The Aluminum Monthly Metals Index (MMI) continued to move sideways, with a modest 1.11% rise from January to February. In the face ongoing tariff threats, LME aluminum prices remained consolidated while the Midwest Premium surged.

Tariffs Add Chaos to the Aluminum Market

Since President Trump’s term started, the aluminum market has been squarely in the crosshairs of trade barriers. News of a 25% tariff on imports from Canada and Mexico set to go into effect on March 1, followed by a 25% tariff on all steel and aluminum beginning March 12, left markets scrambling ahead of the approaching enforcement dates.

While their outsized impact on aluminum prices surprised markets, the prospect of new tariffs was not new. The Midwest Premium and its three-month counterpart commenced new uptrends immediately following President Trump’s November election win. Within days, the premiums quickly had hurtled past their 2024 highs. By mid-February, both had broken above their 2023 peaks.

Gain access to expert-driven market insight, ensuring your company is well-informed and prepared to tackle volatility from aluminum and other metal tariffs. Opt into MetalMiner’s free weekly newsletter.

Aluminum Prices Consolidate While Premiums Turn Bullish

Ahead of the tariffs, import brokers estimated aluminum premiums could jump by as much as $0.20/lb. Since November 1, the Midwest Premium has risen by $0.0965/lb while its three-month futures contract rose by $0.1734/lb, reflecting respective 48.28% and 79.72% increases. Meanwhile, both remain in search of a new peak.

Source: MetalMiner Insights, Chart & Correlation Analysis Tool

While premiums appear decidedly bullish, LME aluminum prices remain consolidated, witnessing a modest 2.28% rise throughout January. This increase preceded an additional 1.17% gain during the first two weeks of February. Meanwhile, markets remain concerned that U.S. tariffs will suppress demand, potentially dragging global prices lower. This seems to be keeping a cap on aluminum prices.

Buyers Rush Back To the Market

Aluminum buyers have rushed into the market as the window before new tariffs go into effect closes, which has helped to boost the U.S. premiums. Although some remain hopeful that Canada and Mexico will negotiate carveouts, those tariffs currently seem poised to come on top of the 25% applied to global aluminum imports.

While tariffs on Mexico are not a significant concern, Canada is a different story. From 2020-2023, Canada accounted for 56% of total aluminum imports into the U.S. Data from the Census Bureau showed that Canada accounted for over 58% of total U.S. aluminum imports in 2024, far exceeding the roughly 6% shipped by the UAE, the nearest competitor.

Many Agree Imports Remain Essential to Meet Demand

Regardless of tariffs, the U.S. market requires imports to meet domestic demand. Data from the U.S. Geological Survey shows an increased reliance on the import market over the last decade. In 2013, the net U.S. aluminum import reliance as a percentage of apparent consumption totaled 47% in 2024, far exceeding the 21%.

Profitability constraints and global competition have reduced U.S. aluminum capacity significantly over the last decade. During that same period, domestic primary aluminum capacity has dropped by an estimated 60%. Meanwhile, there have been closures among primary producers, including Alcoa, Century Aluminum and Noranda Aluminum, resulting in a roughly 1,095,000 metric ton loss in U.S. primary aluminum capacity.

Revisiting the Purpose of Tariffs

While tariffs will have an immediate bullish effect on domestic aluminum prices, the long-term result remains less certain. In 2018, the original 10% Section 232 tariff placed on aluminum imports saw the Midwest Premium rise sharply. However, it had retreated to a historical low by 2020.

It is important to remember that the primary purpose of tariffs is multifold. Historically, the purpose of duties was to support domestic capacity threatened by profitability concerns and give the U.S. leverage in negotiations with its trade partners. However, their effectiveness and economic impact remain debated among economists, policymakers and industry participants. This is because higher domestic prices increase production costs among manufacturers, which can pressure demand among end users and stymie manufacturing growth.

Accurately report the impact of aluminum market volatility on your earnings to leadership and executive teams with MetalMiner’s Monthly Metals Outlook. Download a free sample report.

Aluminum Association CEO Show Support, Stresses Exemptions

Market reactions to Trump’s recent tariff announcements have proven somewhat mixed thus far. In a statement from its CEO, the Aluminum Association appeared somewhat supportive, but urged the necessity for exemptions, particularly regarding Canada.

The Virginia-based group emphasized the importance of strong trade enforcement but also access to metal, stating, “In order for the more than $10 billion invested in recent years to be successful and for American firms to make the cars, trucks, beverage cans, fighter jets, body armor and more that our industry provides, we need ready and affordable access to metal from Canada and other vital trading partners. Today, there is not enough primary aluminum smelting capacity in the United States to supply the growing aluminum industry with the input materials it needs.”

Pick and pay for only the metal price points that impacts your bottom line. Learn about MetalMiner Select.

Other U.S. Aluminum Industry Reactions

Meanwhile, the American Primary Aluminum Association (APAA) appeared decisively supportive. APAA President Mark Duffy noted, “Today marks a significant victory for American aluminum workers. President Trump’s leadership in strengthening the Section 232 program will safeguard thousands of jobs and help revitalize the domestic aluminum sector, which has long suffered from global trade imbalances.”

Century Aluminum also applauded the latest trade barriers. According to a February 10 press release, the company stated it “strongly supports President Donald Trump’s decisive action today to strengthen Section 232 tariffs and fight back against unfair trade practices that have for years disadvantaged the U.S. primary aluminum industry. Today’s executive order implements a 25% tariff on all primary aluminum imports into the U.S. from all foreign countries and closes a loophole in the existing tariff that allowed nearly 75% of imports to avoid the tariff. Closing these loopholes will protect good American jobs and our national security.”

Biggest Aluminum Price Moves

- Indian primary cash aluminum prices witnessed the largest increase of the overall index, with a modest 2.99% increase to $2.91 per kilogram as of February 1.

- Chinese primary cash aluminum prices rose 2.55% to $2,778 per metric ton.

- LME primary three month aluminum prices increased by 2.22% to $2,597 per metric ton.

- European 5083 aluminum plate prices slid 2.71% to $4,583 per metric ton.

- European commercial 1050 aluminum sheet prices experienced the largest decline, falling 2.86% to $3,709 per metric ton.

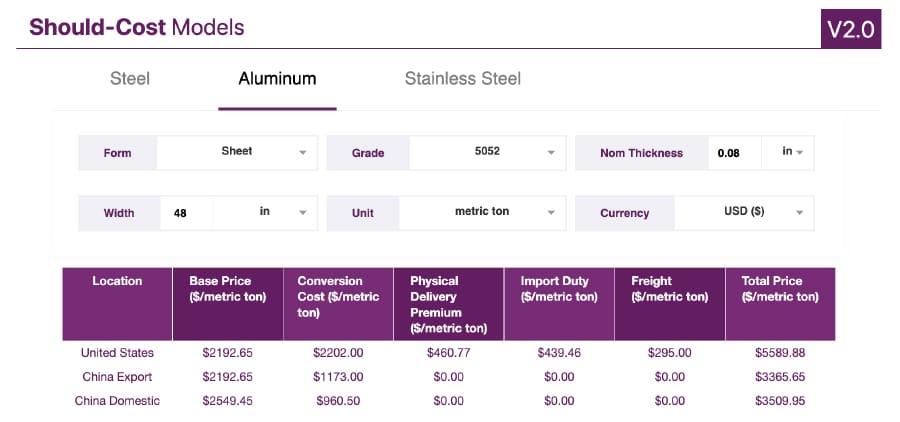

MetalMiner should-cost models: Give your organization levers to pull for more price transparency, from service centers, producers and part suppliers. Explore the models now.