I was doing research for another article and I stumbled upon something that hasn’t been announced or publicized yet. Tesla used vehicles are now eligible for the the $4,000 tax credit in the US!

I’m updating the articles I wrote 7 months ago and 1 month ago on this important subject for lower income people in the US interesting in buying a Tesla. That preceding sentence isn’t one you have likely ever read. Who ever thought we would be talking about Tesla vehicles now available for lower income people this soon?

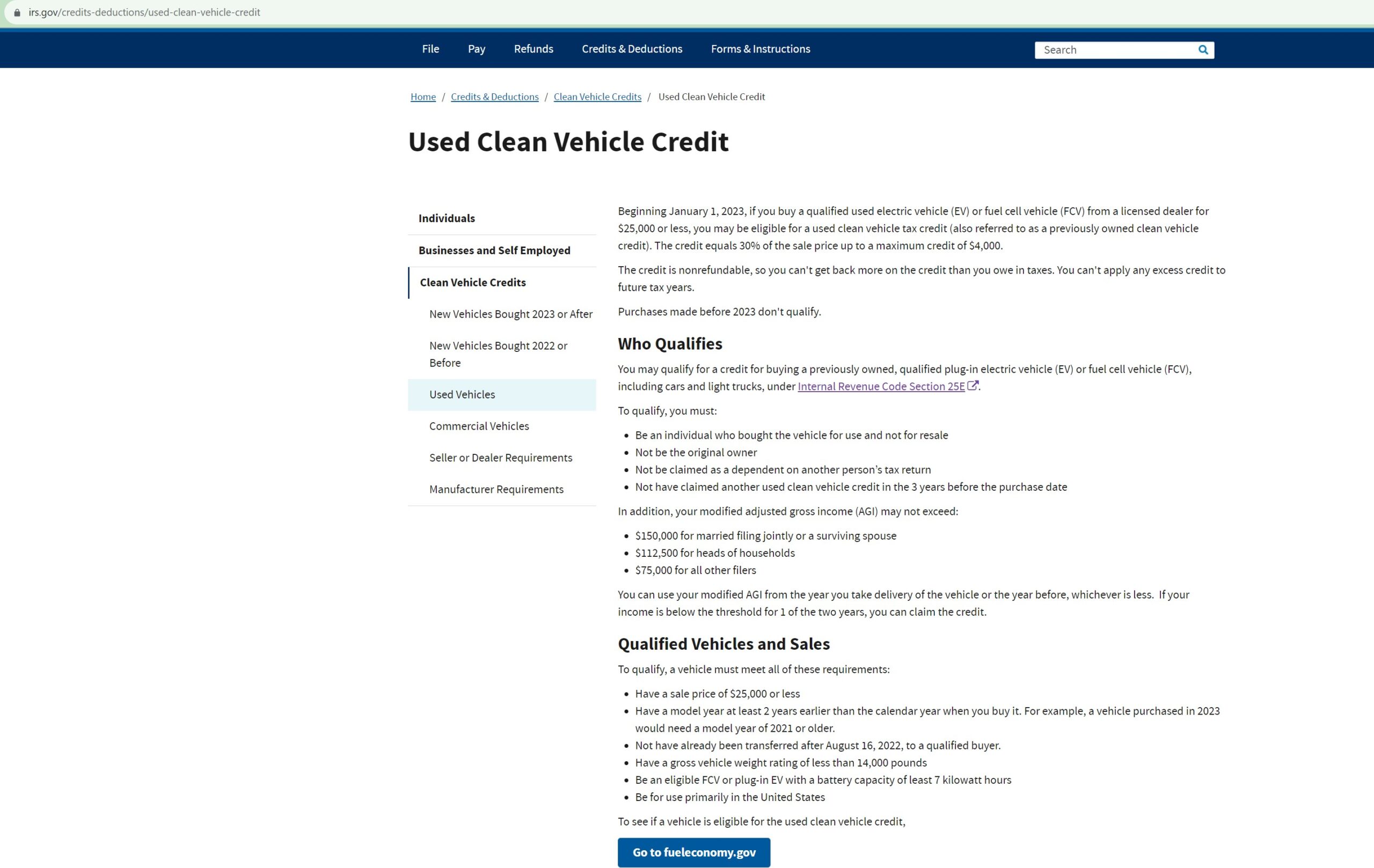

IRS Website Changes!

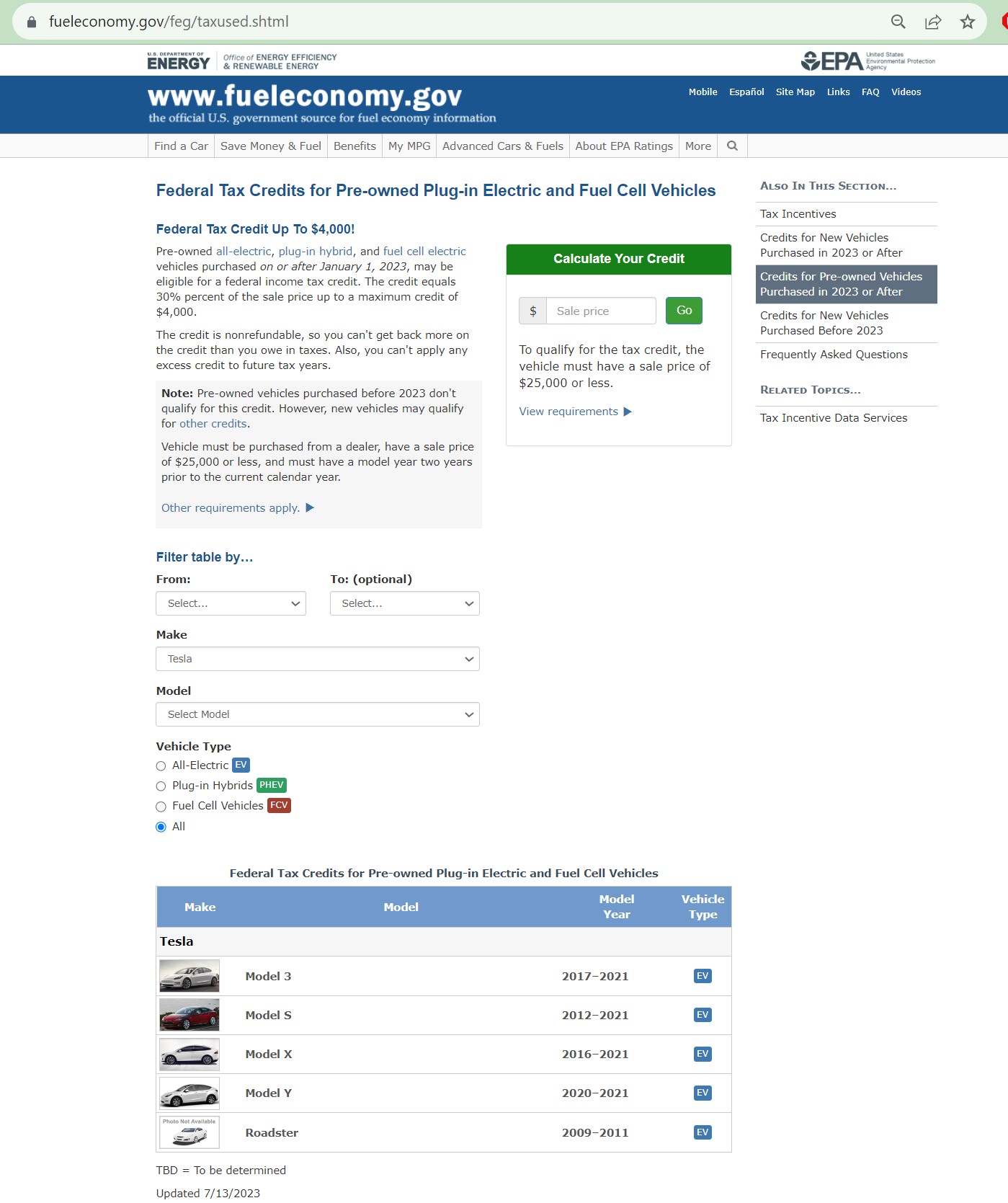

On the IRS website here, they previously linked to a list of vehicles eligible on the IRS site. This list doesn’t include the Tesla Model 3 or the Chevy Bolt, which is bad news. This link is still active, but is not longer what the main IRS page points to. It now points a buyer to the fueleconomy.gov link.

Even though it says it is sourced from the page that doesn’t include Tesla (or the Chevy Bolt), it appears this new page is the one buyers should use (and save a screenshot in case they are audited). Of course, you can also refer to this article. Although I’m not a CPA and this isn’t tax advice, I assume you can use my screenshots to defend your decision to claim the credit if it came to that.

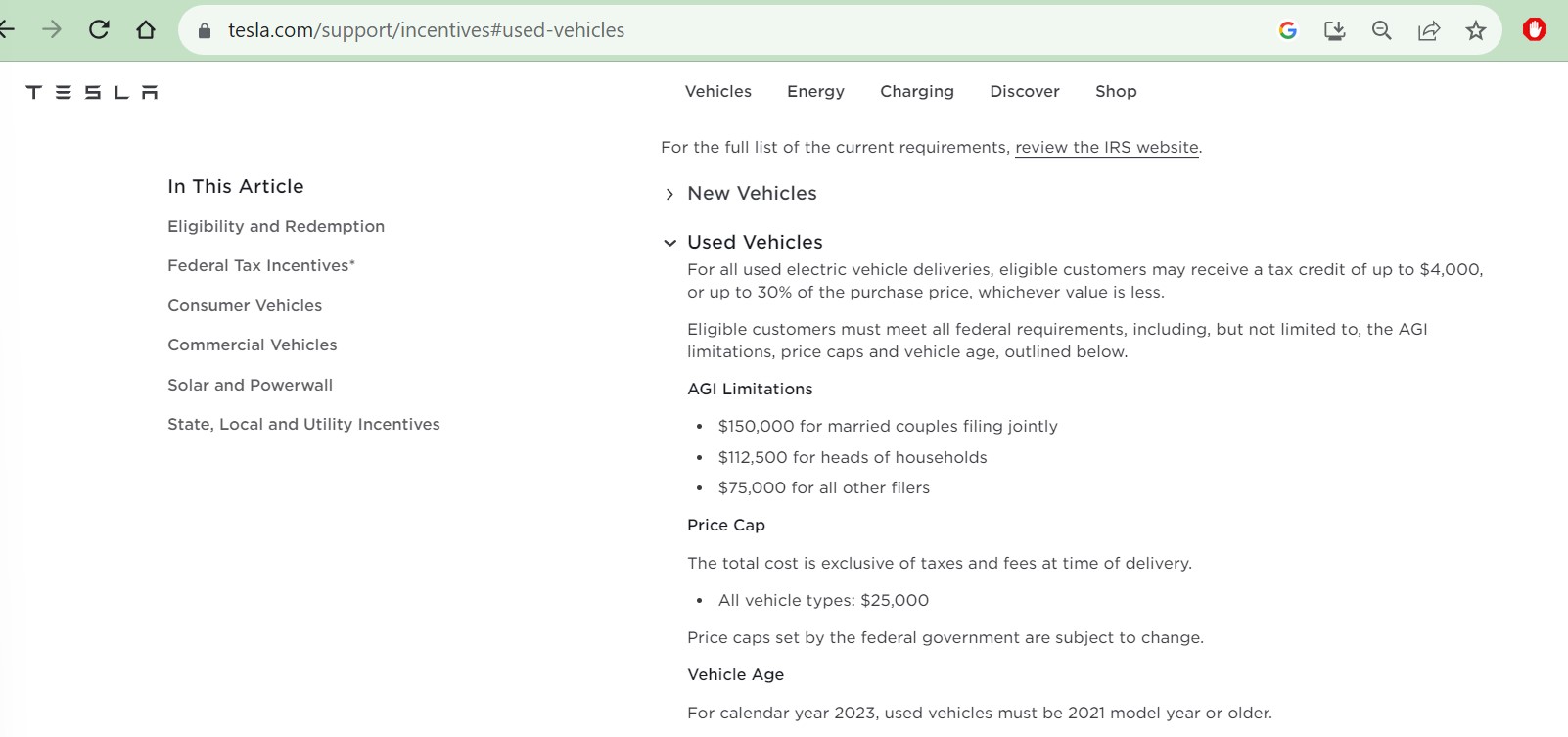

Tesla’s Site Shows Used Tax Credit, Too!

Tesla’s site has also been updated to explain this same tax credit.

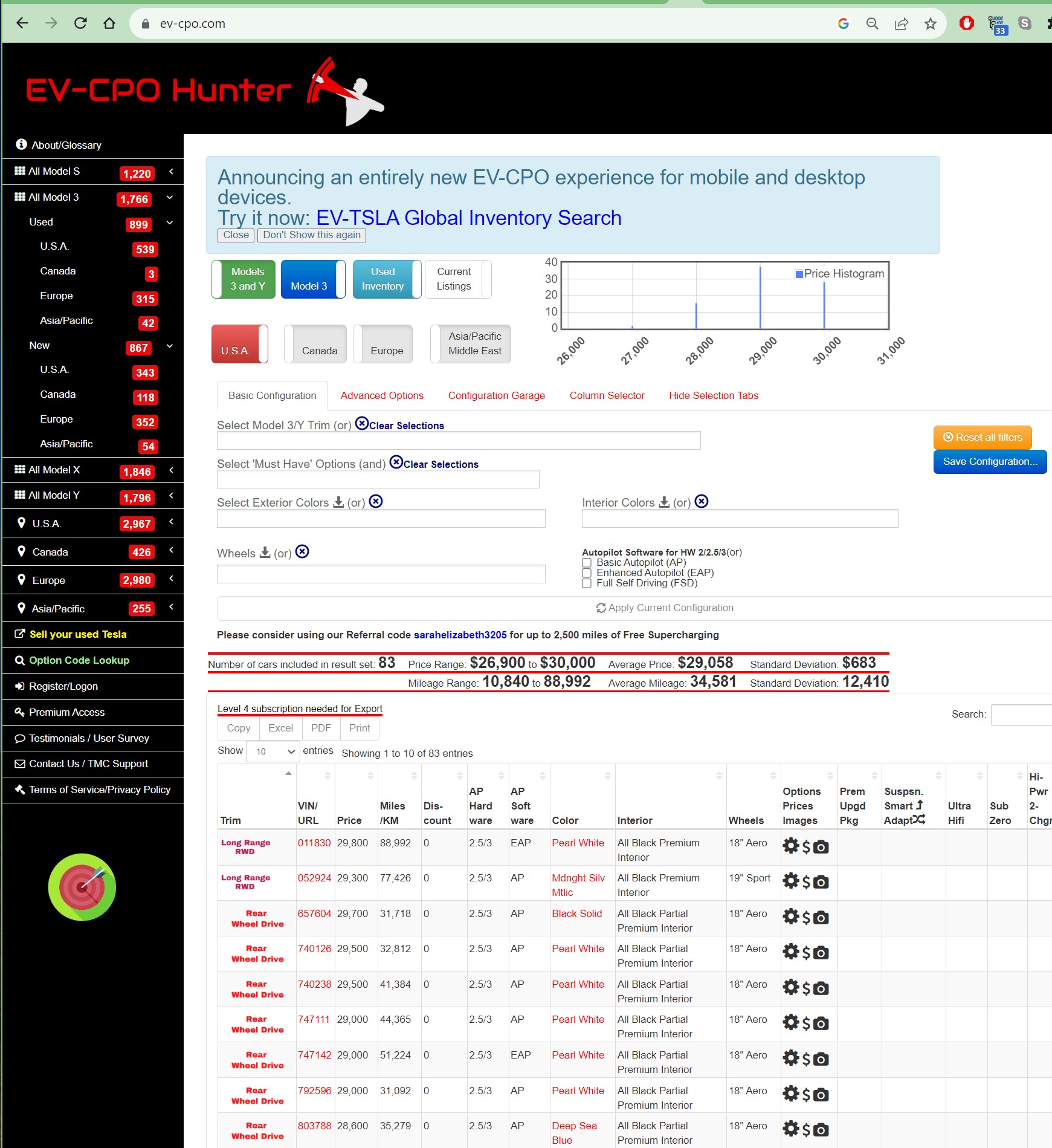

Tesla’s Used Vehicle Pricing Still Barely Over $25,000

I used EV-CPO Hunter to check pricing of used Tesla Model 3 vehicles and some are close to $25,000, but none are below. Maybe this will change when the project Highland refresh comes out later this year.

Private Sales of Tesla Vehicles

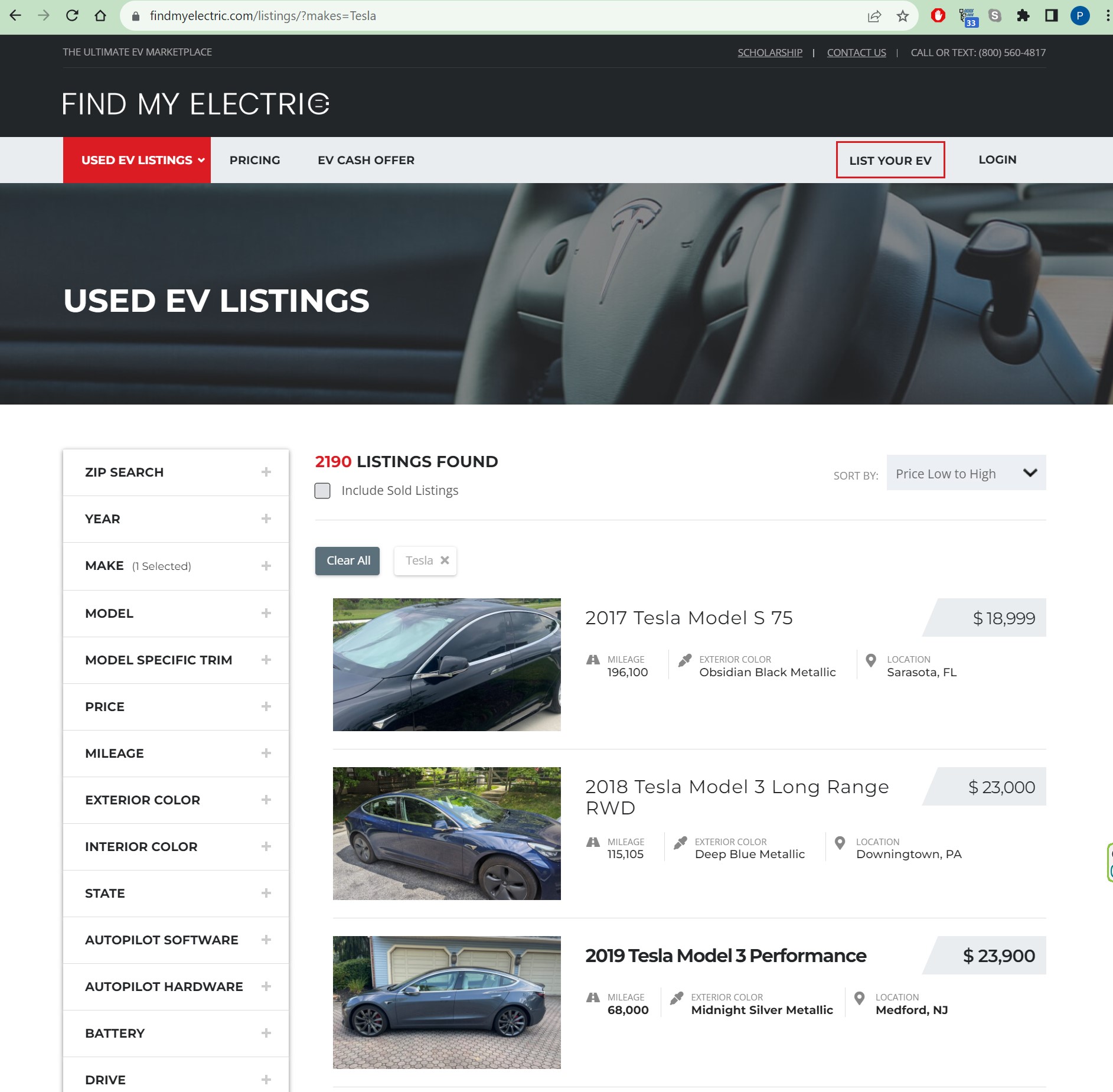

If you want to buy from a private owner, you can now find a few Model 3 and Model S vehicles under $25,000 at the FindMyElectric.com site. Since the IRS tax credit requires that you buy from a dealer, you would need to use a service like KeySavvy.com to run the sale through a dealer for a small fee to get the $4,000 credit.

CarGurus To Find Tesla Vehicles At Traditional Dealers

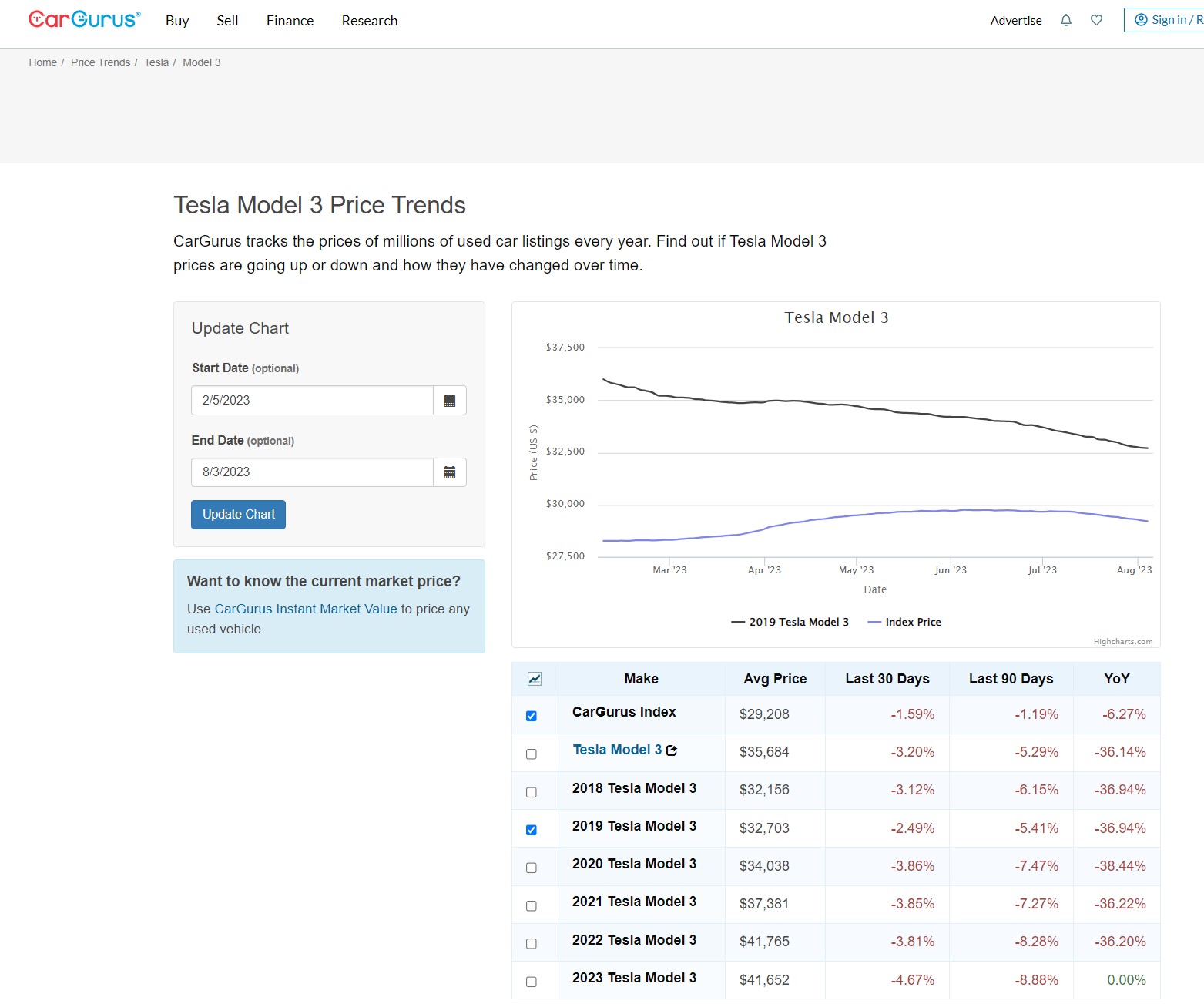

Image Credit: CarGurus

You can see prices have come down 5% or about $1,500 since my article 3 months ago. But it is certainly surprising that a 4- or 5-year-old Tesla Model 3 is selling for the same or more than a new Model 3. Of course, this is the listing price and dealers may be discounting these cars and the selling prices could be substantially lower.

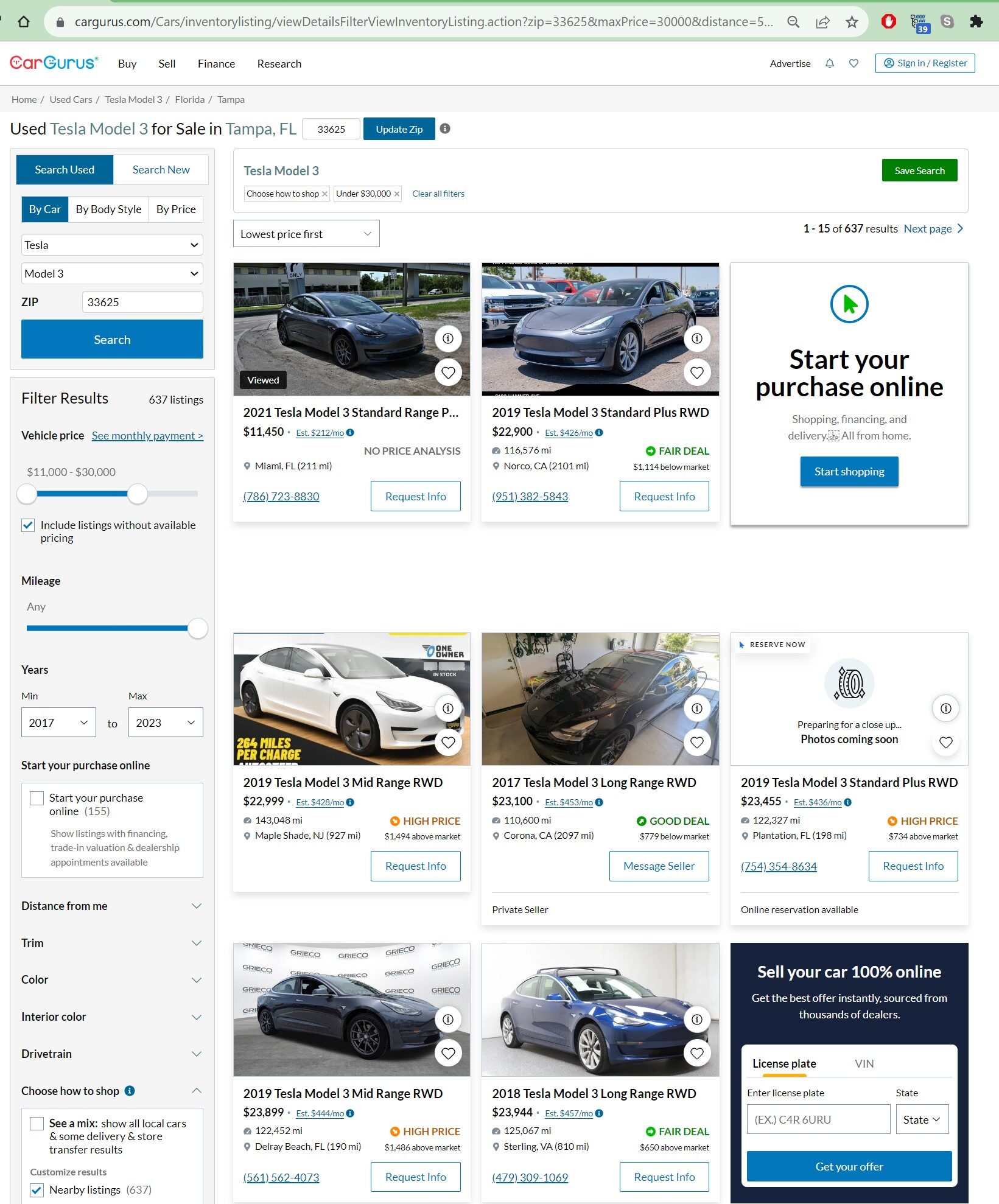

Image Credit: CarGurus

I searched CarGurus.com for Model 3 vehicles under $30,000 and found 637 available nationwide, almost double the number I found a month ago! Obviously, you need to check these out and I recommend you get a lower mileage unit if you want to purchase an extended warranty (which you may or may not want based on your situation).

The IRS Fine Print

Below are some of the requirements I have found that drive me a bit crazy. Here is a link to the IRS website to the recently updated page with the details.

- Your income has to be “just right” to get the full credit. A single taxpayer needs annual income of about $50,000 or so to have enough income to use a $4,000 tax credit (which is not refundable and can’t be carried forward or back to other tax years). But it can’t be higher than $75,000. Luckily, the second limitation can be met in either the year you buy the vehicle or the preceding year. If your income is too high, you lose the whole credit, but if your income is too low, you just lose a portion of the credit. For married couples, the range is much broader. You need combined annual income of about $65,000 to use the full credit, and you can have income of up to $150,000 as stated above.

- You don’t get the credit until up to 7 months in the future, when you file your taxes. So, you may have to take a loan out on a higher amount and pay interest on that money for 15 months (or the life of the loan if you don’t pay down your loan when you get the tax refund).

- You can only buy from a licensed dealer unless you use a service like Keysavvy. I’ve found the best used car deals come from buying from a private seller.

- You can only get the credit if the manufacturer has submitted the paperwork for your make and model. As I mentioned above, it appears Tesla and GM have now done this.

- Plug-in hybrids are eligible for the credit, just like fully electric vehicles. Some people think that isn’t fair. It doesn’t really bother me.

Conclusion

This is a game changer! The ability to get a new Tesla under $30,000 (after the tax credit) has been great for accelerating the growth of electric vehicles to the upper middle class, but others who want more affordable electric cars have been stuck with older Nissan Leafs or other cars that have a range of 100 miles or less. This is fine for a second car, but doesn’t meet the needs of most people who want to travel greater distances. If you can buy one of the many Tesla vehicles for less than $25,000 and you qualify for the tax credit, the net cost of $21,000 or less for a great car with outstanding reliability, outstanding safety, low fuel costs, and the ability to last many years and retain much of its value will allow many people just waiting for a great electric car to be affordable!

If you want to take advantage of my Tesla referral link to get $500 off a new Model 3 or Y (or $1,000 off a Model S or X) plus 3 months free trial of Full Self Driving, here’s the code: https://ts.la/paul92237 — but if another owner helped you, please use their link instead of mine, since I have more referral credits than I know what to do with. If you want to learn more about Tesla’s referral program, here is the link with the latest details.

Disclosure: I am a shareholder in Tesla [TSLA], BYD [BYDDY], Nio [NIO], XPeng [XPEV], Hertz [HTZ], and several ARK ETFs. But I offer no investment advice of any sort here.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …