Mining giant BHP has revealed plans to boost copper production in Chile, projecting an increase in output of 430,000 tonnes per annum (tpa) to 540,000tpa from its existing operations.

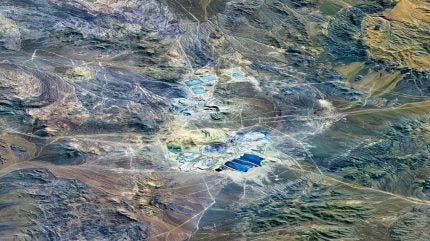

The company operates the Escondida mine in Chile, reputed to be the world’s largest copper mine.

BHP’s plans include an investment of $10bn–14bn at a capital intensity of $23,000 per tonne of copper equivalent (CuEq) to meet its growth goals.

Starting from 2028, BHP will spend between $7.3bn and $9.8bn on new projects at Escondida to counteract ore grade declines and the impending closure of the Los Colorados plant.

During a tour of Chile, BHP’s Minerals Americas president, Brandon Craig, announced that long-term production is set to stabilise at 1.4 million tonnes per annum (mtpa), a modest 100,000-tonne (t) increase from current levels.

Demand for primary copper is forecasted to continue growing, driven by the transition to renewable energy and the rise of electric vehicles, both of which are heavily reliant on copper.

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Your download email will arrive shortly

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

A significant gap between supply and demand is projected by 2035, requiring an additional 10mtpa of copper. Market consensus suggests a 70% increase in demand for the metal by 2050.

Current operations, lifetime extensions and sanctioned projects alone are not expected to meet future demand. The company believes securing funding and progressing these projects is critical to bridging the supply gap.

BHP projects that to meet this burgeoning demand, the industry will require an investment of $250bn over the next decade, potentially fuelling further mergers and acquisitions.

Chile, as the world’s top copper producer, is a strategic location for BHP, with the Escondida mine contributing approximately 27% of the country’s copper production.

The company claims that its operations are vital to Chile’s economy, with an estimated contribution of $9.4bn by the end of the fiscal year 2024.

Since 1990, BHP has produced 38 million tonnes (mt) of copper in Chile, more than 7% of the global copper mine production, the company claims.

However, BHP is also preparing for a forecasted decline in its annual copper production to around 1.6mt by the end of the decade, a drop of roughly 300,000t.

Earlier this month, BHP expanded its partnership with ABB to boost decarbonisation in its operations including the Escondida mine in Chile, the Jansen project in Canada and numerous initiatives across Australian sites.

Beyond Chile, BHP has expanded its copper assets in South America, acquiring a stake in Filo in partnership with Lundin Mining in a $3bn transaction in July.