Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Canada’s Trans Mountain Pipeline expansion project never had a business case that made the slightest sense. Perhaps that’s why its construction project is such a train wreck. In the latest installment of the tragicomedy, TMX — the Crown corporation that owns the dead asset — has requested a route deviation that will delay completion by at least nine months and add costs to the effort.

In the interest of pretending that the details matter for this very black elephant, the construction team found that tunneling was expensive and hard and want to change part of the route south of Kamloops, BC, to a different route where they can use much cheaper and lower risk trenching and covering construction. Naturally, the pathway that the company wants to follow has “profound spiritual and cultural significance” to the First Nations band whose land it would cross, and they aren’t interested in desecrating their land and exposing more of it to dilbit poisoning.

Is it remotely surprising that tunneling is expensive and hard? Err… no.

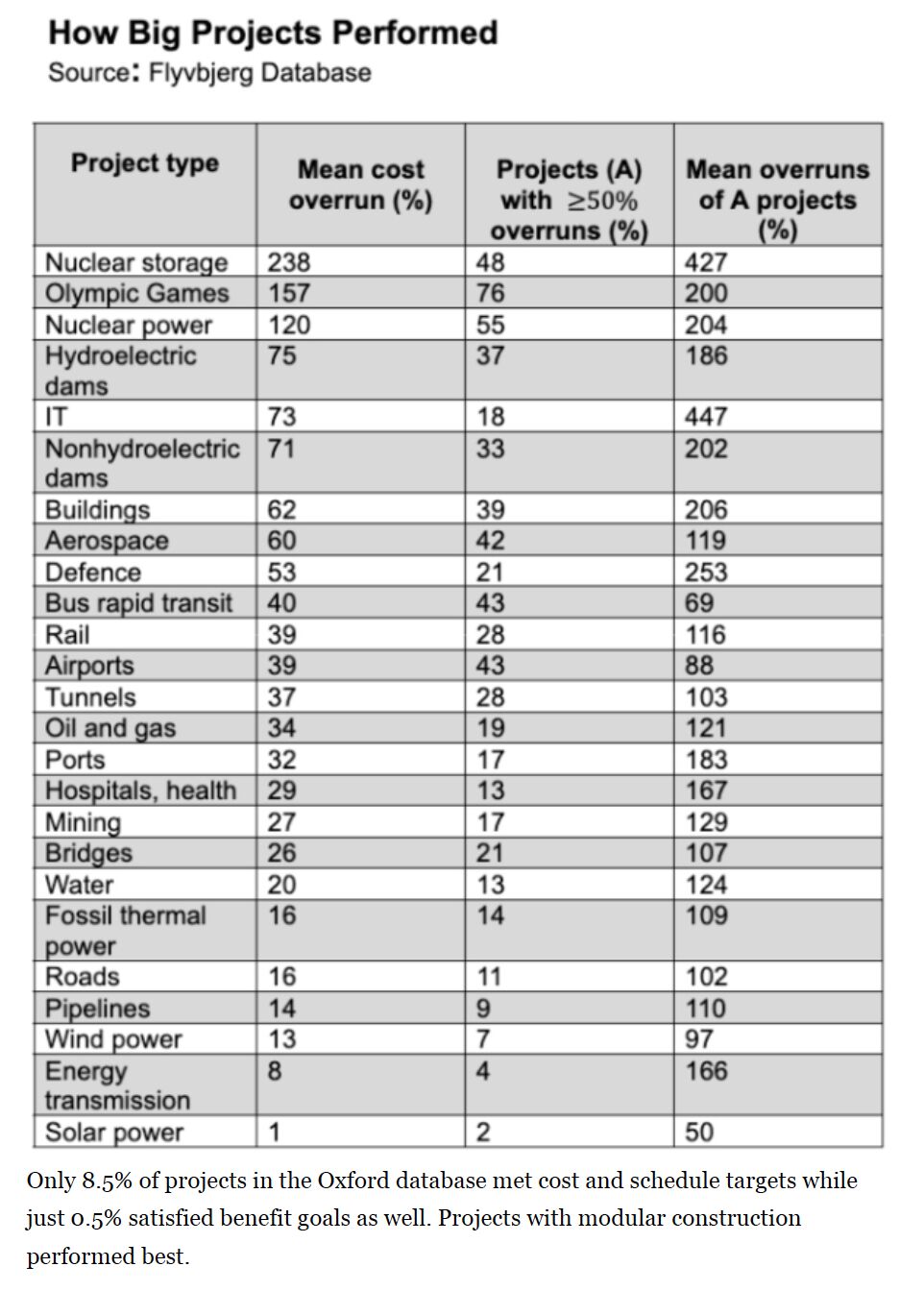

As Professor Bent Flyvbjerg’s published data on over 16,000 projects of over a billion USD in costs shows, anything with tunnels has long-tailed risks. Tunneling is in the middle of the list of 25 categories of projects sort by cost overruns, with those projects having a mean overrun of 37%, and the worst projects having a mean of 103% cost overruns. Anyone investing in the global decarbonization transition should have a copy of Flyvbjerg and co-author Dan Gardner’s great book, How Big Things Get Done, on their Kindle list and a printout of the Coda pinned to their wall, and I would say that even if they hadn’t included some of my material on renewables vs nuclear China in the book.

Assuming Flyvbjerg adds the Trans Mountain Pipeline expansion to his data set, it might push it past airports. After all, the expansion project is currently 300% over budget and climbing. The claim is that this latest delay might only add C$86 million to the cost, but I believe that as much as I believe that there’s a reason for the expansion in the first place.

Let’s cast our minds back to the history of this black elephant for a minute. Alberta has a few problems. A big one is that it’s a long way from oceans and hence markets which aren’t the United States or Western Canada (which has an economy that’s about the size of Ohio’s, so isn’t much of a factor). Another is that its crude isn’t really oil as we understand it, but tar that flows about as well as molasses in January. Another is that the crude is very high in sulfur, which is to say brimstone, the stuff the Christian Bible equates with divine retribution and eternal damnation. Fitting, somehow. Another is that their production costs are really high, as they are basically burning natural gas in absurd volumes to turn water into steam to get the oil sands out from underground where a lot more energy can cleanse the sand from them. Another is that the process of extracting and processing their crude is high in greenhouse gas emissions.

The combination means that without the pipeline, they were facing a US$21 per barrel discount against the Brent crude index, meaning that they got that much less in revenue per barrel. The most recent breakdown I saw was that US$14 of that discount was for the crappy quality of their product, and US$7 was for the cost of transporting it from Alberta to the refineries, mostly in Texas near Houston, where heavy, sour crude is refined.

With high oil prices, they’ve managed to cling to an export market by their fingernails. When oil prices surged again in the middle of the 2010s, they’d been automating operations heavily, and no one was in the business of developing new fields anymore, so the surge was jobless. Hence Calgary having 32% office space vacancy right now, and 19 completely empty office buildings last time I saw a count. They are trying to take those lemons and make lemonade by promoting cheap rents and converting buildings to oddly shaped condos without balconies, but it’s a pretty bitter beverage.

The theory behind the pipeline expansion, which is expected to triple its capacity to 890,000 barrels of oil a day, was that China would be buying all of the crude. Of course, there’s a real problem with that theory, which is that China is electrifying transportation faster than any other country in the world, and transportation is almost the only thing Alberta’s crude is used for, with the exception of asphalt. China has 1.1 million or so electric trucks and buses on its roads. It’s buying (and manufacturing), two-thirds of all electric cars and light trucks sold globally. It has built 40,000 km of high-speed electrified freight and passenger rail and is building 10,000 km more. Most recently, it’s launched a 700-container Yangtze ship with a thousand kilometer route powered solely by containerized batteries, and is launching a twin ship shortly, part of its strategy to electrify all inland shipping.

China’s Sinopec, the world’s largest oil refining, gas, and petroleum products conglomerate, recently announced that peak oil demand had already occurred in China. When the world’s fastest growing major economy, with 5.5% year-over-year GDP growth, is stating that oil demand is now declining, there’s no future market for Canada’s product.

It’s not like there are heavy, crude oil refineries to speak of in China. Canada’s exports of crude to that country collapsed from 2010 to 2020. All of Canada’s product flows southward to the USA, which is also attempting, albeit much more slowly, to pivot away from petroleum for transportation. Southern US refineries were set up to manage heavy, sour crude from Venezuela and Canada, and as US domestic consumption and export markets collapse, those more expensive refineries will be first to decline and shutter.

And it’s not like this was hard to see coming when the pipeline was first proposed, when Kinder Morgan was hesitant about tripling its capacity, when the Canadian government waived federal blockers to it to get the carbon pricing deal through (a reasonable action) or when the federal government bought the pipeline outright (a deeply bad idea).

There are multiple reasons projects fail. Having no reasonable expectation of benefits before the project begins should have been the kiss of death, and clearly was for its previous owners. Putting a linear asset through some of the toughest terrain in the world, hence having high risks related to tunneling and waterways clearly should have bumped up the expected costs and schedule from the beginning. Putting a high-risk pipeline through First Nations lands when many First Nations were strongly opposed to it on reasonable grounds was clearly an opportunity for failure.

And so the failure conditions are coming home to roost. The final cost will be even higher. The start of the meager flow of oil is delayed another year. The costs per barrel to pump dilbit through the black elephant’s trunk will rise even further about what the oil companies are complaining about.

Alberta’s oil firms are getting exactly what they asked for, but what they clearly never needed. And it’s going to cost them and Canadians dearly as a result.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Tesla Sales in 2023, 2024, and 2030

CleanTechnica uses affiliate links. See our policy here.