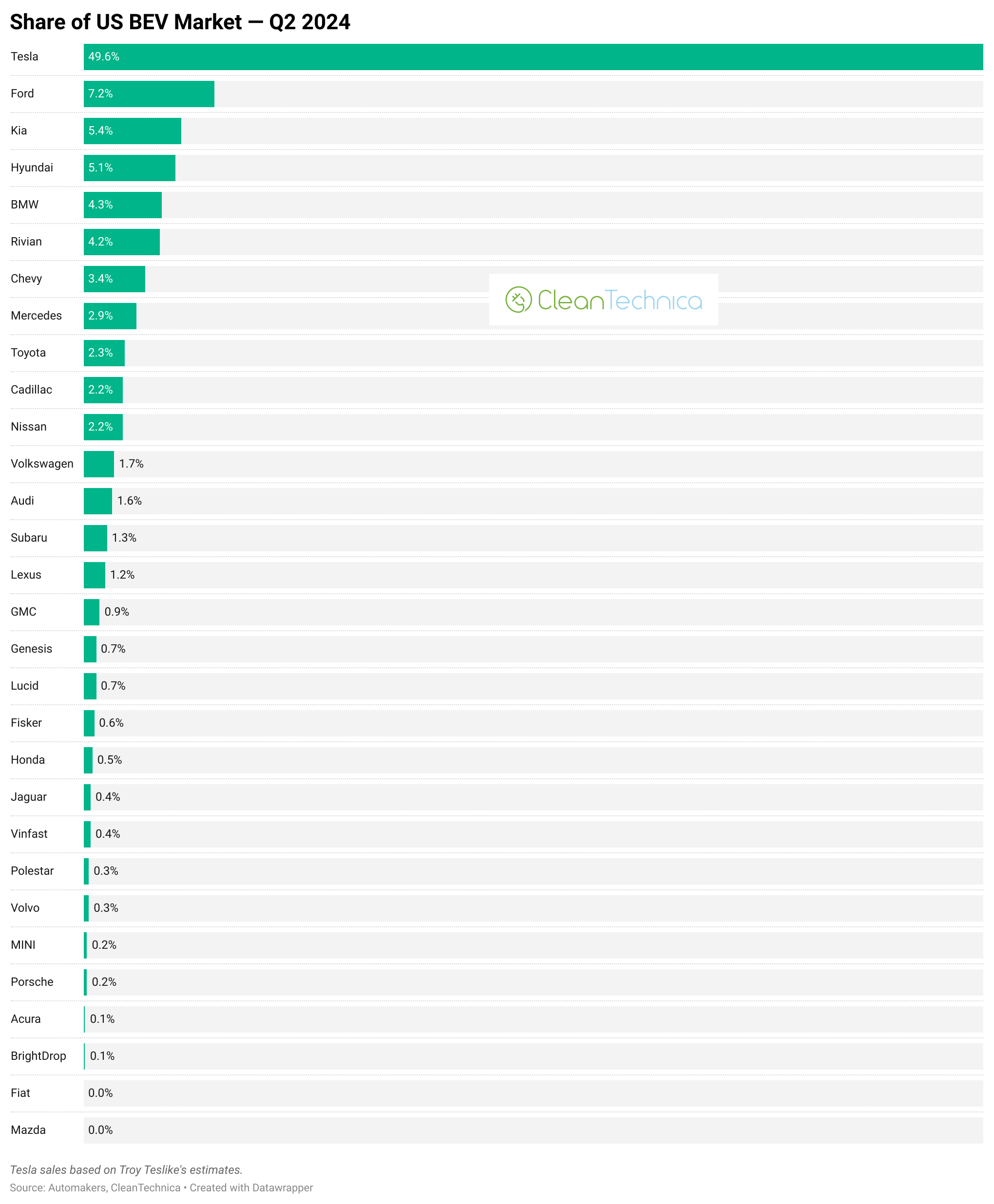

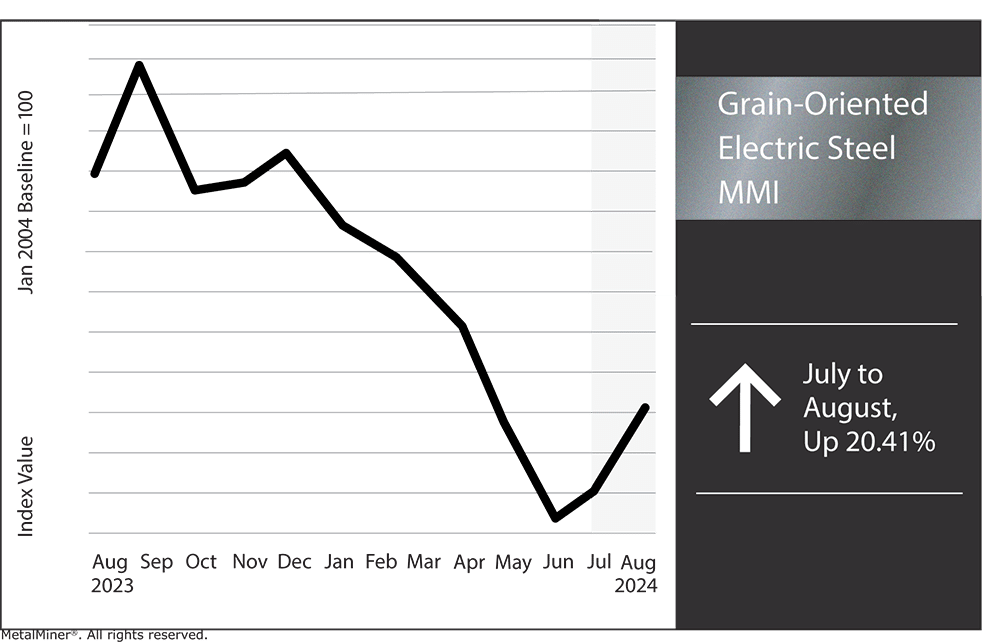

The Renewables MMI (Monthly Metals Index) continued to plateau, moving sideways with only a slight 1.29% drop. Currently, there isn’t enough bullish or bearish price action to yank the index too far out of its sideways trend. The historically volatile movements of grain-oriented electrical steel prices are currently the only factor adding any significant volatility to the index. However, there is also the fact that China currently harbors a vast stockpile of battery metals such as lithium and cobalt, crucial minerals for green energy initiatives.

These stockpiles continue to put bearish pressure on battery metal prices due to market overabundance. However, the situation is more complicated than falling prices and overstock. Within the global trading realm, this could have consequences for the international battery and renewables market; some of which are not yet obvious and many of which tie into geopolitical tensions and supply chain disruptions. Whenever a single nation stockpiles any crucial raw material, supply access could witness pitfalls in the long term.

Understand the macroeconomic factors affecting the prices of battery metals and other commodities with MetalMiner’s weekly newsletter.

Battery Metals Stockpile in China

In recent years, China has ramped up its efforts to stockpile a vast array of battery metals crucial for battery manufacturing, including cobalt and lithium. Though largely unnoticed by the general public, this strategic move has significant implications for global markets, particularly for U.S. companies dependent on sourcing these essential resources from China.

The Scale and Scope of China’s Stockpiling

China stockpiling metals is not a new phenomenon. However, the scale of the current process is unparalleled. Even more problematic is the fact that the metals are essential for producing electric vehicle batteries and other high-tech uses. Because they are so vital to the world’s shift to sustainable energy, they represent extremely valuable strategic resources.

China’s accumulation of these raw materials stems partly from its need to safeguard its industrial and economic future. Furthermore, it has become the leading producer and consumer of many of these vital elements due to its attempts to control the worldwide battery supply chain.

The Reasons Behind China’s Battery Metals Stockpile

China continues to stockpile resources for a number of reasons, both geopolitical and economic. Firstly, China wants to prepare itself for any future geopolitical upheavals and disputes, particularly regarding Taiwan. Second, China is acting to protect itself from a possible currency depreciation. Facing difficult times, the nation hopes to preserve economic stability and safeguard its wealth by transforming financial assets into physical resources like gold.

Maintaining long-term control over supply chains is another benchmark of China’s industrial policy. This means ensuring access to raw materials and taking control of the extraction, processing, and refinement of these metals—areas in which China now holds a substantial global market share. In the face of these challenges, however, supply chain stability can be achieved by reading The Art of Timing Your Metal Buy.

Impact on U.S. Buyers

China’s stockpile of battery metals presents a challenge to U.S.-based companies that depend on them. Many analysts expect prices to eventually rise due to China’s actions, which continue to create a restricted supply and higher demand. This will make it even more expensive for U.S. companies to obtain the commodities they require. The situation is especially troubling for sectors that rely significantly on these vital resources, such as consumer electronics and renewable energy.

U.S. businesses should take into account a number of techniques to reduce potential risks. One alternative is to diversify supply sources. However, as China dominates the worldwide market for many of these minerals, this is easier said than done. Another strategy is to build up domestic production capacity. However, this takes time and a sizeable financial commitment to scale.

Download MetalMiner’s free Monthly Metals index report to stay updated on price trends, market intelligence, and outlooks for 10 distinct metal industries.

Tactics to Help Reduce Supply Chain Pitfalls

Other tactics involve establishing long-term alliances with suppliers in different parts of the globe where significant sources of these vital metals exist, such as Australia, Canada, and South America.

Reducing reliance on these metals also requires innovation. Developments in battery technology, such as the creation of new materials or enhanced recycling techniques, can help mitigate the effects of China’s stockpile on U.S. companies. Meanwhile, those businesses should also attempt to establish more robust supply chains by minimizing the quantity of raw materials required for production or by recovering metals from discarded products.

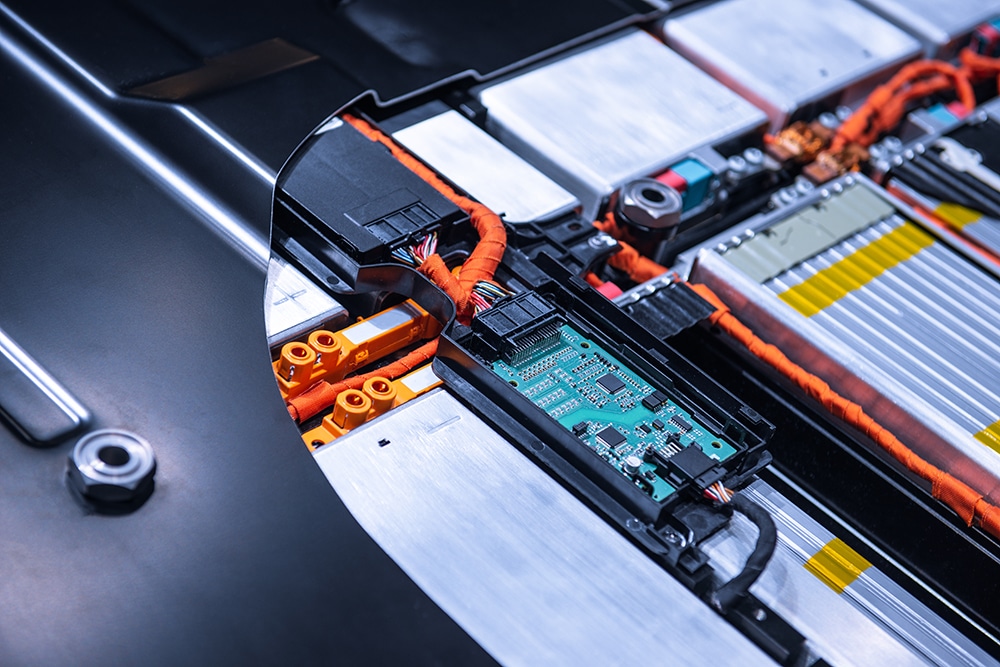

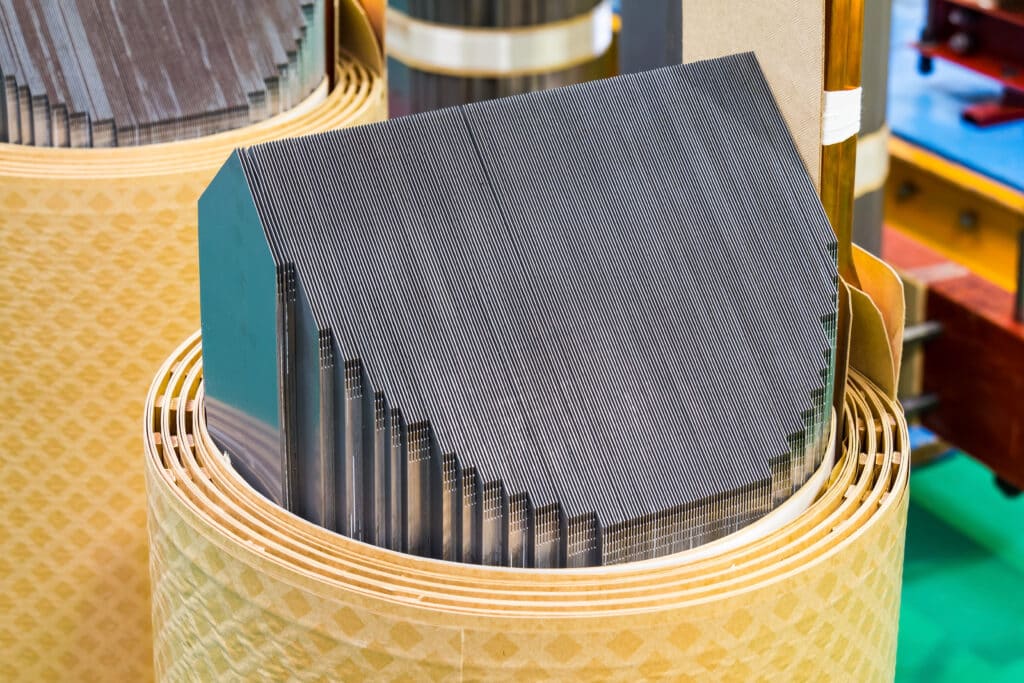

Grain Oriented Electrical Steel MMI

Continuing on its path of wild volatility, the Grain Oriented Electrical Steel MMI (GOES) witnessed a sharp rise in price month-over-month, shooting up by 20.41%.

A Projection for Growth, but a Reality of Supply Shortages

The grain-oriented electrical steel market captured some attention in recent weeks as industry dynamics continue to evolve. Many anticipate that the electrical steel market in North America will continue to grow, reaching US $6.46 billion by 2031. The projected increasing use of electric vehicles and updating of the energy infrastructure, especially in the U.S. and Canada, continue to drive many of these predictions.

Still, supply chain issues persist as producers continue to increase output to try to keep up with demand, especially when it comes to guaranteeing the availability of high-grade electrical steel required for cutting-edge applications.

Furthermore, although predictions state that the global market will expand at a 4.7% compound annual growth rate (CAGR) between 2024 and 2030, industry participants continue to keep a close watch on supply shortages that could impede the sector’s growth. The quick speed of electrification continues to surpass supply, despite improvements in production capacity. This raises concerns about possible future bottlenecks.

Renewables MMI: Notable Price Shifts

GOES is a notoriously volatile market, with unpredictable price action happening year round. If you’re in the energy industry, don’t be caught off guard. Access comprehensive price forecasting for U.S., European, Chinese and Japanese GOES prices through MetalMiner Insights. Learn more and speak with us to ask more questions.

- Neodymium held sideways, rising a mere 2.32% to $62,680.77 per metric ton.

- Silicon prices dropped by 7.24% to $1646.53 per metric ton.

- Steel plate prices dropped by 5.01% to $1,118 per short ton.

- Finally, cobalt prices dropped significantly; a total of 8.47%. This left prices at $23.90 per kilogram.