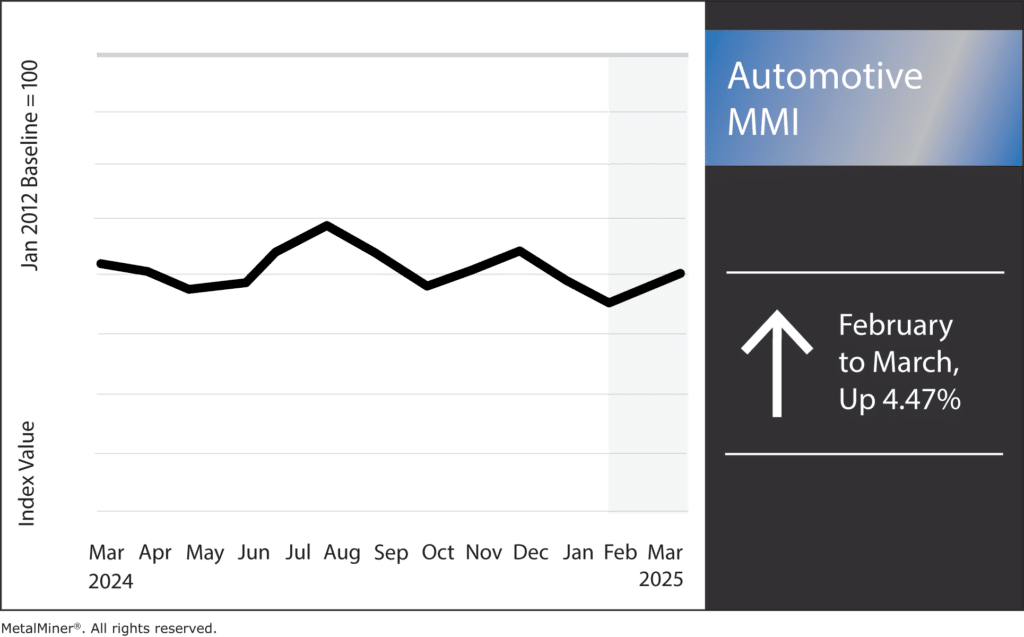

The Automotive MMI (Monthly Metals Index) increased by 4.47% month over month. The primary culprit for the bullish sentiment was hot-dipped galvanized prices rising due to tariff anticipation from the automotive industry.

U.S. Automotive Industry Faces Rising Costs and Trade Challenges

The U.S. automotive sector is grappling with economic pressures that could alter its operational landscape. Two major factors driving these concerns are the Trump administration’s newly imposed 25% tariffs on imports from Canada and Mexico and a rise in hot-dipped galvanized (HDG) steel prices.

Commodity markets are constantly shifting, affecting the automotive industry. Get all of the latest commodity updates with MetalMiner’s weekly newsletter.

Tariffs Introduce New Trade Hurdles

On March 4, 2025, the U.S. government implemented a 25% tariff on all automotive imports from its North American trade partners, Canada and Mexico. According to officials, the move aims to curb the trade deficit and address security concerns related to illegal immigration and drug trafficking.

However, industry experts warn that the tariffs could have unintended consequences, particularly for automakers who depend on cross-border manufacturing networks to source essential vehicle components.

Don’t lose revenue from tariff induced price increases. Learn how to navigate volatility from tariffs by downloading MetalMiner’s free Comprehensive Steel & Aluminum Tariff Guide.

Expected Rise in Vehicle Prices

One of the primary effects of the new tariffs is the likelihood of higher vehicle prices for American consumers. Economic analysts predict that the cost of new cars could increase by a minimum of $3,000, while larger vehicles like pickup trucks could see prices jump by up to $10,000.

The reason behind this spike is the increased cost of importing both fully assembled vehicles and the parts needed to build them domestically. Due to the surging automotive industry costs, car makers may have little choice but to pass these added expenses on to buyers.

Supply Chain Disruptions

The auto industry in North America operates on an intricate supply chain, where companies frequently transport vehicle components across borders before final assembly. The newly enforced tariffs could disrupt this system, making parts more expensive and slowing production schedules.

In response, manufacturers might need to rethink their supply strategies, potentially shifting toward domestic suppliers or restructuring logistics to minimize exposure to the tariffs.

Get price forecasts, specific monthly buying strategies, should-cost models and more on MetalMiner Insights. Request a 30-minute demo of the MetalMiner Insights platform now.

Rising HDG Steel Costs Add Further Pressure

Beyond trade policy concerns, automakers also face higher prices for hot-dipped galvanized steel. Due to its corrosion resistance, HDG is critical for vehicle frames and structural components. The cost of HDG steel surged throughout February, compounding financial pressures on car manufacturers.

With steel being one of the most essential raw materials in vehicle production, this increase will likely elevate manufacturing expenses further, thus contributing to higher retail prices for consumers.

Automotive Industry Response

To mitigate these economic pressures, automakers and trade groups are taking action. Manufacturers and industry associations are lobbying for policy adjustments, arguing that the tariffs could harm competitiveness and hurt both American businesses and consumers. Some groups are even pushing for exemptions or alternative trade agreements to lessen the impact.

Meanwhile, manufacturers are reviewing ways to improve efficiency, cut costs and diversify their supply chains to reduce their reliance on imported materials and parts subject to tariffs. Some may also invest in new technologies that optimize production while keeping expenses in check.

Don’t settle for stagnant savings. MetalMiner’s custom price forecasting unlocks the true potential of your volume commitments, ensuring you maximize profit. View our full metal catalog.

Automotive MMI: Noteworthy Price Shifts

- Hot-dipped galvanized steel spiked 19.36%, reaching $1,122 per short ton.

- Chinese lead prices moved sideways, rising by 2.25% to $2,333.97 per metric ton.

- Lastly, Korean aluminum 5052 coil premium over 1050 remained stationary at $4.21 per kilogram.