The Aluminum Monthly Metals Index (MMI) experienced a modest rebound, with a 3.84% rise from August to September.

Meanwhile, aluminum prices remain in a sideways trend. Prices appeared to rebound throughout August before they found a peak at the end of the month, though they failed to create a new higher high. Prices continued to zigzag within a wide range throughout September, reaching $2,504/mt as of September 20.

Gain access to expert-driven aluminum market insight, ensuring your company is well-informed and prepared to tackle any type of market fluctuations. Opt into MetalMiner’s free weekly newsletter.

Aluminum Prices Shrug Off Rate Cut

While August warnings of September’s rate cut from the Federal Reserve helped aluminum prices find a bottom, prices have failed to gain enough momentum to form an uptrend. The 50-basis-point cut, the size of which surprised many, failed to inspire the return of investors who withdrew from the market at the end of the Q2 uptrend. Trading volumes showed no meaningful or sustained increase during the month, while open interest showed a modest decline.

Nonetheless, investment funds, whose large positions hold outsized sway over price direction, showed a slight pickup in long bets throughout September. Short bets also increased slightly, albeit to a lesser extent. Should this trend continue, it could offer momentum to currently sideways aluminum prices. However, it remains to be seen whether the momentum will last.

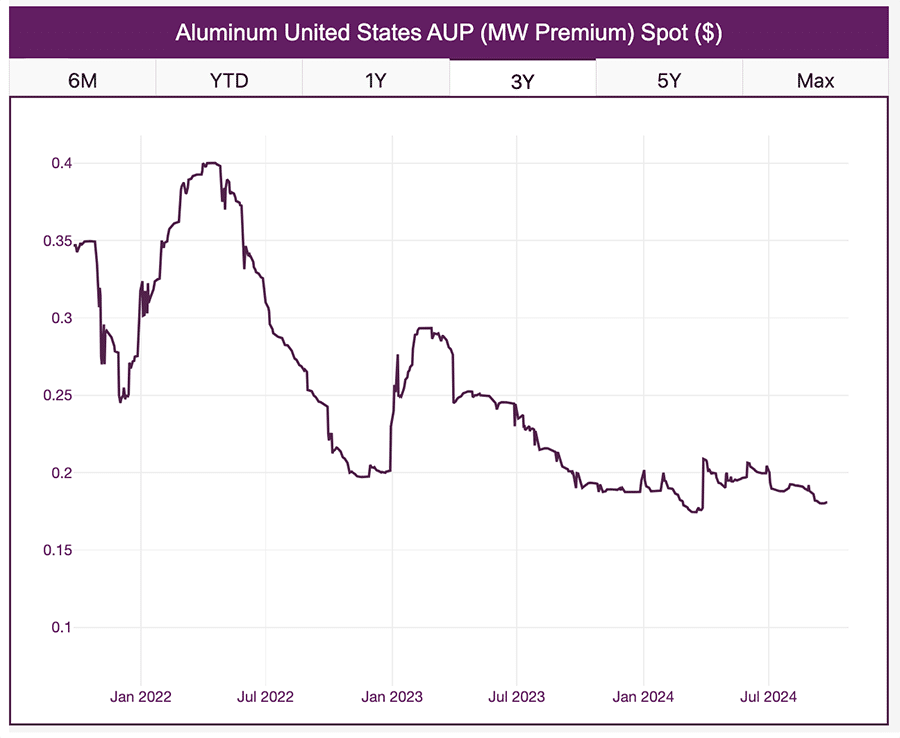

Aluminum Midwest Premium Slides

The rate cut had no discernible impact on the Midwest Premium. While it remained elevated from its early-March low, as of September 20, the premium remained in search of a new bottom. Following a modest 0.95% slide throughout August, declines accelerated during September as the Midwest premium fell 4.25% in the first three weeks of the month. A proxy for domestic aluminum demand, the lack of a rebound within the Midwest Premium suggests no meaningful change in market conditions in the U.S.

China Aluminum Production High, Stimulus Low

China remains a leading influence over the global aluminum market, as primary aluminum output levels from the world’s largest producer continued to show year-over-year gains over recent months. Data from the International Aluminum Institute showed that while North American output held relatively stable over the last year, China showed no signs of cutting production as of August 2024. Moreover, China’s dry season largely averted the major cutbacks witnessed in previous years, leaving the world oversupplied.

The West continued to institute trade barriers in a bid to protect domestic producers from the threat of cheap Chinese imports. Despite these, U.S. aluminum imports from China appeared elevated throughout most of 2024. Data from the Census Bureau showed an almost 17% increase in aluminum imports from China during the first seven months of 2024 compared to the same period of 2023.

While global renewable spending continues, demand conditions in China have remained lackluster, far short of what would be necessary to justify rising aluminum capacity in the country. Between local debt, disappointing industrial production and retail sales data, deflationary headwinds and its moribund property sector, China’s economic outlook suggests little optimism. How companies should plan their aluminum sourcing in times of large geopolitical shifts is covered in The Art of Timing Your Metal Buy.

This has led to continued calls for stimulus throughout the year, which were met with a tepid response from the CCP at best. By late September, the PBOC cut one of its short-term policy rates. This was followed by a larger stimulus announcement of a cut to reserve requirements and existing mortgage rates in hopes of spurring lending. Deposit rates for second homes were also lowered. Beyond that, the PBOC offered $71 billion worth of liquidity support for stocks.

While those moves will offer some support to its economy, they remain short of the $1.4 trillion some have estimated it would take to engineer a turnaround in market conditions. For the rest of the world, that will leave trade barriers as the leading defense against the deflationary threat of Chinese aluminum overproduction.

Biggest Moves for Aluminum Prices

Get all of the current month’s aluminum trends, market shifts and pricing information delivered to your inbox with MetalMiner’s Monthly Metal Index report free of charge.

- LME primary three month aluminum prices rose 8.92% throughout August to $2,502 per metric ton.

- Indian primary cash aluminum prices saw a 6.48% increase to $2.71 per kilogram.

- Chinese aluminum billet prices rose 3.38% to $2,964 per metric ton.

- Chinese primary cash aluminum prices saw a 3.33% rise to $2,824 per metric ton.

- The Korean 3003 aluminum coil premium over 1050 moved sideways, with a modest 2.52% increase to $4.17 per kilogram.