Support CleanTechnica’s work through a Substack subscription or on Stripe.

Every few years, a new administration tries to steer the course of the energy transition by decree. Some do it by boosting clean technologies through subsidies and regulation. Others try to restore fossil fuel dominance by dismantling those same supports. The idea that a single political cycle can redirect a century-long industrial transformation is a comforting myth for those who still see energy as a matter of ideology rather than physics and economics. The United States in 2025 is reliving that pattern. Donald Trump’s return to office brought immediate efforts to roll back clean-energy policies, cut federal incentives, and revive coal and oil narratives that predate the iPhone. Yet the structural momentum of the clean-energy transition remains. The cost curves are still falling, factories are still being built, and the global supply chain for electrons and metals has become too integrated to unravel. Trump can slow it, but he cannot stop it.

The fundamental driver of this transition is not a line of legislation or a presidential signature. It is the compound effect of innovation, scale, and learning. Solar module costs have dropped over 90% since 2010, wind turbine efficiency keeps improving, and lithium-ion batteries—once exotic and expensive—are now a basic industrial commodity. Once technologies reach that point, policy resistance can only delay deployment, not reverse it. Investors follow returns, and the returns on clean energy continue to outcompete new fossil fuel capacity in most markets. The United States can pause its own acceleration, but the rest of the world is still pressing ahead, and cost parity ensures that even delayed domestic markets will eventually follow.

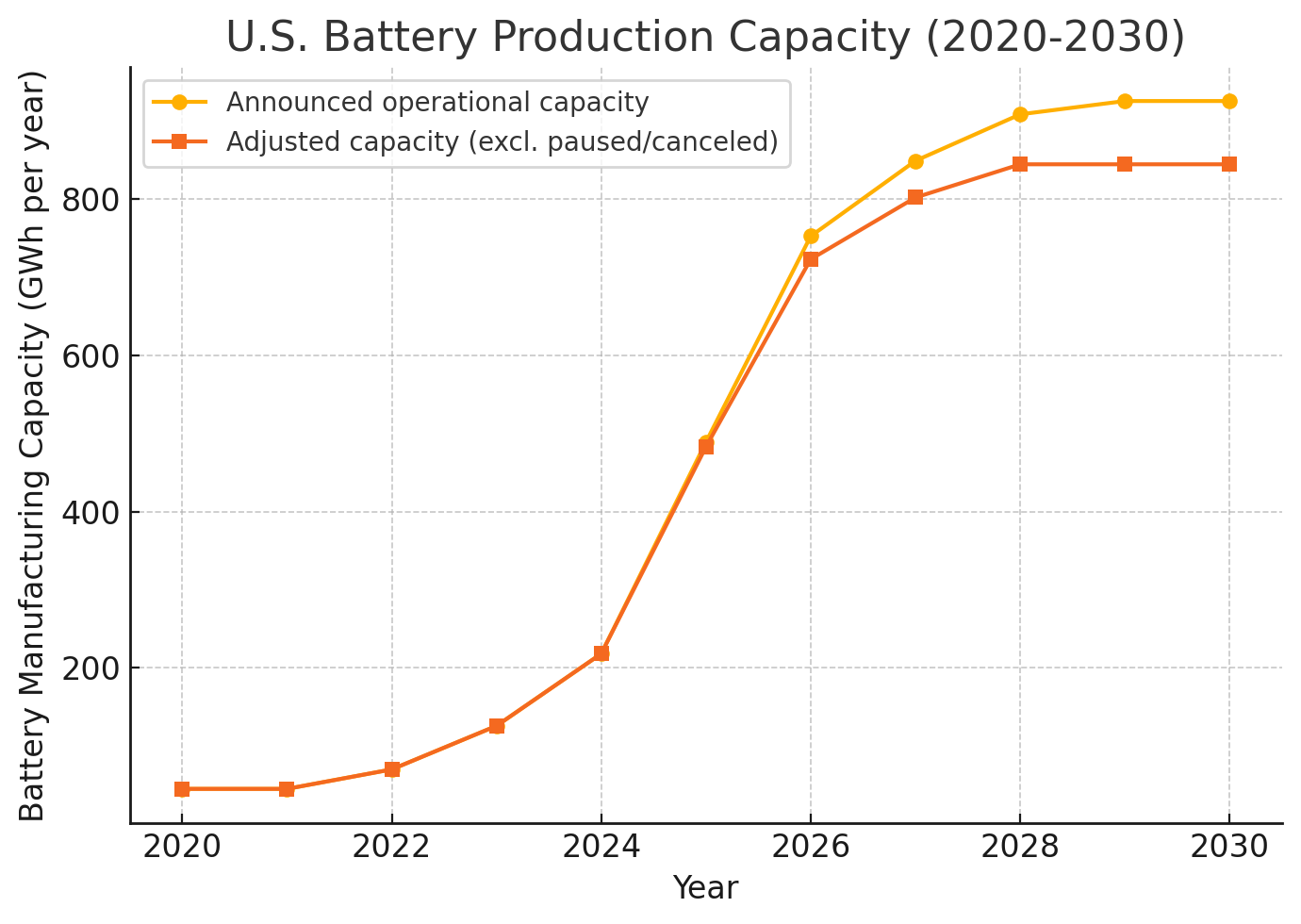

The clearest illustration of that structural inertia is the Battery Belt now stretching across the American Midwest and Southeast. Over the past five years, the United States has announced or begun construction on well over 800 GWh of battery cell capacity. Even with a few cancellations, the buildout remains historic. From Ultium’s Ohio and Tennessee plants to Ford and SK’s twin campuses in Kentucky and Toyota’s growing complex in North Carolina, the scale is beyond anything envisioned a decade ago. Each of these projects is measured not in months but in years, with multibillion-dollar contracts, local tax incentives, and state-level workforce programs binding them to completion. Once the rebar is in and the equipment ordered, a policy speech in Washington cannot unwind that momentum.

The Trump administration’s 2025 reversals have been sweeping on paper. The United States withdrew again from the Paris Agreement, the Environmental Protection Agency reopened dozens of climate and pollution rules, and the One Big Beautiful Bill Act set out to phase down the Inflation Reduction Act’s clean-energy tax credits. Electric vehicle subsidies are scheduled to expire, home electrification grants are being clawed back, and billions in clean-energy projects were canceled in politically unfriendly states. Each move serves the narrative of “energy dominance” through extraction rather than innovation. The short-term effect is real: slower grid-scale battery deployment, canceled hydrogen hub buildouts (mostly thankfully), and frozen grant disbursements for rooftop solar and community energy storage. But none of this changes the economics of electrons or the global competition for clean-technology manufacturing.

The practical damage will be most visible at the margins. Second-tier startups and regional battery suppliers, already stretched thin, may lose the federal incentives that made their financing viable. Some smaller plants may close or consolidate. Grid operators may find fewer domestic suppliers of stationary storage modules, and some renewable developers will again look abroad for battery imports. Investors, wary of political volatility, will demand higher returns, raising the cost of capital. These are frictions, not fatal blows. Most of the large joint ventures—Ultium, BlueOval SK, Panasonic, Toyota, Hyundai–LG—are continuing as planned, because their global supply contracts depend on them.

The deeper reason Trump cannot stop the transition is that it has already outgrown politics. The clean-energy economy is now market-led, not policy-forced. Utilities choose renewables because they are cheaper to build and easier to permit. Automakers are committed to electrification because global emissions rules and consumer demand require it. Capital markets have priced carbon risk into valuations. International partners, from Korea to Europe, continue to invest in US manufacturing even when the federal tone shifts. The energy transition has become a self-reinforcing industrial ecosystem: factories create suppliers, suppliers create jobs, jobs create local pressure to keep the plants open. Each new battery campus or wind-turbine blade facility becomes a constituency for staying the course.

Battery manufacturing itself is a perfect case study. Once a company breaks ground on a 30 or 40 GWh plant, cancellation becomes irrational. The construction alone takes years. Supply contracts for cathode materials and separators span half a decade. Every piece of equipment ordered locks in sunk costs that no administration can claw back. Even paused projects tend to reemerge when market conditions stabilize or new policy incentives appear. In practice, each gigafactory becomes a monument to irreversible industrial change. The policy pendulum may swing, but the infrastructure keeps growing.

If Trump’s actions slow the transition, the delay will be measured in years, not decades. Analysts estimate that current rollbacks could push the US clean-energy deployment curve back by roughly 100 to 150 GWh of battery capacity by 2030. That matters for domestic competitiveness, but it does not reverse the global trajectory. Europe, China, and India are still expanding manufacturing at a combined pace that dwarfs the US slowdown. Their scale will continue to push technology costs down, indirectly forcing American firms to rejoin the race or lose market share. The transition does not stop when one country blinks; it simply reroutes capital to where it is welcome.

What happens next will test how resilient this new industrial base really is. State governments from Georgia to Michigan are now the front line of clean-energy policy, continuing to court manufacturers with tax breaks and training programs regardless of the federal stance. Corporate commitments to decarbonization, already written into supply contracts and investor reports, will keep capital flowing. Even within the fossil-friendly framing of “energy dominance,” the administration’s focus on mining and critical minerals could inadvertently strengthen the battery supply chain. The path may zigzag, but it still leads toward electrification.

The recent turmoil surrounding South Korean battery projects in the United States has been one of the most visible disruptions of 2025, but even these incidents only dent the surface of the overall trend. The high-profile case was the Immigration and Customs Enforcement raid at Hyundai and LG Energy Solution’s joint venture in Bryan County, Georgia. Federal agents detained nearly 500 workers, most of them South Korean nationals who were reportedly in the country without valid work visas. The raid briefly halted onsite activity, disrupted subcontractor schedules, and triggered political outrage in both countries. For a few weeks it seemed like a serious threat to one of the Southeast’s flagship clean manufacturing projects.

Yet Hyundai reaffirmed its commitment within days, local authorities stepped in to stabilise the situation, and construction resumed. The factory, designed for roughly 30 GWh of annual battery output, remains a cornerstone of Hyundai’s North American EV strategy. The episode highlighted the vulnerabilities of a globalised workforce under volatile US immigration enforcement, but it did not slow the momentum of the project or the overall trajectory of domestic battery manufacturing. Once capital is committed and equipment procurement has begun, even a large-scale federal intervention can only cause a temporary delay.

A similar story unfolded in Michigan, where two highly publicised projects became political lightning rods. Ford’s planned LFP battery plant in Marshall, built under license from China’s CATL, was paused amid a storm of congressional scrutiny and campaign rhetoric. Lawmakers argued that the licensing arrangement could channel Inflation Reduction Act subsidies to a “foreign entity of concern.” In parallel, Chinese battery maker Gotion’s proposed facility in Big Rapids was effectively cancelled after local political opposition and the withdrawal of state incentives. Both cases generated headlines about the supposed collapse of US battery investment.

In practice, they represent a narrow category of politically sensitive projects rather than a systemic reversal. Ford’s decision to pause its plant reflects risk management in a political cycle, not a retreat from electrification. The company still has tens of billions invested in BlueOval SK joint ventures and is locked into an EV supply chain that demands more domestic cells. Gotion’s cancellation was a casualty of geopolitical optics, but the lost capacity—tens of GWh at most—is marginal compared to the hundreds of GWh still advancing nationwide.

Together, these two stories show how visible setbacks can distort perception. The ICE raid and Michigan factory cancellations are reminders that politics and public sentiment can complicate individual projects, but they do not change the underlying math of the transition. The cost trajectories of batteries, the commitments of automakers, and the sheer volume of capital already deployed mean the broader buildout continues. Each gigafactory represents a long-term industrial bet that will outlast any administration’s enforcement choices or rhetoric about “foreign control.” The political shocks of 2025 have slowed the timeline in a few locations, but the physics of the energy economy remain the same: batteries are still getting cheaper, factories are still rising, and electrification is still spreading.

Politics can redirect budgets and narratives, but it cannot undo the math. The cost of solar and wind keeps dropping. Battery energy density keeps improving. Every gigafactory under construction today has an operational life well beyond any administration. Trump can pause some credits, cancel some projects, and reignite an old cultural fight over fossil fuels, but he cannot rewrite the physics or the economics of modern energy. The energy transition has already passed the point where it depends on belief. It now depends on arithmetic, and arithmetic has no ideology.

Trump can slow America’s progress toward that future, but he cannot stop it. The rest of the world will keep building, learning, and scaling. In the end, the transition will roll forward, powered not by political will but by simple inevitability. The only real question is whether the United States keeps up or watches from behind as others claim the markets and industries of the next century.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy