Australia’s iron ore industry faces a major challenge, and if the country does not take corrective course action soon, it risks losing its position as the largest exporter of iron ore. This would have a significant impact on the nation’s industry, and its ability to affect the iron ore price.

The challenge is the “changing color of steel,” as one expert put it. According to Magnetite Mines Ltd Chief Executive Tim Dobson, future demand will favor iron ore producers capable of efficiently and sustainably purifying ore at the lowest cost. That, Tim says, could be either an opportunity or a disaster for Australia. Indeed, countries like Brazil and Guinea, along with a handful of other African countries, remain poised to enter the void left by Australia should the nation fail to meet this new demand.

Iron ore, Australia’s primary export, fueled significant economic expansion for years. Over the last two decades, its contribution to the nation’s gross income zoomed upward from just approx. U.S. $5.2 billion (A$8 billion) in 2005 to about U.S. $80.7 billion (A$124 billion) today. But as the rest of the world moves on to a green economy, Australia needs to quickly align its production values to meet demand for “purer,” high-grade ore.

Get comprehensive price forecasting for steel, nickel, copper and aluminum for the duration of 2024. Download a sample copy of MetalMiner’s Annual Metals Outlook: March 2024 update here.

Why China Continues to Look at Other Markets

Even China, the largest importer of Australian iron, recently expressed its keenness to go green. Domestically, the Chinese government issued mandates for the steel industry to cut emissions, aligning with China’s broader “dual carbon” objectives. These mandates aim for emissions to reach their peak before 2030, with the country striving for carbon neutrality by 2060. Moreover, forthcoming tariffs on carbon-intensive steel imports at the international level remain poised to elevate the costs associated with producing environmentally unfriendly “dirty” steel.

Accounting for between 6 and 9% of all global emissions, steel production requires large amounts of heat to transform iron ore into usable steel. Moreover, higher ore impurity necessitates more extensive smelting processes to meet quality standards. Yet, relying on coal combustion to fuel these furnaces is not a viable option in the long term, especially given concerns that global warming already surpassed the 1.5°C threshold.

In 2022, Australia exported 736 million tons of iron ore to China, which comprises about 80% of its total ore exports. And while efforts remain underway to address these challenges, the quality of Australian iron is still a significant problem.Obviously, producing steel from low-grade iron is not environmentally friendly. Not only does the process consume huge amounts of energy, but the high degree of impurities also cuts down the efficiency of the manufacturing process.

Don’t let falling metal demand cost you money. Learn how to generate savings in falling demand markets.

As the Iron Ore Price Drops, Australia Must Compete with West Africa

According to this report, iron ore exports fetched Australia U.S. $131 billion last financial year, but analysts expect that figure to fall to about $100 billion from 2024 to 25. The report also quoted RMIT University lecturer and Wuhan University of Science and Technology adjunct professor Dr. Charlie Huang as saying Australia’s competitors like Brazil and Guinea could soon become the supplier of choice for the global steel industry.

China clearly indicated its intentions concerning iron ore in this report by The South China Morning Post. It states that the coastal African nation of Sierra Leone, though small will continue to play a significant role in China’s expansive agenda to diversify its sources of iron ore beyond Australia and Brazil. Beijing also aims to mitigate supply risks by tapping into resources from other West African nations like Guinea, Liberia, Cameroon, and Congo-Brazzaville.

Massive Iron Ore Plant Breaks Ground

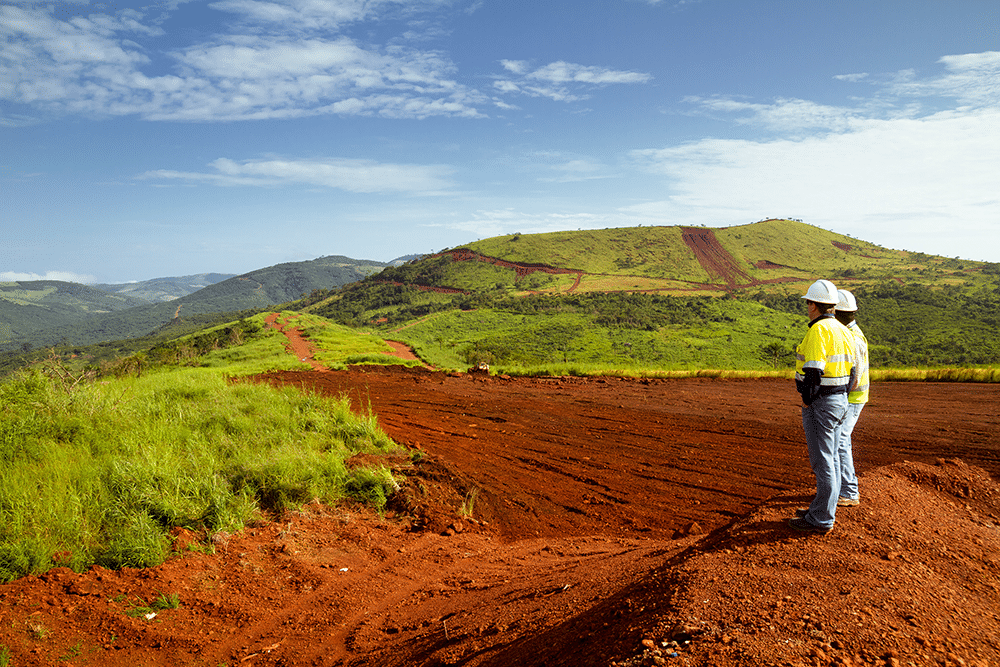

There is currently a 12 million-ton iron ore processing plant under construction at the Tonkolili iron ore mine in Sierra Leone’s northern province. The U.S. $230 million project belongs to Leone Rock Metal Group, a subsidiary of Chinese mining and metals firm China Kingho Energy Group. Reports indicate that the Tonkolili mine boasts an estimated reserve of 13.7 billion tons of iron ore.

Across the border in Guinea, Chinese investors, in collaboration with the British-Australian mining conglomerate Rio Tinto, will soon execute the inaugural shipment from the Simandou mine. Experts recently dubbed Simandou the largest-known undeveloped high-grade iron ore mine in the world. Chinese state-owned enterprises such as steelmaker Baowu Group have already committed investments to this monumental project, which reportedly boasts an annual production capacity of 120 MT.

Start saving on COGS. Explore MetalMiner’s full metal catalog and start getting metal price forecasts custommized to your specific metal types and forms.