The U.S. automotive industry witnessed several changes month-over-month. For one, the demand for new vehicles went up. However, steel prices, particularly hot-dipped galvanized steel, also rose along with demand. With the UAW strike over, analysts expect new vehicle manufacturing to pick up. However, new vehicle demand overall continues to battle elevated interest rates. Experts do not anticipate the Fed going dovish on interest rates until after the beginning of 2024. As a result, automotive sellers are lowering prices to move inventory off their lots.

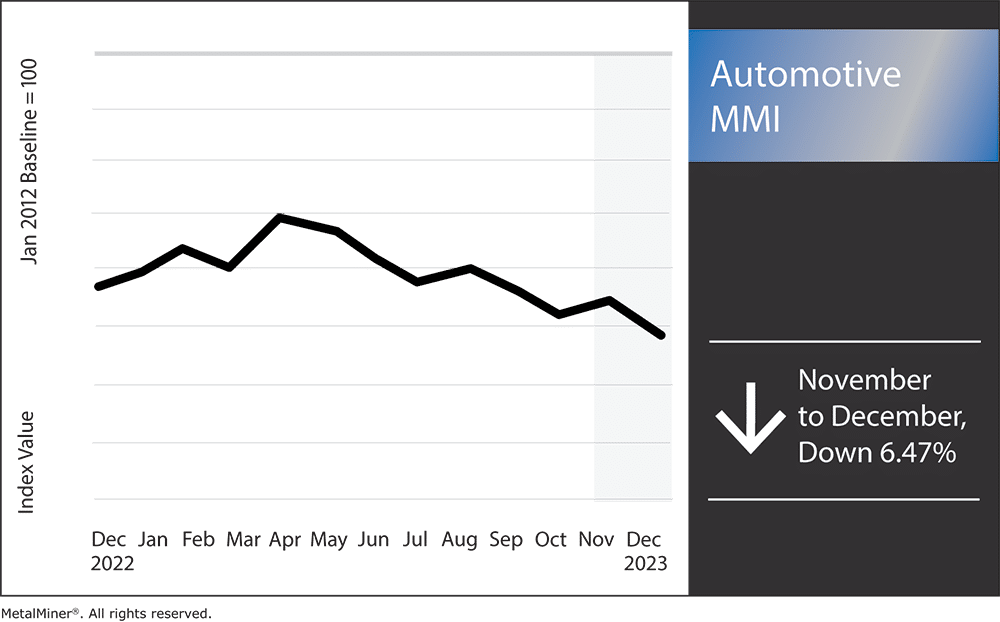

Ultimately, rising steel prices weren’t enough to bring the index up month-over-month. In response, the Automotive MMI (Monthly Metals Index) dropped by 6.47%.

Need to know last-minute 2024 steel procurement strategies? Join MetalMiner’s December fireside chat: Metal Contracting Goldmine: Last-Minute 2024 Market Intel & Strategies

Sales Increase Battling High Interest Rates

A recent Reuters article reported that 1,236,000 new cars would be sold in the U.S. in November 2023, up nearly 10.2% from the previous year. Furthermore, projections suggest that increased vehicle availability and high demand for the newest models would be the main causes of this expansion. Meanwhile, a survey by industry experts J.D. Power and GlobalData states that retail inventory levels, which analysts predict will rise by 43.7% from the previous year and 7.5% from October 2023, were the driving force behind the sales surge.

Even after the nearly six-week UAW strike ended, there was still an improvement in the number of vehicles available. Meanwhile, dealer profits per unit continue declining due to elevated interest rates and increased availability of new cars. Despite this, they are still higher than they were before the pandemic.

This uptick in sales comes after a somewhat robust first half of the year, in which experts estimated that U.S. new car sales increased by almost 13%, significantly exceeding industry predictions. Those same experts anticipate that November sales will remain at 1.23 million units, with vehicle demand levels continuing to decline from the second quarter results.

Overall, the rise in new vehicle sales is a positive sign for the industry. However, vehicle availability continues to face high interest rates, keeping many consumers away. With the Fed unlikely to go dovish on interest rates until after the start of 2024, new vehicle sales might not witness any massive increases until interest rates drop to a more affordable level.

Hot-Dipped Galvanized Steel Prices Impact on Automotive Manufacturing

The outlook for steel prices in 2024 remains mixed. There are also questions as to how prices will impact automotive manufacturing. High hot-dipped galvanized steel prices, for example, significantly impact automotive manufacturing. Indeed, the automotive industry is a major consumer of galvanized steel, using it to produce car bodies, frames, and other components.

Therefore, spikes in the cost of hot-dipped galvanized steel often result in higher automobile manufacturing costs. This latest increase may force automakers to raise vehicle pricing to cover the additional costs, making the vehicles less accessible to potential buyers. Consequently, the market for new cars may decline.

Steel prices can see significant impacts from any disruption in the automobile sector, including United Auto Workers (UAW) strikes. During such strikes, thousands of tons more steel typically become available on the spot market. The increased supply often lowers the price of steel, which typically has a detrimental effect on the profitability of steel companies.

Gain access to expert HDG steel market insights in MetalMiner’s Monthly Metals Outlook report that optimize sourcing, maximize ROI, and fine-tune your HDG procurement skills. Start with a free sample report and then subscribe!

Lower Hot-Dipped Galvanized Prices Could Help 2024 Automotive Manufacturing

On the other hand, lower hot-dipped galvanized prices offer the automotive sector several key benefits. One advantage is the ability to reduce the overall cost of vehicle manufacturing. If automakers can lower their costs, they can pass the savings on to consumers in the form of more affordable vehicles. As a result, this may lead to increased consumer demand for brand-new automobiles.

Reduced hot-dipped galvanized prices also directly enhance automakers’ profitability. So, even if automakers hold the line on vehicle costs, they can boost their profit margins when raw materials are cheaper. This can be especially valuable when customer demand for cars is weak, or the economy is uncertain. By cutting production costs, automakers can better maintain their financial stability and competitiveness.

Overall, lower hot-dip galvanized prices could assist the automobile sector’s expansion. When essential resources like hot-dipped galvanized steel are cheap, automakers could be more willing to invest in ramping up their manufacturing capacity or designing new car models. This could stimulate innovation, growth, and employment in the automobile industry, aiding automakers, their suppliers, and the economy as a whole.

Stop overpaying for steel and other metals. Rely on MetalMiner’s history of success in predicting prices. View our track record.

Automotive MMI: Notable Price Shifts

- Chinese lead prices saw a modest decrease of 0.43% month-over-month, which left prices at $2,218.27 per metric ton.

- Hot-dipped galvanized steel prices shot up 20.02%. This brought prices to $1,247 per short ton.

- Finally, Korean aluminum 5052 coil premium over 1050 increased 4% to $4 per kilogram.