Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

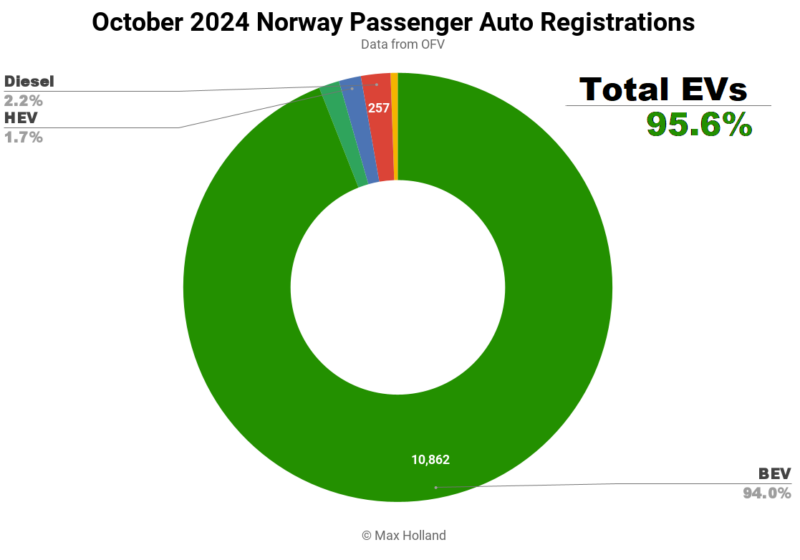

The October auto market saw plugin EVs take 95.6% share in Norway, up from 91.3% year on year. BEVs took 94.0% share, with PHEVs adding another 1.5% to combined plugins. Overall auto volume was 11,552 units, an increase of 29.4% YoY. The best selling BEV was the Skoda Enyaq.

October’s sales saw combined EVs take 95.6% share in Norway, with 94.0% full battery electrics (BEVs), and 1.5% plugin hybrids (PHEVs). These compare with YoY figures of 91.3% combined, with 84.2% BEV and 7.1% PHEV.

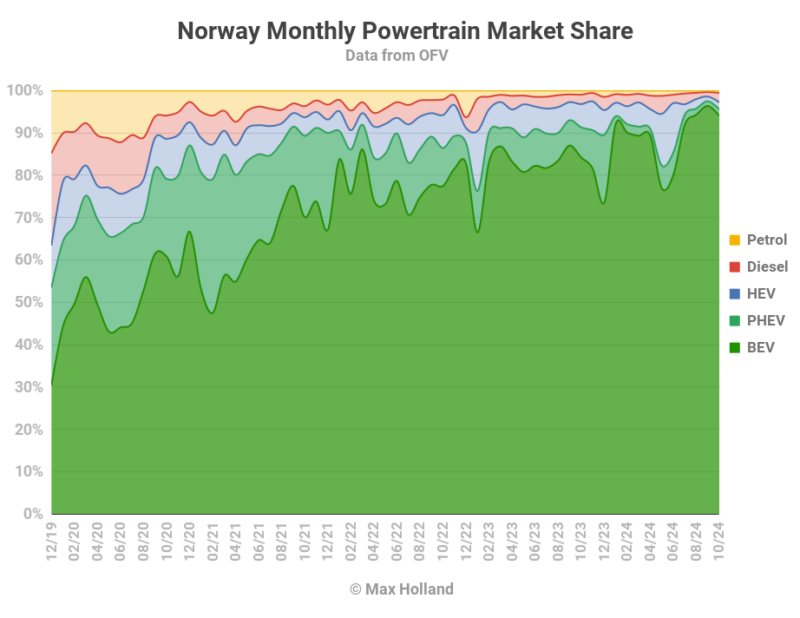

The tax adjustments that started in January have been effective in further incentivizing BEVs and disincentivizing all other powertrains. The 2024 year to date share for BEVs now stands at 88.8%, up from 83.5% YoY.

That 88.8% share is even after the negative of the “clear out old stock” blip for plugless vehicles which occurred in May and June (due to looming new standards for vehicle safety equipment). The full year total will end up right around 90%.

Having the auto market (now essentially all BEVs) back to fairly decent monthly volume helps with speeding progress in the fleet transition, which I will cover in a later report.

Diesels are obviously at a very low level (2.2%) but those that remain selling (about which I can find no specific model data, please comment if you know more) are proving hard to entirely displace, with that market share undiminished YoY.

I’d guess the purchasers are mainly folks living above the arctic circle and other very remote regions, who need to cover long journeys, perhaps with regular towing or working duties, including in the depth of winter. For these folks, diesels (and diesel refilling stations) are obviously a tried and tested technology, for which reliable alternatives at a comparable price are not yet appealing. In this situation PHEV diesels (or EREVs) would obviously be preferable to diesel-only sales, but very few PHEVs diesel models exist.

Given these kinds of edge-cases, perhaps the 100% BEV aspirational goal for 2025 was a bit too idealistic, and a goal of 95% BEV would have been more achievable. There is always a flat top of technology adoption curves, and not necessarily due to consumer stubbornness, but instead sometimes because of challenging (or potentially safety-related) edge cases.

At some point in the coming years battery technology will be ready (and 100% dependable) to serve even these extreme use cases, but we may not be there quite yet. Sodium-ion chemistry has good prospects (once further matured) for working reliably in the extreme cold (-40 degrees and perhaps lower) which can regularly occur north of the arctic circle.

Best Selling Models

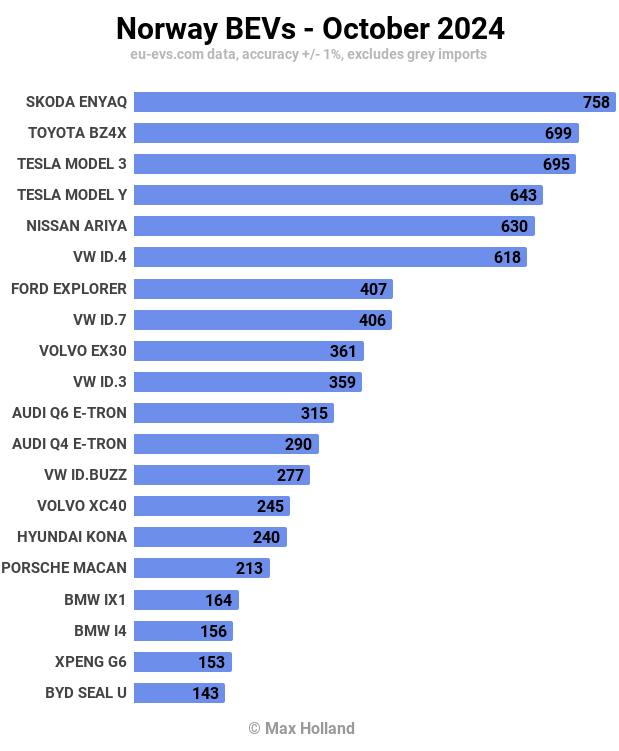

After Tesla’s habitual end of quarter push in September, October saw the brand take a relative break, and the Skoda Enyaq was able to step into the top spot for BEV sales, with 758 units.

The Toyota BZ4X took second spot, with 699 units. In third was the Tesla Model 3, with 695 units (yes, this is rest-break volume for Tesla)!

The notable moves in October included the fast growth of the new Ford Explorer, now up to 7th spot (and 407 units), having only just arrived in August. This is impressive, let’s see how much further it can climb.

Just behind in 8th, the Volkswagen ID.7 also hit record volumes, with 406 units (3.5x its previous best volume). This comes as the ID.7 also took second rank in neighbouring Sweden. What is it about the ID.7 (presumably in the touring version) which is making it so popular in the Nordics?

The new Q6 e-tron also had its best month yet, with 315 units, climbing to 11th spot. Its cousin the Porsche Macan also grew strongly in just its second month on sale, with 213 units and 16th spot.

A couple of significant BEV models saw their debut in October. The Citroen e-C3 saw a single initial unit to break the ice, hopefully with many more to follow.

The new Ford Capri also saw its first sales in October, with 16 units registered. Like its sibling the Ford Explorer, the Capri is built on VW Group’s MEB platform. The Capri is about 170 mm longer (4643 mm) than the Explorer, though both are the same height. Where the Explorer has a more standard “boxy” SUV shape, the Capri has a coupe-back shape (think VW ID.4 vs ID.5).

Priced from 477,800 NOK (€40,200), the entry Capri is about 10% more expensive than the entry Explorer, and has a bit more power and performance, and slightly more range. Let’s see which one is preferred in Norway.

The MG Cyberster also saw its Norwegian debut in October, with 6 initial units. Let’s see what volume level it can achieve. Given the local climate, one has to imagine that the Cyberster’s sales may be distinctly seasonal.

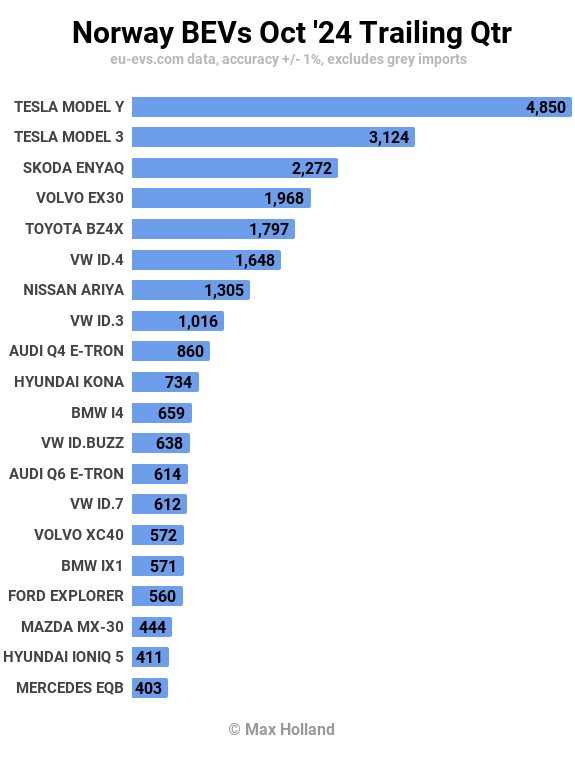

Now let’s check the 3-month perspective: Tesla remains dominant, with the Model Y and Model 3 uppermost in the rankings. Although the Model Y is almost always in the lead, the Model 3 has spent most of the past 18 months outside the top 10, so grabbing second place is a return towards the good old days of 2019-2021, when it mostly led the pack. This is thanks to a very strong September, and a decent October.

Tesla remains dominant, with the Model Y and Model 3 uppermost in the rankings. Although the Model Y is almost always in the lead, the Model 3 has spent most of the past 18 months outside the top 10, so grabbing second place is a return towards the good old days of 2019-2021, when it mostly led the pack. This is thanks to a very strong September, and a decent October.

Having been lacking volume in the prior period, the Skoda Enyaq has recently been strong, and has now grabbed third spot (from 9th previously).

Note the continuing climb of the still relatively new Audi Q6 e-tron (now up to 13th spot, having been 17th in last month’s trailing-3). This is a great result for a premium-priced vehicle. We can confidently predict that its cousin the Porsche Macan will break into the top 20 next month.

Also doing well is the new Ford Explorer, already up to 17th after only two months of commercial volume. In last month’s report I guessed we may have to wait till November for it to reach the top 20, but it has already broken in. If the Explorer can continue on this trajectory, it should get very close to the top 10 by the end of the year, a great result for Ford in Europe’s most mature and diverse BEV market.

The Xpeng G6 has not quite made it this time around (21st spot), but should enter next month.

Outlook

Norway’s broader economy has improved over recent months, with the 2024 Q2 data showing YoY GDP up by 4.2% (latest figures available) thanks to government spending. Expect Q3 results to be more modest, but likely still positive, a turnaround from Q1’s negative 0.9%.

Inflation crept back up to 3% in September (latest data) from 2.6% in August. Interest rates remained high at 4.5%, unchanged in almost a year. Manufacturing PMI is still moderate, at 52.4 points in October, from 51.8 points in September.

With auto sales now improving in volume compared to a year ago, there’s a decent chance for the fleet transition to return closer to the glory days of 2022, when the BEVs could sometimes take an additional 1.5% fleet share each quarter.

As discussed earlier, whilst a worthwhile stretch target, actually expecting 100% of new autos to be BEVs in 2025 now seems unrealistic, but around 95% or above seems possible. 2024 should end up at around 90% BEV share, up from 82.4% for full year 2023, a decent upward trajectory considering we are now at the top of the adoption curve.

For those last remaining 1% or 2% of diesel sales to be converted over to BEV will take a few more battery advancements to be commercialised, which are probably still 2 or 3 years out. But 95+% share for BEV is certainly achievable, and should be considered a very respectable real-world result for 2025.

What do you think about the current shape of Norway’s auto market? What kinds of segments and models would you still like to see BEVs enter into, which are not currently accommodated? What is your take on the remaining edge cases in Norway that need to be met? Please join in the discussion below and share your perspective.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy