- The Yellowhead Mainline will support energy, petrochemical, building materials and hydrogen projects that use natural gas and carbon capture technology to produce products that the world demands with lower emissions than previously possible.

- The Yellowhead Mainline will also reinforce the natural gas network and contribute to energy security for Alberta’s growing population and industries.

- The project is expected to create thousands of direct jobs during construction and enable more than $20 billion of investment and associated employment in Alberta by customers, including Dow’s Path2Zero project, while providing additional market access to producers.

- With the announcement of the Yellowhead Mainline project, ATCO Energy Systems is updating its three-year capital investment guidance.

Canadian Utilities Limited is announcing a new energy infrastructure project that is expected to be a significant driver of lower-carbon economic growth in Alberta. The Yellowhead Mainline project will expand the capacity and enhance the efficiency of the province’s natural gas network, connecting natural gas producers to key markets and delivering the energy required for Alberta’s growing population.

“As Alberta’s energy demand continues to grow, the Yellowhead Mainline will play a crucial role in reinforcing Alberta’s energy infrastructure and enhancing access to reliable energy from one of the cleanest sources of natural gas on the planet,” said Wayne Stensby, Chief Operating Officer, ATCO Energy Systems. “Canadian Utilities has been delivering safe, reliable and affordable energy for more than 100 years and we are excited to embark on this new landmark infrastructure project which we expect to contribute to a prosperous future for Albertans in the decades to come.”

The project is expected to create approximately 2,000 jobs during construction and will provide gas supply for the more than $20 billion of investment and associated employment in Alberta by our customers, including the Dow Fort Saskatchewan Path2Zero project.

“Dow appreciates the partnership with ATCO to supply Dow’s Path2Zero project. Together these projects will have a profound positive impact on communities, creating jobs and economic opportunity for Alberta,” said Diego Ordonez, President, Dow Canada. “Collaboration with government officials, the community of Fort Saskatchewan, our Indigenous neighbors, and the host of partner companies such as ATCO have been key to enabling Dow’s investment to move forward.”

The project consists of building approximately 200 kilometres of high-pressure natural gas pipeline and related control and compression facilities that will run from Peers, Alberta, to the northeast Edmonton area. Total investment for the project is expected to exceed $2 billion, with more precise cost estimation subject to further refinement of project scope, route and detailed engineering. The expansion is expected to have the capability to deliver about 1,000 terajoules (or 1 billion cubic feet) per day of incremental natural gas delivery capacity and is planned to be on-stream in Q4 2027 with construction expected to commence in 2026, subject to regulatory and company approvals.

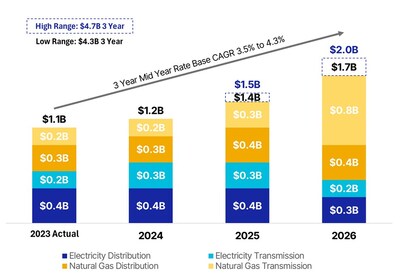

As disclosed in Canadian Utilities’ Management’s Discussion and Analysis for the year ended December 31, 2023 (2023 MD&A), ATCO Energy Systems made capital expenditures of $1,213 million ($1,130 million excluding International Natural Gas Distribution) and capital investments1 of $1,219 million ($1,136 million excluding International Natural Gas Distribution) in 2023. In the 2023 MD&A, guidance was provided that suggested that ATCO Energy Systems (excluding International Natural Gas Distribution) expected to make capital investments of between $3.8 to $4.5 billion over the three-year period from 2024-2026. With the announcement of the Yellowhead Mainline project, ATCO Energy Systems is updating its capital investment guidance.

As shown below, ATCO Energy Systems now expects its capital investment to be in the range of $4.3 to $4.7 billion over the same three-year period. This results in an expected three-year mid-year rate base compound annual growth rate (CAGR) 2 of between 3.5 to 4.3 per cent. ATCO Energy Systems continues to maintain its longer-term mid-year rate base growth outlook of 4 to 5 per cent.

Canadian Utilities Limited and its subsidiary and affiliate companies have approximately 9,000 employees and assets of $23 billion. Canadian Utilities, an ATCO company, is a diversified global energy infrastructure corporation delivering essential services and innovative business solutions. ATCO Energy Systems delivers energy for an evolving world through its electricity and natural gas transmission and distribution, and international operations segments. ATCO EnPower creates sustainable energy solutions in the areas of renewables, energy storage, industrial water and clean fuels. ATCO Australia develops, builds, owns and operates energy and infrastructure assets. ATCOenergy and Rümi provide retail electricity and natural gas services, home maintenance services and professional home advice that bring exceptional comfort, peace of mind and freedom to homeowners and customers. More information can be found at www.canadianutilities.com.

Investor & Analyst Inquiries:

Colin Jackson

Senior Vice President, Finance, Treasury & Sustainability

Colin.Jackson@atco.com (403) 808 2636

Media Inquiries:

Kurt Kadatz

Director, Corporate Communications

Kurt.Kadatz@atco.com

(587) 228 4571

Forward-Looking Information Advisory

Certain statements contained in this news release constitute forward-looking information. Forward-looking information is often, but not always, identified by the use of words such as “anticipate”, “plan”, “estimate”, “expect”, “may”, “will”, “intend”, “should”, “goals”, “targets”, “strategy”, “future”, and similar expressions. In particular, forward-looking information in this news release includes, but is not limited to, references to: anticipated benefits to be generated by the Yellowhead Mainline project, including driving economic growth, supporting energy, petrochemical, building materials and hydrogen projects, reinforcing Alberta’s natural gas network, contributing to energy security for Albertans, significant job creation, additional market access for producers, and expanded capacity and enhanced efficiency of Alberta’s natural gas network; the anticipated size, specifications and incremental natural gas delivery capacity of the Yellowhead Mainline project; the expectation that construction on the Yellowhead Mainline project will commence in 2026 and the project will be on-stream as early as Q4 2027; expected capital investment; expected growth of energy demand; expected emissions reductions; and the expected three year mid-year rate base CAGR for ATCO Energy Systems.

Although the Company believes that the expectations reflected in the forward-looking information are reasonable based on the information available on the date such statements are made and processes used to prepare the information, such statements are not guarantees of future performance and no assurance can be given that these expectations will prove to be correct. Forward-looking information should not be unduly relied upon. By their nature, these statements involve a variety of assumptions, known and unknown risks and uncertainties, and other factors, which may cause actual results, levels of activity, and achievements to differ materially from those anticipated in such forward-looking information. The forward-looking information reflects the Company’s beliefs and assumptions with respect to, among other things, the growth of energy demand; inflation; the development and performance of technology and technological innovations; continuing collaboration with industry participants, business partners, regulatory bodies and environmental groups; the performance of assets and equipment; the ability to meet current project schedules; and other assumptions inherent in management’s expectations in respect of the forward-looking information identified herein.

The Company’s actual results could differ materially from those anticipated in this forward-looking information as a result of, among other things, risks inherent in the performance of assets; capital efficiencies and cost savings; applicable laws, regulations and government policies; regulatory decisions; competitive factors in the industries in which the Company operates; prevailing market and economic conditions; credit risk; interest rate fluctuations; the availability and cost of labour, materials, services, and infrastructure; future demand for resources; the development and execution of projects, including projects not proceeding on schedule or at currently estimated budgets; prices of electricity, natural gas, natural gas liquids, and renewable energy; the development and performance of technology and new energy efficient products, services, and programs including but not limited to the use of zero-emission and renewable fuels, carbon capture, and storage, electrification of equipment powered by zero-emission energy sources and utilization and availability of carbon offsets; risks related to the activities of other industry participants, customers, counterparties and/or stakeholders; the termination or breach of contracts by contract counterparties; the occurrence of unexpected events such as fires, floods, extreme weather conditions, explosions, blow-outs, equipment failures, transportation incidents, and other accidents or similar events; global pandemics; geopolitical tensions and wars; and other risk factors, many of which are beyond the control of the Company. Due to the interdependencies and correlation of these factors, the impact of any one material assumption or risk on a forward-looking statement cannot be determined with certainty. Readers are cautioned that the foregoing lists are not exhaustive. For additional information about the principal risks that the Company faces, see “Business Risks and Risk Management” in the 2023 MD&A.

This news release contains financial outlook information, which is subject to the same assumptions, risk factors, limitations and qualifications set forth above. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise or inaccurate and, as such, undue

reliance should not be placed on such financial outlook information. The Company’s actual results, performance and achievements could differ materially from those expressed in, or implied by, such financial outlook information. The Company has included such information in order to provide readers with a more complete perspective on its future operations and its current expectations relating to its future performance. Such information may not be appropriate for other purposes and readers are cautioned that such information should not be used for purposes other than those for which it has been disclosed herein. The financial outlook information that is contained herein was approved and made as of the date of this news release.

Any forward-looking information contained in this news release represents the Company’s expectations as of the date hereof, and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by applicable securities legislation.

|

_____________________________ |

|

1 Capital investment is a non-GAAP financial measure that is defined as cash used for capital expenditures, business combinations, and cash used in the Company’s share of capital expenditures in joint ventures. The most directly comparable financial measure that is disclosed in the Company’s financial statements is capital expenditures. Capital expenditures include additions to property, plant and equipment and intangibles as well as interest capitalized during construction. Capital investment is not a standardized financial measure under the reporting framework used to prepare the Company’s financial statements. Capital investment may not be comparable to similar financial measures disclosed by other issuers. For additional information, see “Other Financial and Non-GAAP Measures” and “Reconciliation of Capital Investment to Capital Expenditures” in the 2023 MD&A, which is available on SEDAR+ at www.sedarplus.ca. The referenced sections of the 2023 MD&A are incorporated by reference herein. |

|

2 Mid-year rate base is equal to total net capital investment less depreciation. Growth in mid-year rate base is a leading indicator of a utility’s earnings trend, depending on changes in the equity ratio of the mid-year rate base and the rate of return on common equity. Mid-year rate base CAGR is not a standardized financial measure under the reporting framework used to prepare the Company’s financial statements and may not be comparable to similar financial measures disclosed by other issuers. |

SOURCE Canadian Utilities Limited

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2024/08/c6346.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2024/08/c6346.html

Share This: