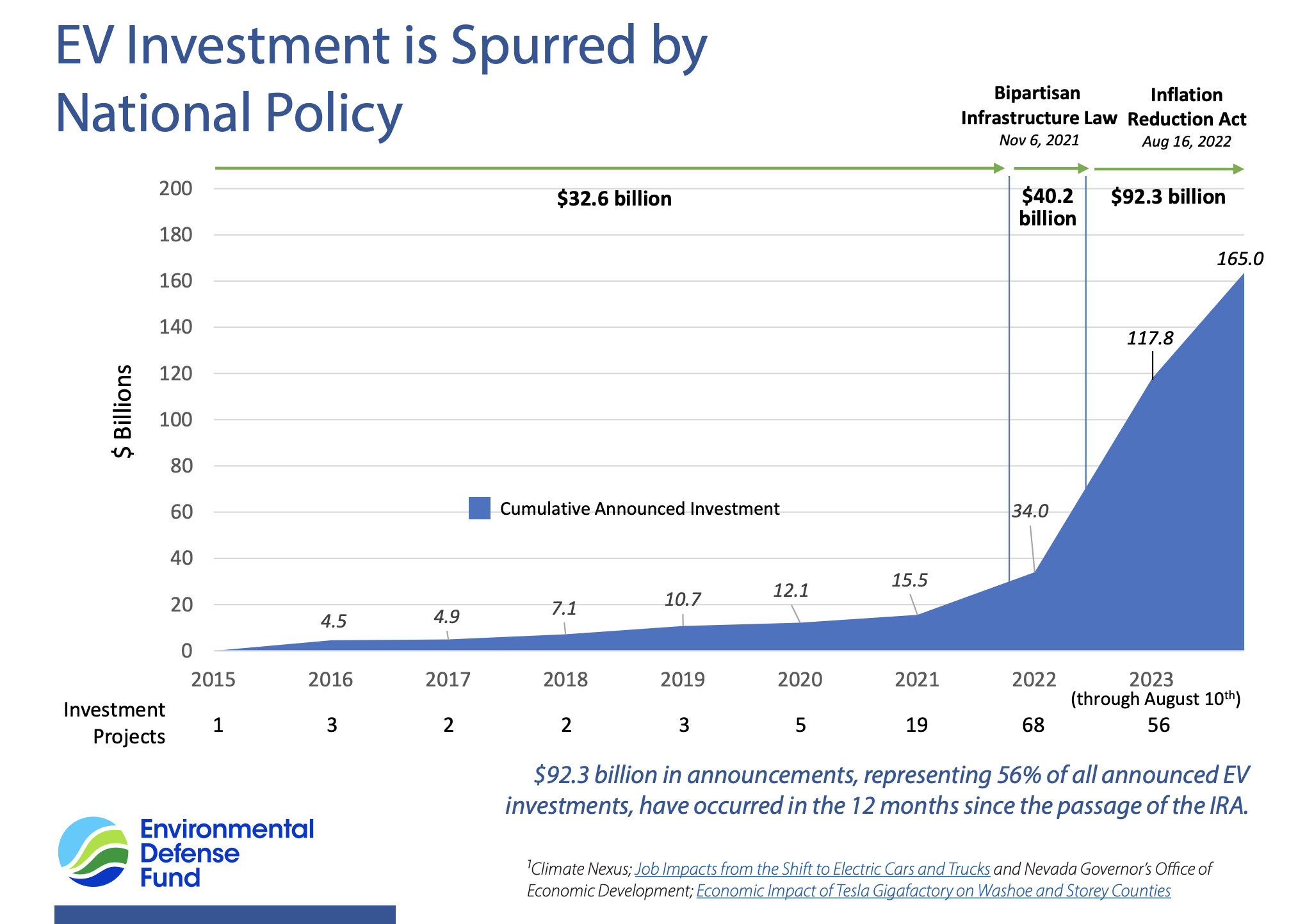

The Environmental Defense Fund has chronicled battery manufacturing announcements in the USA as a result of the Inflation Reduction Act. Earlier this year, I predicted that the majority of all vehicles produced globally would be battery electric by 2027, but there was doubt expressed at how this could occur due to battery supply constraints. However, the IRA has provided extra motivation for investment in battery manufacturing — these batteries will enable the rapid transition.

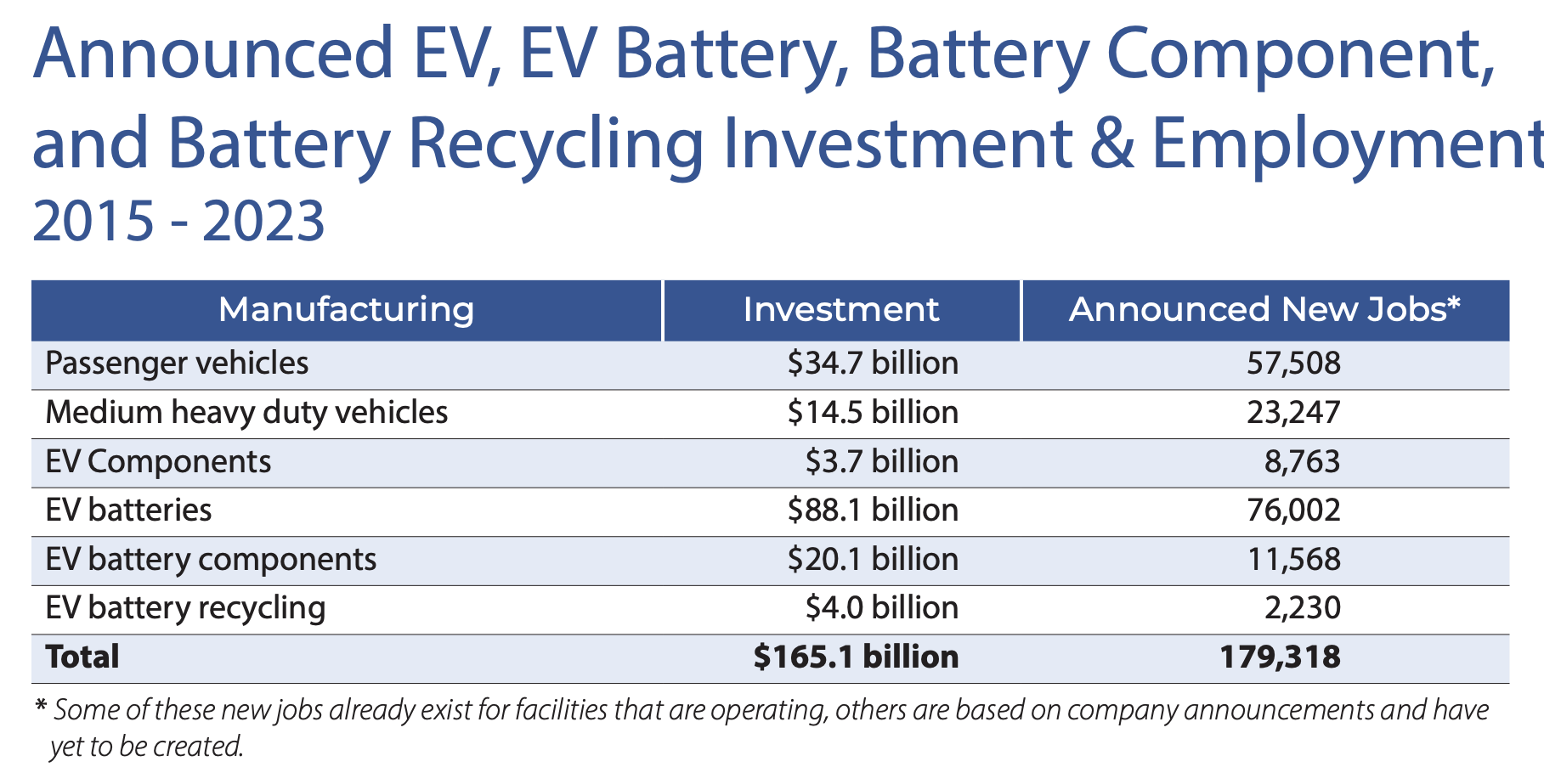

According to the EDF report, by 2027, “U.S. battery manufacturing facilities will be capable of producing batteries sufficient to supply up to 12.2 million new passenger vehicles each year, which represents approximately 95 percent of new vehicles sold in 2022.” Let that sink in for a minute. The graphs contained in the report indicate that there will be enough batteries to power 4 million new EVs in the USA alone in 2024 (that’s next year!), 8 million by 2025, then on to 12 million by 2027. Potentially, that’s all new vehicles sold in the USA. Of course, there will be battery requirements for trucks, buses, stationary storage, and eVTOL aircraft as well. But, from here, it looks like there should be plenty for most of the cars produced.

The report continues: “U.S. Electric Vehicle manufacturing facilities will be capable of producing approximately 4.7 million new passenger vehicle each year in 2026, which represents approximately 36 percent of all new vehicles sold in 2022.” So, could it be that there will be an oversupply of batteries, or will carmakers ramp up their EV efforts? If there is money to be made, I am sure they will. This prediction contrasts markedly with the frequent reports of carmakers complaining that they do not have enough batteries.

EDF predicts: “U.S. investments, jobs, and production capacity will likely continue to grow in response to strong federal investments and incentives. Global EV and battery manufacturers have announced aggressive and sustained investment needs worldwide to support the EV transition over the next decade. While many have not yet specified where those investments will occur, current investment data demonstrates that the IRA has made the U.S. a highly attractive market for EV ecosphere manufacturing facilities.”

In case some might think this is just wishful thinking, I would like you to reflect on the methodology applied by the EDF. Its research team “reviewed announcements released by investors, state and local governments, industry publications and local media, to capture the following data for each project: Company and nationality; Investment type (EV assembly plant, Battery manufacturing plant, Battery component plant); Location (City, State); Announced investment value ($ billions); Facility production capacity (vehicles/year, Gigawatt-hours/year, tons/year); and Announced Schedule (Construction Begins, Production Begins).”

Apparently, 101 projects have been announced in the 12 months following enactment of the IRA, worth approximately $92 billion. This makes the transition to EVs by 2027 even more likely. The report is only 8 pages and is a good read.

EDF has reported battery manufacturing capacity in terms of the approximate number of light duty vehicles that the batteries could power. “Battery manufacturing capacity values were available in gigawatt-hours for most of the projects, which were converted into vehicles using a factor of 89 kWh per EV battery. This is the average of the values used by the U.S. Department of Energy Office of Energy Efficiency, Vehicle Technologies Office (77–100 kWh/EV) to estimate 2030 North American EV battery production capacity in Fact of the Week #1271, published January 2, 2023. This figure is larger than the current size of most EV batteries, so the resulting battery production figures can be considered conservative. Given the variety of different measures used to quantify the production of battery component plants, this information was noted, but not included in the quantitative analysis.”

So, based on this analysis, it is likely that batteries will be available to power more than 12 million cars. It is also worth noting that battery chemistries are constantly being tweaked to give more power in smaller size. This figure determined by the EDF might prove to be very conservative indeed.

And, this is just the USA — what of Europe and China? China appears to be a long way ahead with both battery manufacture and electrification of its fleet. I have reached out to my friends at Rethink Energy to access European data.

Is there anything that could derail this exciting trajectory? Some commentators on my March article brought up possible issues with battery supply. I think the EDF report has put that to bed. Also mentioned was the progress of charging infrastructure. I am sure if a researcher was to apply the same methodology to charging announcements as EDF did to battery announcements, they would find that this problem is also disappearing into the distance. Like a Tesla taking off at the lights!

What of mineral supply? Australian lithium mining alone will be able to satisfy the demand. The IRA has encouraged investment in North American mining of future facing resources. China currently refines the vast majority of minerals needed for batteries, but I expect the IRA will change that also, with facilities to be set up in the USA.

Back in March, I wrote of the global surge in EVs: “In 2020, 3.2 million plugin vehicles were sold. In 2021, this increased to approximately 6 million. Last year, it was over 10 million. So, we would expect 16 million to sell in 2023, 25+ million in 2024, over 40 million in 2025, and over 60 million in 2026. By 2027, the game is over — the whole market is under 80 million vehicle sales a year.”

There were 333 comments on that article, with some great discussions. The comments reveal how much more information the public needs in order to understand the difference between living with an EV and living with a petrol car. This will come.

My great excitement arose this morning, because this report from the EDF shows that it is possible for almost all new cars to be electric by 2027. The rest of the EV ecosystem will grow with the numbers of cars on the road. Market forces will encourage charging infrastructure. Problems with apartment dwellers will be solved. The grid will survive. We will all have less expenses (fuel and maintenance) and live healthy in a quieter world.

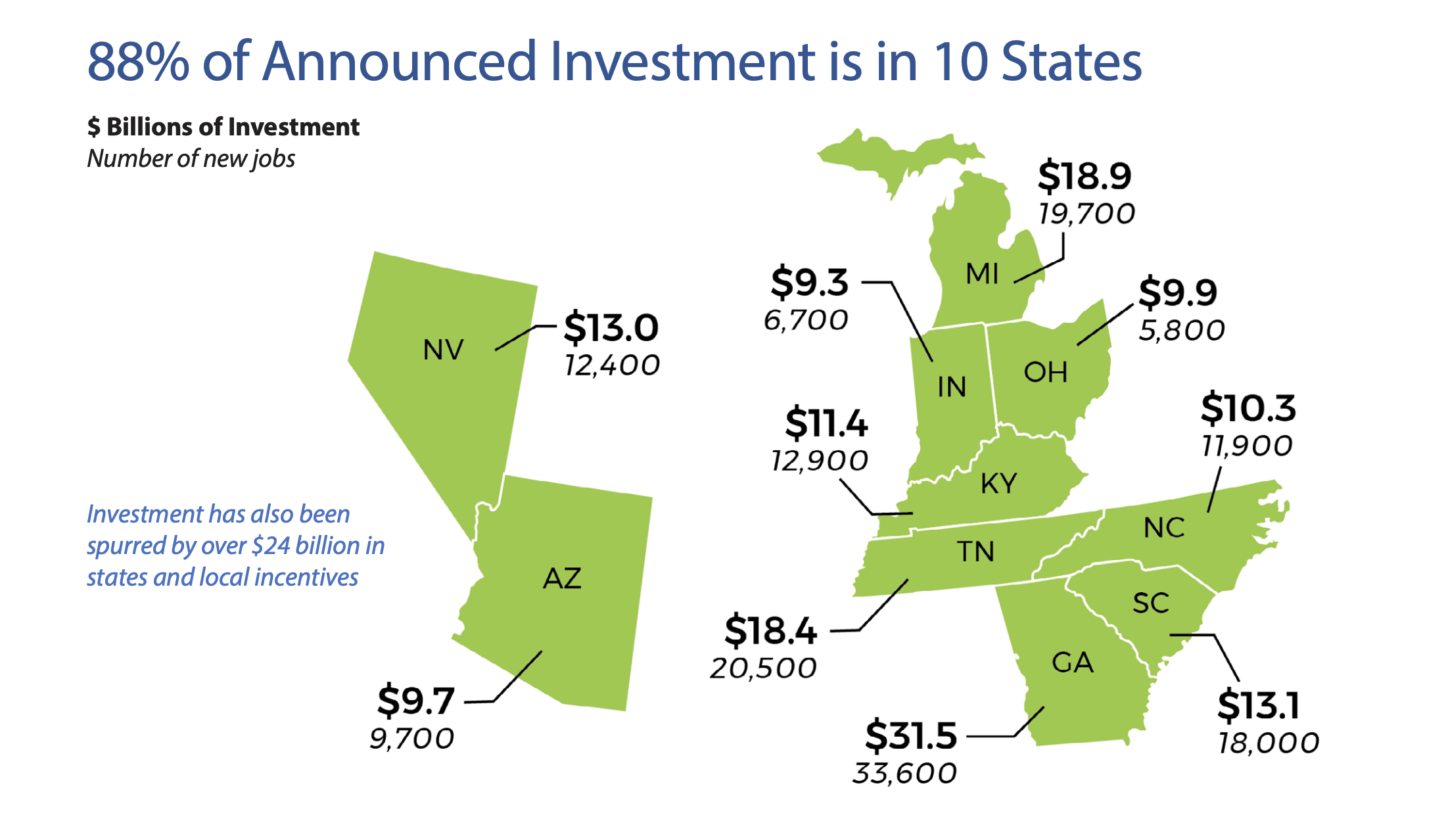

Images courtesy of EDF

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …