Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

I know many of our readers are not too fond of plug-in hybrids (PHEVs), considering them an inferior solution to purely electric vehicles (BEVs), which, to be fair, they are. But modern PHEVs, with their all-electric ranges over 50 km and their hyper-efficient powertrains (some of which may get 2,000 km out of a tank gas), are still a significant improvement on regular ICEVs, and in some cases can be seen as “almost” BEVs, insofar as they can rapid-charge and make small trips in electric mode.

Latin America’s EV leaders (in market share) have shown a strong preference for BEVs. But Brazil, the largest market in the region, is going in the opposite direction, with PHEVs commanding two thirds of the EV market and reaching an all-time high record in December.

Market Overview

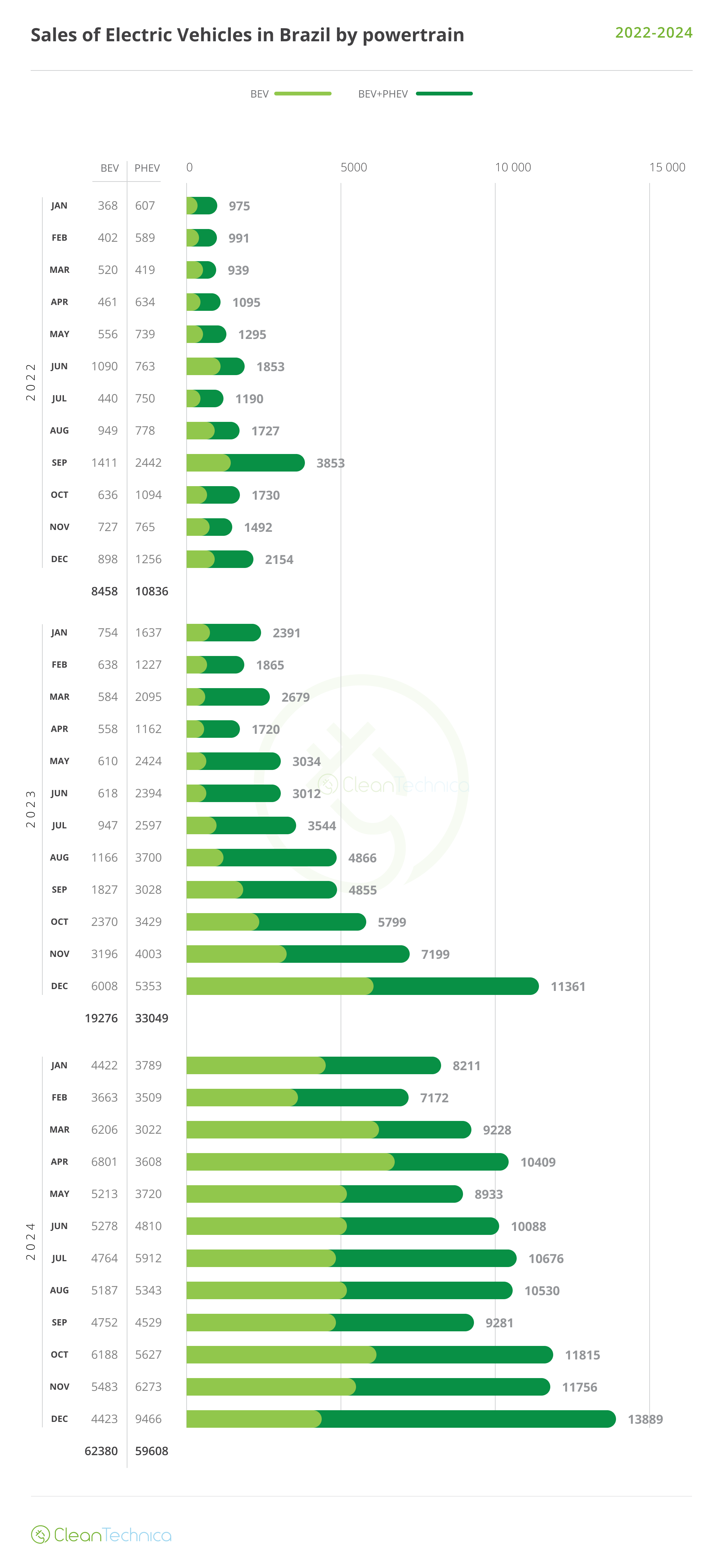

2024 has been a good year for vehicle sales in most of Latin America, and Brazil is no exception: total vehicle sales grew 21% to 2.6 million vehicles. EV sales grew 133% through the year, thanks to significant year-on-year sales as well as slow yet constant growth month-on month:

Brazil’s market is highly seasonal, so expect January 2025 to present lower numbers, though maintaining YoY growth.

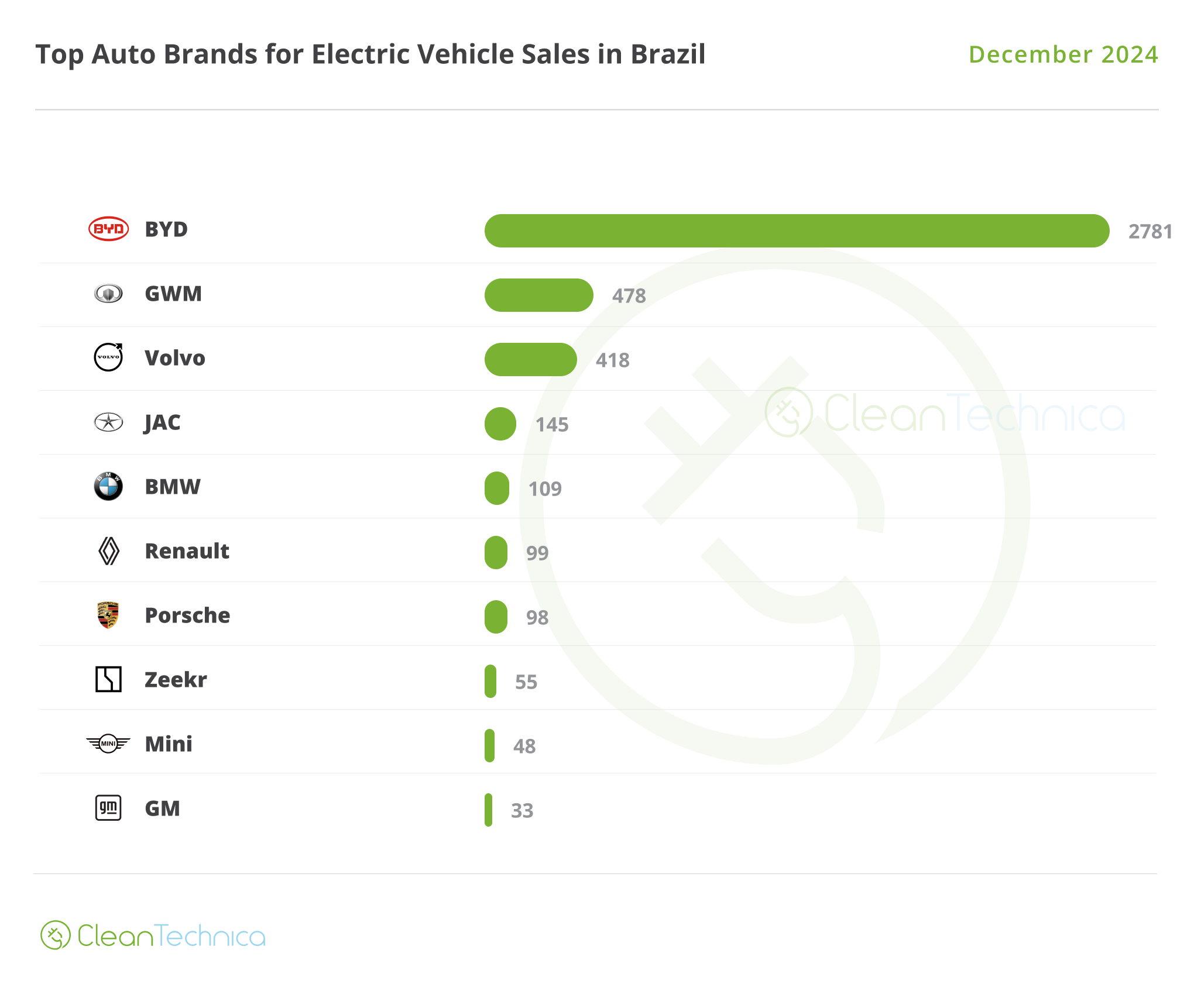

December 2024 reached an all-time high of almost 14,000 units. However, this followed a similar record in December 2023, so growth YoY was only 22%. PHEVs accounted for all the growth, as BEV sales fell 27% that month:

Due to the general market booming through 2024, market share did not rise as steeply as it otherwise would’ve, but it still managed to clock a healthy 5.4% share in December (1.7% BEV, 3.7% PHEV).

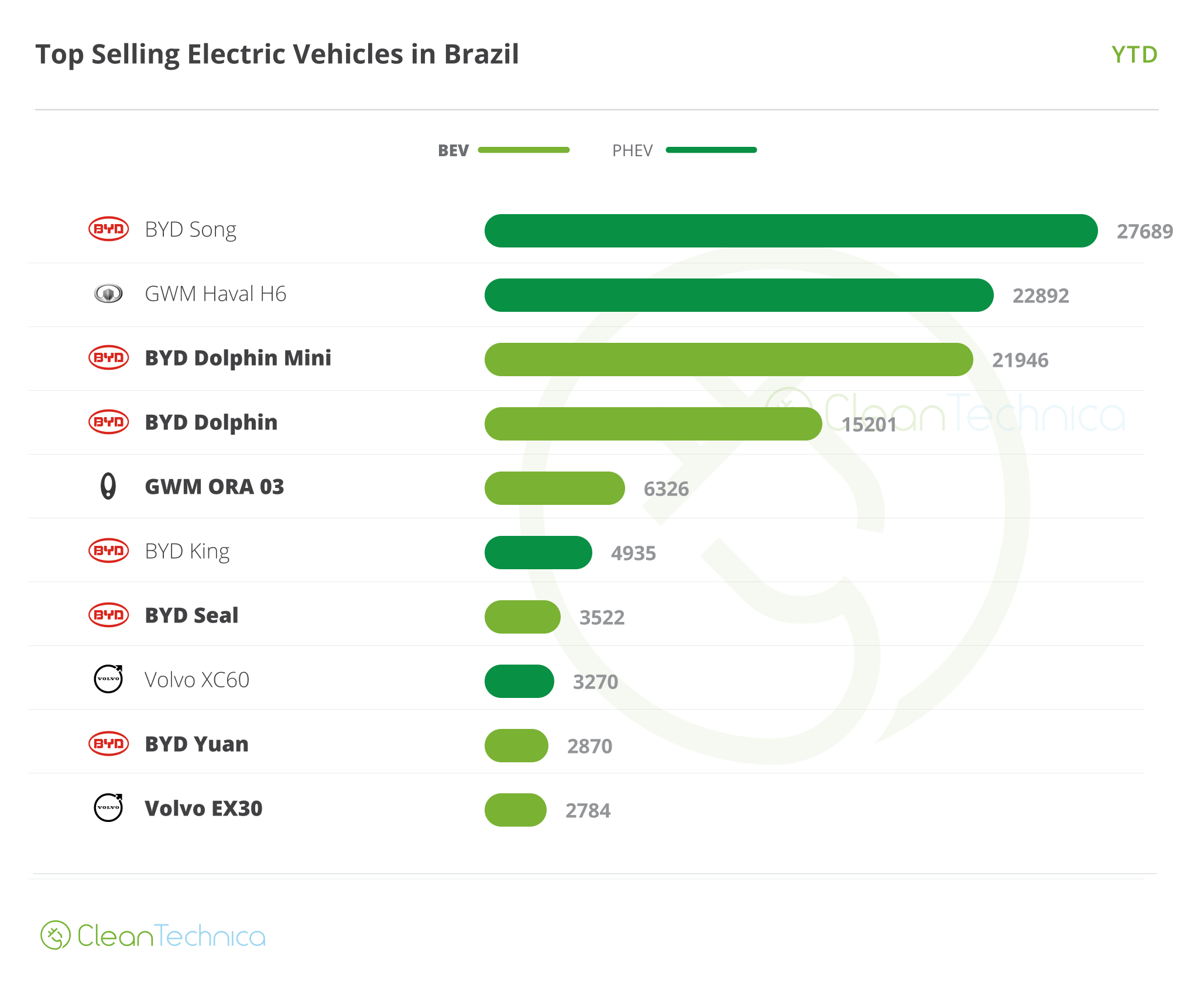

Now the rise of PHEVs has a name: BYD Song. This large SUV (for Latin American standards) stands roughly between a Chevy Equinox and a Blazer, yet it can be purchased for a mere BRL$189,800 (USD$32,100), and it was briefly discounted to USD$28,778 in November, making it one of the most affordable vehicles in its class. The Song accounted for over a third of EV sales in December, followed by the GWM Haval H6 and the recently arrived BYD King. Note: a certain number of Haval H6 were HEVs, and we have no means to determine how many, so it may well be that this model deserved to be much lower on the list.

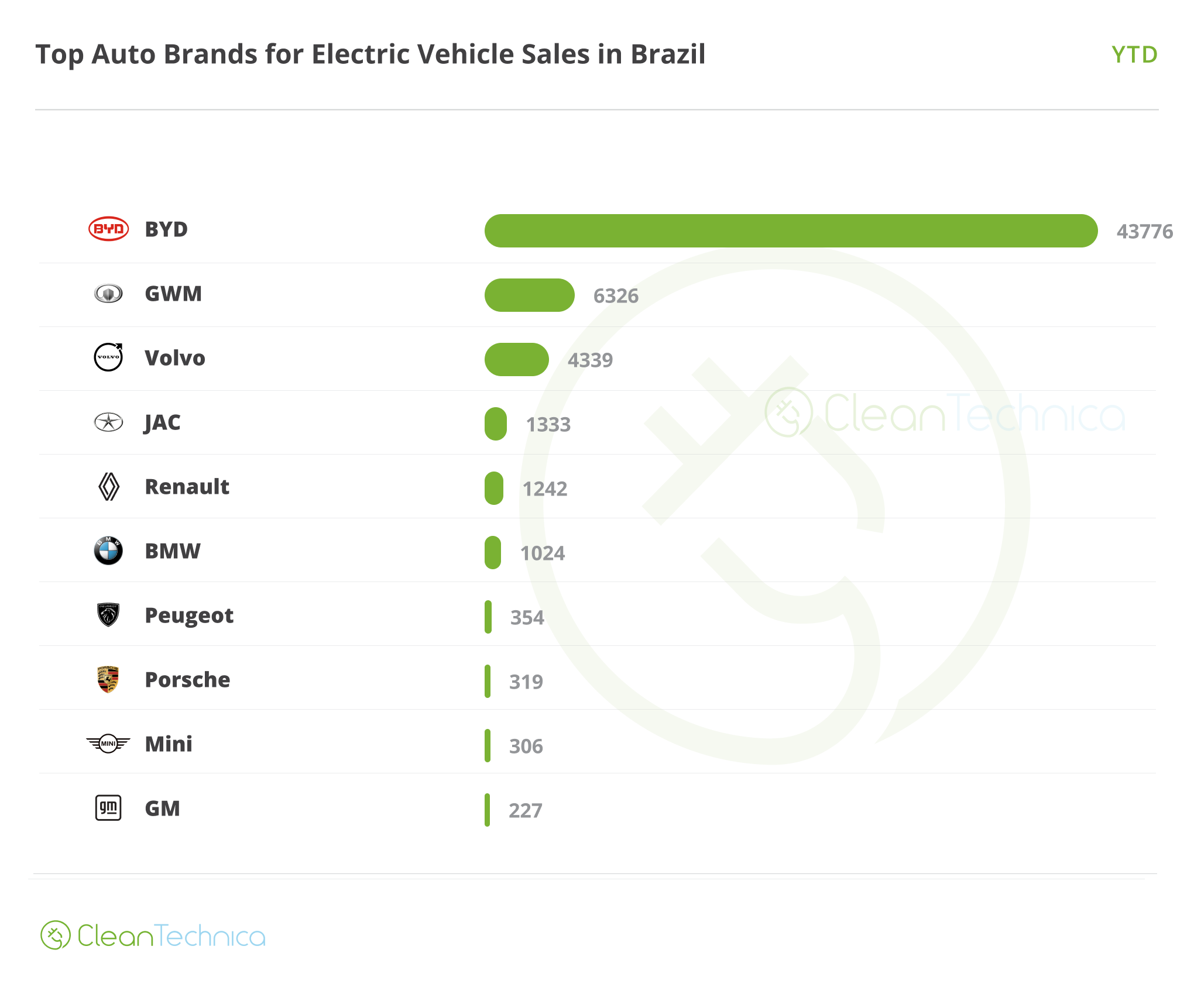

Brand-wise, Brazil does not provide data for PHEVs, so this is a BEV-only list that accounts for a third of EV sales in the country. Unsurprisingly, BYD dominates (spearheaded by its successful BYD Seagull/Dolphin Mini), followed by GWM and Volvo.

Through 2024, the BYD Song remains the most sold EV, followed again by the uncertain Haval H6 and the BYD Dolphin Mini.

Brand-wise, BYD once again dominated BEV sales in 2024, with 70% of the BEV market for itself. Given the dominance of the BYD Song, it also got over 50% of the PHEV market, making it the most dominant automaker in Brazil. It is one thing to dominate small markets like Uruguay or Costa Rica, where a few hundred EVs are sold every month … but Brazil is a giant, and BYD is making quite the power move by taking over the world’s sixth largest car market.

Friendly reminder, this is a BEV-only list.

Final Thoughts

We’re only getting started.

Later this year, BYD will start producing the BYD Song and the BYD Dolphin Mini in its recently purchased factory in Camaçari (despite the scandal about worker’s rights a month ago, on which there seems to be no update yet). GWM seems to be ready to launch production for the PHEV Haval H6, and Chery is also ramping up the Tiggo 8 Pro, which has a PHEV variant. Chery also produces the i-Car, but after the arrival of the BYD Dolphin Mini, sales of this model have collapsed.

These three brands are poised to dominate the heavily protected Brazilian market as tariffs go back up again. It’s very likely that the Mercosur market will also have a significant presence of these three, though Argentina’s policies have distanced it from the protectionist policy that once characterized the entire South Cone. And since Brazil is an important vehicle exporter for South America, I wouldn’t be too surprised if all these models arrived in Colombia, Peru, Ecuador, etc., from Brazil instead of China in 2025/26.

However, the turn to protectionism (which we all knew was coming since 2023) will likely deepen the PHEV dominance we’ve so far seen in this market. BEV-wise, only the Dolphin Mini (and the not-so-popular i-Car) will be produced in Brazil in 2025, meaning the market will further turn to locally produced PHEVs. Until the Chery EQ7 and the GWM Ora 03 start local production, expect the Brazilian market to remain dominated by PHEVs.

And yet, climate-wise, this may not be as bad as it sounds. Brazil is a world leader in biofuels, and it will translate that expertise to its new PHEVs: all these new models will be built in Brazil with flexi-fuel engines — that is, with engines capable of running at 100% ethanol and/or mixes of gasoline and ethanol.

So, sure, we know that biofuels are not a viable solution for regular ICEVs (as they can’t scale up enough), but they could be a viable solution for PHEVs, if PHEVs are used mostly in electric mode and fuel consumption is reduced by 80% or more. It may well be that Brazil is the one country where PHEVs can make a real difference in phasing out oil consumption. Or it may well be that, after a few years, the market becomes BEV-dominated as we’ve seen in other countries in the region. What do you guys think?

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy