Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Following up on our report on the best selling electric vehicle models in the world in August, here’s a report on the top selling brands and auto groups in the world EV market.

Top Selling Brands

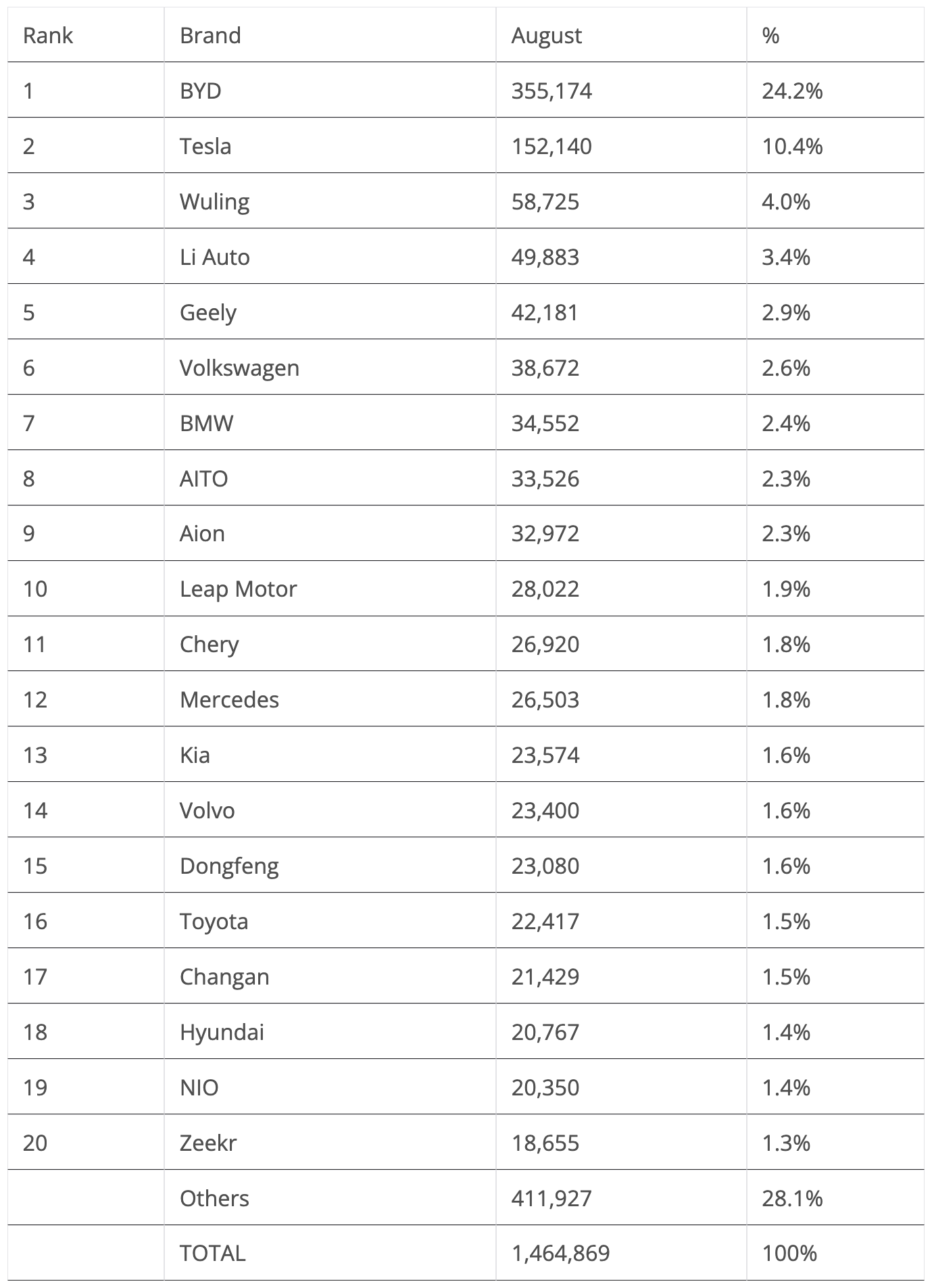

In August, #1 BYD, now deep into pricing out the competition (fossil fueled and electric…) didn’t disappoint. It scored some 355,000 registrations. With sales at this level already, one starts to wonder how high the Shenzhen make’s sales could go. Ain’t no mountain high enough for BYD?

As for Tesla, it continues randomly switching between black and red, between growth and dropping sales. After a 4% rise in July, the company returned to red, dropping by 11% in August. Despite the additional deliveries of the Cybertruck, now running at over 4,000 units per month, the remaining models dragged the US make down. So, in the first 8 months of 2024, there were three growth months (January, May, and July) and five months in the red (February, March, April, June, and August). As it is, the jury is still out on whether 2024 could be the first year of dropping sales for the US make.

Below the top two, profiting from the expected slow month from legacy OEMs, particularly those based in Europe, this time Wuling won the last position on the podium, with close to 59,000 units, beating Li Auto’s 50,000 units. Wuling profited from the good month from its two best sellers, the Mini EV and Bingo.

Geely is also on the rise, ending the month in 5th, with 42,000 units. The Galaxy E5 (12,227 units) and the adorable Panda Mini (11,122 units) represented most of the sales of the Chinese brand.

The first half of the table saw Leap Motor reach #10, with 28,022 registrations, a new year best.

In August, known brands like Ford, Peugeot, and Jeep were left out of the top 20, being replaced by more Chinese brands. Overall, China had 12 brands in the top 20.

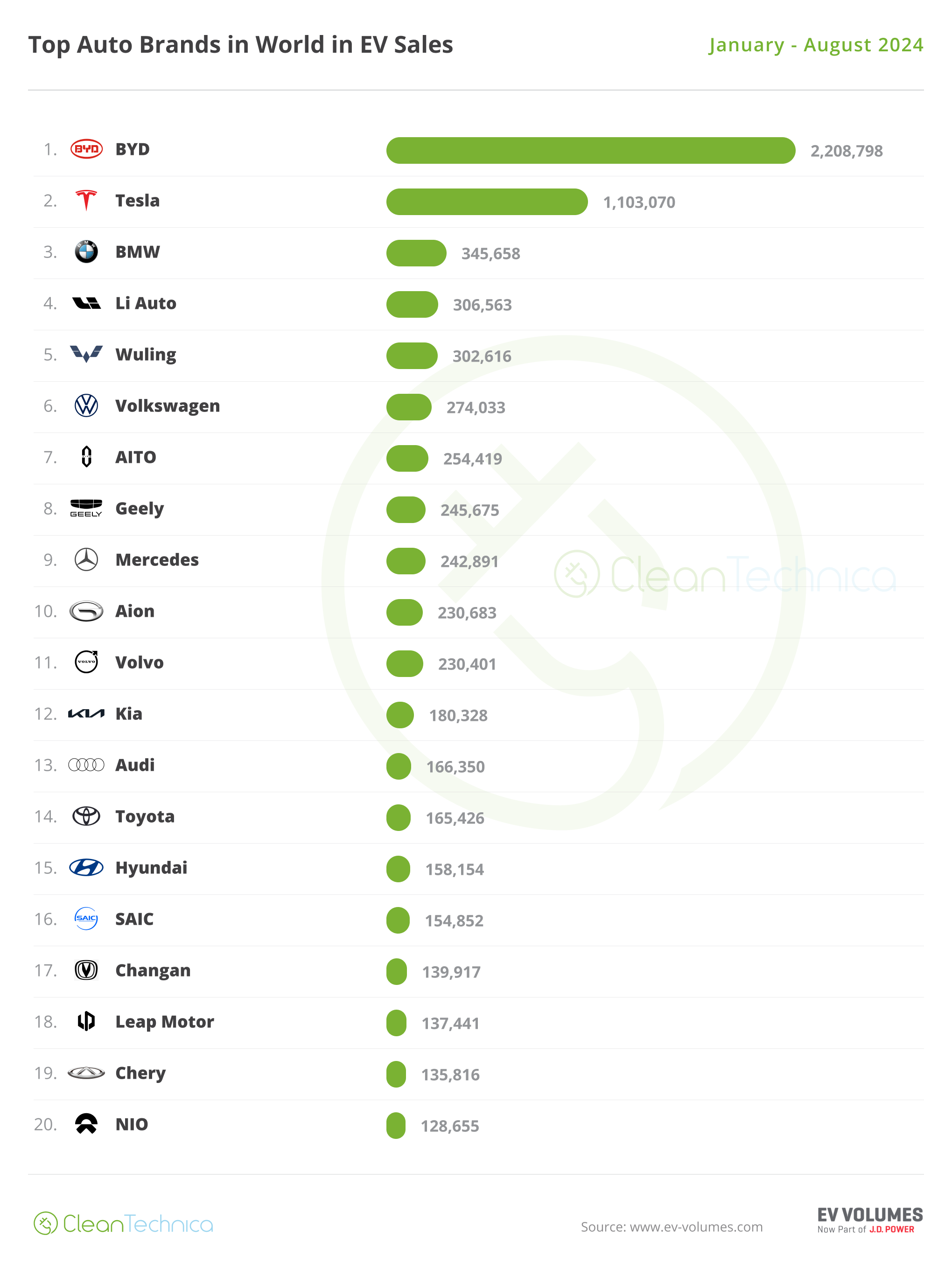

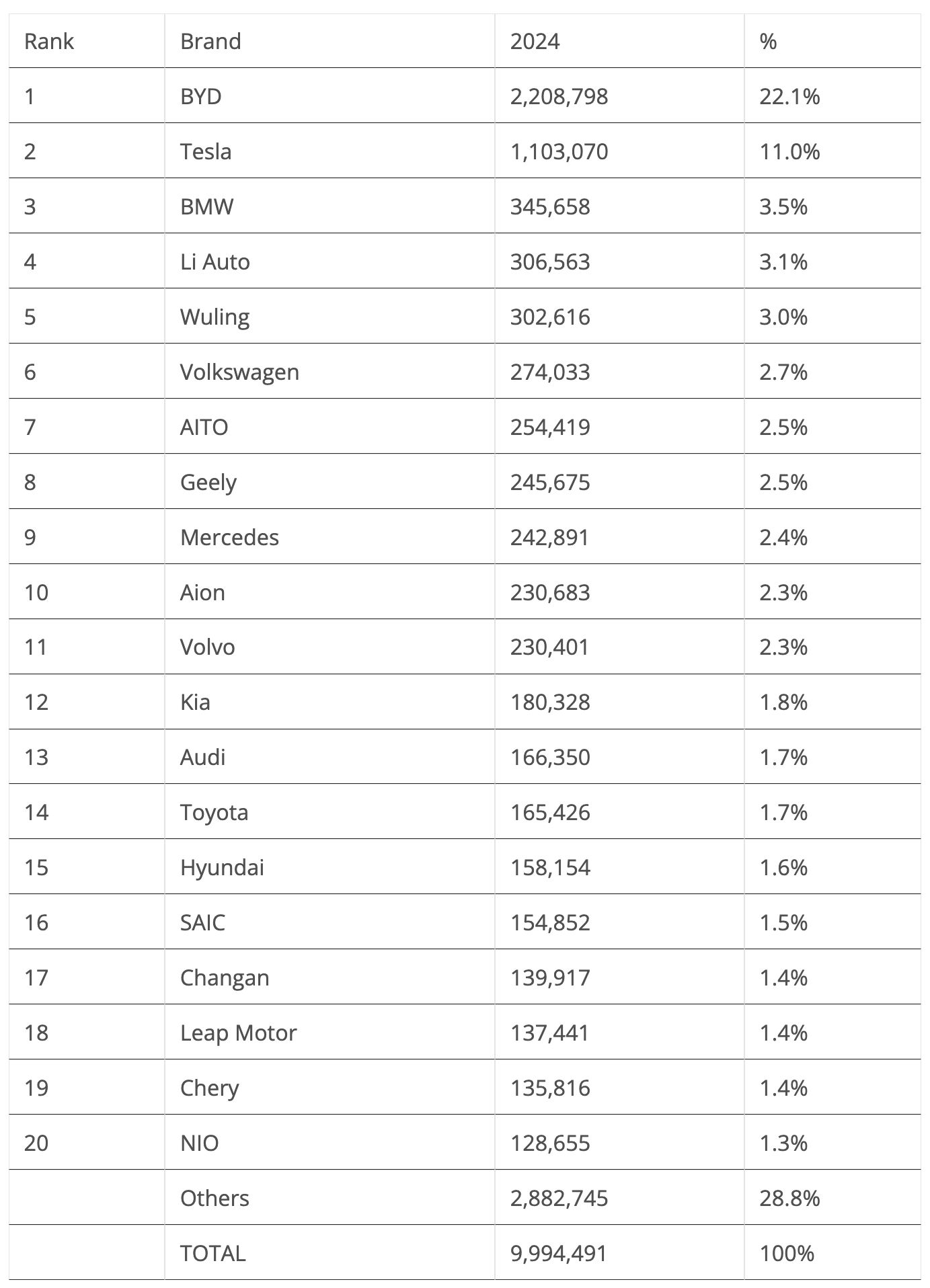

In the YTD table, there wasn’t much to report regarding the podium. BYD has double the sales of Tesla, and the US brand has three times as many registrations as #3 BMW. But while BYD continues to grow by double digits, Tesla’s sales are stagnant in 2024….

Far below these two, which are really in a league of their own, BMW, the #1 premium brand in the ranking, stayed in its podium position, while #4 Li Auto shortened the distance to the Bavarian make by 15,000 units, to the current 39,000. So, the bronze medal (and #1 position in the premium category) should witness a close race between BMW and Li Auto towards the end of the year. Having said that, I wouldn’t rule out a three-horse race, considering that #5 Wuling could also compete for the 3rd position, as it is just 43,000 units behind BMW, but the Chinese make has been inconsistent so far. Will it have a strong end of the year?

The first position change happened in the 8th position. Geely profited from the landing of the Galaxy E5, gaining one position while dropping Mercedes to #9.

Aion was also up, to 10th, surpassing Volvo in August, but expect the Swede to recover the position in September.

In the second half of the table, Hyundai benefitted from another bad month from SAIC and climbed to 15th. The Shanghai-based OEM needs to be less dependent on the MG4, because when the pointy hatchback is down for some reason, there’s really no one else to pick up the slack.

Chery profited from a series of new PHEV models in the lineup, climbing one position to 19th.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

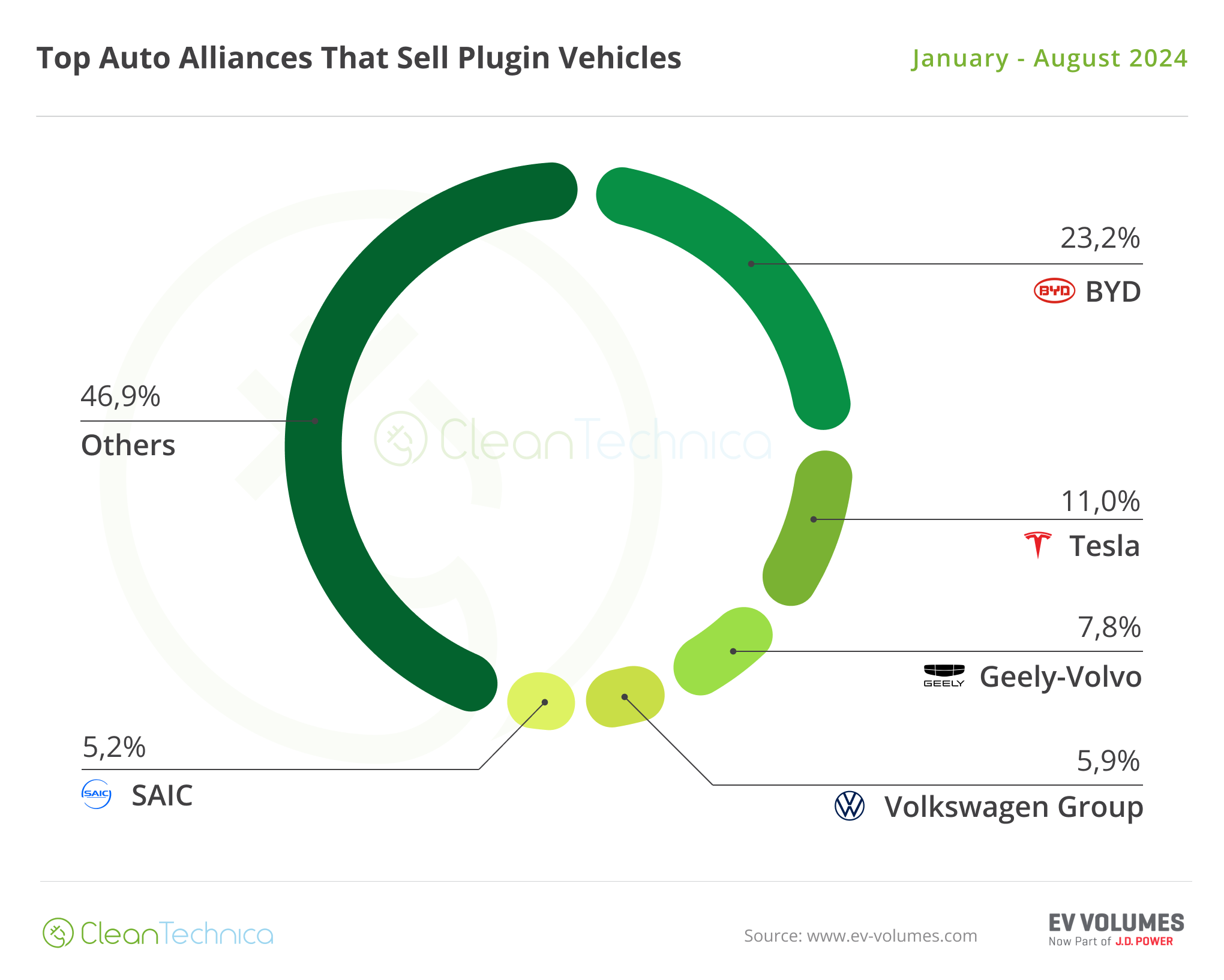

Top Selling OEMs for EV Sales

Looking at registrations by OEM, #1 BYD again gained share, thanks to its recent price cuts and new model launches, going from 22.8% to its current 23.2% (it had 21.8% a year ago), while Tesla ended August with 11 % share (it had 14.4% in the same period of 2023).

3rd place is in the hands of Geely–Volvo, with the OEM steady at 7.8%. The Chinese OEM is the one that most progressed in the top 5, going from 6.1% in August 2023 to its current 7.8%.

Considering Tesla’s recent share drop and Geely’s significant growth, will we see the Chinese juggernaut threaten Tesla’s silver medal in the near future? This year is unlikely, but in the second half of next year … it could very well happen.

Meanwhile, #4 Volkswagen Group (5.9%, down from 6.1% in August) lost share, losing distance over #5 SAIC (5.2%, up from 5.1%). Thanks to Wuling’s positive month, the Shanghai-based OEM managed to compensate for the slow month from the rest of the lineup.

Below SAIC, #6 BMW Group (3.7%, down from 3.9% in July) lost ground over the competition, with #7 Changan (down from 3.8% to its current 3.7%) closing in.

Hyundai–Kia (3.5%) surpassed Stellantis (3.3% vs 3.6% in July), which continues in freefall, while the Korean OEM climbed to 7th. This is particularly worrying for the multinational conglomerate. It has lost significant share compared to July 2023, when it had 4.6% share.

The multinational conglomerate needs to react fast — its cheap EVs (Citroen e-C3 EV, e-C3 Airscross EV, Opel Frontera EV, Fiat Grande Panda EV, etc.) need to land as soon as possible and in significant volumes (a refresh on the Fiat 500e wouldn’t hurt either…). This year, Stellantis not only lost touch with the top 5 OEMs, but it is being swallowed by the competition.

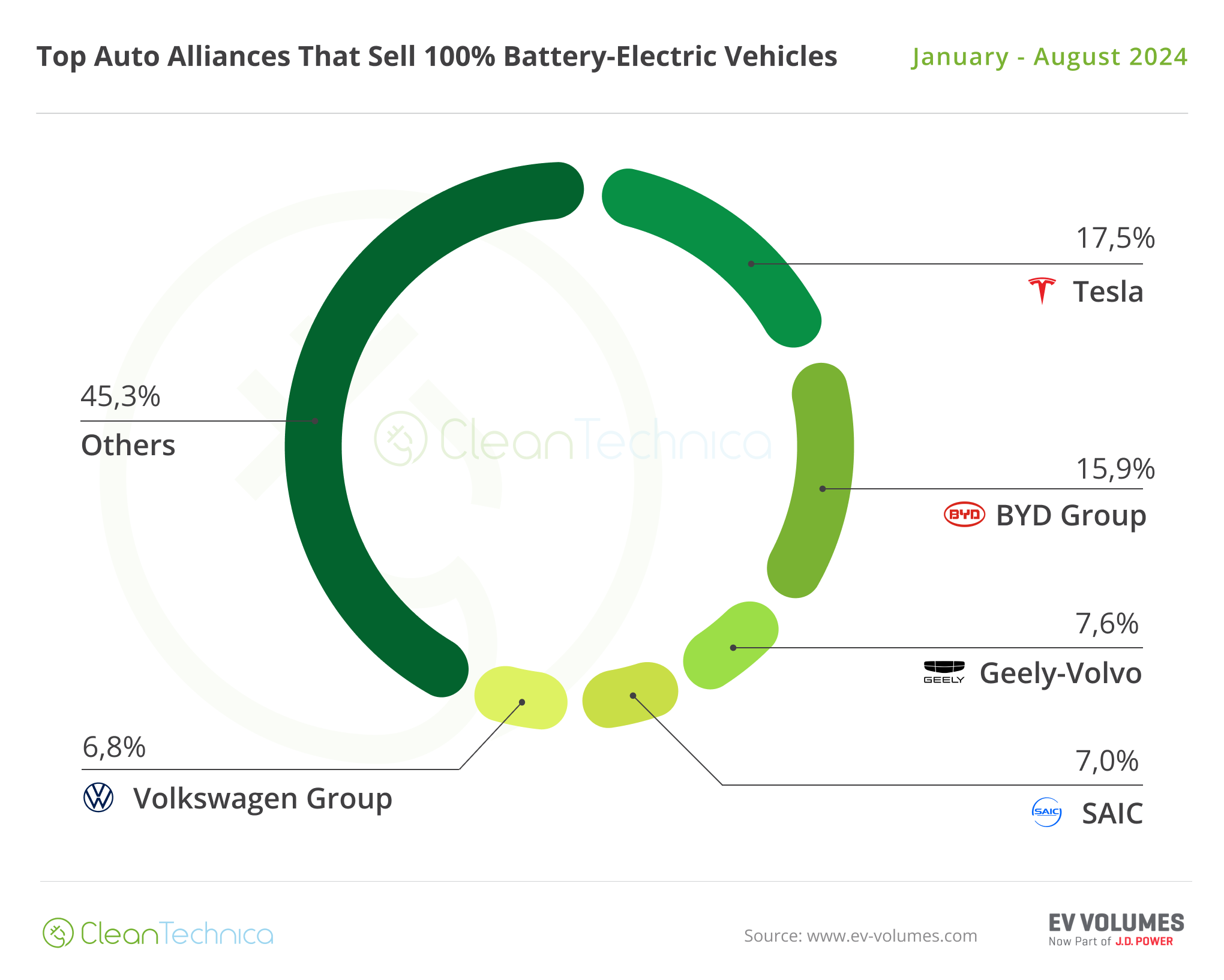

Looking just at BEVs, Tesla remained in the lead with 17.5%, but it has lost 3.1% share compared to the same period last year. In second is BYD (15.9%). With Tesla losing share, we might see BYD surpass it in the first half of 2025.

It is not doing so sooner, because the Shenzhen OEM is now focusing on PHEVs, so expect only significant growth on its BEV side next year.

Geely–Volvo (7.6%, up from 7.5%) was up thanks to good results across its long lineup of brands. Comparing the OEM’s performance to where it was 12 months ago, the progress is visible, jumping from 5.6% share in August 2023 to its current 7.6%!

In 4th we have a position change, with SAIC (7%, up from 6.8% in July) surpassing Volkswagen Group (6.8%, down 0.1%), but expect the German OEM to recover in September and maybe return to the 4th position. We will continue to see an entertaining race for #4 in the remainder of the year.

Below the top 5, BMW Group (4.3%, down from 4.5% in July) is steady in 6th, followed by #7 Hyundai–Kia (4.2%), and while both shouldn’t be able to reach the top 5 this year, in 2025, the Korean OEM might have a shot at a place in the table.

Last minute note: At the time of writing, October 1st, we already know the first September results coming out of China, and it’s a record fest, with several OEMs posting unprecedented sales highs. Add this to the fact that Chinese EV makers are landing virtually everywhere (Latin America, Africa, Asia, Oceania …), and I believe we are getting to another inflection point in the EV Revolution.

Up until 2018/19, the question was “if” the Age of the Electric car had finally arrived, after two failed attempts in the past. After that, the question was no longer “if,” but “when” it would be complete. How long it would last until the electrification process was mostly completed.

Now that the “when” question is starting to get an answer (2030 in China, 2035 in Europe(?), 2040 in North America(?), and somewhere between these dates in the rest of the world), the next question is “who?” Who will survive the transition to electricity? With Chinese OEMs expected to have between one third to 50% of the overall market in five to ten years, many (most?) of the legacy OEMs will necessarily have to downsize and learn to live with fewer sales and less revenue.

So, not only will there be a consolidation effort within Chinese EV makers, but also among legacy OEMs, or more likely, the consolidation will also mean that Chinese and legacy OEMs will become more intertwined. The line between what is a Chinese brand and what is a legacy one will become increasingly more blurry. Existing examples like Smart, MG, and Leap Motor are only the firsts of a long line of synergies that will happen in the future.

Besides, legacy OEMs know that they need to learn with their Chinese counterparts, not only regarding batteries and EV drivetrains, but also regarding the digitalisation that follows it. We have seen some of them already playing their cards, with Volkswagen Group buying 5% of Xpeng, the Stellantis deal with Leap Motor, BMW making a JV with Great Wall, Renault cozying up with Geely….

One thing is certain: 2025 will be a defining year, the EV business on the 31st of the December of that year could be in a very different place from where it was on January 1st of that same year.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy