast tonnages of coal, oil, and gas across borders on continents, explaining the ratio variances. You can’t put iron ore in pipelines, as a key note.

But the 40% of bulks that are fossil fuels will mostly stop flowing through ports in the future. Similarly, the 15% of so of bulks that are raw iron ore will diminish as well, in part because China’s infrastructure boom is over, and in part because the economics of green steel will support making iron and steel with renewable electricity directly or through green hydrogen close to mines.

That means all bulk ports are going to be hunting the increasing container market, which isn’t going to increase to replace the bulks by tonnage. There will be a period of decreased revenues, possible port bankruptcies, mergers, acquisitions and cut throat competition. As I noted when assessing this, the container ports that electrify will have a competitive advantage.

But at the same time that all ports will be seeing threats to or actual declines in revenue, they will be expected to transform to bunker the low-carbon energy of shipping’s future. At present, there are a lot of contenders and confidence is ebbing and flowing between them. However, imagine a geographically-constrained port expected to be able to bunker very low sulfur fuel oil (VLSFO), biodiesel, methanol, ammonia, hydrogen, and electrons. At present, they bunker only VLSFO and some biodiesel, usually blended with the VLSFO, not maintained separately.

In my projections, biofuels and electrons win out, which has the merit of a much simpler bunkering logistics situation in ports, with one of the solutions having no moving parts. But if a multi-fuel future emerges, ports will have to bunker three or even four distinct fuels, necessarily either having less of each of them or losing port space for freight.

More expense and complexity combined with lower revenues is a very bad combination, and will cause significant challenges for ports in the next two decades.

Luckily, my port contact and I agreed completely that ammonia, hydrogen, and nuclear were dead in the water as new energy sources. For the first, her shipping colleagues tell her that the crew in engine rooms today can tell what fuel they are burning because they can smell it, as small amounts leak or are vaporized into the engine room. With ammonia, that would be fatal for the crew, and so won’t be adopted. And as a port expert, she knows that the cities which surround ports will quickly forbid it. We remain perplexed that it’s seriously being considered given its drawbacks even before the price of actually low carbon ammonia comes up.

We also know that no shipping firms are remotely considering hydrogen. While it gets discussed in hydrogen circles and think tank studies as if it’s a thing, it’s just not being considered for moving ships across oceans by anyone that does that.

Nuclear has a similar challenge to ammonia, in that cities will be very hesitant about nuclear-powered commercial ships. More to the point, no freight port today has any procedures, trained resources, and emergency response resources in place for nuclear ships, and they won’t be bothering to do so unless there’s a very strong economic reason.

In this complex environment, ports are trying to figure out what to do. It’s been a period of prolonged growth and increasing operational excellence, but now they are hearing very confusing messages about what they need to do to support their clients. And per my contact, many are unaware the fossil fuel bulks are going to radically diminish and not be replaced, and are also in denial about the coming re-powering. That’s unsurprising, in a way. If 90% of your job was loading and unloading fossil fuels, it would be easy to assume that something would be replacing fossil fuels in the same volumes, or just assume that this entire climate change thing would blow over soon enough.

After that great conversation, my next chat was with a PhD of economics who works for a central banker in Europe. The focus was more on what economics could do for climate action, what spaces I saw as unexplored and of high merit.

I had to drag my head out of ports and into economics, so I started with a bit of a progression through Kahneman’s prospect theory and related Nobel Prize as a bar to consider for significant impact, and a note on the disservice that Nordhaus’ lowballing of climate change impact costs and unfortunate Nobel Prize have had on policy discussions. I’ve been leaning into the much better and more recent Swiss RE Institute’s modeling of roughly 10% of global economic value lost in 2050.

I was pretty sure that none of the climate impact economic assessments, however, had estimated costs for the impacts of climate refugees. As a couple of key examples, the Syrian Refugee Crisis had climate change in the causal web, with climate change-exacerbated drought making marginal land grazers and farmers unable to eke out a living. They went to cities to try to find work, and were able to be mobilized. I attribute about 10% of the cause of the war to climate change, as it happened in a fragile economy with dysfunctional and corrupt governance and other contributing factors.

But that Crisis saw 14 million Syrians displaced, seven million internally and seven million externally. Over a million entered Europe, disrupting all politics, fueling some of the right-wing xenophobia that’s been on display since then, and leading to Angela Merkel losing the Chancellorship. On the other side of the Atlantic, the Crisis was used by Donald Trump in his campaign to foment fear of the other as part of his racist Build the Wall movement.

But the Build the Wall movement is also due to climate refugees. Central American countries are poor with low resilience. Climate change has hampered agriculture and extreme weather has destroyed homes, crops, and livelihoods. The countries aren’t well off enough to house and re-employ the displaced people and instead refugees stream north, hoping to get into the US.

Much of Kamala Harris’ efforts related to the southern border were focused on economic development and building resilience, addressing the root causes of the flow of displaced people, not building an idiotic, expensive, and ineffective wall.

Economic modeling which identified the higher probability regions for significant displacement, and the economic implications of that, would be useful. That would create a priority list for the developed world to invest to reduce the flow of displaced people. At present it doesn’t exist.

Perhaps my suggestion to the young PhD will bear fruit. Perhaps we just weren’t aware that it had already been done. But they were looking to apply their specific skills, knowledge, and training to addressing the problem, and reaching out to people like me to get some ideas about where to focus.

The next discussion was with a management consultant with an engineering background and expertise in the automotive industry and product development lifecycles. After a successful several years with a firm, a merger and acquisition failure led to the opportunity to reflect. They wanted to figure out how their particular skills and focus could be more aligned with moving the needle on climate change.

Our discussion found multiple pathways they could explore, obviously related to electrifying transportation. For those who missed it, after another similar mentoring session I wrote down the basic career guidance I’ve been providing for a while now when asked. But I’ve updated it for the people who tend to reach out now. It’s no longer necessary to compromise in order to have a career that moves us forward, simply because the renewables, EV, and battery industries are huge, global, and now require all of the specialists and types of people that exist. While it used to be hard to get into the space or require fiscal sacrifices, the question is now, where best do you fit?

Following that discussion, the next was back to logistics with an owner and executive of a firm that works in the freight industry, moving hundreds of thousands of containers daily through ports in Europe and North America. They had key strategic insights about the disruption possible when a critical mass of the freight operators they depend on electrify, creating a two-tier total cost of ownership that will upend the traditional booking of capacity. When electric is cheaper than diesel, the electric operators will have a significant competitive advantage and will no longer be booked a year in advance, but sell themselves to the highest bidder.

They explained to me the nature of the trucking operators that service ports, and how so many are just not considering electrification, leading to slowed climate action for freight.

Their customers which are public companies have to report full logistics greenhouse gas emissions, so a decarbonized supply chain is becoming a strategic differentiator. Some players in the space are small and can’t afford the software to record and report the emissions with any accuracy, and as it’s becoming a cost of doing business, they are losing customers.

As per Rumelt’s kernel of good strategy, they’d identified and considered three different potential policies for exploiting the situation for both significant growth of their firm, but also accelerating decarbonization. That’s right, more money and more virtue. We discussed them and considered how they might be quantified and compared.

The nature of the options made me realize that the young management consultant was very well positioned to flesh them out, so I introduced them.

Last, but not least, I spent a couple of hours with Richard Delevan, host of the great podcast and related media, Wicked Problems. As always, I envy his production values and ways of building a story when I think about just chatting with a deep expert on a climate challenge or solution field I find interesting, then publishing the results. Upcoming in that vein, a conversation with the CEO of Supernode, a superconducting transmission company that I recorded while in Brussels as well.

I flew back inspired by the deep insights, the passion to move the needle on climate change and the diversity of this group of people. I learned a tremendous amount, triangulating further in my thinking on multiple topics. Thank you to all of the people who reached out and took time out of your week to travel to Brussels to spend time with me.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy