In my Friday’s intraday Alert, I wrote that the post nonfarm-payroll rally wasn’t here to stay. It didn’t.

Market Reactions to Employment Data

As is always the case, it’s a good idea to check for previous analogous situations before claiming that “this move” is real or fake. This time, it was the above-expected employment numbers that caught the market’s attention, and I marked the cases, when the market was positively surprised in the past with vertical, dashed lines. On Friday, right after the market moved higher, I wrote the following:

“In May, June, and early September those [marked moments] were clear tops. There was some immediate-term strength, and it was a fake move that was then followed by bigger declines.

The October case was followed by a rally, and the December case was followed first by a decline, and then by a rally.

Overall, the implications are either neutral, or a bit bearish. In other words, like I wrote above, it’s a non-event.

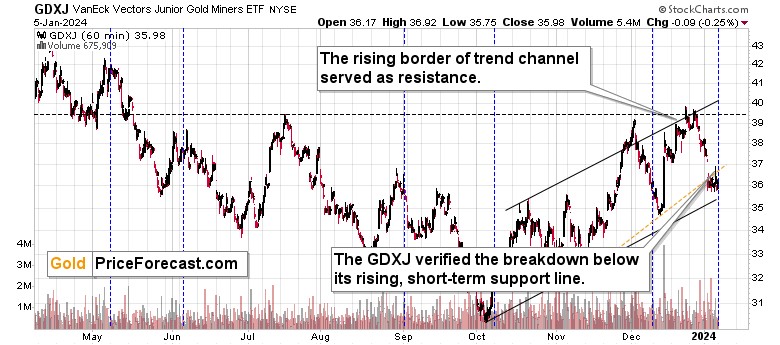

The GDXJ moved back to its rising, orange resistance line, further verifying it as resistance – the breakdown was not invalidated, and the bearish implications thereof remain intact.

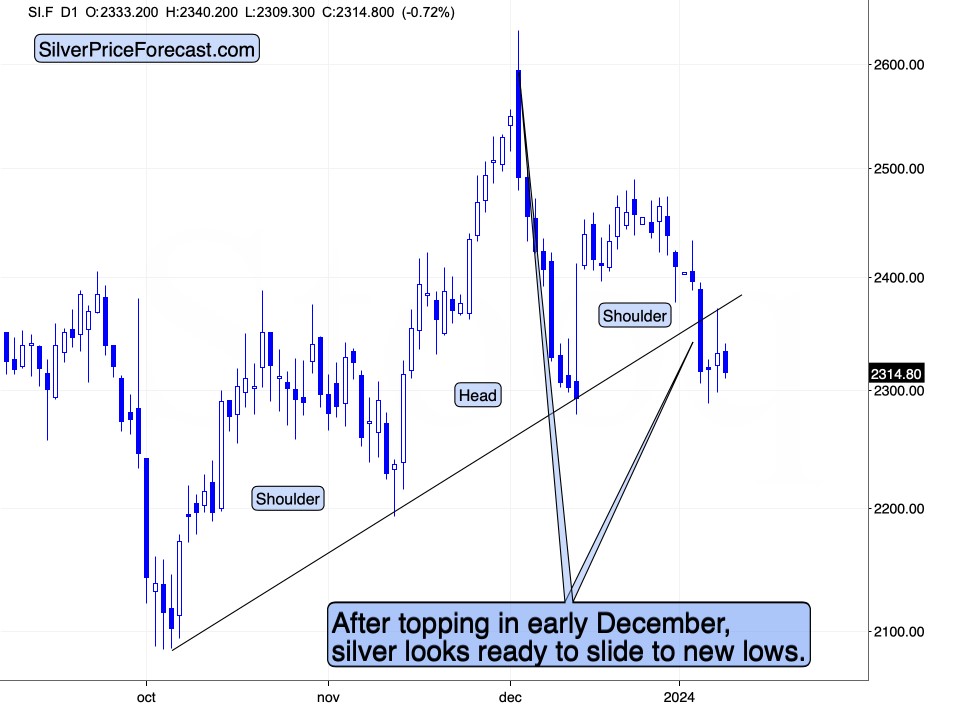

Silver moved higher, but it also moved higher in perfect tune with what I prepared you for earlier today.

The white metal moved back to the previously broken neck level of the head-and-shoulders pattern, which is a completely normal phenomenon. It’s not bullish, it’s a common thing to see at this point.

As the pattern gets verified, the bearish case gets stronger.

The enormous opportunity in the precious metals sector remains intact.”

Silver’s Breakdown: Implications

After Friday’s close, and given today’s pre-market move higher, it became obvious that silver price has indeed verified its breakdown below the head-and-shoulders pattern. The implications are very bearish, as silver’s decline from the neckline is likely to be at least as big as the size of the pattern’s head. This implies a decline to at least the October lows.

Please move your attention once again to the first chart from today’s analysis.

While silver verified a breakdown below its head and shoulders pattern, the junior mining stocks verified their breakdown below the rising, short-term support line, which has now turned into resistance.

That’s not all as far as indications from Friday’s session are concerned.

If you look at how far silver rallied and compare it to the performance of gold and mining stocks, you get a very interesting indication.

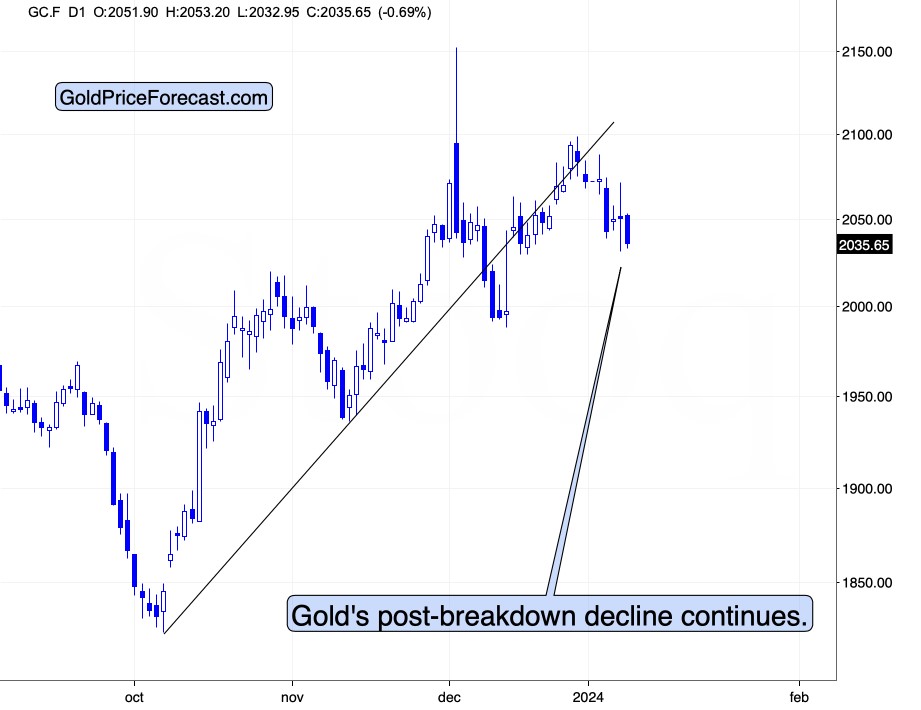

Gold rallied a bit, miners were pretty much flat (in fact, the GDXJ ended the day slightly lower), while silver moved visibly higher.

Silver’s short-term outperformance of gold is a bearish sign.

Miners’ short-term underperformance of gold is a bearish sign.

We just saw both.

What does it mean? It means that today’s pre-market downswing is not accidental. It’s not a quick, one-time event, either. It’s a continuation of a much bigger decline.

The rising support line was broken, and the breakdown was verified.

On Friday, gold moved back and forth, hesitating what to do. Today, it’s clear that it made up its mind. And – unsurprisingly (at least if you’ve been following my analyses) – gold is moving lower once again.

As a very, very quick reminder, gold is after a powerful weekly reversal that was then followed by yet another, smaller weekly reversal. This is an extremely bearish combination for the following weeks and what we see now is one of the results. More of them are likely to follow, and it’s possible to reap rewards based on those moves.

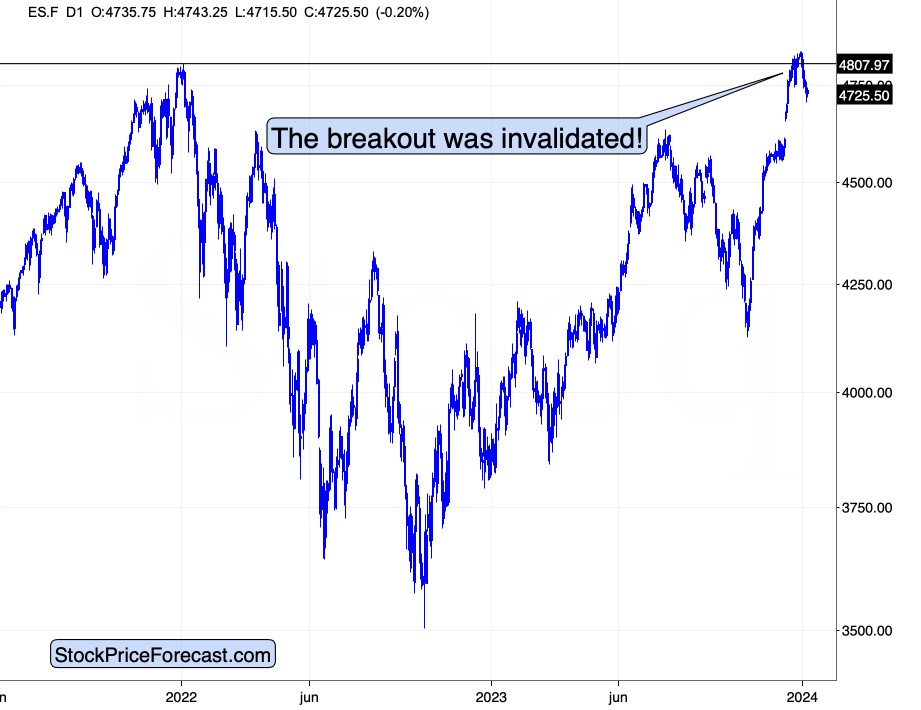

One might think that the stock market would be rallying based on positive news from the jobs report…

But it didn’t.

If one paid attention to the technical side of the S&P 500 Index futures market, it would be obvious to them that the next move will be to the downside based on the clear invalidation of the breakout to new all-time highs.

Invalidations are immediate sell signals, so it’s no wonder that we’re seeing decline’s continuation (and that Paul took profits when the year started). The declines are also on the horizon for many commodity stocks. This is important for the precious metals sector, especially for silver and junior mining stocks as they are particularly connected with the general stock market.

So, yes, silver and miners fell decisively this year, and it took just a relatively small decline in the stock market to fuel those declines. When stocks really fall, the impact on both markets is likely to be really significant.

This upcoming slide can be profitable on its own (through profiting on the price declines), but also if one is simply waiting to buy silver or mining stocks (or gold) at lower prices. After all, in order to make money on any market, one needs to buy low and sell high (some choose to buy high and sell higher, but that’s an exception rather than rule). This upcoming decline is likely to provide multiple opportunities – don’t miss them, don’t let yourself be harmed by them. And, ideally, profit from them.

********