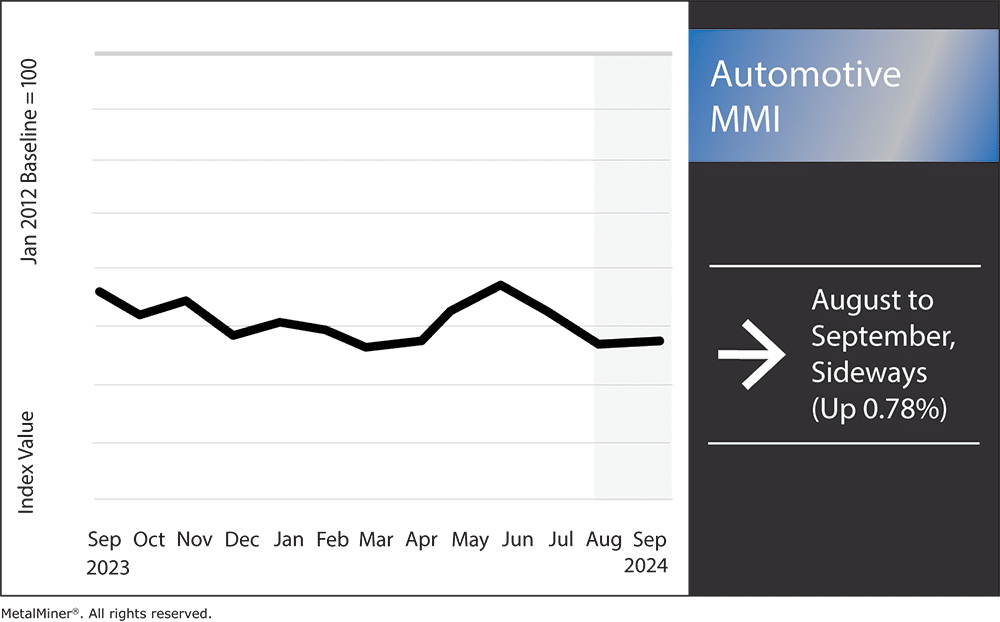

The Automotive MMI (Monthly Metals Index) moved sideways month-on-month, only rising by 0.78%. Hot dipped galvanized steel prices remained sideways, which helped to hold the index firmly in range. However, China’s recent dumping of excess steel supply into international markets could cause downward price movement and bearish sentiment for the remainder of 2024.

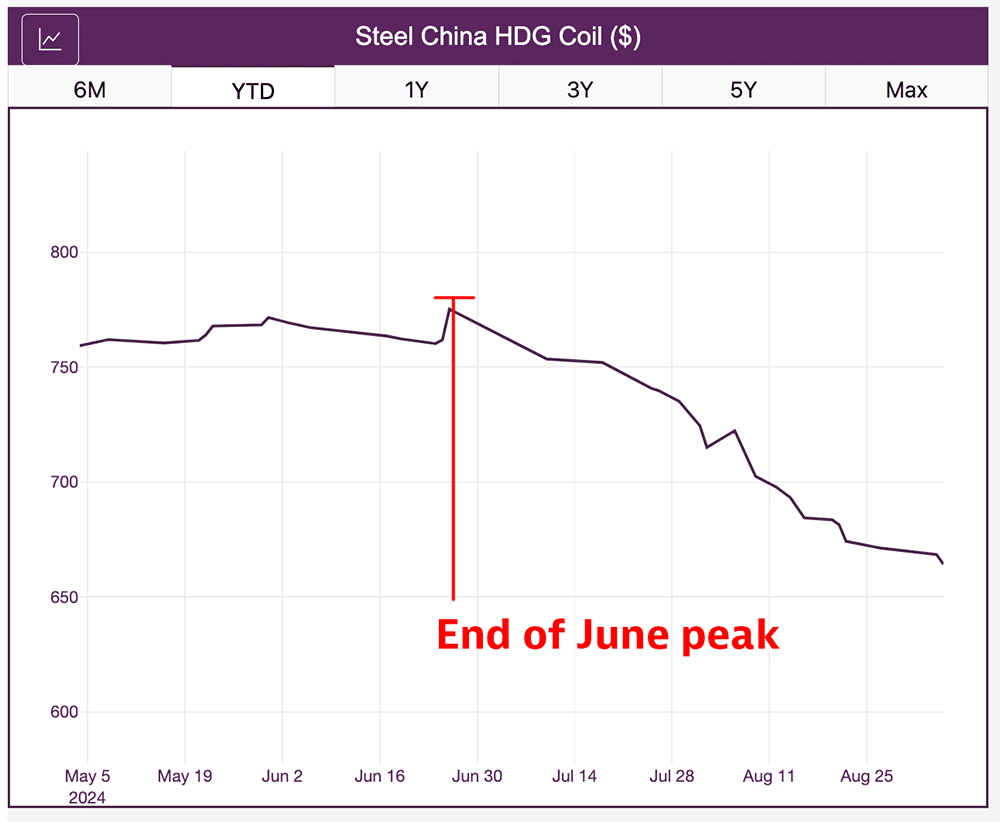

China’s Hot-Dipped Galvanized Steel Prices Drop

As the remainder of 2024 unfolds, global steel markets are witnessing a decline in Chinese hot dipped galvanized (HDG) steel prices. However, the impact extends beyond China’s borders, affecting automotive manufacturing industries globally. In response, countries continue to explore international trade measures to address excessive dumping practices. MetalMiner’s weekly newsletter helps businesses adjust their hot dipped galvanized sourcing strategies accordingly in response to excessive dumping practices.

What’s Causing This Drop?

The main reason for the drop in Chinese HDG steel prices is the domestic market’s oversupply. China continues to produce more steel than its industries, particularly manufacturing and construction, can absorb. In the first seven months of 2024, China boosted its steel shipments by more than 20%, but export prices dropped by over 25%.

The drop in prices also stems from reduced raw material costs. With the decline in prices for key inputs like coking coal and iron ore, Chinese steelmakers have been able to lower their prices significantly. Despite the falling production costs, Chinese mills remain highly incentivized to offload excess steel in foreign markets.

Dumping Steel into Global Markets

In response to the domestic oversupply, China has turned to exporting its HDG steel at prices below market value—a practice known as dumping. This is especially true in countries with open markets or weaker anti-dumping regulations.

For instance, China producers have increasingly routed their steel exports through Vietnam, India, Mexico and other intermediary countries to bypass tariffs and trade restrictions. These nations remain some of the hardest hit by China’s steel dumping. Meanwhile, India recently launched anti-dumping investigations into imports of steel believed to originate from China but entered the country through Vietnam under free trade agreements.

Similarly, Malaysia recently began probing whether sellers are offering Chinese exports below domestic prices, thus further intensifying regional trade tensions. This influx of cheap steel is destabilizing global markets and leading to calls for protective measures. As governments and industries react, monitoring and predicting the movements of these steel exports could offer businesses a way to adjust to new market realities.

By using accurate forecasting tools that track global price changes, businesses can better plan their purchases and avoid unexpected price spikes or overpaying during market downturns. MetalMiner’s free Monthly Metals Index report covers trends for 10 different industries, including automotive.

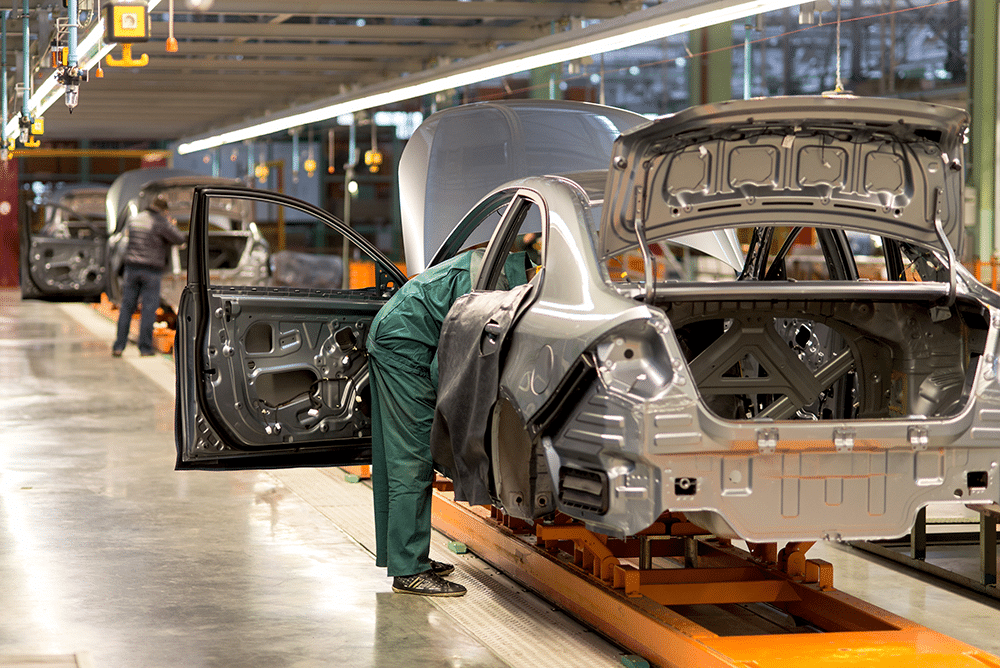

Impact on the Global Automotive Industry

China’s actions directly impact the automotive industry, a major consumer of hot dipped galvanized steel. As the cost of producing car bodies and other parts drops, automakers may initially view declining HDG costs as beneficial. Lower material prices can help manufacturers in countries that import cheap Chinese steel by boosting their overall competitiveness.

However, the long-term outlook isn’t quite as promising. Local steel producers need to cut prices or lose market share due to the influx of inexpensive steel imports, which could threaten domestic steel industries. This pressure could lead to industry consolidation, reducing competition while stifling innovation and product quality.

Meanwhile, tariffs and trade restrictions imposed in response to China’s dumping further complicate global supply chains. Over time, trade disputes could drive up costs for automakers, as they rely on a stable and consistent supply of resources. While cheaper imports may offer short-term gains, retaliatory tariffs or quotas could ultimately raise steel prices and offset those benefits. This makes it increasingly important for companies to carefully track global steel price movements. The Art of Timing Your Metal Buy covers the tactics of this process in great detail.

Preparation for Volatility in Hot Dipped Galvanized Steel Prices

While lower hot dipped galvanized steel prices may offer temporary relief for industries like automotive manufacturing, the long-term effects of China’s dumping practices could be disruptive to the global automotive markets. As countries impose anti-dumping measures and trade barriers, the global steel market may become increasingly fragmented, with some consequences for international supply chains.

Automotive MMI: Noteworthy Price Shifts

Visually see where 2025 metal prices are projected to land with MetalMiner Insights’ comprehensive short and long-term price forecasts.

- Chinese lead prices dropped 9.65% to $2,428 per metric ton.

- Hot-dipped galvanized steel

- Finally, Korean aluminum 5052 coil premium over 1050