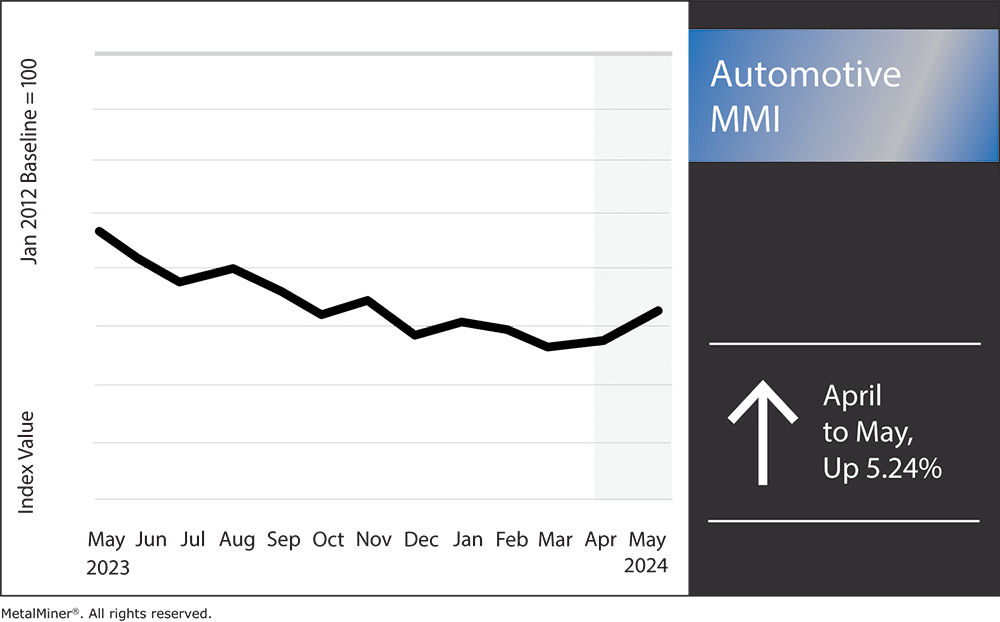

The Automotive MMI (Monthly Metals Index) broke out of its nearly 6-month-long sideways trend amid several changes in metals prices. Month-over-month, the index rose 5.24%. Except for shredded scrap steel and palladium, most components of the index either moved up or sideways with slight upward movement. With the recent LME and CME ban on Russian aluminum, copper was the main component pulling the index up, as the ban swiftly led to a copper rally. Even with metals prices now evening out after this rally, experts warn of potential copper shortages and ongoing price volatility, which could impact the automotive market.

Want to find out how MetalMiner’s metals prices forecasting methods save metal sourcing companies millions of dollars and learn cost-saving sourcing tactics? Join our May introduction chat session MetalMiner Introduction: From Price Data to Forecasting to Cost Modeling.

Potential Copper Shortages Related to the Automotive Industry

A possible scarcity of copper, a critical metal for the automotive sector, might hinder the development and manufacturing of electric cars (EVs) and other vehicles. Indeed, industry analysts caution that the supply of copper may not be able to keep up with the increasing demand for the metal worldwide, mainly due to the deployment of renewable energy infrastructure and EVs.

The average automobile currently requires 40-50 pounds of copper. Furthermore, manufacturers require around four times as much copper for an EV compared to a conventional gasoline-powered car.

The International Copper Study Group recently released a paper indicating they anticipate a shortfall of around 200,000 metric tons in the global copper market for 2023. The spike in demand for copper in the renewable energy and electric vehicle sectors, combined with the continuous supply chain disruptions and geopolitical conflict, are the main causes of this potential deficit.

Will the Shortage Impact Automotive Copper Metals Prices?

With metals prices already seeing a boost from the LME and CME Russian metal restrictions, the automotive industry could experience ramifications and even higher copper prices if supply shortages occur. For instance, a scarcity of copper might significantly affect the car industry. If obtaining copper becomes more difficult for automakers, it could lead to delays, higher prices, and even supply chain bottlenecks. This, in turn, could ultimately result in elevated prices for consumers.

Manufacturers should look at substitute materials and recycling techniques to lessen the impact of a possible copper shortage and higher metals prices on the automotive industry. Some producers continue to consider replacing copper in some applications with aluminum or other metals. Others are ramping up initiatives to enhance the recovery and recycling of copper from end-of-life automobiles, which may assist help ease supply shortages.

Time is metal, don’t waste it searching for money-saving market insights. Get MetalMiner’s weekly newsletter delivered straight to your inbox.

Another Possible UAW Strike on the Horizon

Due to unresolved health and safety issues, the United Auto Workers (UAW) union is getting ready to go on strike at the Stellantis Warren Stamping Plant in Michigan. More than a thousand UAW Local 869 employees who work at the facility have cast ballots in favor of a strike, granting the union the authority to call in workers if Stellantis disregards their complaints.

“Not only do we want these health and safety grievances resolved, we want our members to leave the same way they came. We want members to understand they’re not just a number or just a body on the line. They will come to work and feel like they have some ownership in that building,” said UAW Local 869 President Romaine McKinney III.

Given that the company provides parts to more than six North American Stellantis facilities, including those producing the Dodge Ram, Jeep Wrangler, and Jeep Wagoneer, a strike at this location might have serious repercussions.

Automotive MMI: Noteworthy Shifts in Metals Prices

Generate hard savings on your metal buys year-round; get a sample of MetalMiner’s Monthly Outlook report.

- Chinese lead prices moved sideways by a slight 2.69% to $2,334.19 per metric ton.

- Korean aluminum 5052 coil premium over 1050 traded flat, remaining at $3.78 per kilogram.

- Lastly, hot dipped galvanized steel moved sideways, budging up 2.39% to $1,242 per short ton.