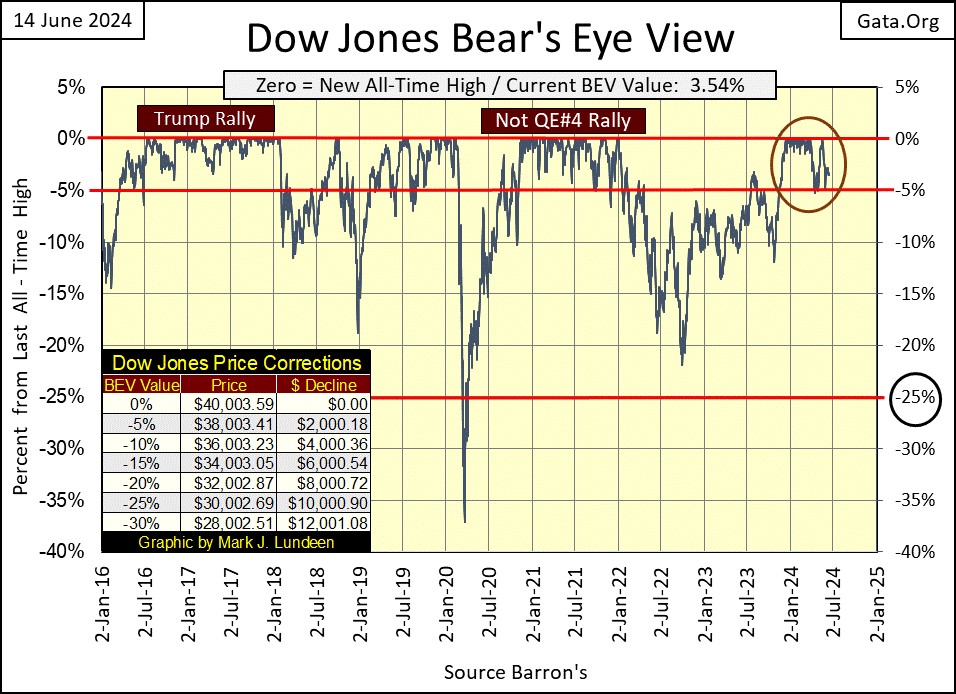

What’s to say about the Dow Jones at this week’s close? It is still in scoring position in its Bear’s Eye View chart below. For that reason, it’s best assuming the advance that began last November, when the Dow Jones first closed in scoring position (inside of circle), continues. Looking at the market action inside the circle, the Dow Jones was making new all-time highs (0% = BEV Zeros) fast and furiously from December 13th to February 23rd, twenty-one of them. Things have slowed down since late winter, with only five additional BEV Zeros since then, for a total of twenty-six so far in this advance.

Just keep in mind, things will change in the market, and it’s hard predicting the future. Maybe, the next big thing for the Dow Jones will be a new surge of BEV Zeros in its BEV chart below. Then maybe, twenty-six BEV Zeros is all this advance is good for.

So, what do I think will happen next? I don’t know. What I do know is; for as long as the Dow Jones closes daily inside of scoring position in its BEV chart below (-0.01% to -4.99%), its best assuming the advance that began last November will continue.

That’s my story, and I’m sticking to it. That plus until the Dow Jones closes below its BEV -10% line, or maybe just its BEV -7% line, I’ll remain short-term bullish on the stock market.

Keep in mind, this bull market in the Dow Jones began in August 1982, when it last closed below 800. Forty-two years later, it has broken above 40,000.

This has been a massive bull market, fueled by an ocean of “liquidity” flowing from the Federal Reserve System. For that reason, expecting the following bear market will be just as massive is a logical assumption.

And why would that be? Because; “liquidity” flowing from the Federal Reserve = someone, or something is taking on debt, debt that must be serviced. The ability of the Federal Reserve to pump their “liquidity” into the economy is infinite, unlimited, as they can issue as many dollars of debt, as there are stars in the universe, effortlessly. But for those assuming that debt, their ability to service that debt is not infinite. Once interest and principal payments exceed income, debt becomes a big problem.

There is a limit to how much debt a consumer, corporation, the government, or an entire economy can service. When an economic entity assumes more debt than they can service, they will default on that debt. Think of bull markets as when the idiots at the FOMC are pumping “liquidity” into the economy, and everyone is taking on debt, and it feels great. Now think of bear markets happening, when the economy (and banking system) discovers it is overwhelmed by servicing this debt, and debt defaults now become the thing driving the economy, and markets downward.

Exiting any bull market within 10% of its absolute top, thus keeping most of your profits, especially for this bull market, would be no small accomplishment for either retail investors, or managed-money professionals. If history is any guide, and it usually is, this is something most people in the market will not be able to do.

That is a shame, as to do exactly that, one only has to exit the market should (when) the Dow Jones closes below its BEV -10% line in its BEV chart above, or 36,000 in the daily bar chart below, and absolutely refuse accepting market risk (buying stocks), until the Dow Jones once again closes above its BEV -5% line (38,000). In other words, at a market top; stay in scoring position, or stay out of the market.

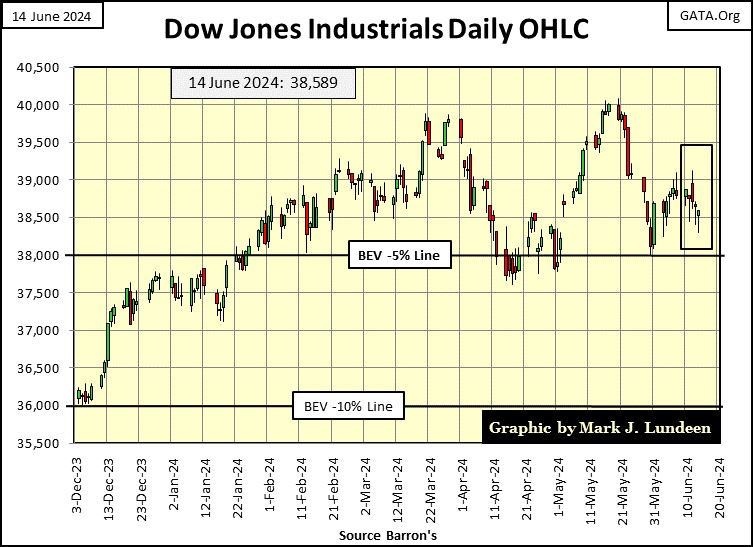

Looking at the Dow Jones in daily bars below, things look a bit more bearish than in its BEV chart above. Two weeks ago, the Dow Jones bounced off its BEV -5% line, then saw a nice gain in the following week. This week, it appears the Dow Jones is once again going to test its BEV -5% line, 38,000 in the weeks to come.

Will 38,000 once again be a level-of-support for the Dow Jones, as it was last April. Or this time, will the Dow Jones fall below 38,000 and keep going down? Before we begin thinking too hard about the Dow Jones rising to new all-time highs, above 40,003, lets see what it first does with 38,000 in the weeks to come. Pondering this situation, next week should be very interesting.

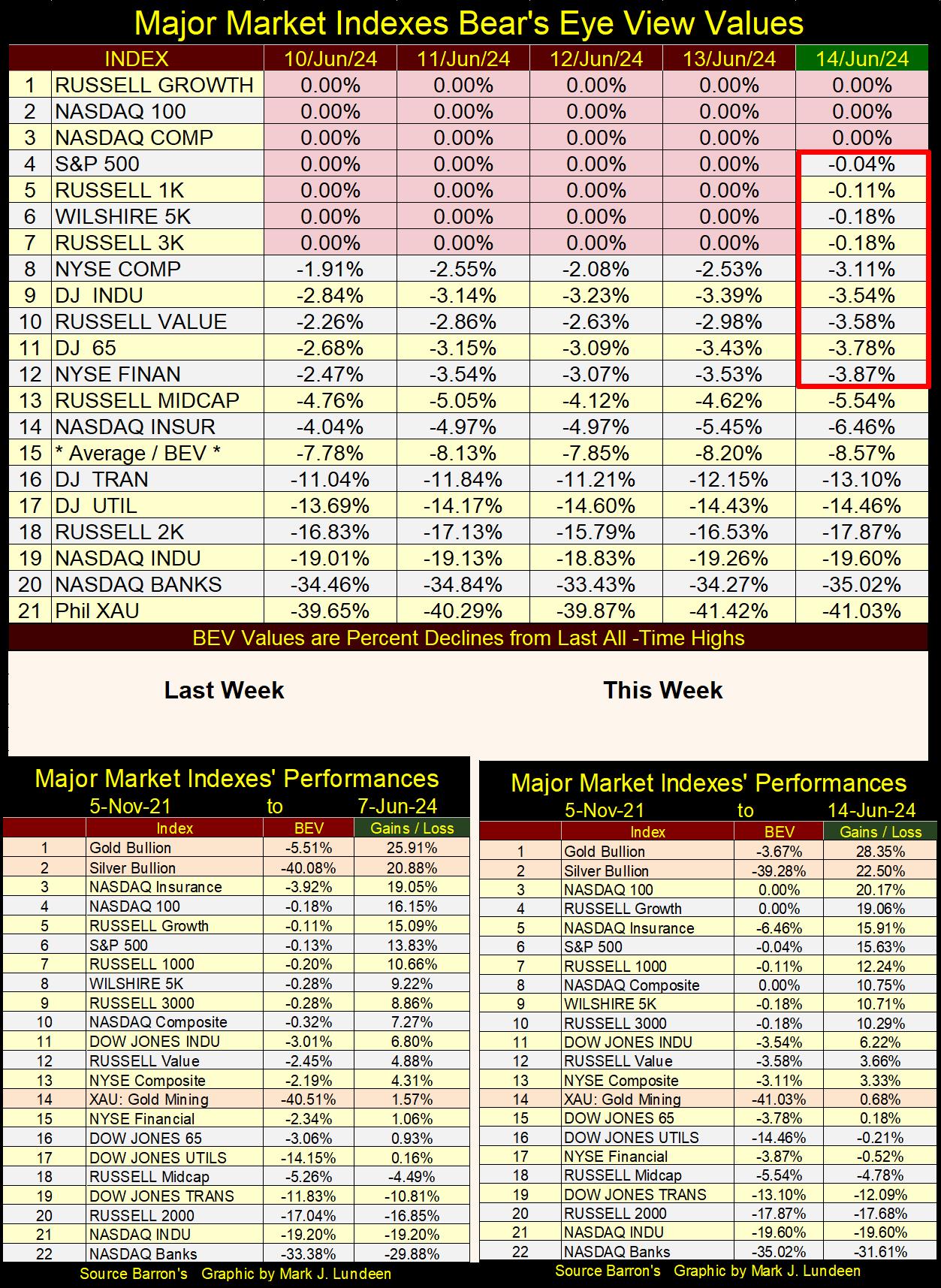

Moving on to my table of major market indexes BEV values below, the stock market at first glance was bullish this week, as seen with all those BEV Zeros in the table. But at the week’s close, the market ended on the weak side, with only three indexes closing with BEV Zeros on Friday. I placed a red box over the indexes closing the week in scoring position. On Friday’s close, the Russell Midcap (#13) and NASDAQ Insurance indexes (#14) were knocked out of scoring position. Not good, but not something to panic about.

If you look at the daily BEV values for these indexes, except for the top three, who saw nothing but new all-time highs all this week, all the other indexes declined from Monday to Friday’s close. This is something to keep an eye on, as this is exactly how a market would top out, if in fact the market is now topping out. But that is something we can’t yet assume.

In the performance tables above, gold and silver kept their #1 & 2 positions, and were up nicely for the week. The XAU, the gold miners were down slightly since last week. In a world plagued with problems spanning from massive monetary inflation, to the US and its toadies in NATO, doing everything possible to provoke nuclear war with Russia, one would think the XAU, as well as gold and silver would be multiples higher than they closed at week’s end.

So, why aren’t they? Most likely it’s a “policy thing.”

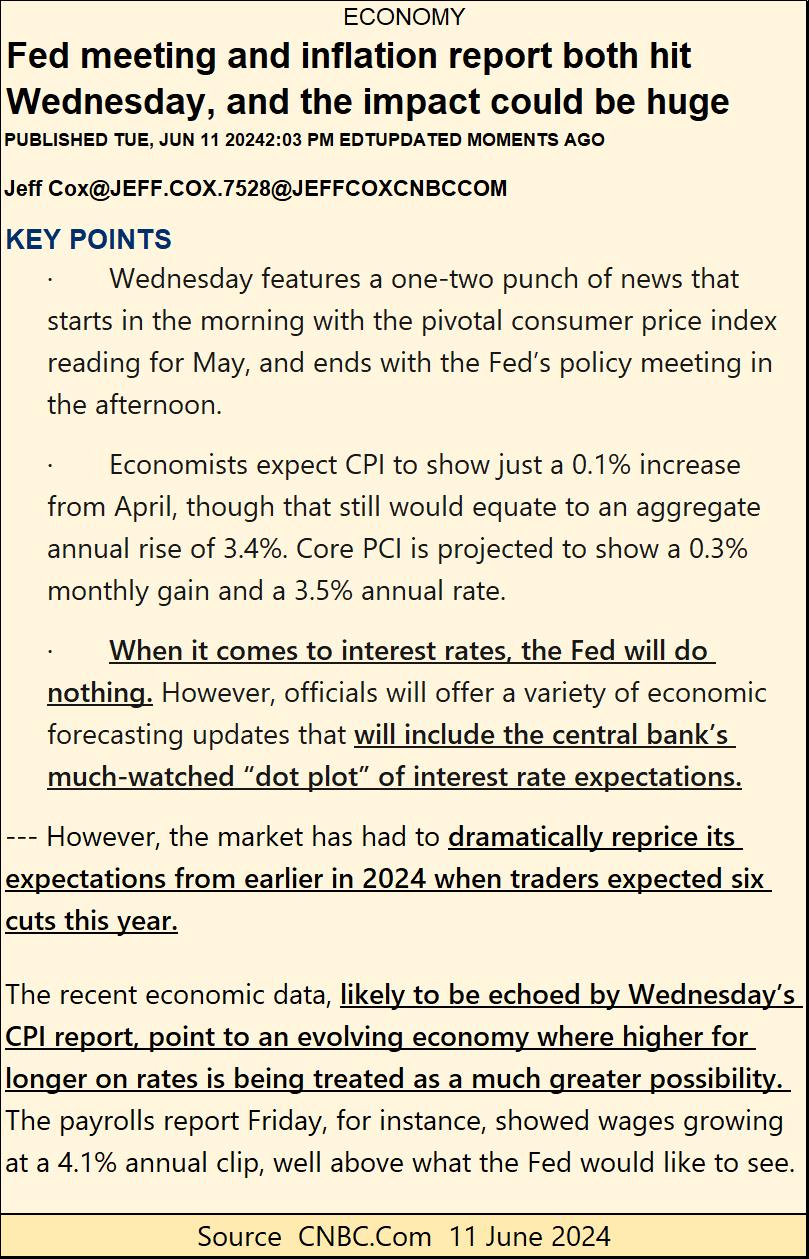

This week, the idiots at the FOMC are holding off on lowering interest rates, see below.

I used to read these FOMC press releases published in the media with some interest, of a “market expert’s” speculation of what the idiots will, or will not do. Now, as my understanding in the ways of “monetary policy” have matured, I now make graphics of these press releases, as seen below, for filler in my weekly articles. If I’m to write about the markets and economy, I have to write about something to generate some paragraphs of text for the week, and the press release below will do nicely.

Looking at the second bullet point, where we see the idiots will use a variety of economic forecasting updates — including the “central bank’s much watched dot plot of interest rate expectations.”

I have to ask myself; what in the hell is a “dot plot of interest rate expectations?” This must be a new gimmick, as it’s something I’ve not heard of before. I imagine this “dot plot” to be something like a Jackson Pollock painting, total confusion confined within the margins of the chart, which normal people would look at in awe, and stunned silence. Of course, it goes without saying the idiots at the FOMC would quickly glance at this “dot plot’s” dots, and with crystal clarity, see future trends in interest rates. Yeah sure, okay; the idiots are so smart, and I’m so dumb.

Let’s see, so far, I have two paragraphs of text commenting on this FOMC press release. I need more. Oh, here is a “fact” from its second bullet point I have to fact-check, as I’m sure this “fact” is in error. This press release states; “When it comes to interest rates, the Fed will do nothing.” It should read: “When it comes to interest rates, the Fed will do nothing constructive.”

Okay, that is paragraph number three.

Do you want more commentary on this FOMC press release? Okay, it says at the bottom that wages are rising at a 4.1% annual clip, well above what the Fed would like to see. No need to fact-check that absolute truth!

* BUT, * and it’s a Big But, the entire point of employing idiots at the FOMC to inflate the money supply, is to steal from wage-earners, old people living on a fixed income, and merchants in the economy, via rising consumer prices. The less for their money, is the more for the government, banking system insiders, and their friends. If it wasn’t for central banking, where would America’s higher education system, the UN and WEF be today?

So, can you see what would be the point of having idiots going through all that trouble, just to then have wages keep up with rising consumer prices?

That isn’t going to happen. The “policy makers” are ripping you off, get used to it!

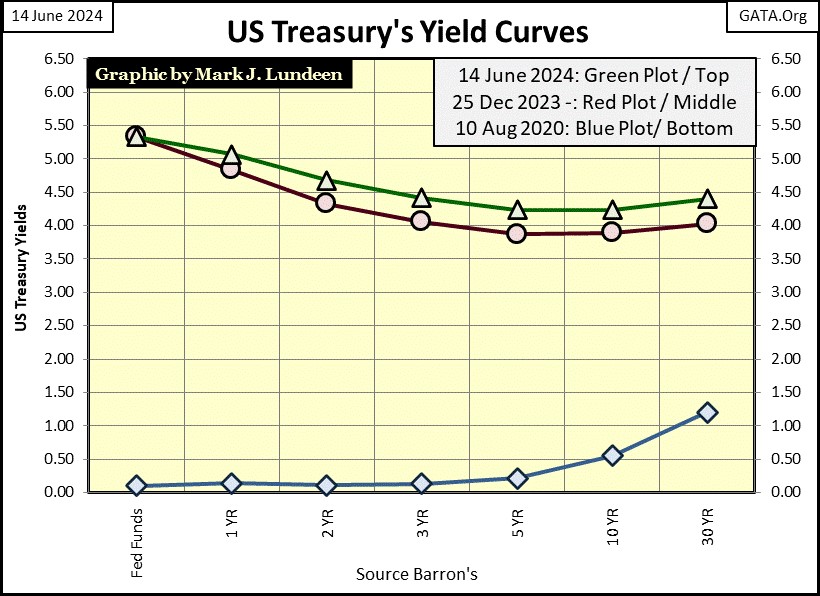

So, why are the idiots struggling with deciding to hold, or lower interest rates? I think a chart of the yield curve will help clarify their predicament. Since December (Red Plot below), bond yields have risen slightly, to where they were at the close of this week (Green Plot), with the FOMC’s Fed Funds rate being nailed on the yield curve, at 5.33% since last summer.

With the Fed Funds Rate fixed at 5.33%, as bond yields rise, the yield curve flattens as seen below, “monetary policy” becomes looser, more accommodating to “economic growth,” which by the FOMC’s Keynesian world’s view, is “inflationary.” To lower rates (the Fed Funds Rate) under the rising bond yields seen below, only makes their hobgoblin of CPI inflation, even more terrifying to them.

Looking at the chart above, I’m thinking the FOMC will do nothing until after the November election, hoping these T-bond yields hold where they are, or begin to decline.

After the November elections, especially if Trump wins, I expect the next big thing in “monetary policy” will be the FOMC increasing short-term rates; raise their Fed Funds Rate to something above 6% to maintain a “tight monetary policy” to fight “inflation.” That could crash the markets, and send the economy into a tailspin. But these people don’t care for Trump, any more than they care for you and me.

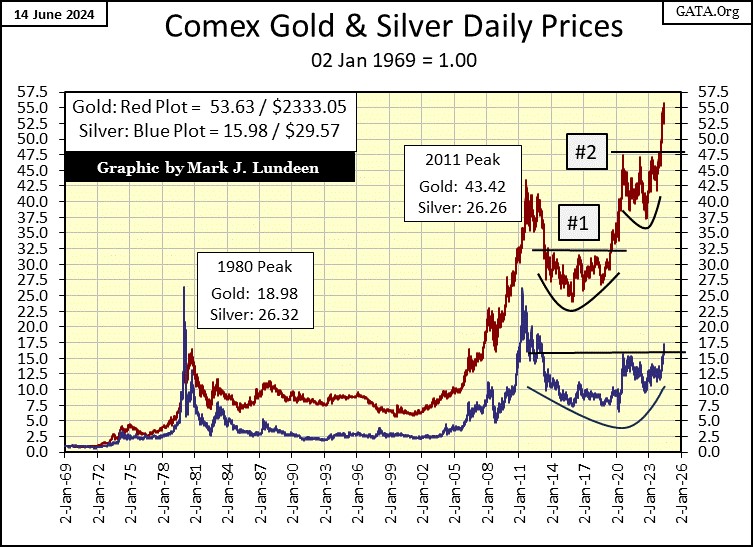

Let’s look at gold’s BEV chart. Like the Dow Jones, since November it has stubbornly refused to stray far from scoring position, making twenty-three new all-time highs in this advance. This is a string of new all-time highs not seen since August 2011, a fact to take note of, that possibly something fundamental in the gold market has changed.

In the gold and silver’s indexed values seen below, it’s been very boring for the past few weeks, as gold and silver take a pause after breaking out of their bowl and break out patterns.

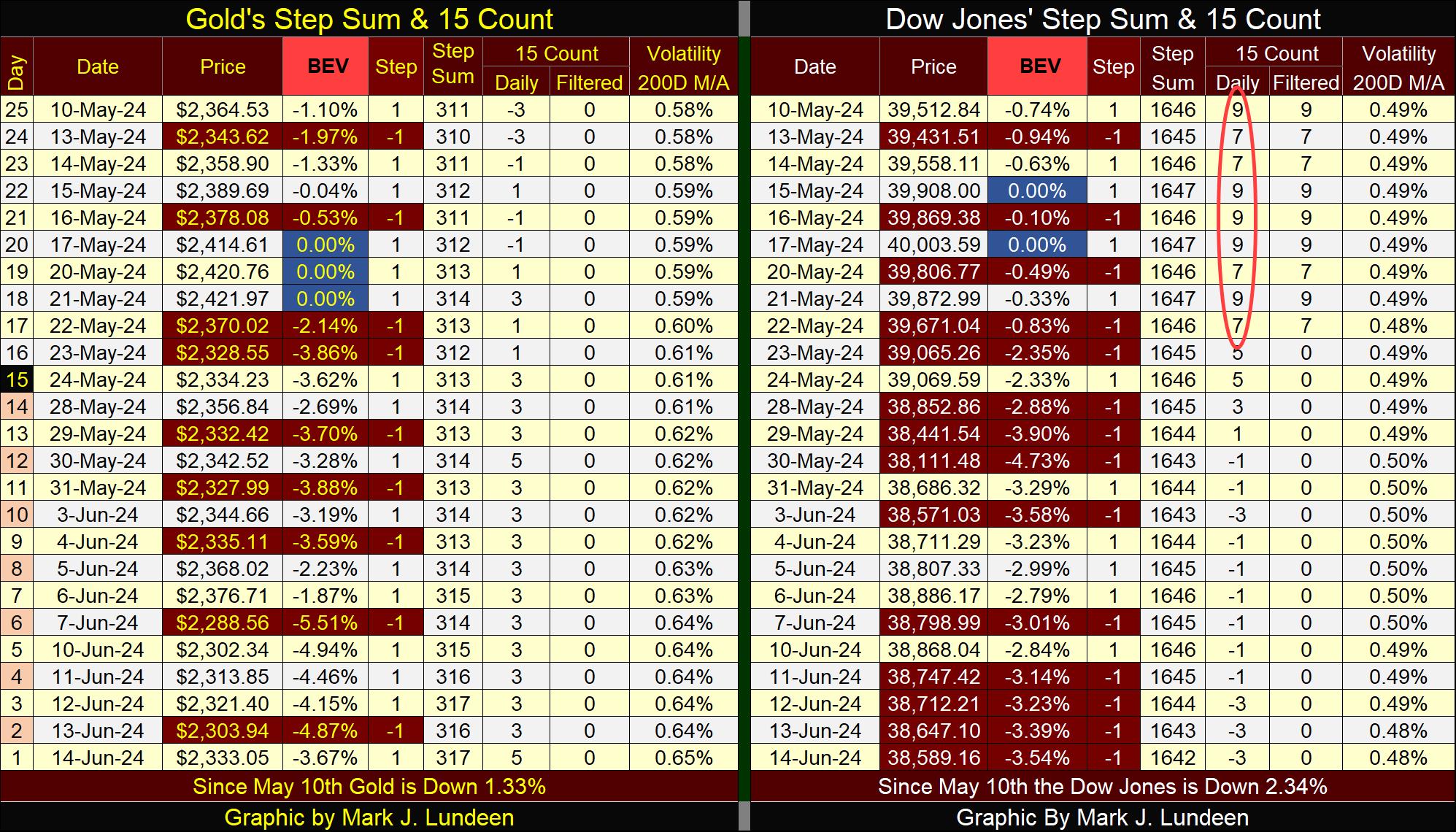

Moving on to gold’s step sum table below, I note how gold last Friday closed BELOW scoring position with a BEV of -5.51%, but bounced back this week, closing the week with a BEV of -3.67%. That is good market action, reason to believe gold wants to rise to new all-time highs in the near-term future. I’m also noting how gold’s daily volatility’s 200D M/A closed the week at 0.65%, up nicely from 0.58% on May 10th. Bull markets in gold and silver are exciting markets, rising daily volatility indicates things are becoming exciting.

On to the Dow Jones side of the table, since its last all-time high on May 17th, when the Dow Jones had a 15-count of +9, making the Dow Jones a very overbought market, the Dow Jones has been overwhelmed by down days. I expected that. With a 15-count of +9, the Dow Jones was very overbought, and markets don’t like being very overbought, and tend to sell off, as we see above.

But, after all those red down days for the Dow Jones, looking at its BEV value on Friday, we see the Dow Jones is down only 3.54% from its last all-time high, which isn’t much. I’m going to take this marginal sell off in the Dow Jones as a sign of market strength. In the weeks to come, once again the Dow Jones will see daily advances overwhelm daily declines. For the bulls out there, its important the Dow Jones makes a few new BEV Zero when it does.

For the record, I’m all for making lots of money in the market. But are we moving into a world that will prohibit us from enjoying our profits, or even enjoying our lives? I look around me, at the world I’m living in, and what I can see, we’re sinking into a New World Order, totalitarian hell hole.

With that thought in mind, I thought I’d republish something I wrote in August 2021, at the height of the Covid vaccination frenzy. I really liked what I wrote three years ago, it’s stood the test of time.

* Start Quote from my 21 August 2021 Article *

Here’s a photo of Earth from space. Edwin Hubble first gazed at the Andromeda Galaxy in the 1920s, through the 100 inch Hooker telescope, discovering it was an entirely different galaxy, distinct and far from our Milky Way galaxy. Science has since pushed back the frontiers of the cosmos, to inconceivable distances from our Earth. Yet for all of that, science has yet to discover anything like the Earth, as the Earth is a living thing. While everywhere else in the cosmos, so far as we can see, is sterile and lifeless.

There are two ways of understanding the Earth. Let’s call them: Inter-Galactic Understanding A, and Inter-Galactic Understanding B.

Inter-Galactic Understanding A: as a follower of Jesus Christ, I base my perceptions of the universe and Earth from the Bible. For example, the following passage from Isaiah.

In other words; God created everything, including the universe. The Earth He created for you and me to live on.

But there are those who vigorously dispute this; you know, the “policy makers,” whose world view is based on “science” rather than “biblical mythology.” Let’s call this, Inter-Galactic Understanding B; which absolutely rules out any possibility of a Creator.

This understanding of the universe chooses to look to the inter-play of the laws of physics, the periodic table, and pure-random chance to explain all we see in the universe, as well as life on Earth.

For we Earthlings, there is a huge difference between understanding A and B. Understanding A types (people like me), by necessity accepts a moral code of conduct. We don’t always follow it, but it’s always there, as is our God. Understanding B types (people like Carl Sagan) recognize a moral code of conduct as a matter of choice, as something they can put on or take off as a situation demands. If there is no God – why not?

I liked Carl Sagan, and really enjoyed his Cosmos programs from the 1980s. But people like Bill Gates and Doctor Fauci, and all too many people at the “policy level” see the world much as Carl Sagan did, and that is not good.

Much of astronomical speculation has to do with life in outer space. It just does, with the general population as well as with astronomers. I find it humorous how a degree in astrobiology, whether a master’s or doctoral degree, comes from a scientific discipline with absolutely nothing to study. “Science” is painfully aware of this; how up to this time, all non-theoretical studies of life, by necessity, are restricted to planet Earth.

The understanding B types find themselves in a vast universe with a critical shortage of life – there is nowhere for them to go. So, they are stuck with tiny little planet Earth. This is the only planet they’ve yet discovered capable of sustaining life, as they very much enjoy it, infested with over seven billion Useless Eaters, or “consumers” as economists like to call them. People who do nothing more than consume Earth’s precious resources, polluting the atmosphere with CO2, as they recklessly reproduce like bacteria in a petri dish.

* What’s a “policy maker” to do? *

I believe the answer to the above question is: whatever it takes.

Neutering the United States, diplomatically and militarily, as well as engineering a total collapse in the global economy via monetary abuses by the global central banking cabal, would solve many “policy issues” our elites wrestle with daily. New, and more drastic covid lockdowns won’t hurt this effort to “save the planet.”

Oh, but that is just a conspiracy theory you say. A few years ago, that’s what I would have thought of the above. Today I’m not so sure.

* End Quote from my 21 August 2021 Article *

Returning to June 2024, these same people are now talking about the “bird flu,” which no doubt will come with its own mRNA vaccine that everyone must take, exactly as the Covid virus required. And exactly how did the Covid vaccine help people? The link below goes to a “consumer” who trusted Dr. Fauci’s “science,” and took it. She now, for good reasons, is having second thoughts about the wisdom of that. There are many people like this, suffering from heart conditions, blood clots, mysterious cancers, and many other maladies. These vaccine victims suffer in silence, as the Main Stream, pro-Vaccine Media has no interest in their suffering.

https://twitter.com/i/status/1613981841140371457

I’ve been watching Alex Jones’ INFO/Wars since 2015, when Trump was first running for President. I knew Jones for being a “conspiracy theorist,” but soon changed my mind when I stopped listening to people talking about him in the MSM, and began listening to him directly. It’s eerie learning just how right he has been for decades now.

I never took the Covid vaccine, as I watched Alex’s INFO/Wars. Beginning in early 2020, Alex used his internet platform to provide air-time for former officials from pharmaceutical companies, and other knowledgeable people, who at great personal costs to themselves, had the moral courage to warn the public of the dangers of the Covid mRNA vaccine, a vaccine that wasn’t a vaccine, but in fact was a gene therapy for unknown purposes.

Alex also gave air-time to doctors and nurses who worked in hospitals, health-care workers who were fired for protesting about what they saw happening – helpless people being murdered by their healthcare system. It says something about the times we now live in, where Sammy “The Bull” Gravano, John Gotti’s former Under-Boss of New York’s Gambino crime family, can honestly say the Governor of New York, Cuomo murdered more people than the Mafia ever did (link below.)

https://youtu.be/AuttlZggGUo?t=99

These people warning the public about the Covid vaccine were available to the MSM, including Fox News, who chose to ignore these now unemployed health-care workers’ testimonies. Instead, the government-controlled media choose to promote the Deep States’ party line; of the need to get everyone vaccinated against the Covid virus. And a trusting public did so.

Here is a video of Alex Jones with Steve Bannon, discussing what will happen to members of the Deep State should Trump become President once again. Massive crimes-against-humanity, and treason by high officials of the United States Government have been committed, while the Main Stream Media provided cover for these criminals. Are we to forget what happened, and live and let live with these monsters? This video is eighteen minutes long, and well worth your time watching it.

Putin has compromising (shocking) videos of Hunter Biden, and is going to release them. Not that you’ll see these videos on CNN or Fox News, media co-conspirators who will do whatever it takes to protect the Biden Family. See link below.

We live in an icky world, and icky is a most appropriate pronoun for the world we live in. The people now “dictating policy,” whether that be monetary, domestic or foreign policy are the absolute worse. It’s not that they are incompetent. In fact, they are very gifted people. My problem with the people at the top of finance, corporate, media and in government, is they are actually evil, people who scheme to bring suffering to the world.

It wasn’t always this way. When America didn’t confuse the Federal Government with God, things may not have been perfect, but they were much better than they are today. For example; the idiots managing “foreign policy,” are now maneuvering the world into a nuclear war with Russia – why? To protect Ukraine from Putin? What??

What is more dangerous to life on planet Earth; rising CO2 levels or a high placed official in the State Department, with a Ph.D. from Harvard or Yale? You tell me.

I finish this week’s article with two quotes, one by Ludwig von Mises, the other by George Washington, who I believe would regret his name now graces the Capital of the United States of America.

Mark J. Lundeen

*********