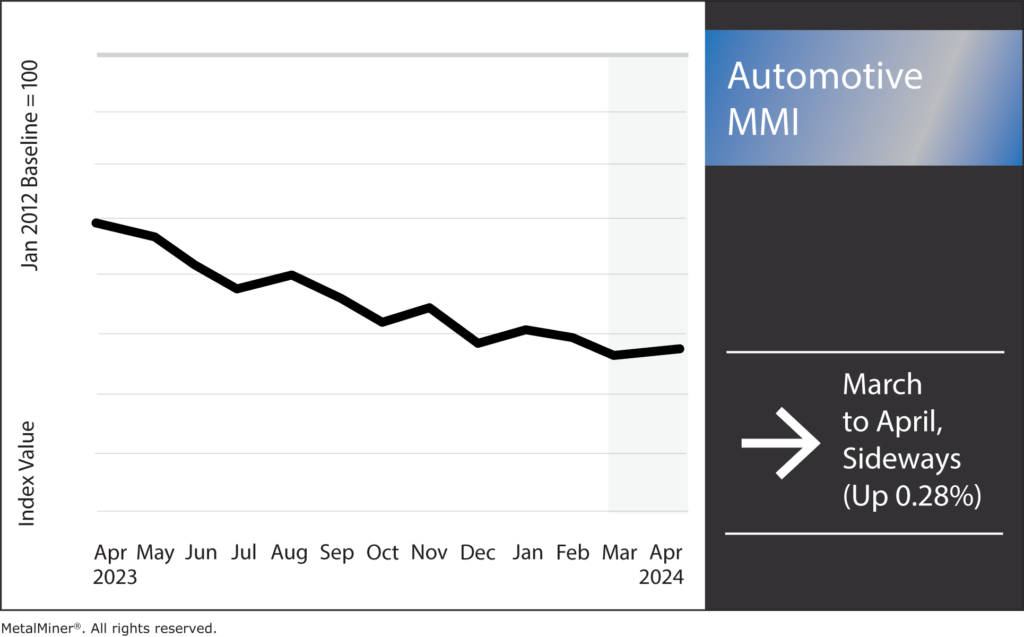

Month-over-month, the Automotive MMI (Monthly Metals Index) exhibited little movement. The index trended sideways, only moving up a slight 0.28%. However, recent events continue to raise questions about the future of the industry, especially where automotive imports are concerned.

Despite the index itself not witnessing much movement, individual components of the index saw much more price movement than last month. This includes palladium, copper, and shredded scrap steel. Despite this, firm sideways movements from other components like lead and hot dipped galvanized steel kept the overall index flat. However, the real talk of the town is the shutdown of the Baltimore port in the aftermath of the Francis Scott Key bridge collapse. With Baltimore being one of the top ports in the U.S. for automobile imports, how will this impact the U.S. automotive industry?

Stay posted on the Baltimore port shutdown, as well as other valuable import and commodity news. Sign up for MetalMiner’s free weekly newsletter and gain access to timely insights that will help your business.

How the Baltimore Port Shutdown Could Affect U.S. Automotive Imports

The recent collapse of the Francis Scott Key Bridge in Baltimore has rocked the U.S. car sector. Experts worry that car prices may increase due to supply chain disruptions brought on by the shutdown of this crucial port.

As a vital component in the U.S. car supply chain, the Port of Baltimore is one of the top sites for automotive imports, especially from Asia and Europe. Karl Brauer, executive analyst at iSeeCars.com, recently commented, “There are a number of considerations, but two important ones are the duration of the port’s shutdown and the capacity of other ports. The degree to which a particular brand depends on Baltimore for supply chain and vehicle shipping is one of the additional considerations.”

A Logistics Nightmare for Automotive Imports

Automobile makers are rushing to find alternate routes for their automobiles due to the port’s partial paralysis. For this reason, experts anticipate a cascading impact, with heightened activity in other ports on the East Coast, such as Philadelphia, Virginia, and New York.

The logistical difficulties involved in rerouting supplies continue to exacerbate the problem. Certain parts of the port are still open, but those that handle European imports (like BMW and Volkswagen), could see massive slowdowns.

According to the University at Buffalo, the situation calls for extra transportation like trucks and trains to help circumvent the impact. However, this may raise expenses and put more pressure on the already burdened transportation industry.

Consumers Expected to Feel the Blow the Most

All of these factors mean that car could climb for consumers. Dealership sticker prices may rise due to additional expenses incurred from rerouting shipments, delays and shortages of available new cars. Although the entire effect on prices remains unknown, consumers who are already concerned about inflation and potential supply chain problems should take note.

For many, the collapse of the bridge is a sobering reminder of how interwoven the world economy remains. A single breakdown in Baltimore’s infrastructure could cause far-reaching effects for dealerships, customers, and the nation’s overall logistics industry. The car sector is left waiting for the vital port of Baltimore to reopen in order to ensure a seamless transatlantic vehicle flow as the crisis plays out.

Automotive MMI: Noteworthy Price Shifts

Unlock immediate savings, build a robust category portfolio, and secure a competitive edge for years to come with accurate price forecasting. Learn more about MetalMiner Insights.

- Hot dipped galvanized steel moved sideways, dropping by just 2.02%. This left prices at $1,213 per short ton

- Chinese lead price also moved sideways, increasing just 2.71% to $2,254.06 per metric ton

- Finally, Korean aluminum 5052 coil premium over 1050 also moved sideways, declining by 1.48%. This left prices at $3.78 per kilogram