The Aluminum Monthly Metals Index (MMI) edged lower, with a 1.23% decline from November to December.

Aluminum Prices: A Year in Review

2024 began on a low note for the aluminum market, as Q4 2023 witnessed a year-over-year drop in shipments as well as average selling prices for certain domestic suppliers. In its financial results, NorskHydro noted that “challenging markets led to a weaker result.” Meanwhile, exchange pricing appeared largely stable during 2023, which contrasted sharply with the volatility witnessed in 2024.

Q1

Q1 proved mostly uneventful for aluminum prices, which mainly traded within the sideways range established during 2023. Service centers Reliance and Ryerson saw shipments rise from Q4 2023. However, volumes fell short of where they stood the previous year amid constrained demand conditions. Despite the largely flat quarter, the market experienced a few notable events:

- Disruptions in the Red Sea saw freight rates spike during Q1. While the impacts extended far beyond the aluminum market, the situation nonetheless affected the price of imports, limiting their competitive effect on domestic prices.

- Although it did not impact prices, the lackluster environment saw the U.S. lose one of its three primary aluminum producers, Magnitude 7, which accounted for an estimated 30% of domestic primary aluminum capacity. Its closure left two remaining primary aluminum producers in the U.S., Alcoa and Century Aluminum, which operate a total of four smelters.

- China’s dry season, which extends through April, appeared muted relative to other years. Chinese primary aluminum output also saw monthly output rise year over year, which offered no support to global aluminum prices.

Gain access to expert-driven aluminum insight, ensuring your company is well-informed and prepared to tackle aluminum volatility. Opt into MetalMiner’s free weekly newsletter.

Q2

By the end of Q1, prices started to rally alongside other base metals. Aided by a substantial increase in long bets by investment funds, prices surged throughout Q2, breaking above their 2023 peak by late May. However, those spiking prices diverged strongly from the reality of the market. Both Ryerson and Reliance reported quarterly and year-over-year declines in shipments and average selling prices.

Aluminum prices found a peak on May 29 at their highest level since June 2022. This milestone was aided by the copper reaching a peak several days earlier and a substantial delivery to LME inventories by Trafigura.

Q2 also saw an escalation in trade barriers as the Biden administration announced new tariff rates for imports of certain Chinese aluminum products. Added on top of Section 232 tariffs, this increased rates from 7.5% to 25% in a bid to combat Chinese overcapacity. Despite this, Chinese output remained robust throughout the quarter.

Visually see where 2024 aluminum costs are projected to land with MetalMiner Insights’ comprehensive short and long-term aluminum price forecasts. Chat with us.

Q3

Aluminum prices opened Q3 with a sharp retracement. Prices finally found a bottom in late July, followed by an upside correction in the ensuing months. The Fed’s first rate cut since 2020, Chinese stimulus announcement and news of an impending port strike all appeared to factor into the moderate rise in aluminum prices from the end of Q2.

Despite the jump in exchange prices, demand continued to slow for major distributors. Both Ryerson and Reliance reported seeing shipments and average selling prices retreat from Q3 2023 as consumer demand remained pressured.

Meanwhile, the U.S. announced a 10% duty on aluminum imports from Mexico not melted and poured in Mexico. The move was a bid to prevent China from using Mexico as a backdoor for aluminum imports. Though it had no meaningful impact on import levels from Mexico in the following months, the duty nonetheless ramped up trade barriers directed at China.

Q4

The late Q3 rally found its peak by early Q4 just beneath its Q2 high. Meanwhile, the port strike concluded (at least until January 15) after only three days. Therefore, the short-lived disruption showed no meaningful impact on domestic supply conditions. From there, prices mostly trended sideways during Q4, although they appeared increasingly bearish in the final weeks of December.

Unlike other base metals, which declined during Q4, aluminum prices remained resilient. China’s decision to end its 13% export tax rebate and surging alumina prices offered support.

However, it remains to be seen whether the end of the tax rebate will push Chinese prices lower to maintain export demand or result in higher prices for end users. Nonetheless, Chinese aluminum exports hit their highest level since 2022, boasting a 37% rise during November ahead of the December 1 rebate termination.

Meanwhile, alumina prices remained elevated by late December after several supply disruptions, including Guinea’s export halt. Alumina prices hold an 88% correlation to LME aluminum prices. While this does not necessarily mean higher alumina prices cause higher aluminum prices, tighter ore supply will nonetheless pressure producer margins, creating a higher aluminum price floor for smelters to remain operational.

Aluminum Prices Up Almost 10% from 2023 Close

By December 20, aluminum prices held an almost 10% premium over their 2023 closing price. Quarter-over-quarter price increases in Q2 and Q3 only aided this jump.

Not surprisingly, Q2 proved to be the best-performing quarter, while Q1 stood as the worst. While it remains to be seen what will happen in 2025, volatility appears likely to persist as the Trump administration considers advancing trade barriers and shifting the U.S. approach to energy policy.

Biggest Aluminum Price Moves

- Korean commercial 1050 aluminum sheet prices saw the largest rise of the overall index, with a modest 1.84% increase to $4.07 per kilogram as of December 1.

- The premium for Korean 3003 coil over 1050 aluminum sheet rose 1.77% to $4.10 per kilogram.

- Meanwhile, LME primary three month aluminum prices fell 2.71% to $2,582 per metric ton.

- Chinese aluminum billet prices fell 2.83% to $3,020 per metric ton.

- Chinese primary cash aluminum prices declined 3.88% to $2,811 per metric ton.

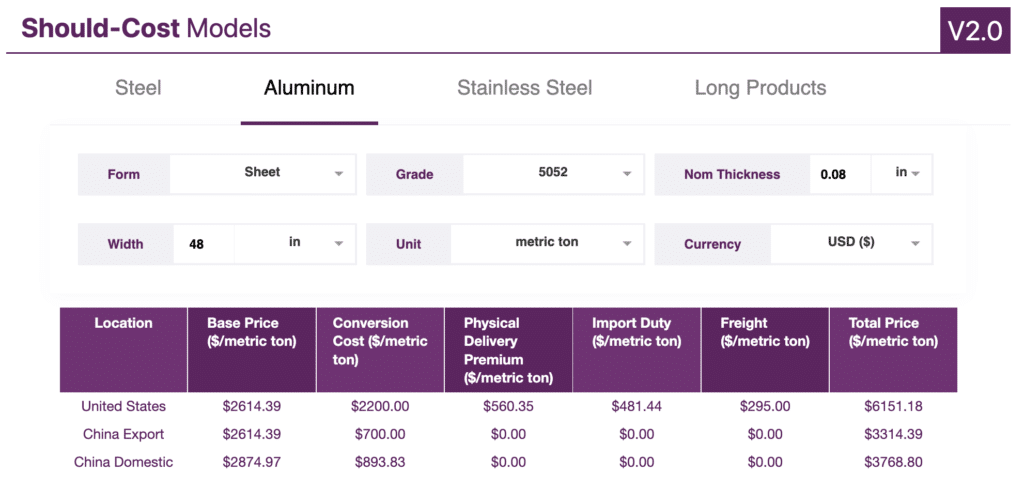

MetalMiner should-cost models: Give your organization levers to pull for more price transparency from service centers, producers and part suppliers. Explore the models now.