Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

A new report explores how Europe can successfully build a sustainable battery value chain

Executive summary

As Europe is decarbonising its economy, it is facing a monumental challenge to rebuild the fossil-based system into a carbon free one. Batteries and the materials that go into making them are central to our effort to clean up cars, trucks and buses as well as to expand renewable energy networks. A year ago, as T&E estimated that two-thirds of Europe’s announced battery plans are at risk, the EU announced a raft of measures in response to the US Inflation Reduction Act. So one year on, what does the progress in building battery supply chains look like? This report analyses the progress, as well as challenges associated with onshoring this supply chain, providing an industrial footprint for governments to build a local, resilient and sustainable battery supply chain.

Key findings include:

- Europe can become self-sufficient in battery cells by 2026, and manufacture most of its demand for key components (cathodes) and materials such as lithium by 2030. But over half of gigafactory plans in Europe remain at risk of either being delayed or cancelled, down from close to two-thirds a year ago.

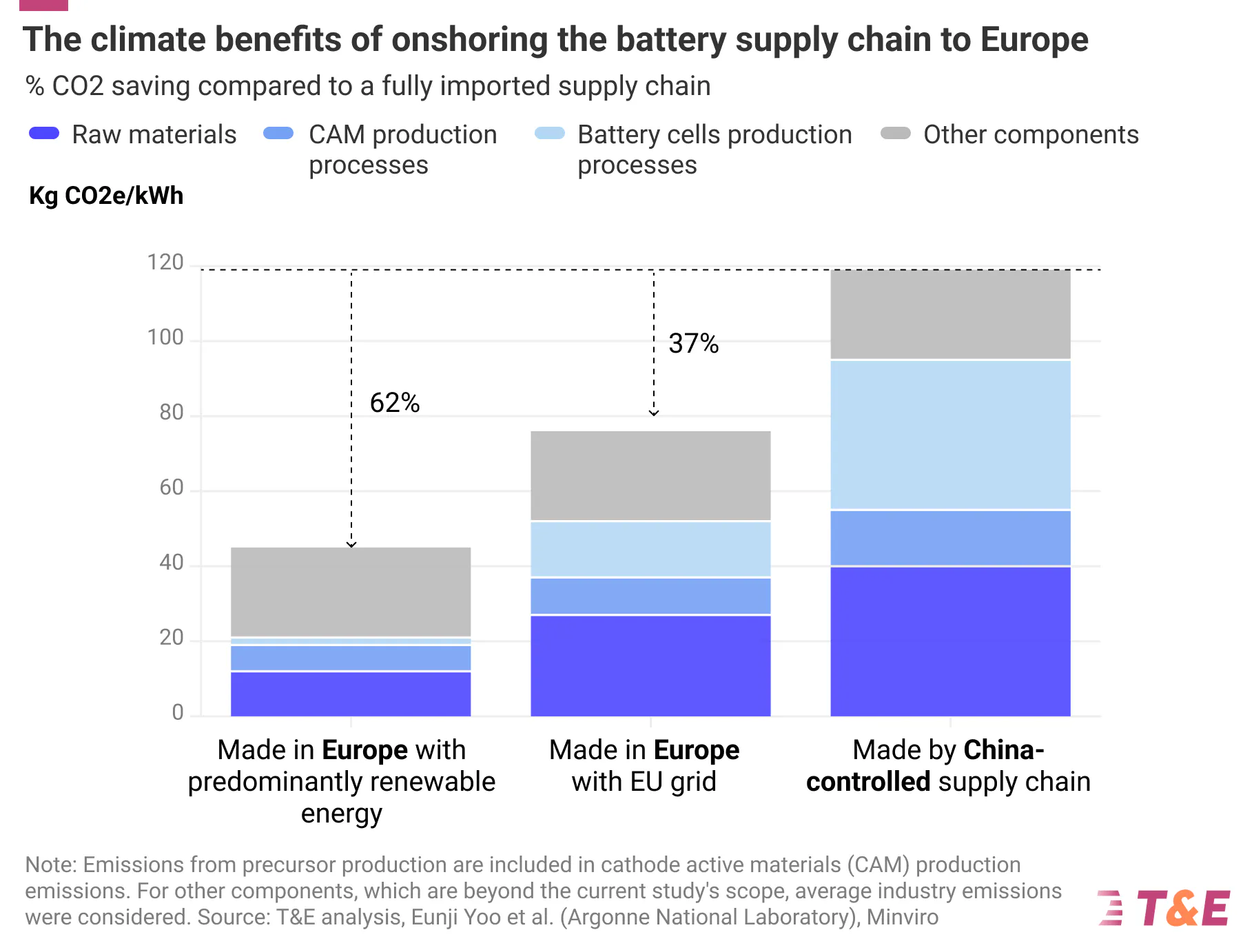

- Onshoring the battery supply chain offers significant climate benefits: 37% reduction in carbon emission when using the EU grid, or 133 Mt of CO2 by 2030 compared to China. When relying on predominantly renewable energy sources, the reductions double to 62%.

- However, many of the announced projects remain uncertain and, given the nascent nature of this industry in Europe, would not happen without stronger government action.

- The industrial policy blueprint should include maintaining the investment certainty (via the 2035 clean car goal), providing EU-level investment support and stronger made in EU provisions for best-in-class projects.

Europe is not starting from scratch. Years of ambitious policy to secure a local electric vehicle market, as well as the efforts of the European Battery Alliance, have resulted in dozens of battery investments and announcements throughout the supply chain.

Chapter 1

Significant local potential exists

Europe is not starting from scratch. Years of ambitious policy to secure a local electric vehicle market, as well as the efforts of the European Battery Alliance, have resulted in dozens of battery investments and announcements throughout the supply chain.

Based on the latest announcements, Europe can:

- Become self-sufficient in local battery cell supply from as early as 2026

- Supply over half (56%) of battery’s most valuable components – cathodes – by 2030, into which critical minerals such as nickel and lithium are processed

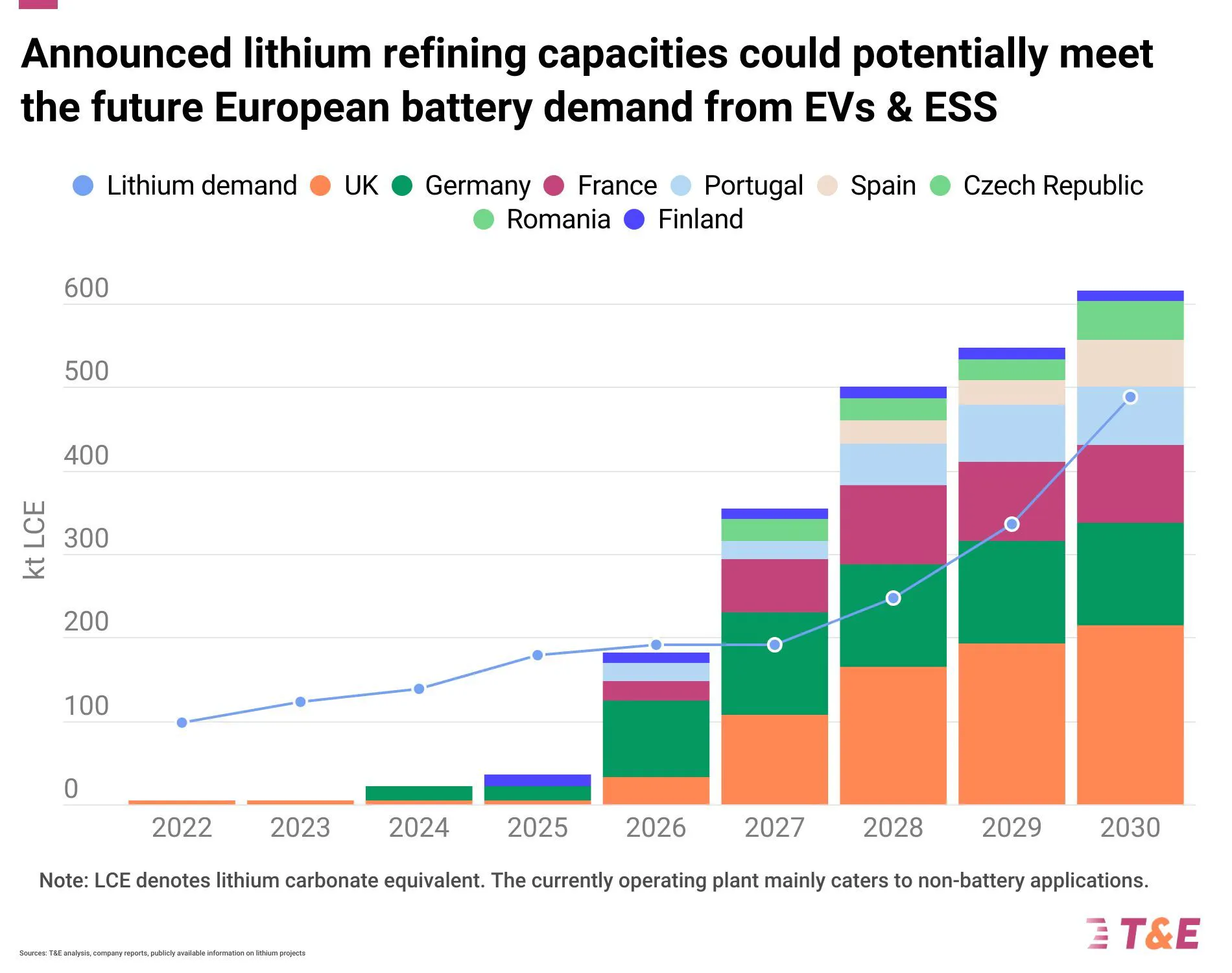

- Supply all of its processed lithium needs by 2030, and

- Secure between 8% and 27% of battery minerals supply from locally recycled sources by 2030.

But these plans are all at different stages of maturity and require long-term political vision and targeted industrial strategy to materialise. On top, Europe is not operating in a vacuum: a fierce “battery arms race” is happening across the world, from China’s overcapacity resulting in imports of cheap EVs and batteries into Europe to growing resource nationalism across the Global South. The risks to Europe’s onshoring ambition are many-fold.

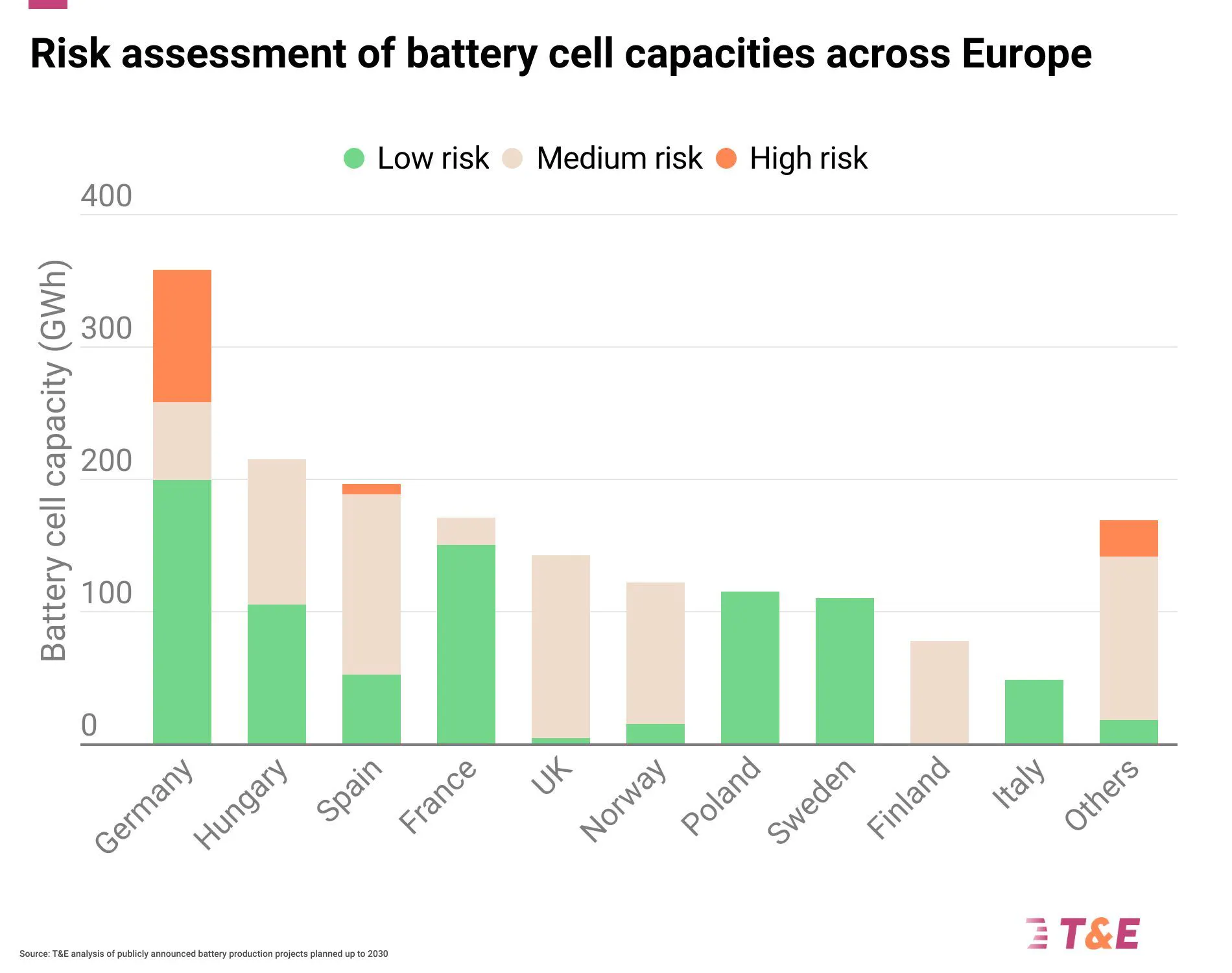

A year since T&E started assessing the viability of battery plans, over half of gigafactory plans in Europe remain at risk of either being delayed or cancelled, down from close to two-thirds a year ago. This is an improvement of 15%. ACC in France kicked off production in the last year, while Northvolt’s second gigafactory in Germany was saved thanks to the German state’s generous subsidy to counter the US IRA. Thanks to a similar support package in France, Verkor is about to start commercial production in France. On the other hand, some companies – notably Freyr and VW’s PowerCo – have downgraded their plans. Overall, the capacities at low risk amount to around 815 GWh, sufficient to power 13.6 million electric cars.

Across Europe, Finland, the UK, Norway and Spain, with projects by the Finnish Minerals Group, West Midlands Gigafactory, Freyr and Inobat, have the highest shares of capacity at high or medium risk. On the other hand, France, Germany and Hungary have made the most progress in securing capacity compared to last year.

Going further mid- and up-stream reveals more risks. While plans to build cathode active material facilities across Europe exist, these have experienced less development than cells, with the region facing critical gaps in terms of project development. These represent over half of the battery’s value with their production almost exclusively concentrated in China today. This highlights the urgency of establishing domestic capabilities to allow Europe to capture the full value chain. But only Umicore in Poland and BASF in Germany have started commercial operations so far, with Northvolt piloting a small batch manufacturing in Sweden. However, in the last 12 months a number of companies, predominantly Chinese, have announced plans to set up cathode facilities on the continent.

Looking at battery metals, lithium refining projects hold high potential for Europe’s self-sufficiency. From a very limited lithium chemicals production today, the announced capacities could cover the region’s needs by 2030. The largest capacities are located in the UK (e.g. Tees Valley Lithium and Green Lithium), Germany (e.g. Vulcan Energy Resources and Livista Energy) and France (e.g. Lithium de France and Imerys). But many of these projects are still in early stages of development. In the nickel space, the existing nickel sulphate plans can potentially cover a fifth of future demand from electric vehicle and energy storage batteries.

Chapter 2

The benefits of onshoring are significant

Onshoring the battery supply chain offers more control over how things are done. Local manufacturing means Europe can set and enforce environmental and social standards, as well as stipulate the effective and meaningful engagement of local communities. Localising the battery value chain can also lead to shorter supply chains and reduced transportation-related emissions, on top of Europe’s relatively high share of renewables to benefit cleaner processes.

From a pure climate perspective, manufacturing some of the more energy intensive and valuable components in Europe will also reduce carbon emissions. Producing battery cells locally compared to China on average saves 20-40% of carbon emissions, while onshoring cathode production would save up to a fifth additionally. Local sources of nickel would be 85-95% lower in emissions than the current supply from Indonesia, while lithium will come with an up to 50% improvement to Australian ore processed in China. Overall, the carbon benefits of onshoring into Europe are in the order of 37% carbon emission reduction based on the EU grid, rising to over 60% when predominantly renewable energy sources are used. Compared to a fully imported supply chain, producing Europe’s demand for battery cells and components locally would save an estimated 133 Mt of CO2 by 2030, comparable to the emissions produced by entire Chile or the Czech Republic in 2022.

Chapter 3

But it won’t be easy

But reaping these climate and industrial benefits will not be easy. Significant challenges in scaling the European battery value chain exist. First, securing the battery raw materials themselves. T&E estimates that the available domestic supply from primary mined and secondary sources can on average cover 35%-70% of end use battery demand (or 45%-100% of cathode processing demand) by 2030, but many mining projects remain uncertain and face local opposition. Ultimately, a global raw materials strategy and sharp diplomacy will be needed to secure the materials for Europe’s ambition with both Europe’s interests and local development goals in mind.

One of the key questions asked is if Europe can develop the expertise and skills necessary to build up this capacity. While some progress has been made on cell making (with over half of Europe’s needs already produced locally by European and Asian companies), the midstream value chain is less certain. However, T&E analysis shows that a lot of innovation and skills are available locally. E.g. much progress is happening in the area of lithium processing, with Europe being one of the leading continents in developing the clean direct lithium extraction technologies (15% of all lithium projects plan to use that), and the first continent that aims to commercialise the cleaner bioheap leaching route for nickel refining (in Finland).

While China undoubtedly has a lead in cathode making, European companies do have the necessary expertise in chemicals and hydrometallurgy necessary to scale this sector. The current efforts are targeting efficiency and process step reduction, as well as using cleaner processes, to cement a European edge. On skills, T&E finds that while there is a shortage of direct metallurgical workers, the adjacent skills can be drawn from the petrochemicals, pharmaceuticals and material science sector among others. Some of these adjacent industries – notably oil and automotive catalysts – are expected to decline in the coming years, so offer a great reskilling opportunity.

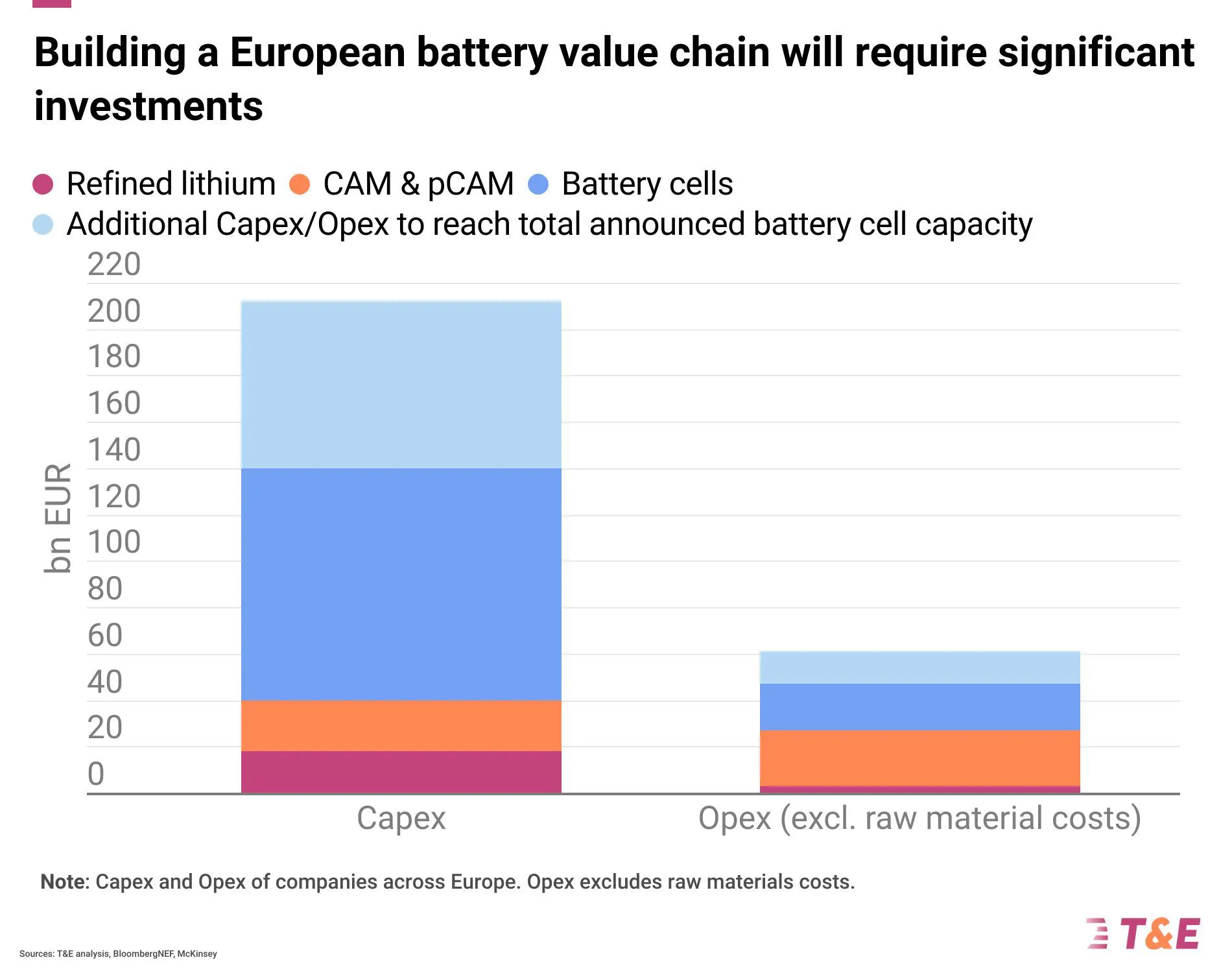

At the same time, both capital expenditure (CAPEX) and running, or operational (OPEX) costs, of building and running battery cell, component and material facilities are some of the highest in Europe. This is due to less expertise building these facilities, as well as due to higher energy and labour costs (at least compared to China). T&E estimates that developing all the announced plans for battery cell manufacturing, cathode and precursor facilities and lithium refining in Europe (including non-EU countries) will require EUR 215 billion in CAPEX and EUR 61 billion in annual OPEX, coming primarily from private investment. If Europe aimed, for example, to match the operational support provided under the US IRA, it would need to provide around EUR 2.6 bn in OPEX support on an annual basis alone.

Chapter 4

Key recommendations

In a nutshell, while the significant potential to build a local and clean battery supply chain exists, the risks are manifold. Without political leadership and strong policies Europe will struggle to create the business case amidst the fierce global competition.

T&E presents its own industrial blueprint for the governments across Europe.

s Europe.

- Clear policy and long-term vision are paramount to secure investment into battery supply chains. This includes the 2025-2035 car CO2 ambition that must remain unchanged, as well as additional ambition to electrify fleets and create a European compact BEV industry.

- Robust policies to secure local manufacturing, away from overreliance on imports. This includes strong sustainability requirements to reward local clean manufacturing (such as the upcoming battery carbon footprint rules), faster implementation of projects under CRMA and NZIA and a revamped trade policy. Crucially, comprehensive investment support will be critical to build the supply chain across Europe, including better instruments under the European Investment Bank and a quickly operationalised EU Battery Fund.

- All of this must be done sustainably, breaking with the past practices in metal supply chains across the world. This means building the global raw material partnerships on high standards and supporting local value add in resource-rich countries. Europe should also commit to bring its own mining practices in line with global best practice, notably on tailings management.

Batteries, and metals that go into them, are the new oil. European leaders will need laser sharp focus, strong and joint up thinking and, above all, stepping out of the comfort zone to succeed. The costs of failing are high and can result in Europe losing out on entire industrial sectors. Some progress has been made in the last year, but the next European Commission and Parliament have a monumental task of finishing the job.

Report courtesy of Transport & Environment

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.